NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

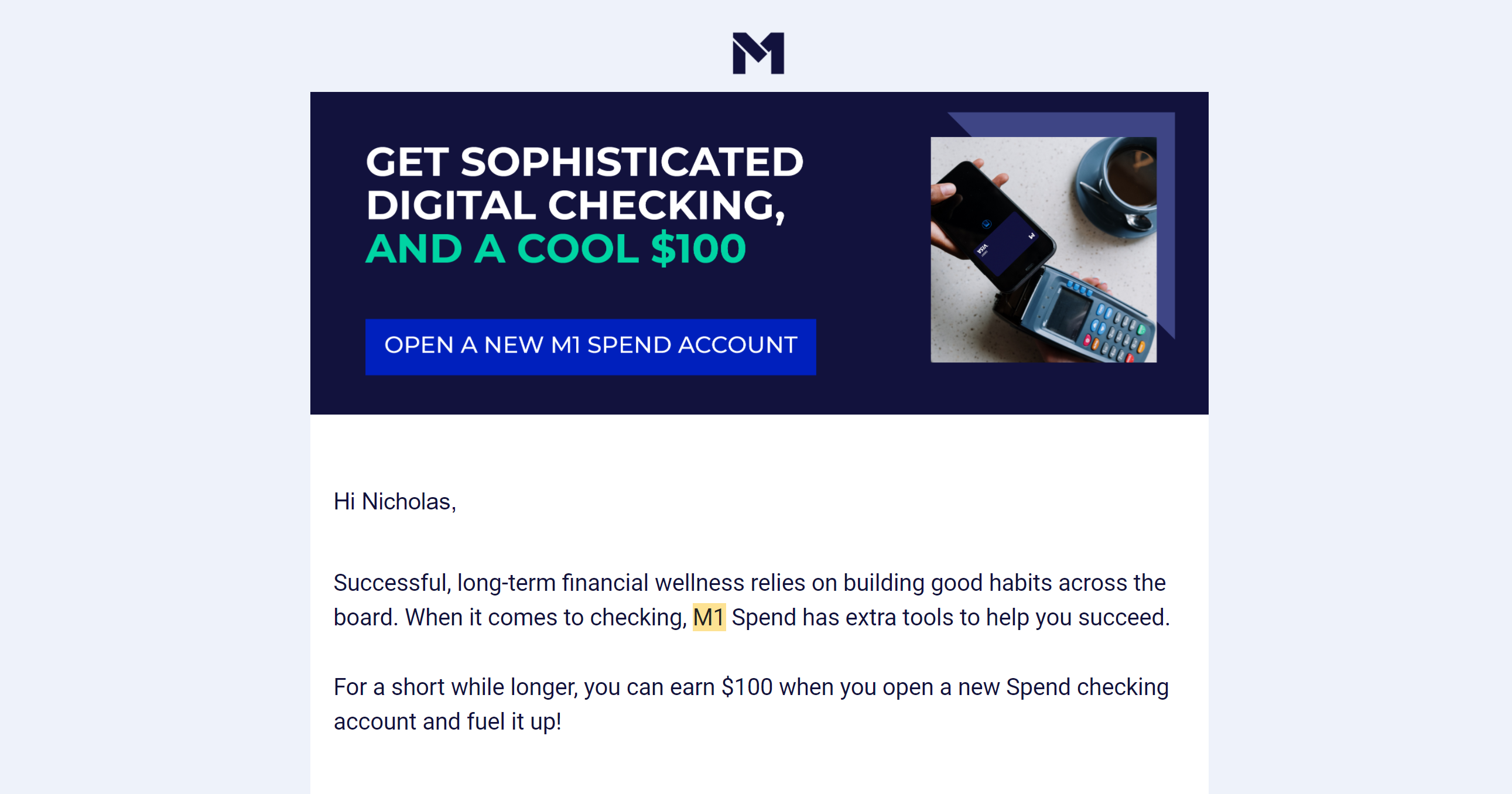

M1 Finance is offering a $100 bonus when you open a new M1 Spend account by the end of March, fund it with $2500 within 14 days of opening, and leave the money in the account for 30 days. This bonus has been around for a while, but I ignored it because I usually stick to higher-value checking account bonuses. However, when I looked at it more closely, I realized that the requirements are so simple (no direct deposit, no debit card transactions, etc) that I thought it may appeal to some readers. Note that I believe you need an M1 Invest account in order to open the Spend account and it may require singing up for a one year free trial of M1+.

