NOTICE: This post references card features that have changed, expired, or are not currently available

Last year, I detailed my plan for increasing my Chase Ultimate Rewards point balance. The reason for focusing on Ultimate Rewards? I’m a huge fan of transferable points programs, especially Ultimate Rewards. Chase has several very useful transfer partners, but the one I transfer to the most, by far, is Hyatt. By keeping a large Ultimate Rewards point balance, awesome hotel stays are always easy to secure.

Examples of great Hyatt stays (in which I transferred points from Chase) include Hyatt Carmel Highlands, Grand Hyatt Santiago, Park Hyatt Vendome, and many more.

The plan I had detailed last year was to earn points through signup bonuses and through Chase Ink and Chase Freedom 5X spend. Since the Freedom card limits 5X spend each quarter to only $1500, part of the plan was to collect additional Freedom cards. At the time, my wife and I had one card each. Since then, we each got another Freedom card by downgrading our Sapphire Preferred cards (and therefore opening the door to future Sapphire Preferred applications). So, we now have 4 Freedom cards altogether. Mission accomplished.

Freedom Unlimited: 1.5X everywhere

Recently, Chase introduced a brand new no-annual-fee Ultimate Rewards card: Freedom Unlimited. The card is marketed as an unlimited 1.5% cash back card. Well, that’s pretty boring considering that Citi offers a no annual fee 2% cash back MasterCard (Citi Double Cash), and Fidelity offers a no annual fee 2% cash back Visa card (Fidelity Rewards Visa). But… in reality, it’s not boring. Not at all!

Just like the regular Chase Freedom card, and the Chase Ink Cash card, the Freedom Unlimited card’s “cash back” comes in the form of Ultimate Rewards points. You can redeem those points for cash back if you want to, but you can do better. If you also have a premium Ultimate Rewards card (Sapphire Preferred or Ink Plus, for example), you can move points to that card and then transfer those points to and airline or hotel program. See: Chase point transfer rules made simple [Infographic].

You can also use the points (once moved to a premium card) for 1.25 cents each towards Ultimate Rewards Travel purchases (e.g. flights, cruises, car rentals, etc.).

Freedom Unlimited: Is it a good deal?

Every dollar spent on the Unlimited card earns 1.5 Ultimate Rewards points. If you plan to redeem points for cash, then compared to a 2% cash back card, it’s a terrible option. If you plan to redeem points for Ultimate Rewards Travel purchases after moving the points to a premium card, it’s still a bad choice. When points are used in that way, your effective rebate is 1.5 points per dollar X 1.25 cents per point = 1.875%.

In order to just break even when compared to a 2% cash back card, you need to get better than 1.33 cents per point value when redeeming points. In my experience, that’s easy to achieve by transferring points to Hyatt or to airline programs for international travel.

So, the answer is yes, it’s a great card, but only if you use the points in ways that deliver high value.

Good old Freedom

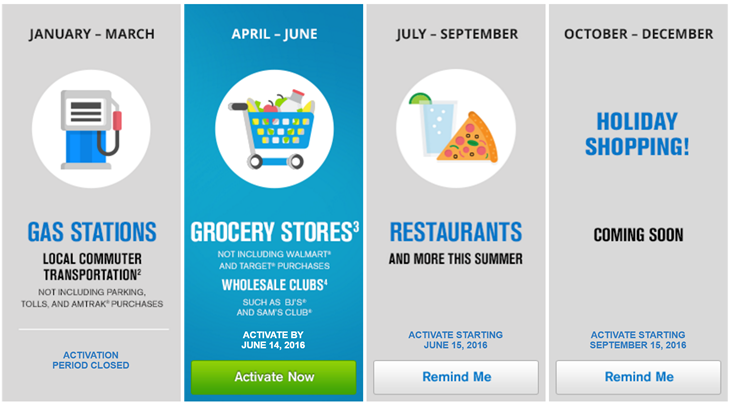

So, as described above, Freedom Unlimited is, conditionally, a great card, but the good old Freedom card is pretty great too. It too has no annual fee and earns Ultimate Rewards points. The regular Freedom card only earn 1 point per dollar for most spend, but every quarter they offer certain categories in which the card earns 5 points per dollar. 5X is obviously quite a bit more appealing than 1.5X.

And, now that Chase has promised to include Wholesale Clubs in the 3rd and 4th quarter 2016 categories, the card is more appealing than ever.

Which is better?

I’m glad that I already have 4 Freedom cards to work with because I would otherwise have a hard time deciding whether my next Freedom card should be a regular Freedom or the Freedom Unlimited. The regular Freedom card is great for its 5X categories. Freedom Unlimited is great for it’s 1.5X everywhere. Which is better?

The regular Freedom card’s 5X categories are capped at $1500 spend per quarter, which works out to $6,000 spend per year. At best, one could earn 30,000 points for $6,000 spend. With the Freedom Unlimited card, one would have to spend $20,000 to earn 30,000 points. But, a very heavy spender could earn much more.

The regular Freedom card is best for low spenders, or for those willing to get many cards and who don’t mind running around buying gift cards to use up each quarter’s $1500 limit. The Freedom Unlimited is best for those with high amounts of otherwise unbonused spend.

The ideal situation is to have both: collect a bunch of regular Freedom cards so as to maximize the 5X category bonuses; and have one Freedom Unlimited card for all non-bonused spend.

My plan adjustment

Thanks to Chase’s 5/24 rule (they usually won’t approve applications for those who have opened 5 or more accounts in the past 24 months), most people today don’t have the luxury of following the plan I laid out last year. However, I seem to be at least partially immune to 5/24. I was approved for a new Sapphire Preferred card in January, two Marriott cards in March, and the United card earlier this month (I’m still waiting for approval for my Ink application).

