| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

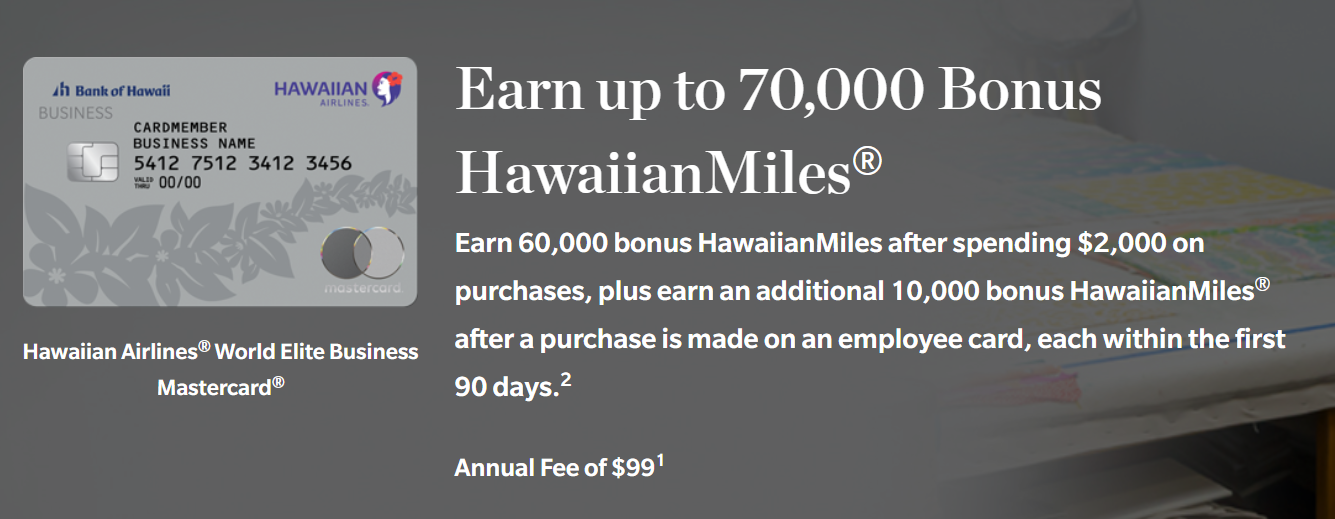

There’s an increased welcome offer out for the Hawaiian Airlines Business Mastercard: 60K after $2K in purchases within the first 90 days and an additional 10K after making a purchase on an employee card.

HawaiianMiles aren’t terribly appealing in their own right, but with the coming Alaska/Hawaiian merger looking more and more likely, there’s much more interest in the Hawaiian credit cards as a means to potentially generate Alaska Miles once the loyalty programs combine.

The Offer and Key Card Details

| Card Offer and Details |

|---|

ⓘ $479 1st Yr Value EstimateClick to learn about first year value estimates 50K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler Earn 50K miles after spending $4K on purchases and paying the annual fee, both within the first 90 days$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 9/11/22: 80K + $99 statement credit after $2K spend in first 90 days Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and office supply stores ✦ 1x everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 40,000 annual bonus miles — 20k miles with $50-$99k annual spend or 40k miles with $100k or more annual spend; Noteworthy perks: One-time 50% off a companion discount on roundtrip coach travel between Hawaii and North America on Hawaiian Airlines and on Alaska Airlines North America routes |

Quick Thoughts

HawaiianMiles are getting a lot of love right now, in anticipation of a 1-1 transfer ratio to Alaska Mileage Plan if/when the merger goes through. Now that the Department of Justice has allowed it to proceed without objection, it seems like the merger is very likely.

For those who are speculatively amassing HawaiianMiles, this is an excellent offer for the business card. We see it every other year or so and the minimum spend is very reasonable given the miles on offer.

Don’t forget that the Hawaiian personal card also has a 70K welcome offer that only requires one purchase and that there is currently a 20% transfer bonus from Amex Membership Rewards to HawaiianMiles that expires at the end of the month, both potentially better opportunities than what we see here. That said, being able to earn 70K miles on $2k spend with no impact to your Chase 5/24 status will be very tempting many folks.

Barclays Application Tips

- 6/24 Rule: Similar to Chase, Barclays has a rule that you may not be approved for a new card if you have opened 6 or more cards (with any bank) within the past 24 months. However, this rule is inconsistently applied and there are data points of people being approved despite being over 6/24.

- 24 Month Rule: Barclays also has a rule that you can only get a welcome offer on a card for a second time if it's been more than 24 months since you last received a welcome offer on the same card. Like the 6/24 rule, this seems to be inconsistently applied and some cards display the following language: “You may not be eligible for this offer if you currently have or previously had an account with us in this Program.”

- No Duplicate Cards: Barclays won't let you have two of the same card. In order to reapply, you'll need to cancel the card first. It's generally thought that you need to wait at least six months after cancelling before attempting to reapply.

- Velocity Limits: It's generally thought that Barclays will usually only approve you for a new personal card every 6 months. However, there are examples of people being able to move faster.

