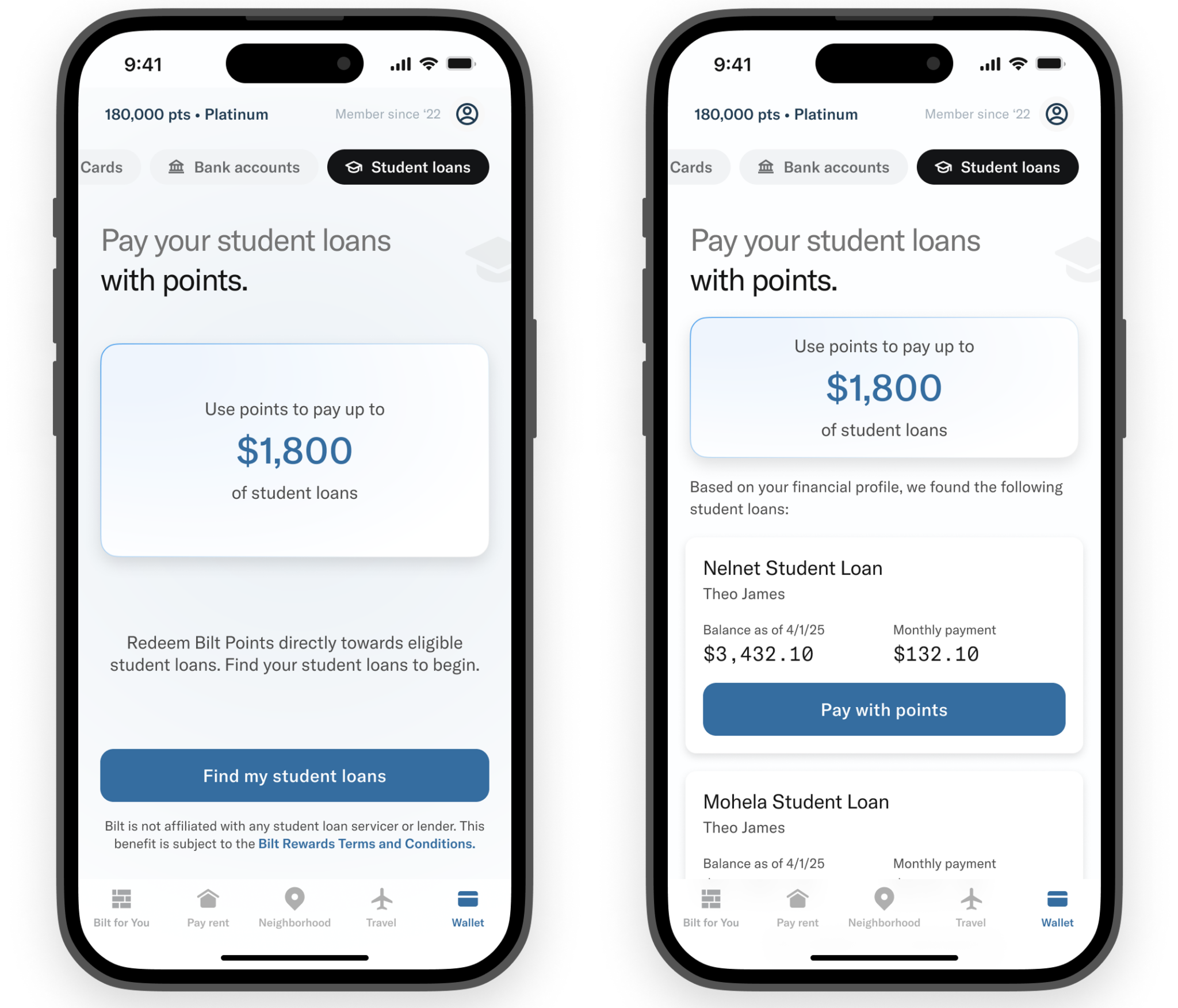

Bilt Rewards has launched a new redemption option today that will likely be appealing for a subset of its loyalty program members. Those with student loans serviced by five major loan providers can now redeem points for student loan repayments at a rate of 1 cent per point. Depending on your situation, you might be able to get even better value than that by paying your student loans with Bilt points.

