NOTICE: This post references card features that have changed, expired, or are not currently available

Introduction

As points enthusiasts, our priority is meeting the requirement to obtain the signup bonus. The next priority is to maximize the benefits that come with the card. These perks include free Global Entry, reimbursement for airline tickets, and lounge access. An overlooked benefit is trip delay and cancellation coverage which can come in handy when itineraries don’t go as planned.

Citi Prestige: Nick’s Positive Experience

Nick has written about how he was reimbursed $500 for a trip delay when he used his Citi Prestige card. Here’s how it works: if you pay for at least part of your ticket on your Prestige card and are delayed for 3 hours or more, Citi will cover your expenses for things like food, lodging, and transportation up to $500 per person (including your family and those traveling with you provided you paid for their tickets with your Prestige card). In this case, Nick had a tight window to make his connection but because his flight arrived late, he missed his connection and was forced to stay overnight.

Citi Prestige: Alex’s Negative Experience

When it is honored, the trip delay protection is a fantastic perk. In the example above, Nick used the benefit successfully when a delay in one leg of his trip caused him to miss a connection. He ended up being delayed more than 3 hours to his final destination. However, more recently, cardmembers have not had the same outcome. Here’s an example of an itinerary where the claim is now being denied.

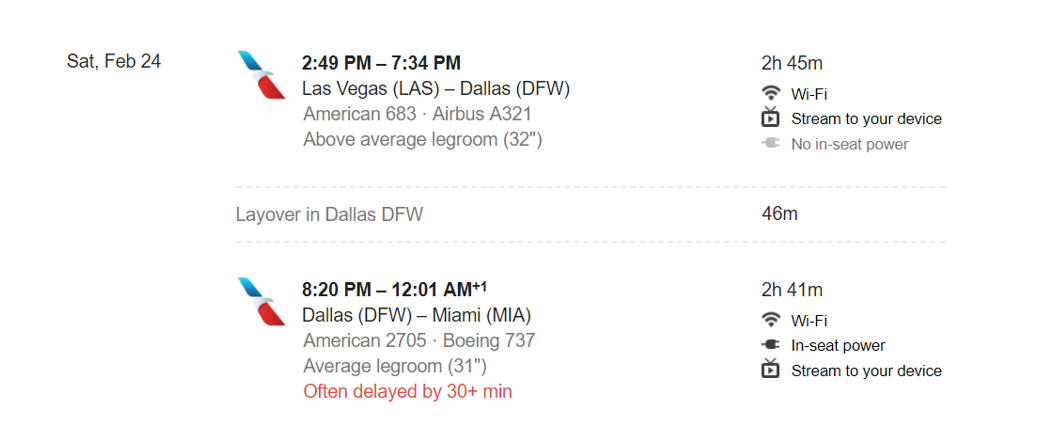

Alex purchases a flight from Las Vegas to Miami with a connection in Dallas. The first leg of the trip is delayed by 30 minutes. Despite his best efforts to sprint to the connecting gate in Dallas, Alex misses his connection to MIA. The airline does not provide hotel accommodations, and Alex has to pay an exorbitant price to stay overnight before taking the first flight to MIA in the morning. In this example Citi will deny Alex’s claim stating that the delay is not covered by the trip delay protection. Why? Because Citi argued that the flight was only delayed 30 minutes, not 3 hours.

Reconciling Nick & Alex’s Outcomes

To begin, let’s look at what Citi’s benefit brochure says to see if Nick got lucky or Alex is getting the short end of the stick.

Citi’s policy states that if the trip is delayed for at least 3 hours, they may reimburse you for expenses incurred because of the delay. It also says the following: To take advantage of this benefit, the following conditions must apply:

- The delay is caused by the Common Carrier.

- The Covered Traveler’s passport, money or other travel documents are lost or stolen.

- The Covered Traveler(s) are not able to board because of overbooking.

- The Covered Traveler’s Trip is delayed because of severe weather, a natural disaster, a previously unannounced strike, a quarantine or hijacking.

The decision as to whether a cardmember receives the benefit depends on what constitutes a “trip.” Unfortunately, there is not a court case or published arbitration decision that definitively defines it. In Nick’s case, Citi looked at the departure time of Nick’s first flight and the arrival time to his destination. In Alex’s case, Citi looked at the departure time of the first flight and the time that flight arrived. Changing the definition of trip is how Citi is able to approve Nick’s claim and deny Alex’s.

What Can Be Done?