- Card Limits: Barclays doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. It's also thought that the bank will use your spending on other Barclays cards as one of its approval considerations.

- Application Status: Call (888) 232-0780 to check your application status or use this link for personal cards and this link for business cards.

- Reconsideration: If denied, call (866) 408-4064 and ask for your application to be reconsidered.

offer just expired

Link says offer has expired.

Any idea when the offer for 70k in one purchase for the personal card ends? I’m thinking of downgrading by JetBlue Plus card to the zero fee and going for this instead!

Dang, didn’t know there was a JetBlue no fee. I should have done that instead of closing.

Does this card have a referral bonus? I just applied and was approved and if there’s an option to refer P2, would like to do that.

[…] providing an amazing bonus in the mean time on their co-branded enterprise bank card, as flagged by Frequent Miler. This provide could possibly be price profiting from, even in case you wouldn’t in any other case […]

[…] are offering a great bonus at the moment on their co-branded business credit card, as flagged by Frequent Miler. This offer could be worth taking advantage of even if you wouldn’t otherwise earn […]

what’s the prospect of this converting to Alaska miles?

[…] HT: FM […]

I applied for this card last week but my app went to review. Fingers crossed!

What’s the over / under on someone (like me) that has 3 existing Barclays CCs (JetBlue Plus, AA Red and Wyndham Earner Biz) getting either/both the personal and biz Hawaiian Airlines CC? I have a combined Barclays CL of $39K. Any recent data points of Barclays letting you move CL from one card to another to get approved?

I had two Barclays cards (Arrivals, AA Silver) when I applied for the personal Hawaiian last week. It went to reconsideration because my credit was frozen, but the agent approved when I unfroze my credit and callled in to restart the review. She did ask if it was okay to reallocate some of my credit from another card. I had no problems with that, and was then approved instantly.

While I’ve never had to do it personally, there’s regular reports that I see indicating that Barclays is usually willing to reallocate credit lines.

Thank you TravelGeek and Tim for the positive data points.

If you were planning on going for 1 card, which card would you go for now? If you are planning on doing both, what is your strategy for the applications?

They are definitely willing to reallocate credit lines between personal and business cards. They asked me on recon call

What’s the likely expiry dates for the business and personal card increased bonuses?

How is this “increased” or “new” in any way? This is the exact same offer that has been available for months (maybe years?). Checking my records…lemmesee…yep, exact same offer I got in late 2023: 60K for $2K spend + 10K for employee card first use. The exact same offer, down to every minor detail. Not new, not “increased”. But speaking of “increased”…

Look, it’s painfully obvious that you guys seem to have decided it’s your mission/obsession now to endlessly flog anything related to Hawaiian Airlines incessantly, to the point where the companies react and kill any reasonable possibility of anyone actually taking advantage of anything good (sound familiar? oh the “sweet spots” you guys have wrecked for years…).

Running short on material? Maybe give this poor airline a rest.

Haters gonna hate

Why don’t you go bother someone else. The offer was just increased from 50k, hence the post. I personally appreciate the notice

If this offer has been available continuously for years, it’s news to us. The previous offer was 50K after $4k in spend and we don’t show this particular version as having been available since last year at this time (probably when you got it).

Not sure exactly what you define as a “mission or obsession,” but we make absolutely no money from anything related to Hawaiian or Alaska (or their credit cards) and in the last four months, we’ve had a total of six posts related to Hawaiian Airlines.

Last week, the DOJ allowed the Alaska/Hawaiian merger to proceed, meaning that HawaiianMiles may very well turn into Alaska miles within the next year. That’s very noteworthy for almost any points and miles enthusiast and we’ve covered it accordingly (and will continue to as developments warrant).

Sounds like you’re not into it, however. Totally fine. We’ll still be putting out another 7-10 posts per day that you’ll hopefully find more useful.

This offer has been around a long time. You have now published it and it’ll get circle hat-tipped around by the usuals until Barclays finally pulls it. And you’re not even making money off of it. Classic FM.

This seems like an almost intentionally disingenuous take. Credit card offers rise and fall over time, the fact that this same offer was available 10 months ago doesn’t mean it’s not an increased offer from the baseline that it returned to in between (and indeed the offer currently being advertised on the HA website is for 50k miles.)

The forthcoming Alaska-Hawaiian merger is perhaps the biggest event in the US points and miles space in years, it’s no surprise that bloggers are writing about it. This month FM has done one routine post about the Amex transfer bonus, one news post about the DOJ approval, one analyzing the Amex bonus in light of the DOJ approval, a post criticizing Bilt for silently dropping HA as a transfer partner, and a post about the business credit card. And they talked about it on their podcast. That hardly strikes me as a “mission/obsession” given the newsworthiness and the volume of other content they’re producing.

I nominate this comment for the FM Bad Take Hall of Fame

Dude, if you’re concerned with “obsessions”, maybe look a little closer to home?

Javier, if you were competent enough you’d start moving on to the next thing now that the blogs have publicized it. A good churner already has the other options on tap