Last year I came across a Loyalty Lobby post which shared that there’s a special rate that IHG shareholders can use to obtain a discount. My wife and I stay at IHG properties quite a bit, so I was curious how this worked and so I decided to become an IHG shareholder to test it out.

Becoming an IHG shareholder

Let me preface this by saying that you don’t have to become a shareholder in order to check what the shareholder rate will be. That’s because you can check IHG shareholder discount rates here. I’d done that and noticed that shareholders could often obtain rates lower than the lowest available rate – even cheaper than Advance Purchase rates.

It seemed like you can book this rate without being a shareholder, but I was wary of doing that in case hotels in the future requested confirmation that I was a shareholder. The thing is, it didn’t look like you can just buy IHG shares through Vanguard, Robinhood, Webull, etc. Instead, the IHG corporate site made it sound like you had to buy their shares directly through their registrar Equiniti. Equiniti is based in the UK and my research led me to Shareview.co.uk. To buy IHG shares through Shareview, you have to be a UK resident which I no longer am. In theory I could’ve used my parents’ home address, but further research showed that Equiniti runs Shareowner Online in the US. On this page you can check the ‘Direct Registration Share Sales (DRS)’ button and scroll down the list to see ‘InterContinental Hotels Group PLC Post Reverse Split 2019’ listed as an option with a minimum initial investment of $250.

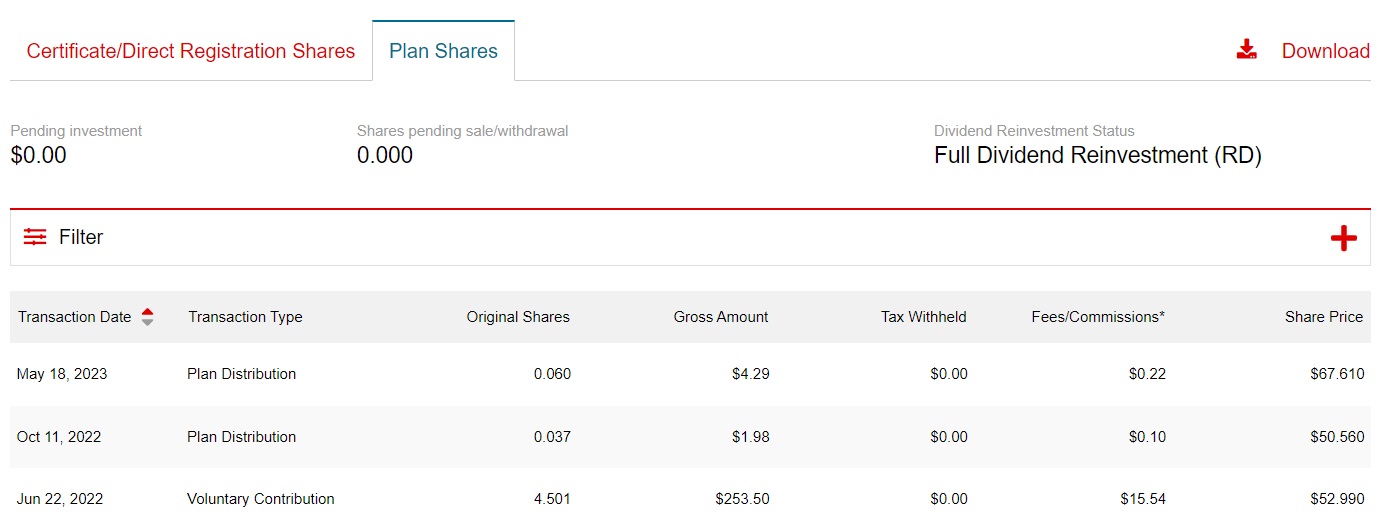

It seems like that $250 minimum investment includes fees. That’s because I spent $253.50 which got me 4.501 shares at $52.99 per share, with $15.54 of fees/commission added on. I never received anything from the registrar regarding the IHG shareholder rate, but at this point I was confident that if I booked an IHG shareholder rate that I could prove to a front desk agent that I was indeed an IHG shareholder.

