NOTICE: This post references card features that have changed, expired, or are not currently available

Many credit cards offer great category bonuses. 3X points for this or that, 2X points for the other, 5X points with categories that change every 3 months, etc. There are apps that claim to help with this problem… and they probably do. But, personally, I’m not going to whip out my phone for every purchase to figure out which card to use. And my wife definitely won’t. Instead, I have a low tech solution…

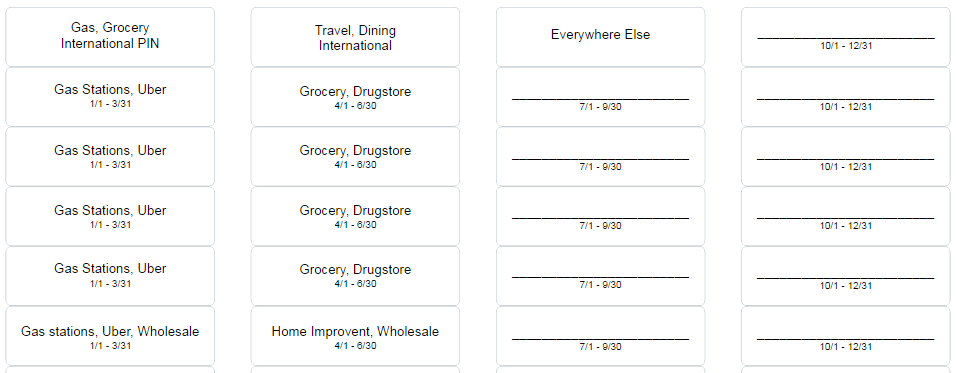

I use sheets of half inch tall labels (such as Avery 8167), and then use Avery.com to design the labels. I then stick them on credit cards as needed. My wife has three cards in her wallet:

- Chase Sapphire Reserve Card with a label that says “Travel, Dining. International“. This way she knows to use the card for all travel and dining purchases in order to get 3X rewards, and that it is OK to use internationally (no foreign transaction fees).

- CNB Crystal Visa Infinite with a label that says “Gas, Grocery. International PIN“. This way she knows to use the card for all gas and grocery purchases in order to get 3X rewards, and that the card has a PIN for international Chip & PIN use. Note that this card also offers 3X rewards for travel & dining, but I’d prefer that she use the Sapphire Reserve for those purchases so I left those off the label.

- Chase Freedom Unlimited with a label that says “Everywhere Else“. This way, she’ll earn 1.5X rewards on all spend where she’s not using the other two cards for 3X rewards.

I also created labels for our four Chase Freedom Cards and our two Discover It cards. While I’m pretty good at remembering the bonus categories for my other cards, its easy to forget with these since the 5X categories change each quarter. I created the following labels for the Freedom Cards:

- Quarter 1: “Gas Stations, Uber. 1/1 – 3/31”. Note that the first quarter category is really Gas Stations and Ground Transportation, but I thought it better to write an example of ground transportation that we would really use.

- Quarter 2: “Grocery, Drugstore. 4/1 – 6/30”.

- Quarter 3: “_______________________ 7/1 – 9/30” (e.g. fill in the blank with a pen once we know more)

- Quarter 4: “_______________________ 10/1 – 12/31” (e.g. fill in the blank with a pen once we know more)

And similar labels for our Discover It cards:

- Quarter 1: “Gas Stations, Uber, Wholesale. 1/1 – 3/31”.

- Quarter 2: “Home Improvement, Wholesale. 4/1 – 6/30”.

- Quarter 3: “_______________________ 7/1 – 9/30” (e.g. fill in the blank with a pen once we know more)

- Quarter 4: “_______________________ 10/1 – 12/31” (e.g. fill in the blank with a pen once we know more)

Other solutions?

How do you keep track of which cards to use where? Please comment below!

[…] I’ve reported before that I’ve packed my wallet (and my wife’s) with 3 key cards: […]

[…] Once you have your goals in mind, you have to know which card to use in order to get there. How do you keep track of which card to use? […]

I personally use Wallaby when in doubt about the best card to use, but this is because I have space for the app on my phone. My wife on the other hand doesn’t, so I just kind of wrote with marker which to use. I will be using your simple solution in future for her. It’s real neat and clean looking.

I’ve been using Avery labels for my husband’s cards for several years now as he has zero interest in keeping track of any of it. Even then he sometimes “forgets” to look at the label. I change out the quarterly bonus cards when needed. Also God forbid there are more than 3 cards going at once because the 4th one gets stuck in a back pocket of his wallet and never sees the light of day again.

He does enjoy the free travel earned, though!

So those are the cards your wife carries and uses, which cards do you carry, Greg? (I know you use MS for many cards, but I’m interested in your day-to-day).