- Option #1: Do nothing. At most, Alex is entitled to $500 under Citi’s travel protection. That’s not enough money to justify the hassle of going through the dispute resolution process which may include hiring a lawyer. Even if Alex did win, Citi may require him to sign a confidential settlement.

- Option #2: Fight! Regardless of the dollar amount, Alex’s claim is definitely worth pursuing. Why?

The strength of the claim is in a reasonable interpretation of what a “trip” is”. By that standard, the plain, ordinary, and reasonable meaning of the word “trip” refers to the entirety of the travel, not just an individual leg or segment of the journey. The terms say that the overall trip must be delayed by that period of time. A potential claim seems clear cut–Citi is in the wrong. (see Beating Citi in Arbitration, What It Means for You and The Successful Fight Against A Citi Shutdown)

Some Final Questions

How pervasive is this? Is this a Citi issue or is it industry wide? Without public records of claims, we simply don’t know. My colleague who practices criminal law advises his clients that the job of a police officer is to make arrests. The police officer’s job is not to be your friend. Similarly, the job of insurance underwriting companies is to deny your claim. It is not their job to make you happy by reimbursing you. That’s why they will find any loophole, including the one above, to ensure that you are denied what may be rightfully yours. One would think that Citi and its insurer of choice are not alone in denying these claims on shaky grounds.

If I am covered for a missed connection, why are there companies that sell supplemental insurance for connections that are not covered by trip delay insurance? There are companies that sell flood insurance in Arizona. Unlike the Citi’s insurance, some policies may explicitly state that they do not cover missed connections. That is when the supplemental insurance would come in handy.

Overall

Overall, it seems likely that Citi is in breach of its obligations but has never been called to task because consumers either do not know about the insurance to begin with or do not care to pursue a claim once they are denied. Hopefully, reading this post will change that.

[…] Trip delay no longer pays for missed connections and price protection has been reduced. I don’t often pay for hotel nights, so I may not use […]

In this case, would it be better to have use another card like the CSR for the trip delay benefit even though it is 6 hours instead of 3? Citi seems like they’re really trying their best to be Shitti.

Seems like the alternative answer would be to contact the CFPB. Citi is a heavily regulated bank so while the issue at hand might not be banking, they are usually quick to make things right when the regulator gets involved.

Seems like it would be better to contact the insurance board for your state. At the end of the day it’s the insurance company that’s on the hook for approving the claim, not Citi.

CFPB is useless.

Clearly this guy has never been to Arizona. Flash flooding is a major issue

Citi insurance policy is going down. Before October 2017, majority of the claims were approved as long as all conditions are met. Now my claim has been denied because they said terms and conditions state “we may reimburse you” and rep said there is a word “may” hence they are not required.

How AA can get away with not providing overnight stay in this case is totally beyond me.

This article is BS. Alex’s claim was THE BS. AA put him on the next AA flight to his final destination. AA should have put him in a hotel since it was AA’s faults. Alex should have contacted AA gate agents while in DFW. Citi and Citi’s Benefits Administrator were and are within their rights in this case. QUIT ABUSING & GAMING THE SYSTEMS.

Where do I start with this comment? 1. Alex’s claim was BS? The reason this article was written is not because Nick got his approved and ‘Alex’ got his denied. It’s because many people have this issue.

And quit abusing & gaming the system? First, quit writing in caps. It doesn’t strengthen your point. And second, you do realize this blog (and mine) are about collecting points right? Gaming the system is sort of the objective.

Finally, Citi and all banks could end the shenanigans by changing explicitly detailing what is and wasn’t acceptable in its terms and conditions and by applying the rules uniformly.

[…] The Fine Print: Fighting Citi Prestige’s ‘Trip Delay’ Shenanigans by Frequent Miler. Will be interesting to see how this plays out. […]

Option 3:

Never book a connecting flight where you have less than an hour from the time you touch ground to the time the door is shut on the other plane; more if at an international airport where the other flight is geographically problematic in terms of adding more time to get you there, and certainly on international flights if you have to go through customs or etc. This option is not so much to meet the CITI requirements for trip delay reimbursement, but to avoid having to go through the claim to begin with.

I dont understand the people who are saying “But the Prestige insurance is still valuable”

No, you have a “memory” of it being valuable….

in the definition of insurance is “guarantee of compensation”

Citi no longer has that guarantee, thus you only “think” or “hope that there is value….

Something is not valuable any more if it does not work the way you expect it to…..Thus… the more things a company does not honor, the less valuable their product is.

