NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

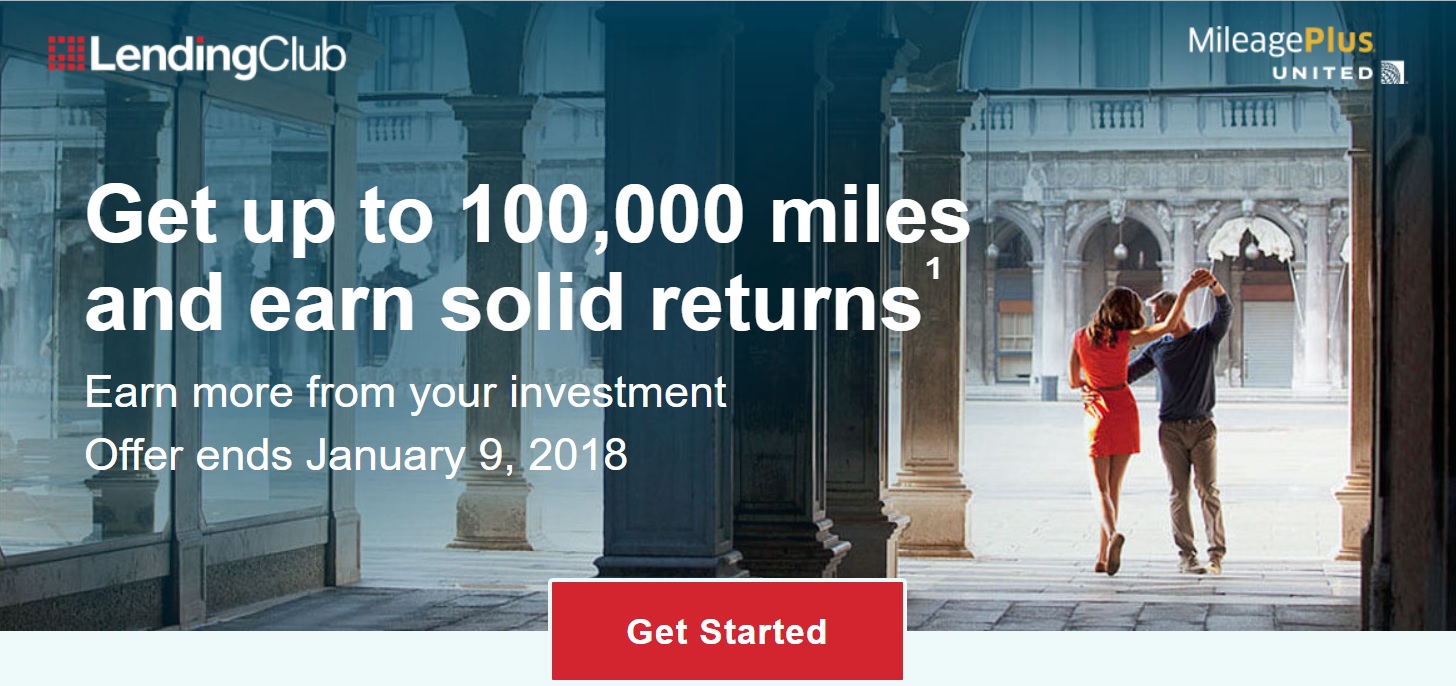

Lending Club has sent out offers in the past to pay out 1 United mile for every $2 invested through the Lending Club Platform. They have recently increased the offer: you can now earn 1 United Mileage Plus mile for every $1 invested up to 100,000 miles.

The Deal

- Earn up to 100,000 United miles by investing with Lending Club

- Earn 1 mile per $1 invested (in “new money”) by January 9, 2018

- Direct link (don’t forget to add your MileagePlus number to your account)

Key Terms

- Must transfer in funds of at least $2,500 and invest those funds

- Must be “new funds” (transferred in from an external bank account; you don’t have to be a new investor)

- Must invest those funds by purchasing Notes through the Lending Club platform

Quick Thoughts

I’ve never invested with Lending Club, but I’ve been somewhat intrigued at the possibility of earning both miles and a cash profit. They claim historical returns of 4-6%, though note that you could of course lose everything. That said, with some due diligence and diversification, losses shouldn’t be that drastic unless Lending Clubs shuts its doors. Gary Leff at View from the Wing suggests that an interesting play might be to invest, hold for a month, and then sell off the investments. Depending on your interest earnings, it might be possible to break even. That said, I have no experience with the platform and suggest you do your research before getting involved.