For day-to-day my wallet looks the same as my wife’s but without the stickers (since I know which to use where). One tough call: we still have a Citi Premier card that we’ve kept due to good retention offers. I really should use that instead of the CNB card for gas, but I decided the difference in value between ThankYou points and CNB points wasn’t enough to be worth making my wallet fatter. If I had the EveryDay Preferred card I would swap out the CNB card entirely since it offers great bonuses on both groceries and gas (especially with its monthly 50% point bonus) and I highly value MR points.

Since I’m always trying to meet some sort of signup bonus, I just take note of the card info in case I need to use it online, and then give my wife that card for all her daily expenses, regardless of category bonuses. Of course, since we usually dine out or travel together I can easily sub in an appropriate card from my wallet as needed. Once we’ve hit the signup bonus, I take back that card and give her the next card that needs minimum spend. KISS.

Scotch tape works well. Then write on the tape.

masking tape and pen

I don’t know if this will get me shut down eventually, but I use a Chase Ink Plus card at office supply stores to buy a lot of Visa gift cards for general spending. I value the 5X Ultimate Rewards at around 7.5% back when transferred to Hyatt, Southwest (have companion pass), or United Airlines. Even with a 3% purchase fee on the Visa gift card, I’m still netting 4.5% back.

When I’m working on a signup bonus, I shift most of my spending to the new card unless I can get an easy 5X Ultimate Rewards.

Post-it makes a label “tape” that I use to label my credit cards. For cards with the 5x rotating categories it is very easy to just lift the label up every quarter and replace it. I write on the label with a Sharpie and it stays until I decide to pull it up.

I don’t bother with maximizing category bonuses anymore on regular spend. I MS heavily using my ATT Access More and Chase Ink Plus/Cash cards so I just use those three cards on regular spend as well to offset what I do on the MS side. At the end of the day, the additional 1x or 2x bonuses I forego not using certain cards doesn’t really amount to much in the grand scheme of things. I am more than willing to give Chase and Citi a carrot as long as they allow me to continue to MS.

So I have general expenses that done fall within any of the rotating categories or in dining/travel/office supply or for any other 3x categories. Which card would you recommend for me to use if I spend about 50k/yr in these non-category areas?

What are your goals? Would you want a Southwest Companion Pass? One sign-up for a 50k bonus and you could nearly spend your way there for a year.

Starwood AmEx would be a good card with the sign-up right now, and if you value their hotels and airline partnerships. (You’d spend your way to SPG Gold when you hit $30k in a year, which right now gives you gold status at Marriott as well and I think some crossover perks to Delta).

Or if you get a lot out of Chase Ultimate Rewards, Freedom Unlimited at 1.5x per dollar is decent.

There might be some cards that offer perks for high-spending thresholds, but I am not well-versed in those.

Honestly for this 50k, I would look for cash back. I already collect a lot of Ultimate Rewards points from travel and dining purchases. I’m looking to donate the cash back I get from this 50k of spend.

This post should give you some good ideas: https://frequentmiler.com/best-rewards-for-everyday-spend/

So, two questions about the CNB Infinite Visa:

1) The 3x on groceries is still on effect? I thought I read that benefit was cancelled.

2) Do AUs on the receive their own separate card number, or otherwise get their purchases broken out?

1) Yes 3X grocery is still in effect. I haven’t heard anything about them cancelling that benefit. I sure hope they don’t!

2) Yes, each AU gets their own card number and you can view their purchases separately.

Am I missing something? If you are looking to meet minimum sign up bonuses, that is the credit card you should use for all purchases, without question. If you are truly travel hacking, this is the best and most efficient way to get free travel. For example, the bonus points per dollar, for our minimum spend on the Sapphire Reserve was 25 points per dollar, or 25%, until we reached 4k in spending. That’s before the 1-3% category spend, in addition to the sign up points. Had we augmented our spending with say, Chase Freedom, for 5% quarterly categories, we would have slowed the progress towards the sign up bonus, and at most would have earned 5% for specific categories instead of 25% plus 1-3% for the minimum spend.

I think there are easier solutions. For example, when I sign up for a new card, I just hand my wife my card to use. Since she does most of the family spending, this works well for us. I will carry a Citi Double cash 2% back card for the few purchases I make. If I spent enough to make a difference, I would simply ask for a second card. However, I also make purchases online and borrow “my” card when we are both at home and I go grocery shopping.

On to my Chase Preferred Card application today, since we are getting close to minimum spend on our second Reserve Card (her card, mine has already been received).

Thanks,

Dan

If you always have a single card to meet minimum spend on, then your strategy makes complete sense. In my case, I often sign up for multiple cards at once and I like to knock out spend requirements quickly using currently available techniques: https://frequentmiler.com/go/ms

So, personally, I find it simpler to keep a few rewarding cards in my wallet for day to day spend.

This is great! I have a label maker, but never thought to use it on the cards!

I use sharpie, but that doesn’t look as nice, rubs off, things change, etc. this is better!