NOTICE: This post references card features that have changed, expired, or are not currently available

This is the latest in our ongoing series of what’s new in the world of manufactured spending. Our last update was in September (here).

As always, you can find an up-to-date complete roundup of techniques for increasing spend here: Manufactured Spending Complete Guide.

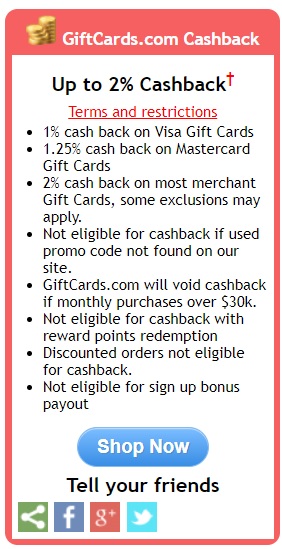

Portal Rewards now limited on Giftcards.com

As you can see in the cash back terms above, Giftcards.com will now void cashback if your monthly purchases total more than $30,000. This news was first reported at Pointchaser. While only a couple of portals showed the new terms at first, Doctor of Credit predicted that these terms would spread to other cash back portals. — and they have. While this is surely bad news for those who were doing significantly more than $30K per month this way, it’s probably net positive for many people in that Giftcards.com has now made it plainly clear that they are willing to accept a decent amount of volume per person. Sometimes, having a speed limit makes it easier as we know how much is too much.

What still works?

Of course, there are still plenty of options for buying Visa and Mastercard gift cards, and GiftCardMall has had some good sales recently.

Pay rent with a credit card fee-free: that died fast

Last week, Miles Talk reported on a special offer from RoomiPay to pay your rent with a credit card fee-free. It died in a day…and then within two days, the ability to pay your rent even with a 2% credit card fee died as well….as you can see in the image above, the site just totally shut down payments until next month. It might be worth signing up for a reminder just in case they offer this again. It looks like a few commenters at Doctor of Credit have reported the payments shipping and/or arriving successfully this month.

What still works?

If you’re willing to pay a fee, there are still options for paying rent with a credit card:

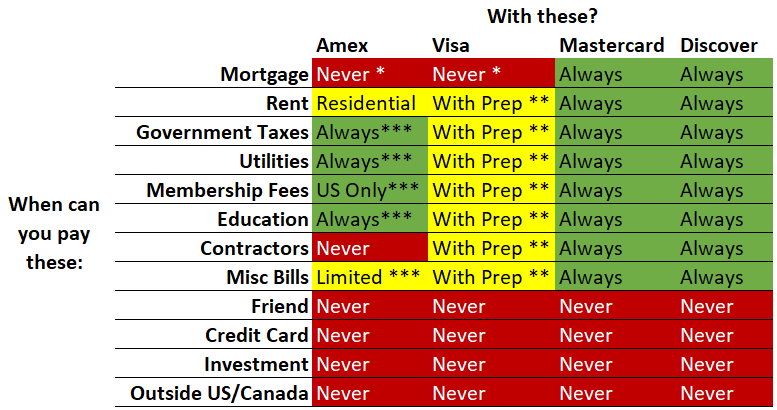

Plastic kills Amex payments, then restores them on a limited basis

Plastiq abruptly stopped taking Amex cards for payments this fall. Fortunately, that was a temporary change — though when Amex payments returned to Plastiq, uses became quite limited (See: Plastiq restores Amex payments within limited industries). For example, you can no longer use an Amex card to pay a mortgage through Plastiq – though you can use one to pay government taxes, utilities, or education expenses.

What still works?

See the chart above and our Complete Guide to Plastiq for more.

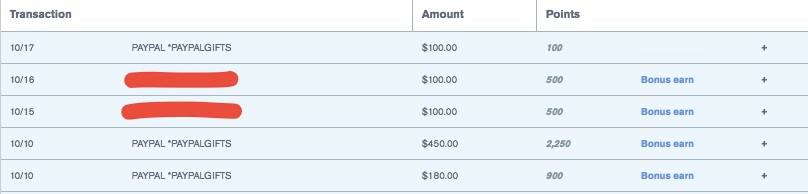

Death of PayPal Digital Gifts: No more 5x

For a long time, purchases with PayPal Digital Gifts coded at 5x on Chase Ink Cash and Ink Plus cards. Unfortunately, that has now completely died — except for folks with old Ink Mastercards. Unfortunately for them, the days are still numbered as those Mastercarss will get changed over to Visas next month.

What still works?

While this was a big blow, it’s not the end of earning 5x on gift card purchases. See: What’s left for 5X Ink? for the options that are still alive.

The war on gaming is underway

While there had long been hints that Amex was tiring of credit card churners and gift card purchasers, the first authoritative steps toward slowing down outlying behaviors came out this fall. First, the Amex War on gaming heated up, and then Amex fired another shot earlier this month. The short of it is this: Amex has made it clear that they may deny and/or claw back signup bonuses if they feel like you gamed the spend. In response to these developments, Greg recommended avoiding the following when meeting minimum spend:

- Don’t buy gift cards or other cash equivalents until after receiving your signup bonus. It is clear now that this includes gift card purchases at retail stores such as supermarkets. I’d avoid buying gift cards altogether.