IHG shareholder rate pricing & cancellation policies

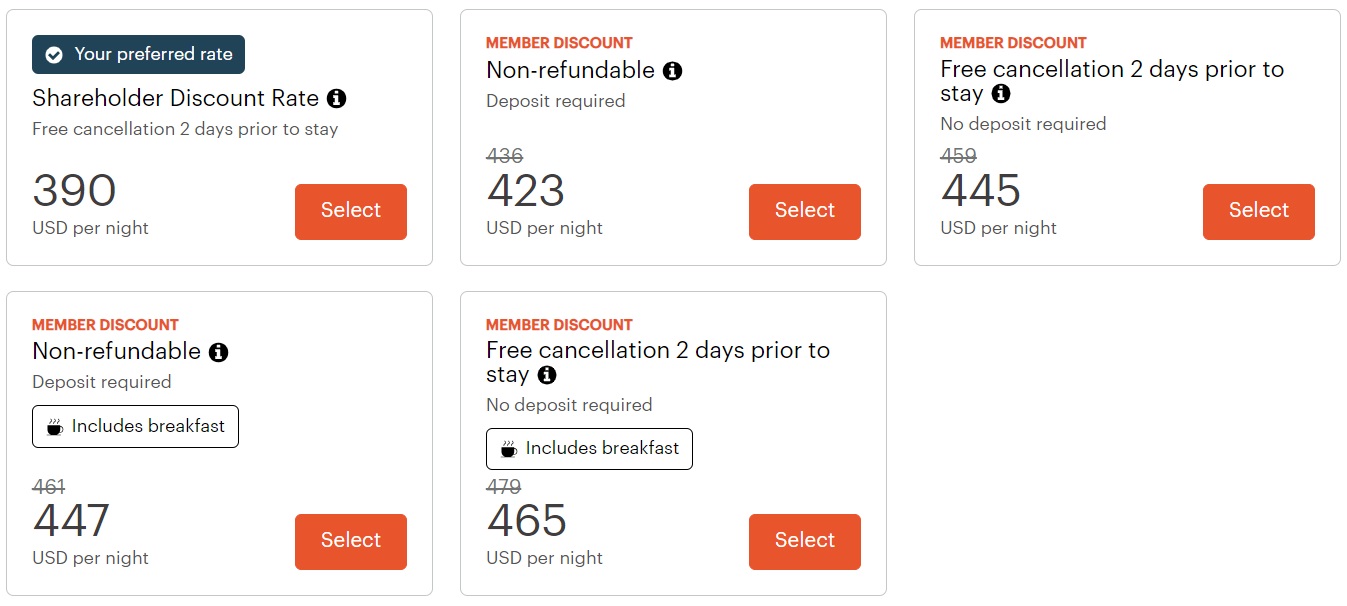

As I mentioned earlier, you can check IHG shareholder rates here. In pretty much every search I’ve ever done, the IHG shareholder rate came out lower than any other publicly available rate. The discount seems to be 15% off the Best Flexible Rate, but your actual savings could be lower depending on other rates available at the time of booking.

For example, here’s the price for a weekend stay at the InterContinental Boston from November 3-5. The shareholder rate is $33 per night less than the cheapest available rate before taxes and fees – that’s 7.8% less.

Note that that’s not a like-for-like comparison though. The cheapest non-shareholder rate is the non-refundable rate for $423 per night, whereas the shareholder rate lists a more flexible cancellation policy of two days prior to your stay. That’s the same cancellation policy as the $445 per night rate, so when comparing those you’re saving $55 per night before taxes and fees, or 12.4%.

I’m don’t think the shareholder discount rate always has the same two day cancellation policy listed above. Instead, I think it might vary from property to property (perhaps based on whatever a hotel’s flexible rate cancellation policy is), so keep an eye out for that.

Point & elite night credit earnings – zilch (in theory)

Something you won’t know until actually going to book an IHG shareholder rate is that you won’t earn points on your stay, nor will you earn elite night credits.

That’s what had, until recently, prevented me from booking a shareholder rate. When getting to the booking page, IHG helpfully advises you how many points you can expect to earn. When booking under a shareholder rate, the estimated points earnings are always listed as zero:

I’d also spotted at one time during a past booking process that I wouldn’t earn elite night credits either. When doing some searches for this post, I no longer see that specifically listed, but it had been listed there in the past.