My next Chase application will likely include the Freedom Unlimited card, along with an authorized user card for my wife. That will then become our new “everywhere else” card once my Discover It Miles card’s first year is over (at that point the Discover It Miles card becomes a regular 1.5% cash back card instead of a 3% cash back card). If I don’t get approved through a new application, I can always downgrade my Sapphire Preferred card instead. One way or another, I want to round out my Ultimate Rewards collection with this new card.

A case could be made that I should instead get another regular Freedom card. That would give me even more 5X capacity. But, truthfully, there’s a limit to how much I’m willing to run around buying gift cards within the Freedom’s 5X categories. It turns out that 4 cards is my personal limit.

I just got approved for both freedom cards to combine with my sapphire preferred, but still debating on if I should replace the CSP with a CSR. I know you can downgrade a card, but I’m not sure if they would let me upgrade the CSP to CSR. I just hit my 5/24 with these two new cards and have a few months before one will fall out of that window.

You might be able to upgrade to the CSR, but I’d recommend waiting a few months to sign up for the CSR new so that you can qualify for the signup bonus. Once you get the CSR, you can downgrade the CSP to a second Freedom card (which is useful for times when they offer particularly good 5X categories).

When you downgraded your Sapphire Preferred card to get another Freedom card, did you get the signup bonus again? Also, are there any rules about allowing you to have multiple Freedom cards under the same name/SSN?

Yes, after downgrading the Sapphire Preferred I was able to sign up for it again and I got a signup bonus for it again.

[…] After this post was written, Chase introduced a new card: Chase Freedom Unlimited which offers 1.5 points per dollar on all spend. It’s a great idea to add this card to […]

Anybody have experience or details on downgrading another annual fee Chase product for a Freedom or FU? I have United Mileage Plus card that will be coming up for an annual fee soon. I would like to downgrade it to something else.

I’ve never tried, but I’ve been told that you can’t downgrade a co-branded card to a Chase card. So, assuming that intel is right, you won’t be able to downgrade United to Freedom.

Bummer, another question. I have read the Chase Private Client gives you the ability to have your banker “override” a rejection. Unfortunately I don’t have the ~$250k to become a private client. I talked to my banker today and he said another option is to have $10k on deposit and they can then submit a reconsideration letter that sometimes works. Anybody have any experience with this process?

That’s interesting. I haven’t heard about a $10K on deposit threshold for bankers to submit a recon letter. If you try it please let us know how it turns out!

[…] Miler pits Freedom vs. Freedom Unlimited. I come to a different conclusion, but not based on the two cards one on one, but rather the […]

In addition to the 3 Hyatt’s you mention above, I’d like to add the Hyatt Zilara all-inclusive resorts in Cancun and Jamaica. My wife and friend recently went for 3 nights (2 nights comp from Chase Hyatt card + 1 night for 25,000 Hyatt points transferred from Chase UR) to the Cancun location. Cash price would have been $480/night, but we got everything for free. My wife said it was the nicest hotel she’s ever stayed in.

BTW — Chase UR to Hyatt transfer is instantaneous. I actually did the transfer while on the phone with the Hyatt rep who was helping me book the room.

A few years ago, when we lived in CT, we had both personal and business checking accounts with Chase. They invited me to be a Private Client and I thought they wanted my investments (which I was not about to give them) and declined. That was stupid!

Now that we live in PA, there are no Chase branches near us. I’m down to one biz Chase Ink Bold (converted 2 others to Ink Cash) and a Sapphire premium cards. I’d love to figure out a way to get another Freedom for each Hubby and me. We go through loads of URs.

So, one has to have multiple accounts of the same credit card to overcome a quarterly spending limit that contributes mightily to the bank’s profit; invest a large sum of money in Chase Private Client which pays piddling interest compared to a local credit union; and, eventually, pay a high annual fee for a Chase Sapphire Preferred or Ink Plus to have a chance at a point redemption value that might make this all exceed the return from a 2% cash back no annual fee credit card? One has to have multiple Chase accounts and crowd out other better credit card options to make this pay? It is clear from the Chase Bank advertising money provided to internet bloggers who is profiting from all of this and it’s not the customers.

Lol

Can I switch my Slate to a freedom Unlimited?

yes, that’s what i did.

cool. Thanks!

Just googled ‘How to become Chase Private Client’ based on your posts about circumnavigating 5/24. If only I had a casual 250k to invest… haha.

Good for you!!

Thanks, but actually I don’t have any money invested with Chase (unless you count my personal and business checking accounts). I think that they let me in because I had temporarily parked money from the sale of our house in my Chase account before using it for our new house.

In this same boat now – Debating on transfering all my points to my INK card, and then downgrading Sapphire to Freedom Unlimited and possibly reapplying for sapphire to re-earn the sign up bonus (its been like 3 years).

Good move if you have a sapphire?

Whats the soonest I can apply for sapphire once I downgrade you think?

Thanks!

Yes, I think so. The one big caveat is that, depending upon your situation, you may have a hard time getting approved for the new Sapphire Pref card. I’m not sure that any particular waiting period is required after downgrading, but you might as well wait a few days at least.

BOA travel 2.625%/Freedom unlimited 1.5x = 1.75 cpp break even. Only Hyatt consistently > 1.75 cpp?

I didn’t mention the BOA thing because it requires $100K invested with them, but that’s unquestionably a great “all other spend” option if you can swing it.

>1.75 cpp? In my experience, yes, I usually get more than 2 cents per point value with Hyatt, but that is due to cherry picking the better opportunities. Depending on the situation, I’ll do either all points, or points + cash, or all cash when rates are low.

Funny how bloggers don’t have any limits to application restrictions, like 5/24. If the rest of us could be so lucky.

It has nothing to do with me being a blogger, but is likely due to my Private Client status.