A lot has been written lately about a Reddit post that suggests that big changes to Delta’s SkyMiles program will be announced on September 14th. We don’t have any details about what the changes will entail, nor do we really know if it’s true at all. My guess is that it is true, though, and so it has had me wondering what is up. What do I think Delta will do? In this post you’ll find my wild guesses. If the announcement really comes out on the 14th, we’ll find out how right or wrong I am at that time…

Intro

A Reddit post claims to show a screenshot of a partial memo about employee training for new SkyMiles changes. The partial memo states:

Training and Onsite Support for Upcoming SkyMiles Changes

Published 8/28/2023

WHAT

On Step. 14, Delta will announce changes to its SkyMiles Program. Since we know any change to our SkyMiles Program can generate questions or concerns from customers, we want to ensure our frontline team members are fully prepared to respond, which is why we are launching a

If we take the words in the memo at face value, then we can expect major changes to the SkyMiles program. Delta wouldn’t need training and onsite support for minor changes. Sure, it would be nice if the changes were towards making SkyMiles more valuable, but that seems very unlikely to me. Instead, I’m betting that the changes are about Delta’s elite program. The Reddit contributor who posted the memo suggests the same. They wrote:

Notes:

- This is not my screenshot

- I don’t know what the changes are but what I’ve heard is MQM, MQD, and MQS will be consolidated into one metric, similar to how United just has PQP and AA has LPs.

Edit: this also seems like a good time for Delta to announce the new SkyClub access restrictions and any other changes they have planned for their credit cards.

The last point refers to rumors that credit card SkyClub access will be limited in the future. For example, those with Amex Platinum cards may be limited to six or seven visits per year. That may happen with this announcement, or not. I have no idea. And I have no idea if the limits will really be implemented. My random guess is that limits will be imposed for Amex Platinum cardholders, but not for Delta Reserve cardholders.

The rest of this post discusses my guesses about Delta’s changes to their elite program requirements…

Delta’s 2023 Requirements for the 2024 Elite Year

Currently, to earn elite status with Delta, you must earn MQMs or MQSs (definitions below) AND MQDs or MQD Waivers.

Definitions:

- MQMs: Medallion Qualifying Miles can be roughly thought of as the actual miles flown.

- MQMs are earned on both paid flights with Delta or Delta partners where the flight is credited to your Delta account, and award flights booked through (and flying) Delta.

- It is also possible to earn MQMs through big spend on Delta Platinum and Delta Reserve credit cards.

- MQSs: Medallion Qualifying Segments are the number of segments flown.

- MQDs: Medallion Qualifying Dollars are the sum total of your base-fare spend (e.g. doesn’t include taxes) on Delta-marketed flights.

- MQD Waiver: Delta Platinum and Delta Reserve cardholders can earn a MQD Waiver (so that MQDs aren’t necessary for status), up to Platinum status, with $25,000 calendar year spend across one or more Delta credit cards, or up to Diamond status with $250,000 calendar year spend.

Delta’s new requirements starting in 2024 for the 2025 elite year

The following is 100% conjecture. That is, I’m making this up based on what I think may happen. We’ll find out on September 14th how much of this I got right, if any.

One elite metric: Medallion Qualifying Dollars (MQDs)

When Delta first introduced Medallion Qualifying Dollars (MQDs) as an elite requirement, I thought it was ridiculous that they kept around MQMs and MQSs as additional requirements. Why not simply move entirely to MQDs? That’s my guess as to what will happen.

