NOTICE: This post references card features that have changed, expired, or are not currently available

Kickfurther is a platform that lets companies seek funding from the Kickfurther community by offering a return on investment (such as 8% profit in 10 months, for example). Technically, these offers aren’t really loans. When you invest in a Kickfurther offer, you are technically buying inventory that is then sold on consignment by the company seeking funds. With Kickfurther, you will earn a profit with each offer that you fund as long as the “borrower” pays out as promised. A nice perk for the points & miles crowd is that Kickfurther allows funding by credit card and, in my experience, it is never treated as a cash advance. Regardless of how you fund these offers, Kickfurther charges a 1.5% fee to withdraw the paid back funds to your bank account.

Offer stages

Kickfurther displays Live Offers (those that you can contribute to now), Upcoming Offers (those that are not yet available for funding), and Funded Offers.

Kickfurther displays Live Offers (those that you can contribute to now), Upcoming Offers (those that are not yet available for funding), and Funded Offers.

Each Kickfurther offer has a timeline which includes an offer close date, multiple interim payout dates, and a final payout.

Close date: If the offer isn’t fully funded by its close date then it is considered an expired offer. Once an offer is fully funded, your credit card is charged at that time.

Interim payout dates: Each offer lists a number of dates with which investors can expect partial payouts.

Final payout: The date upon which investors can expect final payment

My Kickfurther strategy

I first started kicking the Kickfurther tires in October of last year. I was pretty excited about the possibility of both earning a nice profit and increasing credit card spend from home. I started by contributing to just 2 or 3 offers. I then waited until initial payouts appeared in December and January before investing in more offers. My strategy, then, was as follows:

- Set a maximum long-term investment target. Since offers usually take between 6 months and a year to fully pay back, funding Kickfurther offers is a form of long term investment. If you do this, it’s important to know up-front how much money you can afford to have tied up long term.

- Invest in offers that I believe in. This is tough because there isn’t much objective information available for any offer. In general, I prefer investing with companies who have run Kickfurther offers in the past and have successfully paid out as promised. Or, if the product being sold is available on Amazon.com, I like to check the reviews. I’m more likely to invest in an offer where there are lots of positive reviews or the product has a good sales rank. Finally, is the product something that I think will do well? If I look at at the product info and think that I’d like to buy one, then I might just invest as well.

- Diversify: Rather than putting all of my Kickfurther eggs in one basket, I like to make many small investments. This way, if I lose everything with one offer, the other investments will hopefully make up for the loss.

- Once I’ve invested up to my long-term investment target, I’ll wait for interim paybacks before investing more. I’ll use the amount that has been paid back as my ongoing budget. In that way, I’ll maintain my overall investment amount while continuing to add to my credit spend and to hopefully earn a decent profit.

Withdrawals

Once money has been paid out to you, you can withdraw it to a linked bank account or re-invest it. If you withdraw the money, Kickfurther will charge you a 1.5% fee. In my case, I want to use Kickfurther both as an investment platform and a way to run up credit card spend (for the rewards), so I always withdraw the cash and incur the fee. Withdrawals have all gone smoothly for me.

My initial reactions

Early in the year I was frustrated with Kickfurther because all of the best offers were fully funded within seconds of going live. I got into a habit of investigating upcoming offers and then waiting to pounce at exactly 5pm ET when the offers went live. Using my iPhone’s browser, I funded a couple of offers while walking my dog, and at least one at a live basketball event.

My current view

Kickfurther has greatly improved, in my opinion, by limiting the percentage of each offer than an individual can fund within 24 hours, and by introducing the concept of “Offer Keys” (described here). Each Kickfurther member gets one Offer Key per month (or more with successful referrals) which can be used to unlock an offer before it is live. So, if you see an upcoming offer that you’d like to contribute to, you can apply an Offer Key and invest in advance. That way, you don’t have to wait to pounce on the offer the moment it goes live. This has made a huge difference for me. Now, when I see an upcoming offer that I’m excited about, I simply apply an Offer Key, enter the amount I want to fund, and select which credit card to use. Done.

There are still a few things I don’t like about the Kickfurther platform. My biggest gripe is the lack of overall statistics. The site shows detailed information about each transaction and each funded offer, but it’s hard to get an overall picture of my portfolio. No, wait, an overall picture is all I get. That is, they do a good job of showing overall stats in a chart, but very little of that information is available in tabular form.

I would also like better tools and information for assessing each offer’s risk. I’m not sure how Kickfurther can help with this, but it would be great to have some kind of objective risk rating for each offer so that we can know better what we’re getting into.

