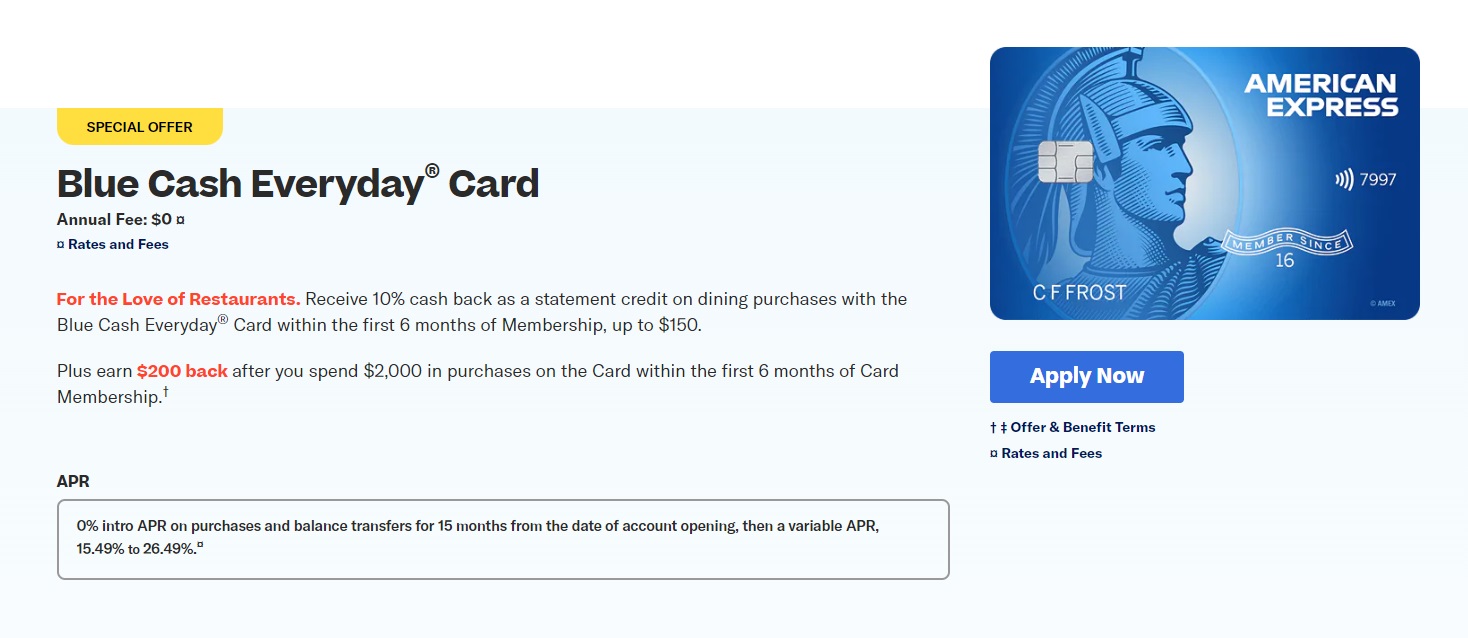

Over the past couple of years, we have seen special offers come out for some Amex cards via the restaurant reservation website Resy (which is owned by Amex). While those offers had previously been seen on the Amex Platinum and Gold cards, we are now seeing a Resy offer on the Blue Cash Everyday card that includes both the standard intro offer statement credit after qualifying purchases and also 10% back at restaurants worldwide (up to $150 back) for the first 6 months. A few new benefits have also been added that make this an interesting cash back card given that it has no annual fee.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $158 1st Yr Value EstimateClick to learn about first year value estimates $200 back ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $200 back after $2K spend in the first 6 months. Terms Apply. Rates & FeesNo Annual Fee Earning rate: ✦ 3% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 3% cash back as a statement credit at US gas stations on up to $6,000 per year, then 1%. ✦ 3% cash back as a statement credit on U.S. online retail purchases on up to $6,000 per year, then 1% ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Gas: 3% Grocery: 3% Shop: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Get $7 back each month after using your Blue Cash Every Day card to spend $12.99 or more each month on an eligible subscription to The Disney Bundle. Terms Apply. |

Quick Thoughts

This card already offered a decent 3% return at U.S. Supermarkets on up to $6,000 in purchases per year (then 1%), but now it adds an extra point at U.S. Gas Stations (now 3% back on up to $6,000 in purchases per year, then 1%) and also 3% on U.S. online retail purchases on up to $6,000 in purchases per year, then 1%. While you could earn 6% back at U.S. Supermarkets on up to $6,000 in purchases per year (then 1%) with the Blue Cash Preferred, that card’s annual fee effectively wipes out the extra earnings. If you would spend a lot in the 3% US online retail purchases, you might come out ahead with the Blue Cash Everyday.

Additionally, this card now comes with a $7 monthly credit when you charge a monthly subscription for The Disney Bundle of $13.99 or more. Those who subscribe to Home Chef will also be happy to hear that the card offers a monthly $15 credit when you use your Blue Cash Everyday card at online checkout with Home Chef. If you’re someone who already subscribes to those services, that’s certainly a nice enhancement — though with all of the constant new subscriber deals on meal kits, you’re probably better off bouncing from one to another for a while if you aren’t already set on Home Chef.

I’d rather have transferable currency points and with the monster offers we are continuing to see on those, this card wouldn’t be my first choice. However, for a segment of users who are annual fee-averse and who have spend in the right bonus categories, this could certainly make sense.