Earning no points and no elite night credits therefore greatly reduces the appeal of the shareholder rate. Not earning any points on paid stays with this rate will be the biggest downside for many people, but not earning elite night credits can be detrimental in three ways. First, if you’re trying to earn status organically (like I am), you’re likely not going to be able to do that if you have a number of paid stays not giving you elite night credits.

The second issue with not earning elite night credits is that it’d presumably affect your ability to earn bonus points with some of IHG’s promotions. Their promotions either offer 2x, 3x or 4x bonus points which you’d be ineligible for if your base points earnings are nil, or you earn x,xxx bonus points when staying x nights which you’d be ineligible for if your elite night earnings are nil.

The third issue is that when IHG revamped their loyalty program in 2022, they introduced Milestone Rewards. These are benefits you can choose for every 10 nights you stay starting at 20 nights. If stays booked using the shareholder rate don’t earn elite night credits, you won’t be earning towards additional Milestone Rewards with those stays.

As a result, since becoming an IHG shareholder in 2022 I hadn’t booked any paid stays using the shareholder rate. While it would have saved us some money, I’d have missed out on points earnings and also wouldn’t have been able to requalify for Diamond elite status organically.

Side note: I know that if you have Diamond status you can buy Ambassador status to renew your Diamond status each year. I personally don’t want to count on that though because a) we rarely stay at InterContinental properties and so paying $200 for Ambassador membership (even if it does come with 20,000 bonus points) isn’t too appealing and b) IHG could end that unadvertised feature at any time. Seeing as maintaining Diamond status with an Ambassador membership isn’t an official benefit of the IHG One Rewards program, they could pull it at any time and you wouldn’t know until your status had already dropped. I’ve been able to qualify for Diamond status organically the last few years, but the Ambassador route might be one I explore from 2025 onwards once we’re no longer living in hotels.

Testing IHG shareholder rate earnings

Here’s the thing – I didn’t know if what was displayed on IHG’s website was accurate. It seemed bizarre that they’d penalize their own shareholders by not awarding them with points or elite night credits even if they were getting a good deal on the room rate.

I was wary of becoming a guinea pig for this because all of our paid stays over the last year have been for 7 nights or more. That’s a lot of points and elite night credits to forgo in the event that IHG does penalize bookings made using the shareholder rate in that way. However, our recent Party of 5 challenge gave me the perfect opportunity to test this out.

