Is a loyalty program primarily designed to incentivize loyalty or to recognize loyalty? Hilton’s new Diamond Reserve tier had me pondering that question this week as Hilton introduced a couple of small new benefits that require far more than Hilton has previously asked of top-tier elites. Greg suggested Hilton implement milestone rewards that would incentivize folks to continue reaching for the next level, but it occurred to me that the goal might not be to incentivize greater loyalty but rather to create a mechanism to recognize loyalty that already runs far deeper than our Hilton Aspire credit cards. As things stood, Hilton wasn’t differentiating those who spent $18,000 a year at their hotels from those of us who give Amex $550 per year for a Hilton Honors Aspire credit card.

We have seen a trend among many programs to create carrots to draw us along the path to status, with airlines like American and Alaska (and many others) implementing a more Hyatt-like approach in recent years, adding meaningful milestone benefits en route to elite status. However, we have also seen an increased focus on making top loyalty tiers accessible to only a brand’s biggest spenders. Hilton’s latest move really just separates the whales who spend the big bucks from those of us who fish for free breakfast. I’d like to see them strike more of a balance between incentivizing and recognizing, but I suppose it is reasonable that identifying and recognizing its most valuable customers took precedence. I think we will likely see better milestone rewards down the road, but the first priority was making its best customers feel like Hilton saw them.

Other things you should see this week at Frequent Miler include Wyndham’s very different approach to bringing you into the fold with a triple stack, a resource that will come in handy for Bilt-turned-Autograph cardholders, everything you need to try to stack one portal’s huge targeted rewards with coming holiday sales, and a lot more.

This week on the Frequent Miler blog…

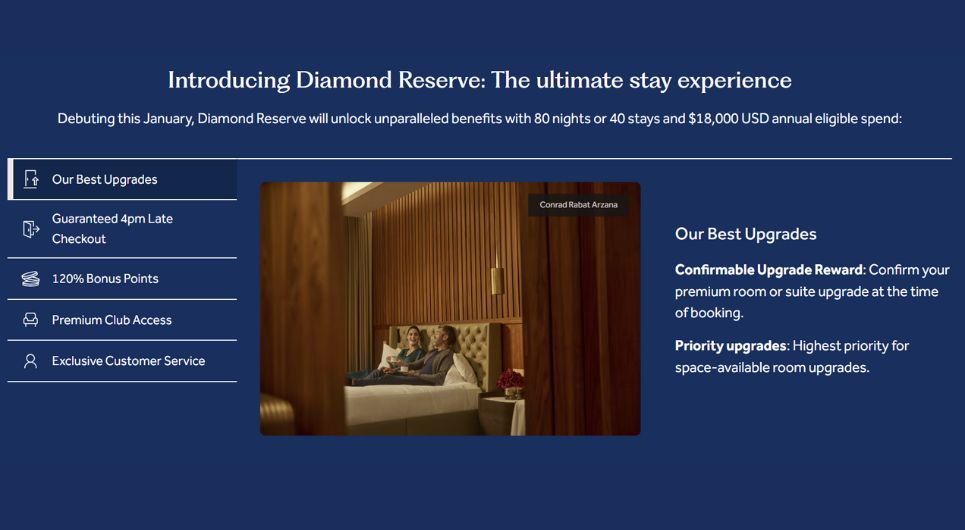

Hilton Diamond Reserve status coming in 2026: Here are the details

The rumors were true: Hilton is launching a brand new tier to its loyalty program. Diamond Reserve status will require 40 stays or 80 nights and $18,000 in spend at Hilton properties. In exchange for that kind of loyalty, newly minted Diamond Reserve members will earn a confirmable upgrade award, better space-available upgrades, and some bonus points. If that doesn’t sound like a lot, that’s because it isn’t much beyond Diamond, which one can get just by having the right credit card. That’s quite a gap in requirements, but the good news is that current Gold and Diamond benefits aren’t changing as of yet.

Hilton’s bright idea, dim execution: Diamond Reserve is out of reach

Greg likes where Hilton is going with its new Diamond Reserve benefits, but he suggests that the absence of any milestone benefits means that there isn’t enough incentive to reach toward this tier. In this post, he gives some excellent suggestions for how Hilton can fix this. That said, I theorize that Hilton may be looking at this from a different angle. While many of us wonder why Hilton isn’t offering much incentive to stretch for Diamond Reserve, I wonder if the point isn’t to motivate more loyalty but rather to give Hilton a way to recognize its most valuable customers. This new tier helps separate Hilton’s big spenders from the plebs like us who are top-tier in name from a credit card, and maybe that’s all this tier is meant to do. If that’s it, it makes sense to me that they would provide a way to make sure that the person spending $18,000 per year at Hilton properties is prioritized for an upgrade over someone like me. I’m just hopeful that we’ll see confirmable upgrade awards become something cardholders can earn through spend. Perhaps that will become part of the next credit card refresh, though I’m not wishing credit card changes on us any time soon.