Finally, Kickfurther should show overall statistics across all investors and all offers. I’d like to know the percent of offers that paid late, percent that defaulted (if any), etc. And I’d like to see stats such as average investor profit or loss, along with 95% confidence intervals.

Current results

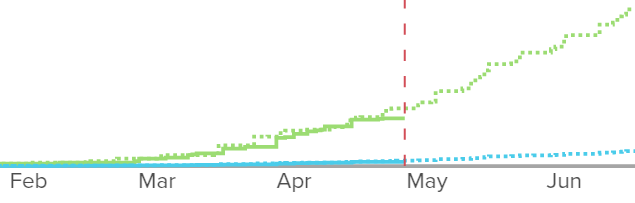

Here’s a picture showing my portfolio to-date. The green solid line shows my cumulative payouts. The green dotted line shows the expected payouts. As you can see, the current expected payouts are slightly higher than actual payouts. This means that some companies in my portfolio have missed payout dates. If you look back to April, though, you’ll see the same thing. The good news is that the payments did eventually appear and my actual payouts were equal to expected payouts for a few weeks.

The blue line, above, shows my profit, and the dotted line shows expected profit.

Overall, I’m pleased with my current results, but it’s still too early to claim success. None of the offers I’ve funded have completed payout. It won’t be until fall or winter that I’ll have much data for calculating my estimated profit or loss from this venture.

What can go wrong?

If a business fails to pay out as promised, Kickfurther can theoretically claim that company’s inventory and liquidate it as it sees fit (more info about this can be found here). If that happens, then hopefully the Kickfurther investors will get back some of their money.

By diversifying investments, I think its possible to reduce risk quite a bit, but it certainly doesn’t eliminate risk. If we fall into another recession, for example, I think it is likely that many offers will fail to pay out, and many investors will lose money.

Referrals: $5 for them, Offer Keys for you

One way to get additional offer keys (so that you can get in early on the best offers) is to refer friends. Kickfurther says “Every 3rd person you invite that signs up and and makes a claim will earn you an Offer Key, which gives you early access to offers by allowing you to make a claim during the preview period.” And the person you invite gets $5 to invest.

If you’re interested in trying Kickfurther, you’ll get $5 to invest if you signup with my referral link. Or, if you already use Kickfurther, feel free to post your referral link in the comments below (note: URLs within comments are often flagged as Spam so I can’t promise that your referral comment will show up).

Your Kickfurther store

Another way to earn money with Kickfurther is to setup your Kickfurther store. Products available through offers you’ve funded can be added to your “store” and you’ll get a 5% commission for each sale. I randomly added a bunch of products to my store to demonstrate what it looks like. I am not endorsing any of these products. This is for illustrative use only. Overall, its hard for me to imagine anyone making much money from their Kickfurther store, but who knows…

Bottom line

Kickfurther is an innovative platform that makes it possible to fund long term investments by credit card. It is possible to get excellent returns on your investment, but it is also possible to lose money. Unfortunately, it is way too early for me to estimate my own profits or losses. All I can really say at this point is “so far, so good”.

Again, if you’re interested in trying Kickfurther, you’ll get $5 to invest if you signup with my referral link (and I’ll get an Offer Key for every 3 people who sign up). If you have money available for long term investments and you’re willing to take on risk, then you may find it worth trying. If you don’t have extra cash that you can tie up long term, then don’t even think about it. Kickfurther is only for those looking for long term gains.

[…] first wrote about Kickfurther with “My half-baked Kickfurther Review” and then followed up with “Kickfurther review 2. Manufacturing profit and […]

Any update on this, Greg? How are the investments going?

I posted an update in July: https://frequentmiler.com/2016/07/26/kickfurther-review-2-manufacturing-profit-and-spend/

Things are still going well, but its hard to know for sure because their reporting tools are so poor.

Kickfurther/Kiva are not MS. It is gambling, pure and simple. I imagine you always win every time you gamble Greg. And you pay for it with your credit cards. The fact that you don’t put caveats on these methods makes me wonder if you get Kickbacks ala the Points Guy.

VERY YMMV. Personally I’d avoid.

[…] My half-baked Kickfurther Review […]

[…] fund these offers with a credit card. Unfortunately, there are real risks as well. Please see this Kickfurther Review for full […]

[…] Kickfurther Review and Guide […]

[…] Reviews: FrequentMiler, Racing Towards Retirement, […]

I was doing some calculations on this and it looks like they do take a big chuck out of your profit in the end. Has anyone had experience with reporting this as an expense on the investment, because this would mean you end up paying more taxes for money that you did not get in the end.

For example, say you put in $1000 into this and invest for 6 months at $10% interest rate. At the end you have $1100 now and want to withdraw it. You will end up paying $16.5 of the fees. This means that Kickfurther is taking out 16.5% of every $100 you make in profit on the site and not just the 1.5% to withdraw your funds.