- Don’t buy anything that you are likely to return until after receiving your signup bonus

- Keep your new card for a year before closing (or product changing) the account

- Don’t use person-to-person payments with your Amex card while working on meeting minimum spend. Examples of person-to-person payments include payments to friends using an Amex credit card via Venmo, Paypal, Apple Pay, etc.

What still works?

As noted in that second post, a number of options still exist for meeting minimum spend requirements.

- Everyday Spend: This is obvious, but needs to be said for completeness. Use the card for all day to day spend.

- Timeshift Spend: With some utilities and other ongoing expenses it should be possible to pre-pay for charges that you know you’ll incur in the future.

- Pay Bills: Obviously if a biller allows credit card payments, that’s a good way to go. If not, consider using a service like Plastiq to pay bills (including things like rent, mortgage, day care, etc.). You will have to pay a fee, but it can be well worth it to meet spend requirements quickly and easily. Note that for Recipients in the United States, the use of American Express cards is permitted only for the following industries: Government (e.g. tax payments), Utilities, Education, Residential Rent and Club Fees and Memberships.

- Pay Federal Taxes: Fees start at 1.89% for credit cards. Over-payments, if any, will be refunded after you file your year end taxes. For full details, please see: Complete guide to paying taxes via credit card, debit card, or gift card.

- Fund Kiva Loans: Do good and hopefully get your money back. See: Manufacture Spend (and do good) with Kiva and Kivalens.

- Buy/Sell merchandise (but not gift cards): For an overview, see: Increasing Spend through Reselling.

As for ongoing spend, I haven’t read accounts of clawbacks on points beyond the signup bonus. In addition to merchandise reselling, I’ve been regularly buying and reselling merchant gift cards on Amex cards without any issue — but be aware that Amex may advance into new territory without warning. Treading softly for the time being may prove wise.

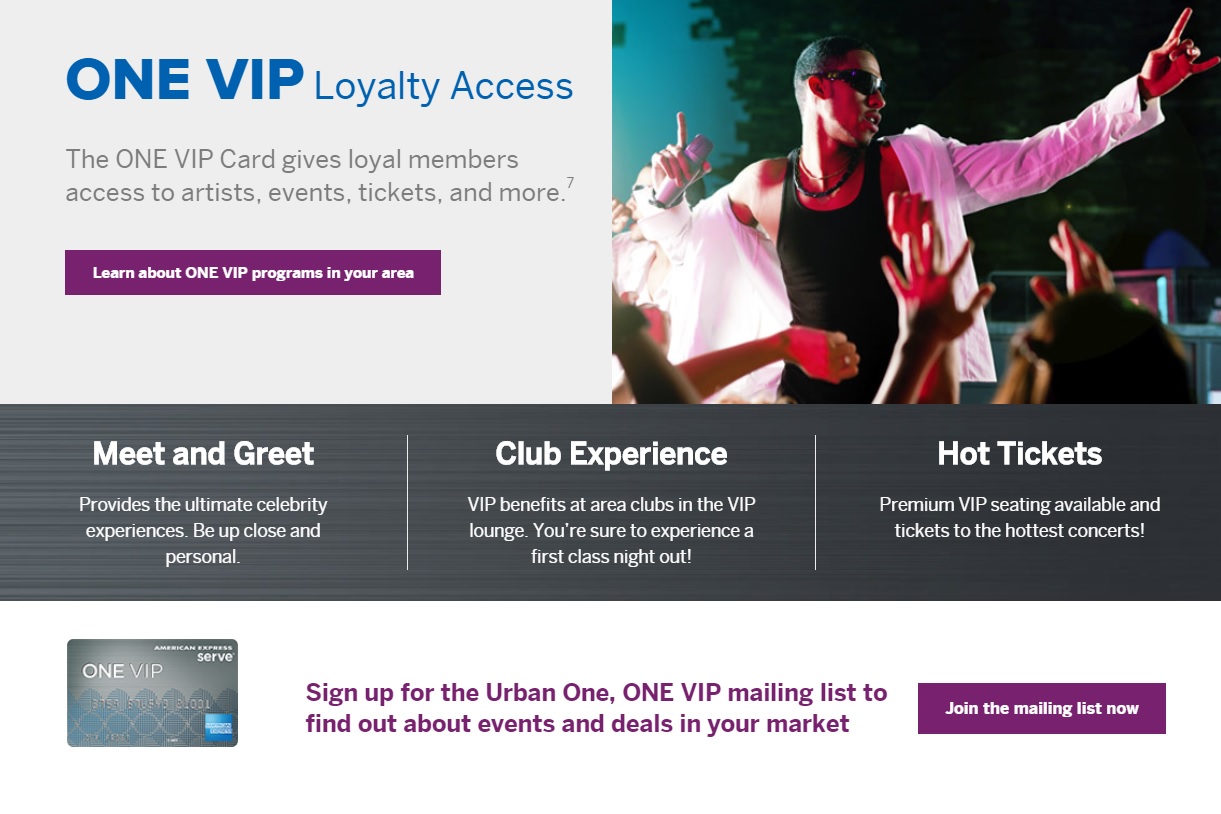

Serve ONE VIP to be discontinued

This is a last call: the Serve ONE VIP card is being discontinued for new applications starting January 1st. If you don’t have this card and want one, make your move sooner rather than later. While many readers have probably long been shut down by serve, those who haven’t should probably get one of these for some easy liquidation before the opportunity slips away.