Wyndham’s end-of-year Triple-Dip | Coffee Break Ep78 | 11-18-25

While Hilton is trying to reward those who spend $18,000 per year, Wyndham is just trying to get us to spend 2 nights by offering what could amount to a near-100% rebate. On this week’s Coffee Break, Greg and I discussed stacking Wyndham promotions that can make for an excellent return on 2 nights spent at Wyndham properties before the end of 2025. Before we did this episode, I hadn’t paid much attention to the Wyndham promos, but a few days later, I very nearly booked a Wyndham, realizing that the stacking promotions could be a sizable rebate on the stay. Hear more about how you could stay two nights that feel almost free after rebate on this week’s show.

Mattress running Versailles

Greg took the Wyndham triple dip and ran with it to provide a fun example of how a Platinum cardholder might play this by leveraging a prepaid hotel credit that could possibly help complete the Wyndham triple dip, making it feel like a really incredible deal. On coffee break, you heard Greg say that he might consider the Wyndham promo if there were a fourth component. Is this the component we needed to see Greg not only theorize about mattress running Versailles but actually put this promo to use?

Elite Benefit Battle: Marriott, Hilton, Hyatt, and IHG | Frequent Miler on the Air Ep333 | 11-21-25

If you’re wondering how Hilton’s new top-tier Diamond Reserve benefits make it stack up against the competition, you’ll want to listen to this week’s Frequent Miler on the Air. This week, Greg and I discussed which of the meaningful hotel loyalty program elite perks are more easily attainable than others, and which are the most valuable in our opinions.

To the point(s): Our 11-night trip to French Polynesia

Elite status perks certainly helped me save a bundle during the past couple of weeks as I loaded up on elite member breakfasts at Hilton and Marriott properties in French Polynesia. I just wrapped up a trip to the gorgeous islands of Tahiti, Moorea, and Bora Bora, soaking up all of that “Vitamin Sea”. While I will have more to say about the hotel stays from this trip, I published an overview this week showing which points covered the flights and hotels. There’s no doubt that costs here are steep, but the value against sticker price is hard to beat.