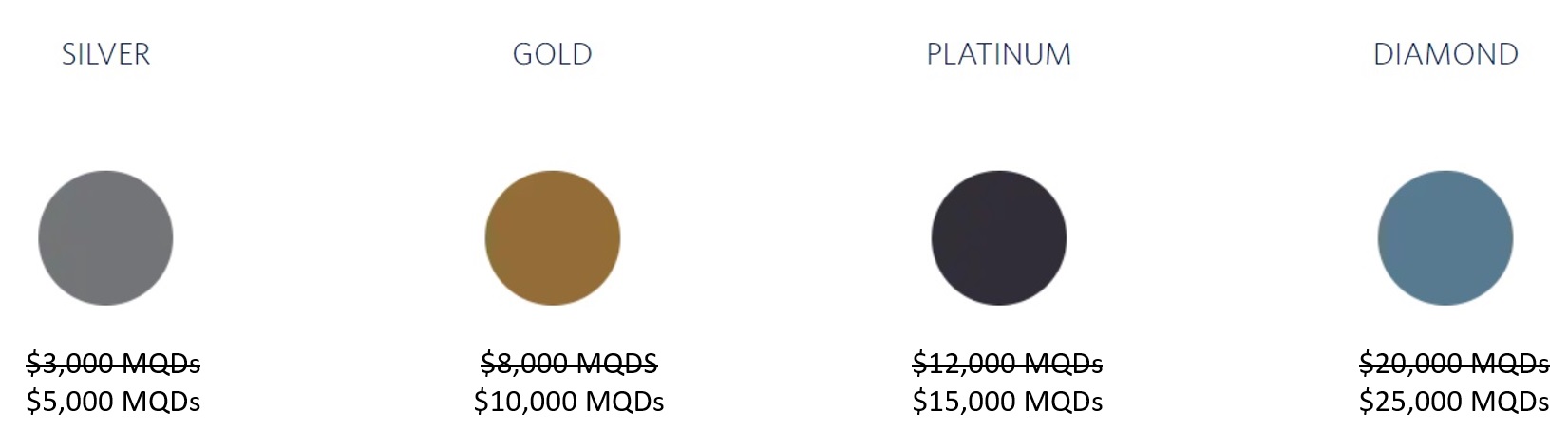

Increased MQD requirements

I think they’ll increase the MQD requirements for each elite tier:

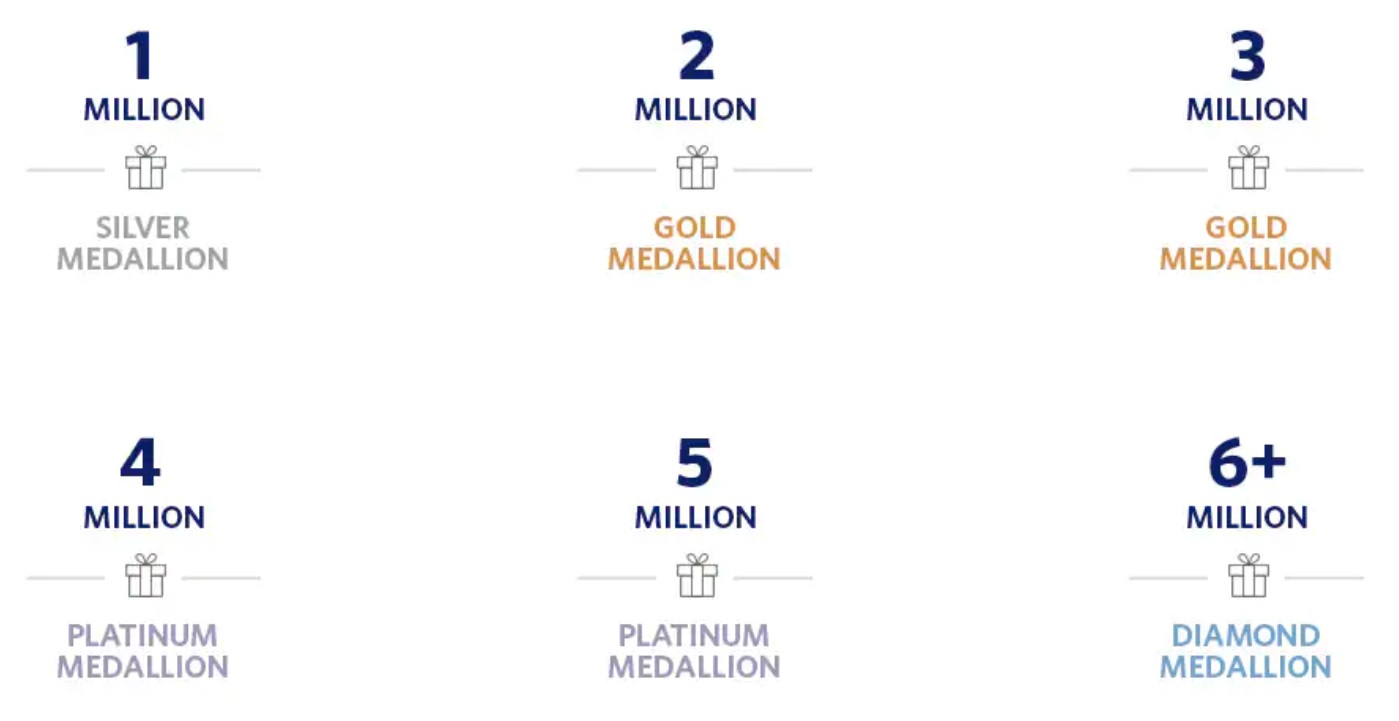

MQMs will still exist as a way to get to Million Miler status

Delta offers perks and elite status with each million MQMs earned. I predict that this will stay as it is today.

Credit cards will earn MQDs with high spend

While I’d prefer Delta to move to a scheme like AA’s where every dollar earns a loyalty point (or a fraction of an MQD, in this case), I don’t expect that to happen. My bet is that they’ll keep the spending tiers that the credit cards have today, but they’ll offer MQDs in addition to MQMs. Today, the Delta Platinum and Delta Reserve cards (both consumer and business versions) offer MQM boosts with big spend, as follows:

- Delta Platinum: 10K MQMs with $25K calendar year spend and again at $50K

- Delta Reserve: 15K MQMs with $30K calendar year spend and again at $60K, $90K, and $120K

I expect that Delta will continue to offer the above MQM earnings (towards Million Miler status) but will also offer MQD boosts, perhaps as follows:

- Delta Platinum: $2,500 MQDs with $25K calendar year spend and again at each $25K increment above.

- Delta Reserve: $3,500 MQDs with $30K calendar year spend and again at each $30K increment above.

If the above predictions are true, then it would be possible to earn elite status entirely through spend as follows:

- Silver Medallion Status (requires $5K MQDs in my predicted scenario):

- Delta Platinum Card: $50,000 calendar year spend (earns $5K MQDs)

- Delta Reserve Card: $60,000 calendar year spend (earns $7K MQDs)

- Gold Medallion Status (requires $10K MQDs in my predicted scenario):

- Delta Platinum Card: $100,000 calendar year spend (earns $10K MQDs)

- Delta Reserve Card: $90,000 calendar year spend (earns $10,500K MQDs)

- Platinum Medallion Status (requires $15K MQDs in my predicted scenario):

- Delta Platinum Card: $150,000 calendar year spend (earns $15K MQDs)

- Delta Reserve Card: $150,000 calendar year spend (earns $17,500K MQDs)

- Diamond Medallion Status (requires $25K MQDs in my predicted scenario):

- Delta Platinum Card: $250,000 calendar year spend (earns $25K MQDs)

- Delta Reserve Card: $240,000 calendar year spend (earns $28K MQDs)

(alternatively: spend $210K to earn $24,500 MQDs and then earn an additional $500 MQDs through travel)

The scenarios laid out above assume that Delta will offer MQDs with every bucket of big spend instead of cutting it off after $50K spend with the Platinum card and after $120K spend with the Reserve card as they do today with MQMs. If they do continue to have the same limits as today, then the above scenarios are still possible but would require multiple Delta cards since each card has its own limits. For example, it is possible to have four relevant cards: Delta Platinum consumer, Delta Platinum business, Delta Reserve consumer, and Delta Reserve business. I’m not saying that’s a good idea, just that it’s possible today and I don’t see why that wouldn’t continue to be the case.

Say goodbye to rollovers

Today, any excess MQMs that you have earned above those needed to earn elite status, get rolled over to the next year. For example, if you have 35,000 MQMs (which is 10K more than needed for Silver status) and enough MQDs or a MQD waiver for Silver status, Delta will will rollover the extra 10K MQMs into the next year.

While I truly hope that Delta will somehow keep rollovers, I don’t expect that to happen with MQDs. Prove me wrong Delta!