The Deal

- Redeem Bilt Rewards points towards student loan repayments serviced by the following providers at a rate of 1 cent per point:

- Sallie Mae

- MOHELA

- Nelnet

- Navient

- Aidvantage

Quick Thoughts

Being able to redeem Bilt points for student loan payments is an interesting new redemption option. At a redemption rate of 1 cent per point (cpp), it’s not a superb option seeing as you can get much better value than that when transferring to travel partners (especially during transfer bonuses), nor towards a down payment for a new home as that’s a fixed 1.5cpp rate. However, it is much better than many other options like redeeming for Amazon or Lyft, both of which are at a 0.7cpp rate.

It’s also significantly better than the main cashout option. Bilt lets you redeem points for statement credits if you have a Bilt Mastercard, but that’s at a 0.55cpp rate and so should absolutely be avoided. Redeeming for student loans is therefore almost twice as good. It’s not necessarily something we’d recommend, but it’s not horrible either.

Despite the redemption rate for student loan repayments being at a fixed 1cpp rate, it is possible to do even better than that. We’ve confirmed with Bilt that in addition to redeeming points for standard repayments, you can also redeem points to make overpayments on your student loans. That’ll have the effect of reducing your loan length and thereby the overall interest payable on your loan. It’ll therefore have the effect of getting you better than 1cpp of value if your redemptions go entirely towards your student loan principal.

At the time of this feature’s launch, only the five student loan providers listed above are participating. However, additional providers are due to be added in the coming months, so keep your eyes peeled for your loan provider if this would be an option of interest for you.

Typo: Neinet should be Nelnet

Thank you – I’ve fixed that

[…] Hat tip to FM […]

Hoping for point EARNING for student loans next. Direct ach integration would be a game changer. Here’s to hoping…

They already give you free points for rent. I think Bilt is trying to reduce the amount of free points they give.

Your expectations should be more that Bilt will encourage you to earn them swipe fees in exchange for your rent points — the new “use any credit card to pay rent” feature is a good example. Bilt charges you 3%, probably pays 2% to the CC processor as the swipe fee, and keeps 1%. Suddenly they aren’t giving you rent points for free, but charging you 1% for it.

Claiming better than 1 cpp due to interest, etc. makes this sound like a sponsored post.

Recall FM’s own posts on why the Southwest companion pass doesn’t double the value of their points.

I wish they would earn points on payments. Currently using the Gift of College pathway.

I agree with the analogy to the WN CP — this is 1 cent, flat and simple. No extras compared to cold hard cash.

This isn’t necessarily a fungible situation though. Someone might not have any cold hard cash to spare, but they might have Bilt points. If they’re making their standard student loan payments, any overpayments might only be possibly with these points.

But then one could argue that Bilt points aren’t worth 0.55 cpp for statement credits, they’re worth 0.55 cpp + the saved interest if you use the money toward a loan payment!

You’re right that the Companion Pass doesn’t double the value of points. However, this is a different scenario. Someone might have no space in their budget to be able to make student loan overpayments with their regular income, but might be able to make overpayments using the Bilt points they’ve earned. Seeing as Bilt points can’t otherwise be cashed out for value such as this unless using for a down payment, it could legitimately get someone better than 1cpp of value.

So… if someone doesn’t have space in their budget to pay cash for Southwest flights, the companion pass does double the value of their points?

With regards to sounding like a sponsored post, I don’t know why it would sound like that. In Bilt’s press release, they didn’t even mention the possibility of overpaying – I specifically asked about that because I thought it could be of interest for readers to know if that was possible in case Bilt was only going to allow you to make standard repayments each month (or whatever frequency people have).