NOTICE: This post references card features that have changed, expired, or are not currently available

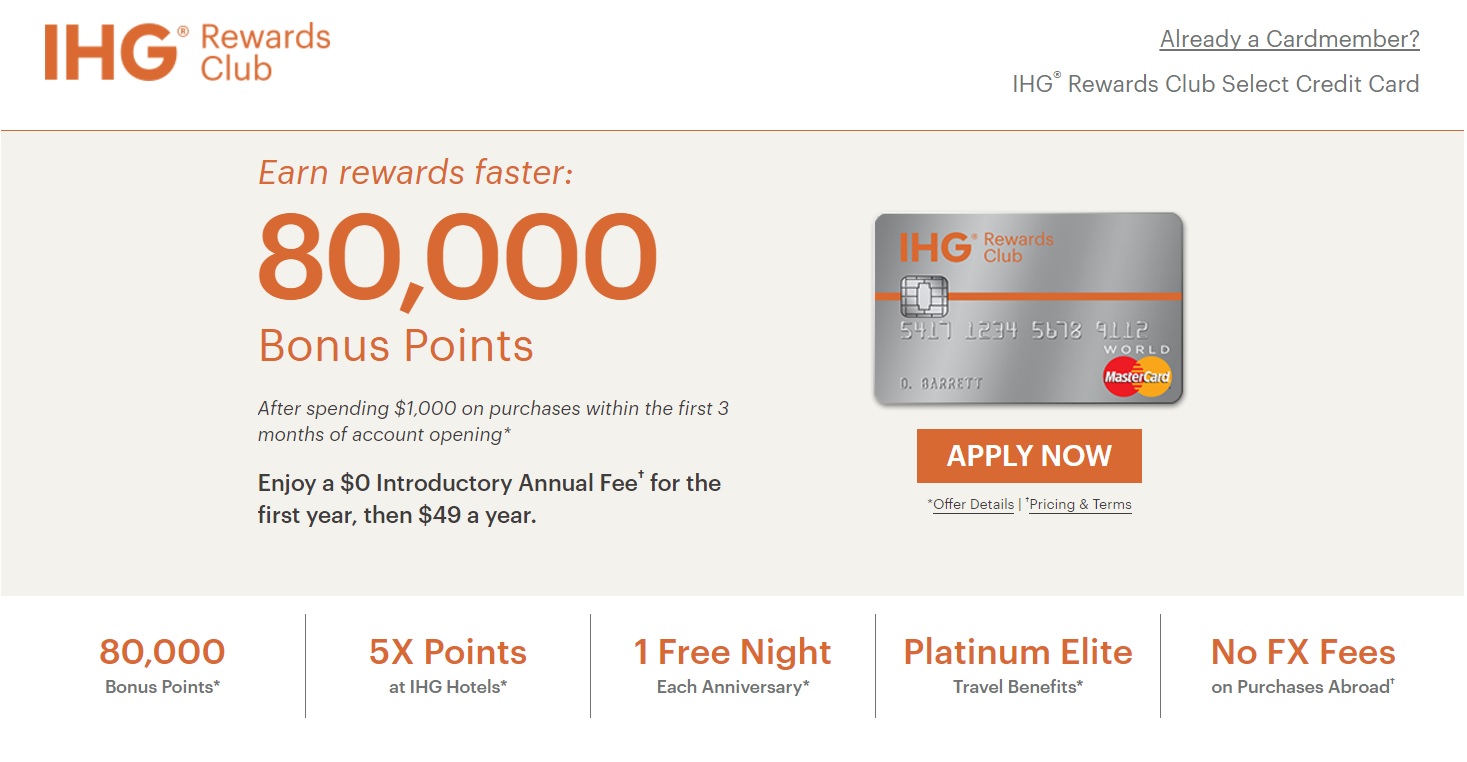

Chase has a new public offer today on the IHG Rewards Mastercard, good for 80,000 points after spending $1,000 in the first three months. The annual fee is waived for the first year.

The sign up offer

- 80,000 IHG Rewards Club points after spending $1,000 in the first three months

- 5,000 points for adding an authorized user and making a purchase

- Annual fee is waived the first year ($49 thereafter)

Key card benefits

- 5X at IHG hotels

- 2X at gas stations, grocery stores, and restaurants

- 1X everywhere else

- Platinum Elite status (this includes 10% back on point redemptions up to 100K points back each year)

- One free night at any IHG hotel on each anniversary date

- No foreign transaction fees

Quick Thoughts

This offer is about as good as it gets. The only better offer I remember was one triggered by a dummy booking for 80K + a $50 statement credit (presumably plus the 5K AU points). I tried to make a dummy booking several times just now and the offer I saw was for 50K + $100 statement credit, which is not as good as the 80K offer. According to our Reasonable Redemption Values, IHG points are typically worth about $0.0054 per point — though we have occasionally posted about opportunities to buy them for closer to half a cent each. That makes the 85K signup bonus worth at least $425 — though you can certainly do better when strategically redeeming IHG points at peak times and locations.

