NOTICE: This post references card features that have changed, expired, or are not currently available

Ben, from Reward Yourself, sent me a survey he received from Personal Capital:

Personal Capital 3% card

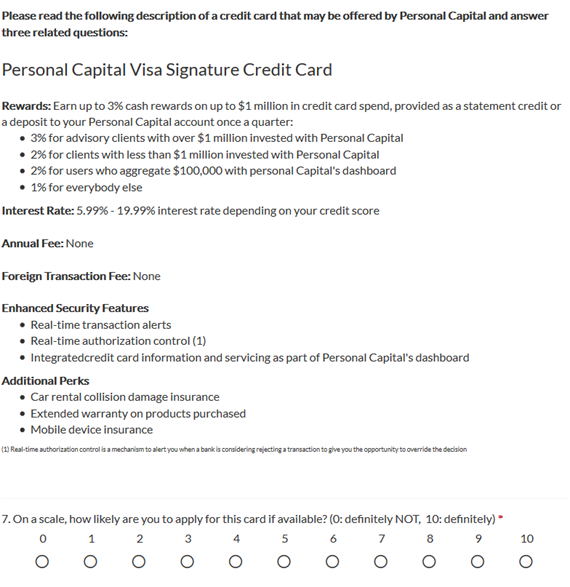

The survey asks for opinions about a possible new Personal Capital Visa credit card:

In case the image, above, is hard to read, here is the important info:

Rewards: Earn up to 3% cash rewards on up to $1 million in credit card spend, provided as a statement credit or a deposit to your Personal Capital account once a quarter:

3% for advisory clients with over $1 million invested with Personal Capital

2% for clients with less than $1 million invested with Personal Capital

2% for users who aggregate $100,000 with personal Capital’s dashboard

1% for everybody elseInterest Rate: 5.99% – 19.99% interest rate depending on your credit score

Annual Fee: None

My take

At 2% cash back, this card becomes competitive with a couple of other no-fee 2% cash back cards: Fidelity Investment Amex, and Citi Double Cash MasterCard. I could imagine some people preferring a Visa card, but at a high level the three cards seem to be roughly equivalent – rewards-wise.

At 3% cash back, across the board, this card would be pretty interesting. The requirement to have $1 million invested with Personal Capital, though, is quite a hurdle.

Is it worth it?

Let’s assume that you’re a big spender and you have $1 million or more available to invest. And, let’s assume that investment earnings from Personal Capital will be similar to other options available to you (Note: I do not know that to true at all – I’m just making blatant assumptions here). And, let’s assume that your next best option is a 2% cash back card.

Given the above assumptions, here is how much you would earn above the 2% cash back rate given various spend scenarios:

| Spend Scenario | 2% cash back | 3% cash back | Difference |

|---|---|---|---|

| $50K | $1K | $1.5K | $500 |

| $100K | $2K | $3K | $1,000 |

| $200K | $4K | $6K | $2,000 |

| $500K | $10K | $15K | $5,000 |

| $1 Million | $20K | $30K | $10,000 |

Obviously, as your spend increases, so do the total rewards. If you spend $1 Million, this 3% cash back card will give you $10,000 more than a 2% cash back card. That sounds like a lot to me, but might not sound like a lot to those who have $1 Million invested with Personal Capital.

What if Personal Capital investments are less profitable than other options?

Let’s assume that you invest exactly $1 million with Personal Capital in order to earn 3% cash back with this credit card. And, let’s assume that you would do better with other investment options. Is it worth it? Is it worth earning higher rewards from your credit card in exchange for smaller investment rewards? Here’s another view of the spend scenarios:

| Spend Scenario | Difference between 3% and 2% (from above table) | Difference as % of $1 Million investment |

|---|---|---|

| $50K | $500 | .05% |

| $100K | $1,000 | .1% |

| $200K | $2,000 | .2% |

| $500K | $5,000 | .5% |

| $1 Million | $10,000 | 1% |

The above table shows that if you max out the 3% rewards with $1 million spend and you keep the bare minimum required $1 million invested with Personal Capital, your profit on your investment due to spend on the 3% card vs. a 2% card is only 1%. In other words, if you’re likely to get 1 percentage point higher returns with options other than Personal Capital, then do it. Heck, even if you can get close to 1% additional returns through other options, you might as well do so since the above table shows only the best case scenario. If you’re likely to spend less than $1 million on the credit card, then the advantage of Personal Capital vs. other investment options decreases proportionately and there is less and less reason to get excited about this card.

My take summarized

Meh.

I wonder how they will treat AMEX GC purchases. The big downside of the double cash card is they’ve been reported to only award 1% on those, which ruins the profit margin.

In the world of financial management, 0.89% AUM is not bad if it includes financial advice and all the trades. OTOH, it’s very impersonal. I had some exposure to PC when my 401k provider used their platform. It’s OK, but nothing special.

My impression that it was more of a robo-adviser than anything else. And if one is looking for MPT portfolio management, like these guys are, plenty of firms will do it for a flat fee that’s much less.

And to the second point – chasing miles and points has nothing to do with a person’s income.

Maybe at 8-figure income, it stops to make sense. I don’t know. Below that, it’s still a game many play. Look at it this way – if a family of 4 travels buys business class for cash for a few trips/year – it could easily add up to $100k. Would a person earning $1M/yr spend 10% of pre-tax income on airfare? Doubtful…..

“Try this one simple trick to…” [insert nonsense here]

“The weird miracle cure for…” [insert nonsense here]

and my favorite…

“BANNED from the internet!…” [insert nonsense here]

Welcome to Clickbait Headlines For Morons and Boarding Area Bloggers 101.

An interesting concept, and an interesting thought in terms of where the card industry is migrating. But honestly? How many people chasing free points & miles are going to *spend* $1M in a year? Sure, 3% on $1M spend is $30,000 – but how likely is that?

And to *invest* $1M with PersonalCapital.com, the fees (and commissions – not called out in the table below). After looking this over, I think one can do better self-managing your investments at Vanguard or Fidelity and investing in Total Stock Market / Total Bond Market ETF’s (IMHO).

(From PersonalCapital’s website)

<blockquote cite="What are your fees and how are you compensated?

We have one simple fee based on a percentage of assets managed. We bill monthly, in arrears. Wealth management, trade costs and custody are included – you do not pay trade commissions. We routinely help clients with financial planning and 401k allocations at no charge. Here is our fee schedule:

First $1 Million: 0.89%

For clients that invest $1 Million or more:

First $3 Million: 0.79%

Next $2 Million: 0.69%

Next $5 Million: 0.59%

Over $10 Million: 0.49%”>

That’s $8,900/year in fees alone. Compare that to 3% cash back on *spend* of $1M/year

Correction: they clearly state “you do not pay trade commissions”, so the $8,900 (min) is an all-you-can-invest fee.

Where’s the “I bet you didn’t care series” today?

Pro-tip: While you may have learned a while back to make “exciting” headlines to grab people’s attention, It should be noted that this one gets into “yahoo” or main-stream media territory. Meaning, once you open the article you realize it’s a huge let-down. i.e. I’m guessing a pretty good portion of your readers don’t have $1MM to get that 3%