Whats more valuable……

A 6 hour delay insurance that actually pays out when you are delayed.

Or

Prestige insurance that you can file more often, but get less compensation for actual out of pocket expenses is less valuable.

Charge your trips on more valuable cards where you know the insurance works, let your spending do the talking

suggestions on the card to use, Craig?

Dave

I agree what card pays off 100% of the time ??

Only Correct answer me when I travel with my GF I pay no matter what happens HaHa .

CHEERs

I’ve thankfully not had to take advantage of this benefit, but I’ve always assumed if I had a legal connection the benefit would apply. Obviously not, but that would be my argument if it came to that point.

In the past I’ve always assumed I wouldn’t have any protection if I was combining two separate tickets so in cases like that I always leave an insane amount of time for connections.

Separate but related question – Is there any site where people compile data points on what has been denied (and presumably, for contrast, on similar fact patterns where claims have been accepted)? Only then could we see if there is a pattern on the part of the benefits administrator. I’ve been particularly interested in this question since I had a very clean return protection claim denied by Chase (Card Benefit Services). With one report, it’s just a data point. With many reports it is possibly indicative of deliberate mishandling of claims. (After the denial I did file a complaint with my state insurance commission in the hope the data point would be out there if anyone were ever looking into this benefit administrator).

I read about the official change in rules yesterday, and reacted with a “meh”. Prestige is a valuable card to me with or without this benefit, and its travel protection beats the competition by a good margin. Even if it tightens this rule a bit (in some ways to reduce cheaters, possibly), it’s still quite generous… so why complain?

This is why I find posts like yours valuable. Level set by reading the lawyer’s perspective, and realize that it’s about the fairness in the contract language and not so much about how big it is or whether I will personally need it. Still not gonna get worked up over this, but now I have a better appreciation for why it matters.

Thanks again Alex for the education.

Thank you for reading.

This has been the case since at least October 2017. And I actually had an email convo with Greg about it in late Nov’17. I’m surprised no one has decided to litigate one of these yet (although as you said, perhaps someone has, and the settlement included a confidentiality clause).

From a lawyer perspective could you shed some insight on this question: It seems frankly pretty black and white that if someone did actually decide to sue the insurance company that you’d have a very solid chance of winning the case based on the way the T&C is currently written (I’m assuming the suit would be filed against the insurance company not Citi itself?). So why doesn’t Citi and/or the insurance company just rewrite the T&C to specifically note this exception and that way they eliminate any risk that people start filing suits against them?

It would be a consumer arbitration claim and it would be against Citi. You would think they would just rewrite it and avoid the controversy. At the same time, you would think that they would say any manufactured spending will result in automatic account closure.

Gotcha. So a few more questions:

1. How difficult is the arbitration process for an intelligent person. Is it very complex and very challenging to navigate if you don’t have a legal background, or would a fairly smart person be able to figure it out and handle this without hiring an attorney?

2. Would you even be interested in taking on a case like this given the low potential payout of $500? As you sort of mentioned above wouldn’t the attorney fees quickly dwarf any potential winnings?

3. So in terms of confidentiality clauses. Lets say in a simple word this is how things unfold:

-I file an arbitration claim against Citi

-Prior to the arbitration hearing, they say “ok fine we’ll pay you the $500 but you have to sign a confidentiality agreement”

-At this point can I say “nope, I want my $500 AND I refuse to sign the confidentiality agreement”

-Citi either accepts that or they refuse…if they refuse then does the case now proceed in front of the arbitrator

-Arbitrator rules in my favor: I get my $500 and now the case is part of public record and sets a precedent?

These answers will cost you!

1. Anyone can do an oil change with enough research but I would recommend an attorney. My firm works on a contingency.

2. We do not look at the dollar amount for the claim to determine if we will take it. We look at the merits. We try to collect our fee through laws that provide for it or through aggressive settlement.

3. There’s no precedent if you win but it will be public. And yes, if you refuse to sign, it will proceed unless we can negotiate a less restrictive confidentiality agreement which I have done in the past.

Thanks for the detailed response! Hopefully someone soon bites the bullet and litigates one of these!

Given how difficult to read this post was, I’m not sure it will effect any change with Citibank

Bring your umbrella, stvr is here.

With regard to hidden city ticketing, I keep reading that the airline in selling you a flight from A-B, not from A-C-B. Seems like the trip delay insurance should make the same considerations: were you delayed from A-B.