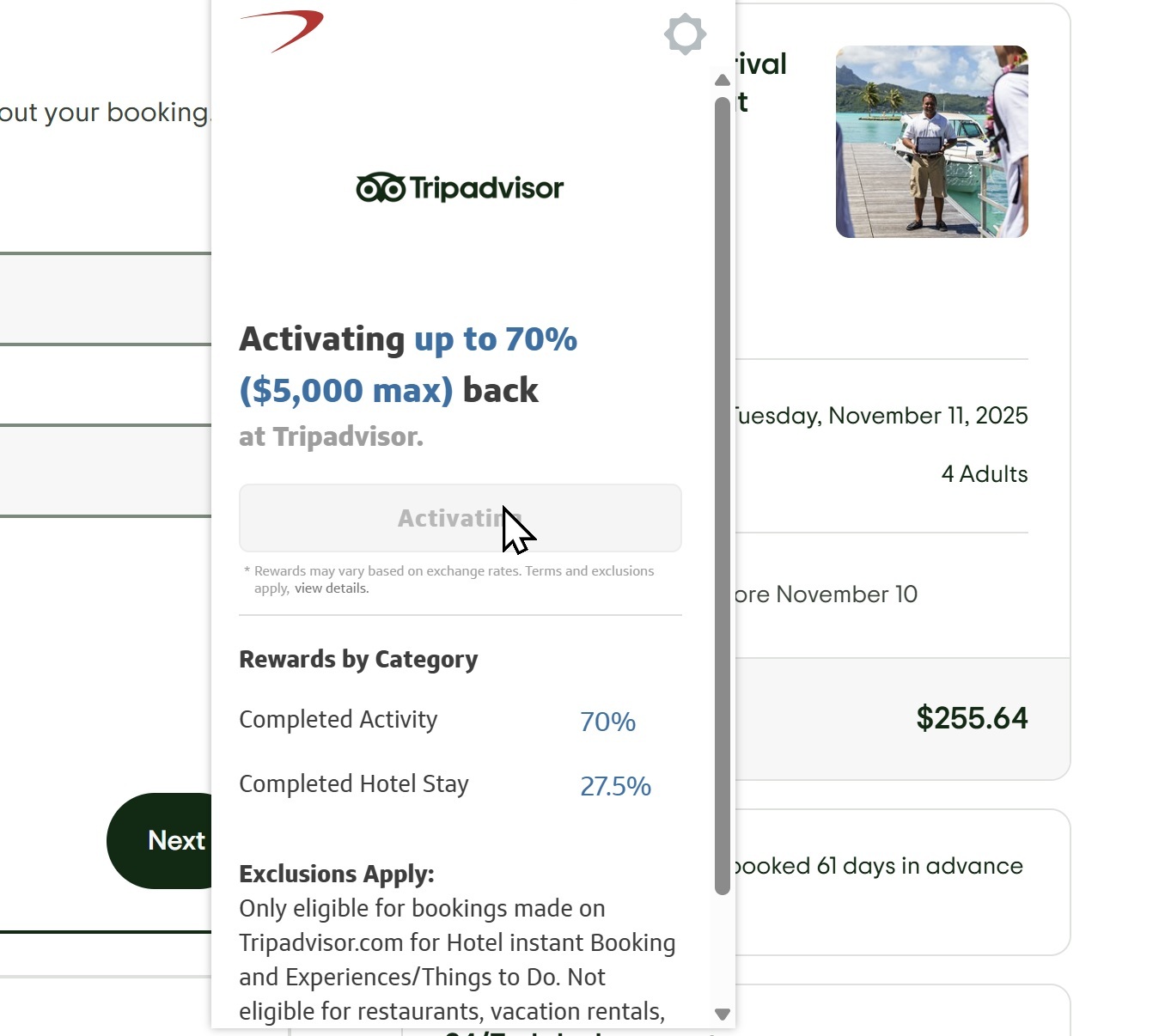

Capital One Shopping Complete Guide

Speaking of sticker price, with the holiday shopping season upon us, many of us cheapskates outsized value aficionados will be in our element over these next couple of weeks as stores slash prices for holiday sales. Few things are more fun than snagging that Black Friday deal and stacking it with a ton of additional rewards. Capital One has been in full swing with big targeted offers, from last week’s 70% back at TripAdvisor (for some of us) to many offers of anywhere from 30-50% back showing up in my email each day. Because this portal is both loved by some for the big targeted offers, but also hated by many for its shortcomings, I wrote a guide explaining how to use it and increase your odds of success.

Wells Fargo Transfer Partners: Which ones are Best?

I chuckled a bit at the title question here since Wells Fargo has so few transfer partners as to have limited competition for the crown. However, until Tim created this resource, I had constantly been trying to search around for a comprehensive list of Wells Fargo transfer partners since they were never top of mind for me. Many folks with Bilt Mastercards may be particularly curious about Wells Fargo since they are on track to end up with an Autograph card in February 2026.

United increases prices for close-in award bookings

Years ago, United used to have a $75 fee for booking an award within 21 days of departure. They dropped that fee a long time ago, but we have unfortunately seen them reinstitute the fee in a stealthy way: by increasing the number of miles required for flights booked close to departure. I have often said that miles can be incredibly valuable for last-minute needs, whether you are traveling to attend to a family emergency or you need to save plans that were derailed by a cancellation. It is disappointing that United is taking a slice out of the value of using their own miles in those circumstances.