H/T: View from the Wing

[…] Now up to 100K at 1mi/$1 investing with Lending Club (Expires 1/9/18) […]

[…] Now up to 100K at 1mi/$1 investing with Lending Club (Expires 1/9/17) […]

I’ve had a Lending Club account for several years now. At first the returns were great — consistently about 10-12%. Over time, however, as the loans have aged, the returns have gradually dwindled. My current cumulative returns are at just below 2%. So I haven’t lost money, and have still made more than I would have in a savings account, but there’s a significant amount of risk.

I have been investing on both Lending Club and Prosper for many years (over 8 years on Lending Club). Both are well run and stable companies and if you diversify into $25 notes across multiple loan grades that has historically provided returns above 5%. I have been sharing details of my returns every quarter since 2011:

https://www.lendacademy.com/my-returns-at-lending-club-and-prosper/

Really encourage everyone to be careful here. Potential risks are huge.

Those who have had experience with prosper.com (a separate company, but with many similarities) several years ago know what I’m talking about. From the wikipedia summary of Prosper (https://en.wikipedia.org/wiki/Prosper_Marketplace):

“As of August 2008, approximately 18.5% of all money loaned through Prosper from inception (February 2006) through June 2008 were in some form of delinquency. Also, more than 35% of all loans that originated in February 2007 were in some form of delinquency.

As of January 24, 2010, Prosper reported that 22.45% of all money lent since inception had been charged off and an additional 2.51% was delinquent but not yet charged off.”

Let me first admit that I’m out of my element here — I don’t know a ton about either Prosper or Lending Club. As with any investment, I’m sure there is risk, so I’m definitely not arguing with due diligence and caution.

However, out of curiosity, I looked at the Wikipedia page you linked to. To be fair, you’re talking about numbers from about 8-10 years ago from the days when loan rates were done auction-style. According to the page to which you linked, they changed that model in response to that poor performance (and surely due to litigation as well). That Wikipedia page notes exponentially lower default rates since then (and sizable investments in the past few years from venture capital).

I don’t know that any of the Wikipedia page is true, so I’m not arguing that Prosper is a “good” place to invest, just that you took quotes a bit out of context (indeed the overall tone of the Wikipedia page sounds to me that things turned around after that time).

And I’m not sure whether any of that applies to Lending Club. It certainly may — like I said, I haven’t looked far into it. I plan to do so and I appreciate the encouragement to everyone to do some of their own research as well. I may invest some here. I surely won’t put in $100K, but I may do something. We’ll see what I find when I look into it a bit more 🙂

Nick,

Thanks for your comments. I think you made some excellent points, and I don’t disagree with anything that you said.

I think I wanted folks to understand that, during those earlier times (I had a small amount invested – maybe $150 – and lost most of it), there was much positive press about Prosper and similar sites that didn’t pan out. Both Prosper and Lending Club had to suspend operations for quite some time due to the SEC cracking down, litigation, etc. Yes, they have restructured and things do look better. At the same time, and as your original post noted, there is risk here, and it’s a lot of money to be putting into play for the benefit of some United miles.

Remember that you are making loans to people whom you’ve never met, and getting your money back depends on their decisions as to whether or not they are going to repay you.

I’m getting 10% returns managing my LendingClub investments through LendingRobot. This is a great deal!

Has anyone who participated in this last MileagePlus promotion been credited their miles yet? The promotion ended January 9, and I still don’t have mine. When I called to follow-up they said mine didn’t code properly, so they are working on it manually and it will take 4-7 more weeks to get my miles!