Converting our existing MQMs to MQDs

Thanks largely to the pandemic where Delta rolled over MQMs for a couple of years in a row without even reducing our MQMs for elite status achieved, many frequent Delta flyers have large balances of MQMs today. Personally, I have over 400,000 MQMs!

If Delta stops using MQMs as a criteria for elite status, this could make their most loyal customers very upset unless they do something to convert those MQMs to MQDs or provide some other way in the next several years to continue to let customers use MQMs to earn elite status.

My guess is that they’ll convert rolled-over MQMs to MQDs at a rate of something like 15%. E.g. 100,000 MQMs will become 15,000 MQDs. If Delta doesn’t offer MQD rollovers in this new world, though, that would be a problem for people like me who would have far more than the required $25K MQDs to reach top-tier Diamond status in 2024 for the 2025 elite year. So, the solution is new Choice Benefits…

New Choice Benefit tiers

If Delta does away with rollovers, they’ll have to do something new to entice people to keep spending with Delta once they reach Diamond status. One simple solution is to add new tiers for earning Choice Benefits. Today, Delta flyers earn one Choice Benefit selection when they reach Platinum status and three selections when they reach Diamond status. In this made-up new scenario of mine, Delta will offer additional Choice Benefits as people earn higher and higher numbers of MQDs. Perhaps they’ll offer more selections when people reach $30K MQDs, $35K MQDs, etc.

Bonus guess: 25% SkyMiles discount for elite members

Delta recently added a nice perk for most Delta credit cardholders: 15% off award flights when flying Delta (i.e. it doesn’t apply when using miles to book partner flights). I think it would be easy for Delta to increase the discount to 25% for certain members. For example, the 25% discount may be limited to those with Gold status and above, or maybe it would be a Choice Benefit selection.

Bottom Line

As discussed above, I’m predicting that Delta will simplify their requirements for earning elite status to a single metric: Medallion Qualifying Dollars (MQDs). The rest of the post details my guesses as to how that will work.

The reason behind my guess is that I believe that Delta wants to reward their best customers, and that the best way to identify their best customers is not by miles flown but by the amount spent with Delta and with Delta credit cards.

If they do as I predicted, is that good or bad for Delta loyalists? That will depend on the specifics. Most likely, the changes will be bad for those who earn elite status entirely by flying, but that it will be good for those who earn status through a combination of flying and big credit card spend.

![[Dead] Delta One Suites to Taipei starting at 146K SkyMiles Round Trip a tv and a chair in a business class](https://frequentmiler.com/wp-content/uploads/2020/03/Delta-One-Suites-scaled-e1585682128234.jpg)

Afraid you were giving Delta way too much credit. MQD requirement for diamond is $35,000, not $25,000. Spend on reserve card $1 for every $10 (unlimited), so not too far off, but spend on platinum $1 for every $20, so way worse. Conversion of MQM at 5%,not 15%. All in, massively worse than projected. Delta Reserve card, $350,000 spend versus $240,000 spend expected. Delta Platinum, $700,000 spend versus $250,000. And pretty much a complete loss of MQM rollover miles

I tried to get some info out of a Delta employee. All I could get is that they are going to “rightsize” the business traveler. Personally I think they will make it harder to get status through spend aka you gotta spend more. People seem to be happy to spend away on those cobranded cards (facepalm)

I agree, the current system is still built around the “road warrior” and more specifically around the young “consultant” and career starter…too loop them in before they start a family and become an executive … but those don’t exist in the same numbers in a world of Zoom meetings. My hunch is that Delta wants to change the world to “we want you to spend more on the 5 or 6 times you travel each year” combined with “we want you to spend with us on hotels, cars, and on your everyday things with your credit card.”

They continue to play games with us?

We’ll continue to game them.

Fair play…

Game on!

It would seem reasonable to use a metric for flights that is akin to AA. That is, tier status multiple x dollars. That would give reasonable comparability to scale of credit card spending. But, Delta would also be wise to incentivize (as AA does) spending in all revenue channels. Hotels, rental cars, shopping, etc.

@Greg – I dont think MQM will go away. Or at least not yet. There’s still the million miler program qualifications that weren’t in these considerations.

We’re on the same page. See the section titled “MQMs will still exist as a way to get to Million Miler status”

Yes, oops. Must have scrolled too fast past that section or forgot about it.