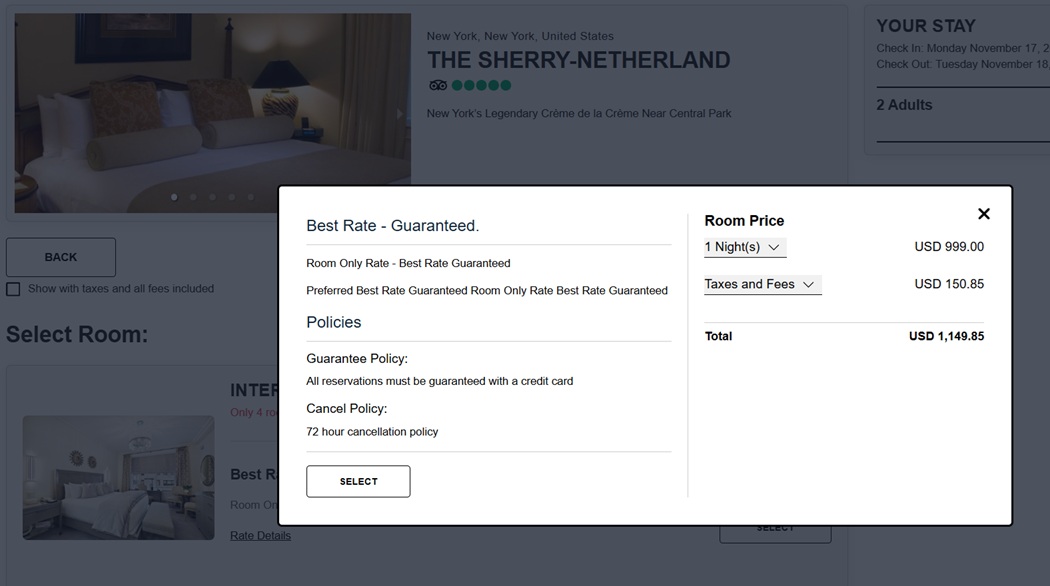

My experience cancelling a Preferred Hotel booked with Choice points

I have to laugh and shake my head every time I learn something new about the trials and tribulations of using Choice points to book Preferred Hotels. In the latest chapter of this saga, Greg shares a situation that worked out well, but which was fraught with the risk of losing all of his points. I would have been even more concerned that perhaps his points would be redeposited, but he would be charged for the late cancellation (as Marriott would do in this case). Still, Grg showed that his memory remains sharp when he found the true cancellation policy in an unexpected email. The devil is in the details, so make sure to keep screenshots and/or all those old emails.

That’s it for this week at Frequent Miler. As we approach the end of the month, keep an eye on this week’s last chance deals to catch those ending soon.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

I kind of feel like the top statuses make more sense for business travelers anyway. When I travelled for work I preferred whatever nearby brand I was familiar with and the travel folks were more likely to approve a known chain hotel anyway. Now that I am retired and travel a lot for leisure I put in enough nights, but chasing status doesn’t make sense because staying in chains is too restrictive, and focussing on a single chain even more so.

So as much as I like shortcuts to status, I don’t begrudge if the top levels are saved for the poor folks who have to be on the road all the time for work.

When I was a consultant sleeping in a hotel room at least once a week and flying almost as often, our ranks were full of people who were bitter they earned status the “real” way yet they weren’t any different than someone who gamed it.

Now that I’m not doing that for a living anymore, games all day baby

Those who have spend 100s of nights in Hilton understand that Hilton underpromises and over delivers and has always relied on hotels to drive status recognition and benefits. Marriott over promises and under delivers. I can see why a blogger likes Marriott as they have more stated benefits despite the many exclusions & exceptions to those. In reality they’re prob not that much different. Hilton needed to recognize their roadwarrier elites and lifetime diamond elites above credit card diamonds. They’ve done this by prioritizing both these groups in the upgrade process and creating this new tier. This isnt a new tier to get folks to reach. Greg misses the point. Also I dont believe Hilton can create a lot of stated benefits as they have too many elites and probably cant deliver. One thing I hated about Starwood was the number of times I could not check into my room until 8pm and when i did the rooms were not thourougly cleaned since too many people have 4pm check outs. Chains must find a balance. I dont think that all chains need to be the same. I like Hilton the way they are by making elite status more attainable as I can use the status when i go to far flung places rather than a chain like Hyatt that is much harder to get but has better elite benefits. Hilton works fine the way they are.

“Going for” tier status suggests that a person is doing something more than what they would ordinarily do. Spend more than they would ordinarily spend. It is to be expected that those in the hobby will seek short cuts, which creates a problem for the loyalty programs. But, whether they will admit it or not, when something can’t be gamed . . . when it’s the hard way or no way . . . those in the hobby feel cheated. And, they say the loyalty program is so unfair.

That being said, I applaud Hilton for recognizing this top group. I would agree with Greg that this top group deserves greater recognition. But, credit card Diamonds deserve no sympathy.

The question is: What is it that deserves recognition? It is natural for a business to base recognition of customers on revenue and profit. Loyalty programs painted themselves into a corner by recognizing customers who don’t . . . by creating tier status with associated benefits that require little to no effort to achieve. As result, benefits are watered down and customers who actually deliver revenue and profit are left unrecognized. Clearly, something needed to change. Perhaps Hilton’s pendulum swung too far (as did Delta’s when it released its refreshed loyalty program). And, perhaps Hilton will/should tweak things. But, in the end, ya gotta climb the mountain if ya wanna enjoy the view.

Spend $18K, get one guaranteed upgrade? What a farce.

Agreed. Revenue milestones would seem to be more aligned with Hilton’s financial objectives. For example, X time-of-booking upgrades in the calendar year one initially qualifies for Diamond Reserve and, if renewed, X time-of-booking upgrades in the subsequent calendar year. Then, for every $Y of spend after the Diamond Reserve revenue threshold, an additional time-of-booking upgrade (which would expire at the end of the subsequent calendar year). They’ll come to their senses and rework it.

Without recognition there is no incentive. In any case, with Hilton diamond reserve and the death of unlimited UR-> Hyatt, both top tiers are dead to me, no longer worth it. 2026 will be my last year as both globalist and diamond. I plan to dump all my points this and next year, and then go free agent.