NOTICE: This post references card features that have changed, expired, or are not currently available

Update: As noted by commenters below, the 3% and 2% categories actually are capped at just $10K spend per year. That makes this card a non-starter for most folks.

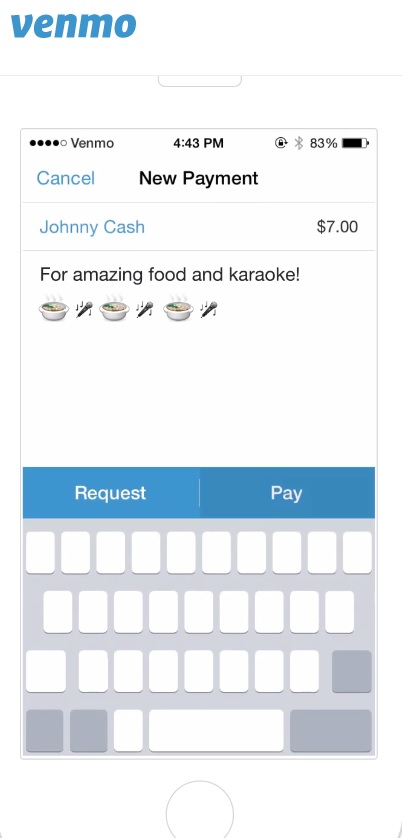

Venmo is launching a new credit card that offers no welcome bonus and is currently only available to some users, but it does offer 3% cash back on the category in which you spend the most out of a few potentially useful options.

Key Info & Quick Thoughts

The Venmo credit card has no annual fee and offers a “3-2-1” earning structure: 3% on the category in which you spend the most each month, 2% back on the category in which you spend the second-most, and 1% back on everything else with no caps noted. Here are the eligible categories:

- Grocery

- Bills & Utilities

- Health & Beauty

- Gas

- Entertainment

- Dining & Nightlife

- Transportation

- Travel

One percent and two percent are of no interest since you can easily get a card with no annual fee that offers 2% back everywhere (and in the case of the Citi Double Cash, you could also have the option of 2 airline miles per dollar spent).

The real draw here is getting a potentially uncapped 3% back in the category in which you spend the most money (Update: The 3% and 2% categories are cumulatively capped at $10K spend per cardmember year). There are other fee-free cards offering at least that much back on at least some travel (and potentially transportation) and dining and many rewards cards that bonus gas and grocery (though uncapped 3% back with no annual fee may still be interesting to some). The categories I find potentially most interesting are Bills & Utilities and Health & Beauty. We don’t see many cards that bonus “Bills & Utilities” — and it isn’t immediately clear to me what would qualify as a bill. Would a student’s tuition qualify as a bill? Surely taxes are a bill? Would anything paid via Plastiq count as a bill? There could be some good uses there.

Health & Beauty would almost surely include things like gym memberships and salons, but would it include hospital bills and health insurance (or would those be “bills”)? Would a Miraval wellness getaway code as a health purchase (kidding: it would code as travel on most cards)? Would pharmacies be included here? Getting uncapped three percent back on those types of things on a card issued by a bank that you don’t probably care much about (Synchrony) might be appealing.

You could easily get an effective 3% back for the first year with a Discover IT Miles card, so the attraction here would be getting 3% back for the long haul and perhaps simplicity if you are familiar with and a fan of the Venmo platform.

Overall, I find this card not particularly exciting yet, but it may have some potential.

H/T: TPG

It’s not uncapped.

https://www.synchronycredit.com/gecrbterms/html/RewardsTerms.htm

Since I already have an uncapped 2% everywhere card, this seems like it offers an incremental 1% on $10,000 in spend (or, $100) in one select category. Probably not worth the effort to figure how to spend $10K to maximize. Drug is an obvious option but i probably have better (>$100) uses for the 5/24 slot.

The only other card I know that has a bonus category in utilities is US Bank’s Cash + card where you have the option to select that as a 5% category. It doesn’t include internet or telecom providers like this Venmo card.

I’m sure card issuers purposely exclude large tickets like insurance and medical bills. Even BofA’s Cash Rewards card specifically excludes these from the online shopping category.

Not uncapped, its 3% up to 10k for the bonus category

https://www.synchronymastercard.com/gecrbterms/html/RewardsTerms.htm

Still not too exciting but in the terms, it does state this:

Just FYI, the 3%/2% categories are not uncapped.

https://www.synchronymastercard.com/gecrbterms/html/RewardsTerms.htm

Assuming uncapped 3% (until told otherwise by the official release statement from Venmo), I’m still hesitant in picking this up for MS purposes. PayPal is notorious for shutting down accounts of users they suspect are engaging in “abusive behavior” (PayPal owns Venmo).

Meh is about right. Would love to hear how others and/FM can extract maximum value out if this. Not worth my 5/24 slot.