I can confidently predict that any change Delta makes will be to no one’s benefit except Delta’s.

I think everybody’s crazy pessimistic.

1.) U.S. domestic revenge travel has come to a hault.

2.) There is still substantial pent-up demand for long haul. [I’m hailing from Germany, and I am seeing tons of Americans when staying in hotels for my EU work travel. This has been quite noticable over the past few months.] But the long-haul excess demand will go away as well. My bet would be it will normalize by summer of 2024.

3.) The US economy is doing exceptionally well. But the world economy isn’t. That will drag down growth in the US eventually. We’re already seeing early signs of weakness in the US labor market.

4.) For SkyMiles, there was a status cliff at the end of Jan ’23. But it feels like there could be a second, smaller status cliff again Jan ’24.

In light of what I envision for the aviation market as well as the macro environment, I think it would be short-sighted of DL to enhance as much as you predict. Let’s not forget their business model ceases to work if there are too few highly-engaged Skymiles members.

@ Greg — I think your predictions are pretty spot on, except the MQM to MQD conversion. I can’t imagine Delta giving you $60,000 MQD for your 400,000 rollover MQM. I imagine something more like a 10% conversion with a cap, or a couple extra choice benefits, or something? Anything? Otherwise, Delta will be overrun with Diamonds instead of Platinums come 2025, which I doubt is a desirable outcome.

I also think Delta and Amex may cap the number of MQDs you can earn from each card (as it currently is for MQMs), at least on the Platinum card. Otherwise, people interested in spending/boosting status wouldn’t necessarily need the Reserve card (since getting Silver status would actually require less spend on the Platinum while getting Platinum status would require the same spend on either card, but the Platinum has non-Delta bonus categories).

Yes, the Reserve card has lounge access/first class companion certificate, but I do believe Delta and Amex will want to continue incentivizing big spenders to have the card.

Perhaps the Diamond problem is solved with a ticket spend metric in the MQD to hit Diamond.

Right now there is a waiver for $250k card spend but your math has that in the early $200s.

Diamonds can only get there with ticket spend? Or only half way there with card spend unless the threshold $250k is hit?

HOW DO I MAKE MONEY ON THIS?

With a complexity akin to the credit default swaps and subprime mortgages of the 2008 financial crisis, Delta, home of the Sky Peso, is once again, looking to further marginalize its customers, but do so in a way which can be passed off as an “enhancement”.

There must be a way to game this mofo.

As airlines continue to drift away from their original core business of transportation and into the murky waters of banking, the very idea that rewards programs could be a perfectly legal way to print money and, more importantly, to control the nominal value of that money, is intoxicating. Instability and consolidation in the airline sector used to be predicated on ticket sales. Now, it rests firmly in the cradle of marketing revolving credit accounts to the masses. The average person only flies a few times a year at most, but they use their credit cards every day. Who would have thought we’d be charging perishable goods at usurious rates to collect Monopoly money? Even worse, that Monopoly money can only be used to enrich the entity which produced it.

P.S. I do not want to hear one more word about the ethical implications of travel hacking. We do what we do because we can. Nothing more, nothing less.

We are not benevolent benefactors of a just and fair capitalist system. We look to take every advantage, no matter how clearly mistaken the provider was in offering it, in every situation. As it has been so aptly put, we “strike while the iron is hot”.

If it’s all spend based – I’m going for diamond with MS only

With someone with 125K+ MQMs (like yourself), your Skymiles page would show something like ‘2024 Status progress: Diamond Medallion’ (since you already qualified) — it would be a shame if with the new no-rollover prediction, suddenly one is status-less (i.e. ‘2024 Status progress: SkyMiles Member’)! Either a lot of unhappy members or somehow they’ll have to honor the already earned DM status for next year…

To be clear, I don’t expect any changes to how you earn 2024 elite year status. Everything I wrote was about earning status in 2024 for the 2025 elite year

A big Delta announcement was made today that Tom Brady will have some major marketing.operational role with the company. Strange move

Not if they plan to “deflate” the value

Hands down the most thoughtful predictions from any travel site so far. Keep up the awesome work!