| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

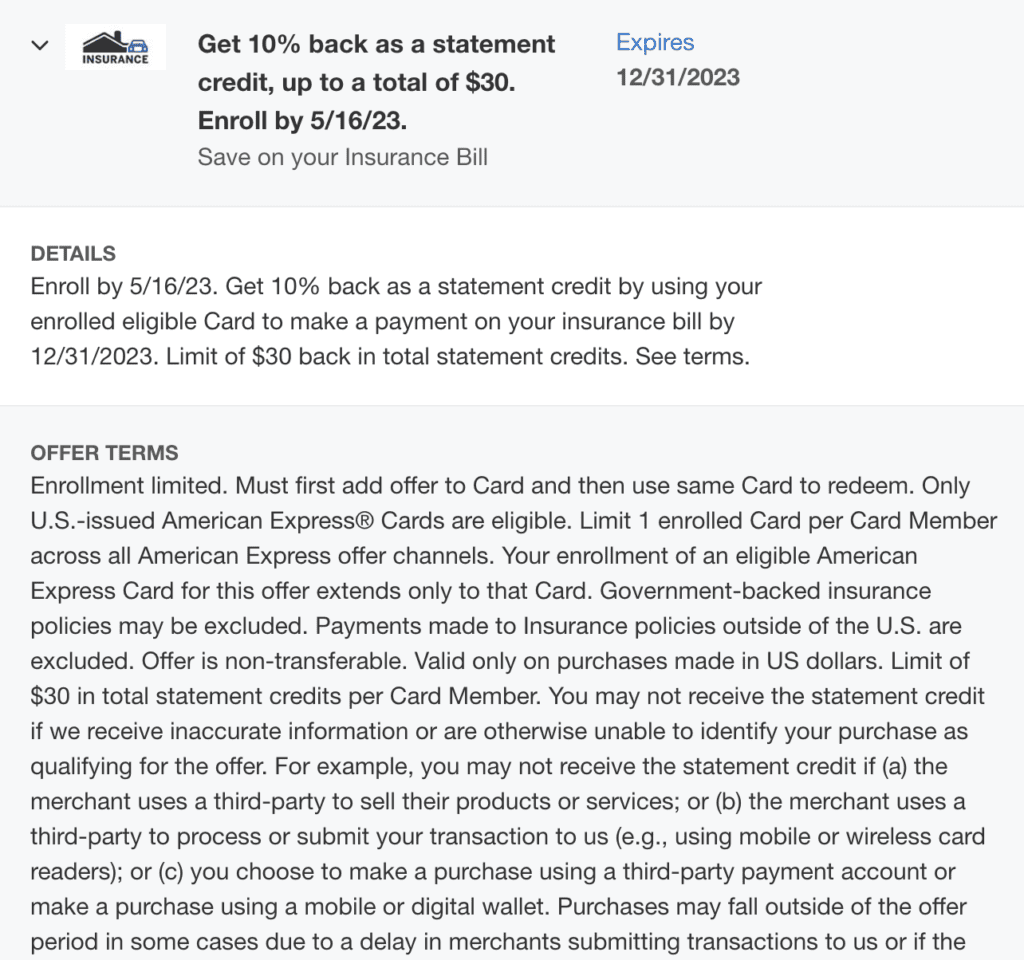

An Amex Offer re-appeared in the last day or two that’s offering a 10% statement credit when paying an insurance bill. While the limit on the statement credit is fairly low, it’s an easy win if you need to make an insurance payment this year (and who doesn’t).

The Deal

- Get 10% back as a statement credit when paying your insurance bill with a card enrolled in an Amex Offer ($30 maximum credit)

- Enroll by 5/16/23

- After enrollment, credit can be triggered by any insurance payment before 12/31/23.

Key Terms

- Government-backed insurance policies may be excluded.

- Payments made to Insurance policies outside of the U.S. are excluded.

- Valid only on purchases made in US dollars.

- Limit of $30 in total statement credits per Card Member.

- Statement credit will appear on your billing statement within 90 days after 12/31/2023, provided that American Express receives information from the merchant about your qualifying purchase.

Quick Thoughts

This might be a targeted offer, but my wife and I each had it on several of our personal cards. If there are two or more of you in your household with the 10% offer on your cards, it should be possible to call your insurance company and have them split the payment (or split the payment online) so that you can get two or more $30 statement credits. If your insurance bill isn’t due until after December 31, you can also hopefully prepay to lock in the savings.

yeah got this…too bad Progressive doesn’t take Amex. VGC and grocery bonus…is the way.

Progressive via paypal works

oh…didn’t know that. I’ll look for that next time! thanks!

Thanks for the tip! This worked for me.

Is this targeted or am I looking in the wrong place. My wife and I have 6 cards between us and we never seem to get any of the deals that are posted here.

It’ll likely be targeted.

According to my records, it was added to my Plat card on 1/24/2023. I recently used the offer for part of my automobile insurance and it shows as redeemed.

I remember I added it to my account and my husband account about 2 weeks ago. This morning I check on both available and added offer and it no longer there.

Nada on my cards. It’s been a while since I got a general offer like this.

Nothing on 19 cards. And I pay a lot of insurance bills.

Looks like Amex cheapened the deal – $20 max statement credits for me, zippo on all of P2’s cards.

Funnily enough, not on my Amex Plat, but is on all 3 of my AU’s cards!

Ours are only 10% max $20.

I got a rock on all my AMEX cards.

Got the offer on my brand new Delta SkyMiles Platinum (I made it the default payment method for my USAA car insurance a couple weeks prior, for an autopay due in March). That was an extremely accurate targeted offer…$20 off is a small win, but still a win.

No luck this time, but I had it last year and maxed it.

No targets

US Bank has a targeted offer for the old Radisson (new US bank version) cards where you get 1,000 points if you pay an insurance bill but it doesn’t seem like any minimum. Although you can’t stack with this it might pay to pay a bit here and there.

I got it on my gold card. Maximum of $15 statement credit though

I had your offer on my Hilton card, but on my Delta Reserve card I had “get 4 additional Delta miles per $1 spent on insurance”, which is worth more than the $10 offer.