Use a 2% credit card or other one of your choice. Earn $20.

Funding with CC is optional as you should be able to earn more than 1.5% plus rewards/cash back.

True, I have been using cards to fulfill bonus requirements and putting rest on the 2% cards for now.

Yes, good point. I noticed that too. Since the 1.5% fee is based on the entire amount, it is wrong to assume that profit can be calculated (in that example) as: 10% – 1.5% = 8.5%. In reality, since the 1.5% fee goes against your initial investment, the total profit in this example comes to 8.35%. I’ll leave it to accountants to say how this should be reported.

With eTrade or other broker websites, there is a field which asks for expenses on the investment. This is where you have to usually enter the fees you paid. If this has to be treated as investments then I would assume it would require the same treatment.

Maybe Kickfurther should clarify this further. Their site has so many glitches and attracting serious investors would require clear information from their side.

Your math is way off. First off, you are effectively paying 1.65% on every $100 you INVEST assuming a 10% profit. It simple, it’s just 1.5% of the amount you want to withdraw. Period.

I’ve been using it for about a year and have been doing pretty well. AGAIN…..just like Kiva, be careful in which ones you choose. I only choose ones that have had success previously on KF. I do the same with Kiva and haven’t lost a dime on kiva in 2+ years.

Please use my referral link too!

http://kickfurther.com/s/qw5bl43f3j

[…] like reading about personal finance opportunities for investments so I found this Frequentmiler review on Kickfurther interesting. Sounds like an interesting investment opportunity, albeit with more risk than some […]

I’ve actually been wondering why there hasn’t been more discussion of Kickfurther in the points-and-miles community post-Bluebird, since it seems like a significantly better deal than Kiva at face value. Wish there were more data points out there about how common it is to loose money with them.

[…] Kickfurther may be a way to increase credit card spend. There may also be some further opportunities here, but too soon to tell. Frequent Miler has a great review, so much so that I’ve already signed up myself. Now, FM has done all the hard work, so should you choose to sign up – you can use his link in the post, or if you like, here is my referral link. — note, you get $5, and for every 3rd, the referrer (FM or I) get an “Offer Key” […]

I’ve used Kickfurther nearly a year now and I’ve averaged 25% yearly return. It’s great! There are definitely some problem offers, but if you’re smart with who you pick and diversify you’ll do fine. Some tips: I stick to companies with good cash flow, lots and lots of sales history, low product price, and not a niche industry (e.g. I don’t know why people fund super expensive fashion crap). Even better, stick to companies that have had multiple funds raised on kickfurther before.

If this was helpful you could use my ref link too: http://kickfurther.com/s/k57rqys84w

You can’t average a yearly return of 25% when you have been using it for less than a year. Your return might have been 25% YTD, but an average requires at least 2 data points.

He already has the two data points.. The term and the interest for each deal. With that, you know the APR.

Sure the returns sound great, but think about it for a minute. Take the offer for a 13% return in 7.7 months posted on their front page right now. That’s 21% APR. What kind of business takes loans out on such terms? Ones with no credit history or ones that are desperate and can’t get a loan from the bank.

Do your homework first or you are speculating, not investing in these companies.

There are other benefits to the companies, like 1) they get the money MUCH faster than traditional loans and 2) there are fewer hoops to jump through. When they have to deploy quickly to fulfill purchase orders, it can be worth it. Also, not all companies offer the same returns – companies that come back to KF repeatedly can usually get away with lower return rates because they are good with the community.

What a company.

Use them a little bit, but never even knew about ‘keys’. Not sure how that even got communicated. I get emails constantly about new offers, but nothing about bad offers or website changes.

Also when a offer stops payback completely, Kickfurther leaves you high and dry. Have one offer that stopped paying in Jan. Kickfurther posted a few vague updates about repayment that never came to be. I don’t think any of the safeguards they claim they have are worth anything more than words on your screen. So the risk is painfully real and pretty much a crap-shoot. Reminds me of Prosper and Lending Club in that regards.

Agreed. Several of my investments are not paying out and Kickfurther is silent on the issue. It only takes a few bad investments to negate any profits you earn. Sound great in principle, but Kickfurther has done a bad job following through. And now the investment amounts are quite high, increasing the risk for default. I’ve stopped investing in Kickfurther and advise you to invest at your own risk

Agreed, my return has been -17% in the last 8 months that I’ve been on kickstarter. Too many defaults, too little accountability from kickfurther. As long as they’re getting their cut they don’t seem to care how much investors get shafted. Great for potentially shady/rocky companies though.