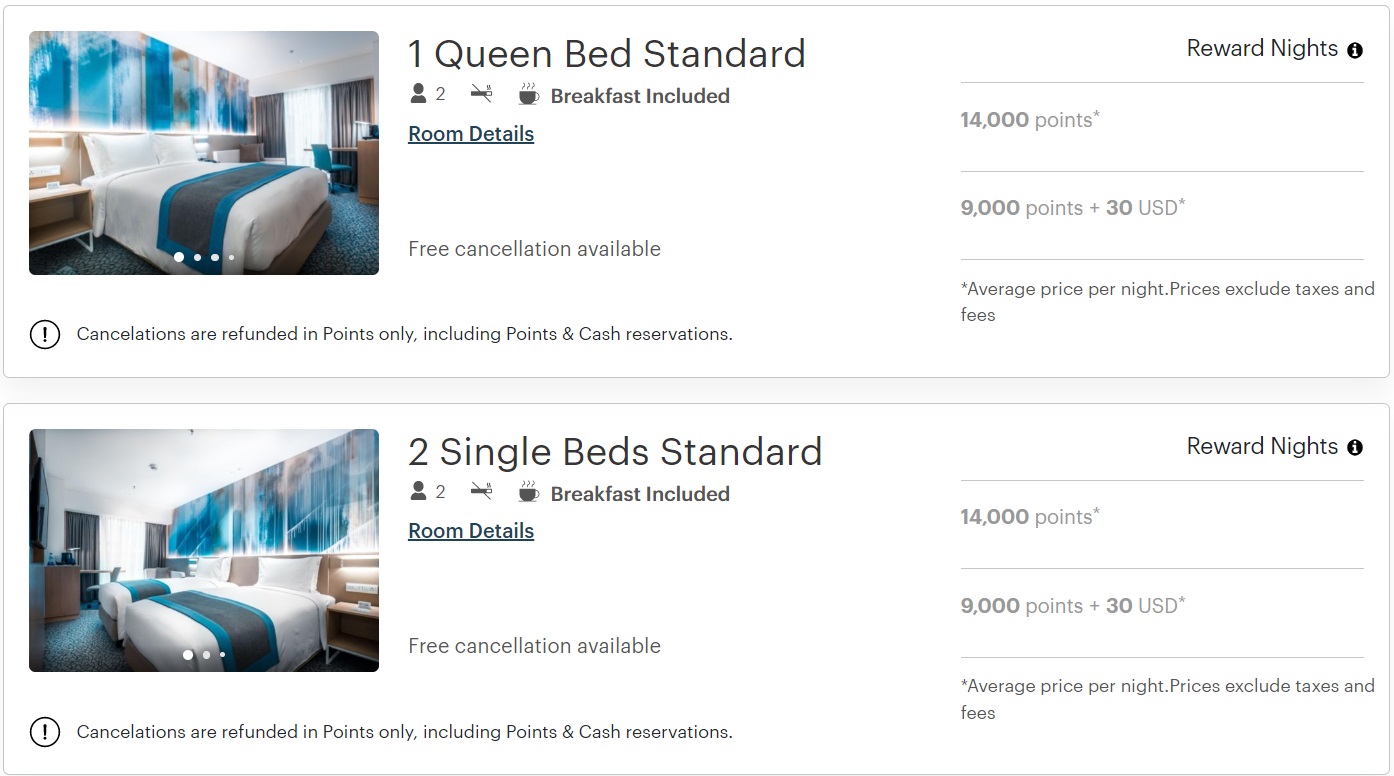

We were due to arrive in Manila late at night and the best hotel option was the Holiday Inn Express Manila Newport City. It was attached to the airport (sort of) and was reasonably priced. The award price was 14,000 points per night; I have the IHG Select credit card which gives a 10% points rebate, so the net cost would’ve been 12,600 points. IHG One Rewards points frequently go on sale for 0.5cpp, so those points could be bought for $63 – not a bad deal at all.

In fact, we’d originally booked our stay there because when originally making those reservations the paid rate was $102.39, so almost $40 more expensive per room versus the award pricing. However, when checking the rates again a few nights before our stay the paid rates had dropped.

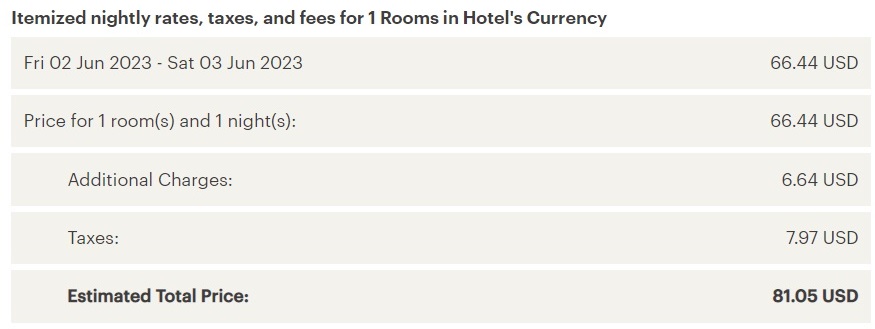

At this point our plans were as locked in as they were going to be, so we were comfortable with booking a non-refundable rate. That was $81.05 per night with taxes and fees, so about 20% less than the paid rate had been when checking a month or so earlier.

I then checked the IHG shareholder rate and, as I’d expected, that turned out to be even cheaper. That rate was $74.77 with taxes and fees – almost 8% cheaper than the cheapest publicly available rate.

$74.77 was still higher than the $63 worth of points we already had booked at that point, but there was another factor to consider. At the time, Capital One Shopping was offering me 16% cashback on IHG bookings. Although you have to book via a special landing page to obtain the shareholder discount, that landing page is on IHG’s website. I figured that I could click through to IHG from Capital One Shopping, then copy and paste the shareholder rate landing page to get that pricing while still earning the 16% cashback.

