| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

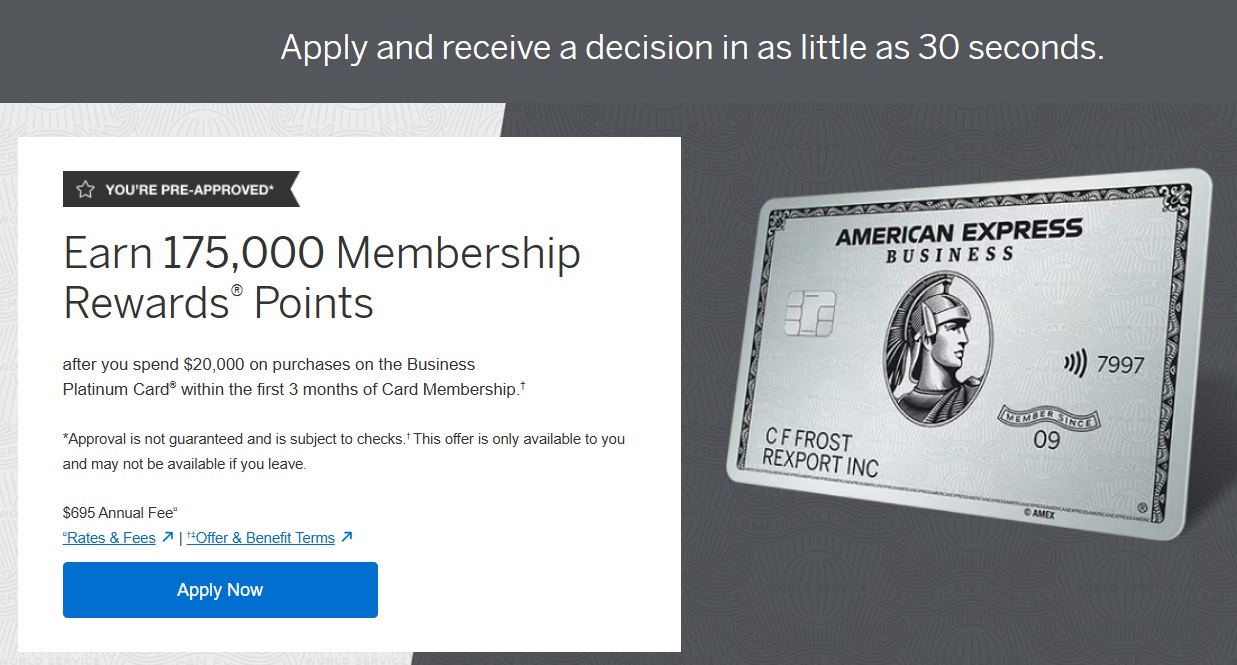

The referral offers giving 250,000 bonus Membership Rewards points for a new Amex Business Platinum card died a couple of days ago, but some cardholders are being targeted with a new offer where you can earn 175,000 bonus points for a Business Platinum. Even better is the fact that this offer has no lifetime language, so if you’re targeted then you can get the bonus even if you have/have had a Business Platinum card before.

The Deal

- Earn 175,000 Membership Rewards when spending $20,000 on an Amex Business Platinum credit card.

- Direct link to see if you’re targeted.

Quick Thoughts

This bonus obviously isn’t as high as the referral offer that had been available for months until just a few days ago. However, what it does have going for it – if you’re targeted – is that it has no lifetime language.

After clicking the ‘Apply Now’ button on the offer page linked to above, you’ll be prompted to log in to your account. If it says ‘This offer is no longer available. If you’d still like to apply for a Business Card from American Express click here’, that sadly means that you’re not targeted.

Hi, can I get the Amex card for the first time with this offer? I missed the previous offer of 250K points.

Offer no longer available.

As noted in the post, that means you’re not targeted unfortunately.

I know. I like to leave a DP where possible.

Thank you!! I got it and I’ve had the card before

20k spend in 90 days,doable but is it worth the stress?

Federal tax (over)payment.

How much can you overpay and how long does it take them to refund you?

You can overpay 10s of thousands. You should do it close to filing your return in order to minimize the time you float the money to the IRS.

Now is actually excellent time to do it by paying towards 2024 taxes. I usually overpay a week before filing, update my return to reflect the payment and then file. I usually get the money back from the IRS before the statement is due.

Just don’t overpay more than you can float. If your refund is delayed for any reason, you don’t want to be in liquidity problems. IRS will pay you nice interest on the refund if this happens but that’s no help if you can’t pay rent.

Also, don’t overpay for 2025 taxes as you won’t see that money for more than a year.

Interesting, appreciate the insight. I don’t have a business, just regular employment where taxes are automatically withheld. Can I still log in to IRS and “prepay” with Amex plat my 2024 taxes before filing and then add that on top of what employer withheld when i file? Is this all OK with IRS? I’m not going to get in trouble, am I ? LOL

Yes, this is ok. You’re giving more money to the IRS, then they give it back to you.

Thank you. If anything, I’ll tell them I read it on the Internet : )

1040 Current Tax Return – Tax Year 2024

==

Is it the form you used on ACI or Pay1040? I used to pay Estimated Tax, but it closed in January already for tax year 2024.

Yes, 1040 2024 is what you want to pay under. Estimated taxes for 2024 ended in January.

Starting March you’ll be able to pay for 2025. But, you won’t see that money until 2026.

Thank you for the explanation.

A follow up question about “update my return to reflect the payment and then file,” do you remember where you update the return in the tax form? Thank you.