Furthermore, the ongoing value of this card makes it an absolute keeper in my book. The annual free night in exchange for a $49 annual fee makes this card a great value as the free night can be used at any IHG hotel in the world. I used my last two at the Intercontinental Barclay in New York City and the Intercontinental Sydney. Both times, rates were well over $50 a night (in fact, rates at the Barclay were starting at $552.53 the night that I used my free cert there). I’m happy to keep this one year after year. As a couple, I suggest timing apps so that both partners get the free certificate around the same time — thus enabling you to book back-to-back nights for a free weekend stay.

A link to this offer has been added to our Best Offers page, where you can find the best public offers on a wide assortment of cards.

H/T: reddit/r/churning

Ask through secure message yesterday told no. Was very polite, should i call chase?

Can’t find a link for the 80k bonus, only 60k. How do I sign up for the better offer. Tried a dummy booking but that only offered a 50k bonus. Thanks

Try our Best Offers page (linked to in the post). We also have a new post out this morning on the targeted 100K offer. Even if you’re not targeted for that, you might be able to match to it.

If I apply for a second card 2 years after received a sign on bonus, how long do I wait after closing my first card? In other words, could I close IHG card 1 on Monday and apply for IHG card 2 on Tuesday?

I’m not aware of concrete data on this. General wisdom is that you should wait at least 1-2 weeks between closing one and opening the next to make sure you are out of the system and they don’t just re-open your old account. That said, a reader reported closing a Fairmont card and opening a new one the same day and getting the bonus (after an agent telling that reader that it could be done). So it may be possible to do the Monday-Tuesday plan, but YMMV.

Just recvd the card 3 weeks ago. What are the chances of trying to get the additional 20000 points retro.

You can probably get an extra 40K. See our new post:

https://frequentmiler.com/2017/07/07/match-105k-point-ihg-offer/

[…] we reported the increased 85,000-point offer (total points with bonus and AU). I tried making dummy bookings under different accounts and with […]

Should we clarify that it’s exempt from 5/24 – but still counts as 5/24 for other Chase card applications?

I believe IHG and Kimpton Karma were scheduled to merge sometime in 2017. Any news about possible integration and ability to use IHG points and annual free night at a Kimpton hotel?

I haven’t heard anything new. I imagine that day will probably come, but I haven’t seen anything about when.

Great news about the 5/24 rule and getting a second card. Did you have to close your first account before re-applying? Also, does one have to wait 2 years since getting the first bonus?

You would have to do both. Note that you don’t have to wait two years from account closing, you have to wait 2 years since getting the first bonus.

Both times, rates were well over $50 a night

==

Do you mean $500?

No, he means over the $49 annual fee.

Yes, that’s exactly what I meant — a lot more value than the $49 I paid to keep the card :-).

Is the new card exempt from 5/24 like the previous one?

Should still be, haven’t heard of that changing

Can you apply and get a second credit card with the bonus if you are under 5/24 and haven’t gotten the bonus in 2 years? I will be finally under 5/24 later this year and would love to get more points in my IHG account.

I got it again, and way over 5/24. This card is exempt from 5/24.

As Lynn said, this one has historically been exempt from the 5/24 rule.

I’ve had mine for 2+ years and recently paid the AF. If I cancel/reapply will I loose my free night cert?

Great question! I’m not positive. My instinct is that you wouldn’t lose it, and this Flyertalk wiki backs that up:

http://www.flyertalk.com/forum/intercontinental-hotels-ihg-rewards-club-intercontinental-ambassador/1232030-annual-free-night-cert-ihg-rewards-club-visa-mastercard-40.html

Awesome. Thank you Nick.

nope

You can cancel/reapply? Does this not have the 2-year language in the terms?

Also, do the free night certs EVER expire? (Regardless of if you cancel the card or not)? Thanks!

The offer contains the standard language about getting a new bonus once per 24 months:

“This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.”

If you’ve gotten the bonus within the past 24 months, you’re not eligible.

Yes, the free night certificates expire 1 year from the date they are issued. That’s why I suggest a couple each opening their cards around the same time — so the certificates will be issued around the same time each year (and therefore have about the same expiration date). Of course, the annual free night begins on your first anniversary — you only get the signup points for the first year.