The 16% cashback rate is calculated on the base room rate before taxes and fees. In this instance the room rate was $61.28. The 16% cashback would reduce the net cost with taxes and fees to $64.97 – not far off the $63 worth of points for our existing bookings. I was fairly confident that we would indeed earn the cashback through the Capital One Shopping portal, so for the sake of a $5.91 loss (the $1.97 difference x three rooms) we’d be able to test the shareholder discount rate to see if it did indeed not offer points earnings or elite night credits.

IHG shareholder discount rate – the tests

To recap, we were testing the three things listed above, as well as a fourth element, when booking the IHG shareholder discount rate:

- Do you earn points on a paid stay with that rate?

- Do you earn elite night credits?

- Do you earn cashback through a shopping portal?

- Do you receive elite status benefits?

That fourth and final element – do you receive elite status benefits – wasn’t particularly important for our stay as there weren’t really any room types we could be upgraded to, plus breakfast is included at Holiday Inn Express properties regardless of elite status. However, it could be an important factor if you have Diamond status and wouldn’t receive free breakfast at brands like InterContinental, Kimpton, Crowne Plaza, Holiday Inn, etc. when booking the shareholder rate.

IHG shareholder discount rate – the results

Unfortunately, it turns out that booking the shareholder discount rate worked out even worse than I’d expected. That’s because there were failures with three of the four elements I tested.

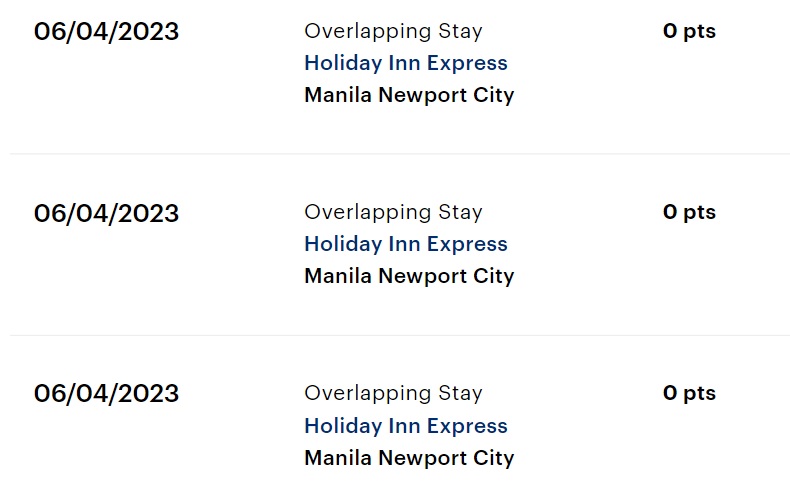

Do you earn points on a paid stay when using the IHG shareholder discount rate? No.

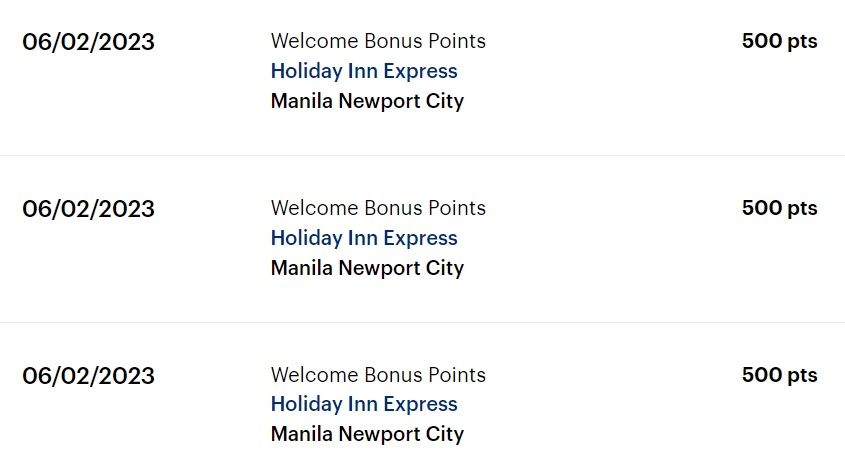

We didn’t earn points for any of the three rooms that we booked using the shareholder discount rate.