The Deal

- M1 is offering a $100 bonus when you open an M1 Spend account by March 31, 2022, fund the account with $2500 within 14 days, and maintain your balance for at least 30 days.

- Direct link to this offer

Key Terms

- To be eligible for this Promotion, and solely during the Promotion Period, you must (1) have successfully opened an M1 Spend checking account1; AND (2) have made an aggregate deposit of at least $2,500, within the first fourteen (14) days of M1 Spend checking account open date. If you satisfy the aforementioned conditions, M1 will make a one-time deposit of one hundred dollars ($100) into the cash balance of your M1 Spend checking account (the following accounts are ineligible to receive any direct cash deposit: accounts held by M1 Finance LLC).

- You are only eligible to receive a one-time cash bonus of one hundred dollars ($100) (the “Promotional Credit”) under this Promotion. The Promotional Credit will be deposited into your M1 Spend checking account on May 13, 2022 (the “Pay-out Date”) provided that you satisfy the conditions stated herein.

- The Promotional Credit deposited by M1 is a fixed cash value and does not constitute stock or any other security, nor is it a recommendation to buy any specific stock or other security.

- You must maintain a deposited value of at least two thousand five hundred dollars ($2,500) in your M1 Spend checking account for at least thirty (30) days from the date your deposited value is at least two thousand five hundred dollars ($2,500).

- M1 reserves the right to revoke the Promotional Credit cash deposit if the total aggregate transferred deposited value is not retained in your M1 Spend checking account until the Pay-out Date.

- See promo page for full terms

Quick Thoughts

M1 Finance is an investing platform. I’ve dabbled with many of the various investing apps and M1 is my favorite for long-term investing because it is easy to set asset allocation percentages and then put the account on autopilot for monthly investments.

They also offer a “Spend” account that is similar to a checking account (without paper checks I think?) that includes 1% APY. The new account user bonus here is obviously a way to draw people into the ecosystem. Still, I think it is worthwhile for anyone who can float the cash for a month as there is no effort required apart from that $2500 deposit requirement. This bonus has been out for a month already, but as I said above I had initially ignored it. I’ve reconsidered that now.

Based on a read of the terms, I think you might need to sign up for M1 Plus in order to be eligible for this promotion. M1 Plus costs $125 per year, but you can sign up for the first year for free (and turn off auto-renewal within your account settings).

If you already invest with M1 but you are short the cash to meet the deposit requirement, there may be a way around that. Note that I’m being theoretical there. I encourage anyone who considers doing something like that to do your homework and perhaps consult with a financial advisor (I’m not one and this is not financial advice). However, it dawned on me that one way to free up capital might be with a margin loan if you have an investment balance with M1. I’m not terribly familiar with margin loans, but M1 does offer them. While margin is traditionally used as a way to increase investments, M1 allows for you to borrow and have your loan deposited to an external account. While the current rate of 3.5% isn’t bad, M1 Plus members get a rate of 2% APR. I think it would be possible to take a margin loan from your account, have the cash deposited to an external account, and then fund your M1 account with $2500. A month later, it would theoretically be possible to collect your $100 and pay off your loan (there is no set repayment schedule on a margin loan). I think that should cost less than $5 in interest, leaving you with a ~$95 win without tying up any extra money. However, the terms of the M1 spend offer do go on to say that they reserve the right to take back the $100 if you don’t maintain the balance until the payout date, so it might be best to wait for the $100 to post. Again, I’m not a financial advisor and there are risks of a margin call, etc, — it’s just a thought.

Overall, this seems pretty easy. I did recently take a margin loan at 2% APR by signing up for the M1 Plus first-year-free offer. There’s no hard pull for that or for the M1 Spend account. Since this is pretty low-hanging fruit, I think my wife and I might each take them up on a hundred bucks with this offer.

It directs me to open up the apple App Store to download the app. I used the link initially & opened the brokerage account. Can I still open the checking & get the bonus?

Coincidentally I received in the mail an offer for them with higher bonus for higher deposit amounts and parking the money longer. Need to put at least $10k and have it sit till 8/1/22 to get the $150 bonus and up levels, topping out at $500 for $50k. Excludes retirement accounts. Link is m1.com/fund-500-bonus. I don’t think I’ll do either offer.

That sounds like the Invest (brokerage) account bonus, this is the Spend (checking-like) account bonus. Two different things. They also have a bonus right now if you create and fund an IRA.

I’ll probably open this account for an easy $100, but the part you mentioned, “ …may require singing up for a one year free trial of M1+“ may hinder me since I am not a good singer.

(as an editor) I love this snark 😀