No more money orders at the post office

Speaking of easy liquidation, this fall the post office register system stopped allowing gift cards to process as debit cards for money order purchases (See: Ugh…no more money orders at the post office). Of course, money order purchases are always a bit tenuous — you want to be careful where you put them and there is always a rumor about the next big change. The latest rumor has been about an update to Walmart payment systems that some people think will lead to a similar shutdown on gift card money order purchases. At this point, it’s business as usual — I bought money orders as normal this past weekend. In fact, this weekend marks the second time a cashier has asked to see the card I’m using and I’ve clearly showed them the gift card and they have nodded in approval and said “that should work”. There isn’t cause for panic here yet — but I wouldn’t want to get stuck with tens of thousands in gift cards the day something major changes, so always be sure you have a backup plan…or four.

What else still works?

In terms of increasing your credit card spend and getting most of it back, there are still lots of ways to do so. In addition to things discussed above, some healthy options remain:

- Fund College Savings or Student Loans with Gift of College gift cards

- Pay Federal Taxes

- Pay Friends with Venmo or Paypal

- Kiva Loans

- Reselling

Beauty is in the eye of the beholder in terms of the attractiveness of each option, but these are still reliable methods for meeting heavy spend. Additionally, while my wife ran into a bit of a roadblock (See: Shop until you’re dropped: Chase Financial Review freezes account), she and I have both increased merchant gift card reselling with decent success (and thankfully, her situation works out OK — see Chase Financial Review: Results are in for the outcome) and merchandise reselling continues to be a viable option for us.

While the landscape has certainly changed in the past couple of years, opportunities still exist for earning some great rewards without much cost.

Does anyone know what renttrack codes as for ink preferred?

[…] This is the latest in our ongoing series of what’s new in the world of manufactured spending. Our last update was in December (here). […]

I use one Simplybest coupon login to order visas for myself and my wife from Giftcards.com (2 different GC.com logins), so would it be correct if I wanted to get above $30K, I should open up another simplybest coupon site for my wife so we could each get $30K?

Hope my question makes sense.

Thanks,

Thereoretically, yes. That’s the way it should work. Whether GC.com might limit their payouts per billing address, I don’t know.

Are giftcards.com limits per portal or per account? I rarely hit 30k but was curious based on what you wrote..

I expect that they are per account

It has become harder to order from GCM and GCcom since the start of the year. GCM tends to prolong the hold time for unsuccessful transactions. Some reports say they have taken more than two weeks now for orders from last week of Dec that failed. If this is their way to slow down their regular customers, they are succeeding but then if more and more customers quit buying from them…maybe they’ll start ‘shaping’ up and become customer friendly again.

hahaha would pay a bounty for info on the other methods not mentioned. Send me an email

One little nasty discovery about GOC, that may vary by lender (mine is Firstmark). I called and submitted a form to place my loan in “Paid Ahead” status so that additional payments push the due date back. So in late November I posted a $500 payment through GOC that hit in early December.

Unfortunately, because I was signed up for auto-debit (and that’s a no-brainer given the .25 interest rate reduction) my regular monthly payment got pulled as well a couple of days ago. Turns out that auto-debit debits EVEN IF there is no payment due in a month.

Is there any other way to Pay Mortgage other than Plastiq (Where Visa or Amex can be used easily)?

Not that I’m aware of

There’s still quite a few MS methods that have survived because of minimal to zero exposure. I’m sure those who are continuing to enjoy them would like to keep it that way because overexposure has proven to kill gigs instantly once it is published.

I promise not to tell!

How does Amex know if I buy a gift card at a retail store? By the amount charged?

Some stores provide what is known as Level 3 data, which means that they tell the credit card company what you purchased. On my Amex business statements, sometimes it shows a breakout of exactly what I purchased at some stores.

I have been paying rent using https://www.renttrack.com/

Cost me like $10 after accounting for 2% cashback, not a bad deal since they report to all 3 credit bureaus and the customer service has been great till now.

A couple of days only, but for the many who will no longer be able to itemize federal tax deductions, look at what you normally deduct and charge to a credit card (organizational memberships, museum memberships, gifts to educational and religious organizations, other charities, etc.) and “pre-pay” in 2017 what you would normally do in course of 2018

There are one ot two methods you’re not revealing here. You know it’s true.

You can’t handle the truth!!!

😀

Oh, you!