You might notice that each of those three rooms have a notation stating that they were overlapping stays. For the purpose of earning points with IHG, that doesn’t matter because with IHG you can earn points on up to 9 rooms booked on the same account. Having overlapping stays therefore had no impact on the result of this test – IHG simply doesn’t award points booked with that rate as they’d warned ahead of time.

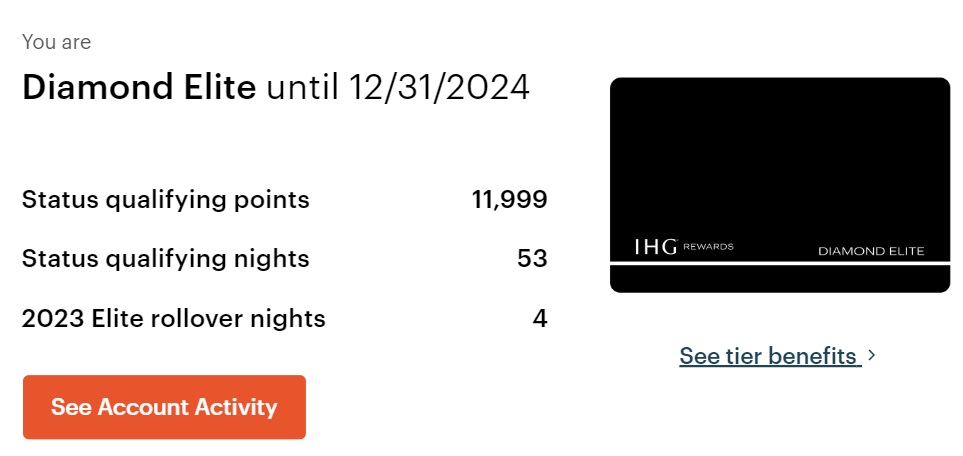

Do you earn elite night credits when using the IHG shareholder discount rate? No.

This one was a little trickier to work out. At the time of writing this post I have a total of 57 elite night credits this year – 53 from stays this year and 4 rolled over from last year.

The thing is, I didn’t know if I’d earned any of those from our three rooms booked using the shareholder discount rate. I therefore had to scroll through all of my account activity since January 1 to calculate how many elite night credits I’d earned from other stays.

I initially miscalculated that, but when recounting them I confirmed that I’d earned 53 elite night credits from all of our other stays this year and none from our stay booked using the shareholder rate.

Do you earn cashback through a shopping portal when using the IHG shareholder discount rate? No.

This was the biggest disappointment from my test. In pretty much every case I can think of with other retailers, if you click through from a shopping portal and then copy and paste a different landing page into the address bar you still earn rewards through a shopping portal. There might be rare exceptions, but for the most part it works.

The problem here is presumably that the IHG shareholder discount rate isn’t a commissionable rate and so they don’t offer any payouts via affiliate networks when someone books with that rate.

As a result, we didn’t earn 16% cashback from Capital One Shopping for any of the three rooms. Unfortunately that meant that rather than effectively overpaying $1.97 per room (the loss if we’d earned 16% cashback versus booking with points bought at 0.5cpp), we overpaid by $11.77 per room, or $35.31 total. That’s disappointing, but it’s another reason why it’s good not to run these sort of tests on more expensive stays.

Do you receive elite status benefits when using the IHG shareholder discount rate? Yes.

The one silver lining in all of this is that it looks like you are eligible to receive elite status benefits at IHG properties when booking stays using the IHG shareholder rate.

The reason I know that is because I earned 500 bonus points for each room when checking in. This is a benefit that Platinum and Diamond elite members can receive when checking in at IHG properties. If you have Diamond status, you’d get far more value at some brands by selecting free breakfast as your welcome amenity. However, at brands like Holiday Inn Express where breakfast is complimentary for all guests, you get the free points instead.

The fact that I earned these points gives me confidence that members with elite status will still be eligible for other elite status benefits when booking with the IHG shareholder discount rate.

Conclusion

The fact that you can’t earn cashback through a shopping portal, nor earn points or elite night credits, when booking a paid stay with the IHG shareholder discount rate greatly affects the value of that discount.

Consequently, I’m highly unlikely to take advantage of that shareholder rate as I doubt there’ll be many – if any – occasions where the savings from booking that rate will outweigh the cashback earnings from a shopping portal, the value of points earned on a paid stay using a “normal” rate and the elite night credits I’ll pick up.

IHG Shareholder Rate FAQs

How do I become an IHG shareholder?

In theory you can buy IHG shares through any platform that you’d normally buy shares from. However, for the purpose of being officially eligible for the shareholder rate, it seems like you have to buy the shares through Shareowner Online. Check the ‘Direct Registration Share Sales (DRS)’ button and scroll down the list to see ‘InterContinental Hotels Group PLC Post Reverse Split 2019’.

How do I book the IHG Shareholder Discount rate?

You can access the rate here.

How big is the discount?

You supposedly get 15% off the Best Flexible Rate. Your savings might be lower though depending on other rates bookable at the time.

What’s the cancellation policy with the IHG Shareholder Discount rate?

It seems to be more flexible than the Advance Purchase rate, but it can differ based on the hotel and so you need to check the cancellation policy when booking.

Do you earn points when booking with this rate?

No.

Do you earn elite night credits when booking with this rate?

No.

Do you receive elite status benefits when booking with this rate?

Yes.

Can you earn cashback through a shopping portal when booking with this rate?

No.

I paid for a Wall st journal membership recently as I was cheaper to renew my marketwatch/barrons and combine all three. The WSJ has a 20% discount till 31.12.23 (I presume it rolls over annually) and the discount works same as the shareholder one, never used it though so do not know re nights, points etc.

So sad! Have you at least enjoyed a bit of profit on the stock? 🙂

Yep, it’s gone up since I bought it, so that side of it has worked out well 🙂

I was all set to become a shareholder, until I finished your article.

Would you consider using the shareholder rate after you met your elite night goal and milestone goal for the year? How many elite nights can you roll over from year to year?

I’m assuming you can roll over an unlimited number of elite nights, but I haven’t checked the T&Cs to confirm that. I only just make it to 70 nights organically, so I don’t end up having many rollover nights beyond that. As things stand, it looks like I’ll roll over 3 nights this year.

I doubt I’d use the shareholder rate for any bookings beyond that though unless the rate was significantly cheaper. The points earnings and shopping portal earnings seem to outweigh the savings from the shareholder rate, plus booking the shareholder rate could mean missing out on the next Milestone Reward.

That makes sense, that’s what I would do too.

If you are already a Diamond elite and stay less than certain threshold for milestone rewards. This shareholder rate may not be as better given 15% saving is no bigger than 20x points back (=15% or so imo) plus elite night though if you are willing to spend on Ambassador elite then it may not be as useful but only towards hitting milestone rewards.

For Platinum member 16x definitely not worth 15% Cashback so it really depends on if you want those elite night to hit Diamond

How does the Shareholder rate compare to the Friends & Family rate, which does earn points? Looks like it it could be the same rate?

I’ve never checked the friends & family rate, so I’m not sure if it’s more expensive or not.

I priced a NYC stay that I’ve already booked with AARP discount. SH discount was $6.32 less for the five-night stay. I think I’ll pay the difference for the points.

Yep, definitely worth paying that little bit extra as the points and cashback from a shopping portal will be worth well in excess of the savings from using the shareholder discount rate.

Given what you’ve learned, my only question would be, do you intend to continue to be an IHG shareholder?

I’ll continue being a shareholder as there’s no need to sell the shares, but knowing what I know now, I don’t think I’d choose to become a shareholder purely for the shareholder discount.

r u going to short the stock now?

Maybe I should if I’m putting people off buying their shares now!

It sounds like the discount is lifetime so you don’t have to buy new stock periodically to avail yourself of the discount??

That’s my understanding, yes

One more followup, I went to the website to look at the cost and now it says 250 USD initial investment 25 USD recurring minimum annual investment, So this is new requirement?

https://www.shareowneronline.com/transactional/anonymous/newsol/register/dspp?dsppOnly=true&issueNumber=I324

I interpret that to mean either a $250 minimum initial investment or a regular investment of $25 per month. I think Shareowner Online is a UK company and those are common requirements there, so I don’t think you have to invest a minimum of $250 and then $25 per month too.