| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

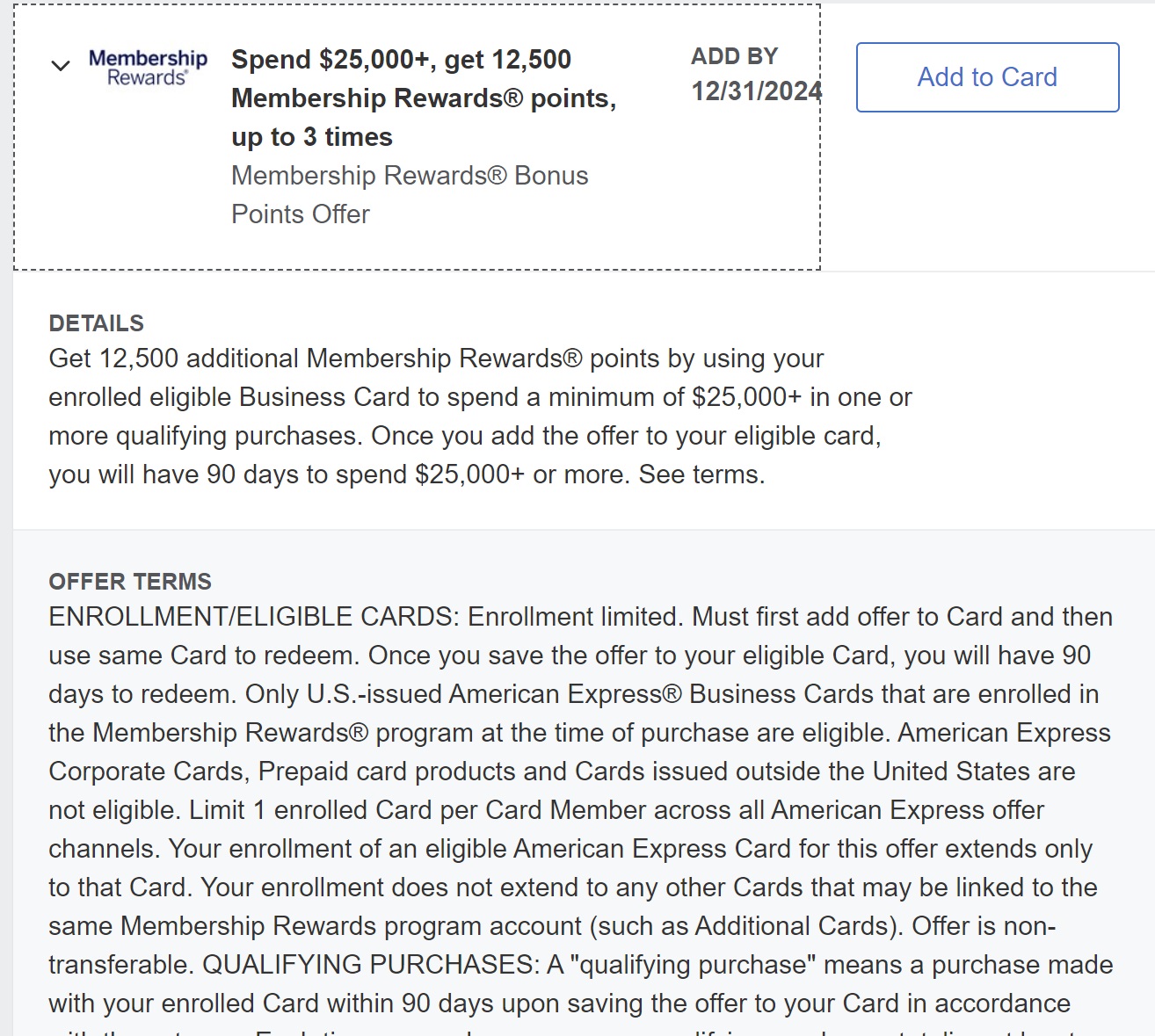

Amex is out with targeted spending offers on some credit cards. While the offers I’ve seen require big spend without much additional return, these could be worth adding for big spenders. You’ll need to enroll to take advantage.

The Deal

- Amex is out with targeted spending offers for big spenders. Exact offers vary, but my offer is valid through 12/31/24, which creates a long enough spending window that it could be worth syncing up

Key Terms

- See your targeted offer for exact terms of your offer

Quick Thoughts

As noted at the top, the incremental value here is tiny. My offer for an additional 12,500 points after $25K spend (up to 3 times) adds just half an extra point per dollar spent. That said, I had this offer on my Blue Business Plus card. I’d be fairly likely to spend $25K on that card over the course of the year since the card offers 2x everywhere on the first $50K in purchases per year (then 1x). This offer would add an additional 12,500 in points that I wouldn’t have had to show for that spend otherwise, and the offer runs through December 31st, so I might be able to take advantage of it at least one time and see a total return of 2.5 Membership Rewards points per dollar spent on that $25K, which is a solid return for otherwise unbonused purchases.

Update: As pointed out by JC in the comments, my offer terms note that I have until 12/31 to activate, but once activated I have only 90 days to meet the required spend. That makes it far less likely that I’ll use my offer.

Let us know in the comments if you receive an interesting offer.

I got 1k for $3k spend

7K for 27K spend on my business platinum cards. That’s a negative Ghostrider.

I have 4k for 4k spend. Also got to meet 10K spend for this card – so its great.

If I pay 10K in tax in one transaction – do I get 8K MR or do I need to break up the transactions? I also need to meet minimum spend on my Ink card, so want to avoid multiple IRS transactions

Also, keep in mind once the offer is activated you only have 90 days to complete the spend. I have also seen in the past with these offers where they say the offer expires on 12/31/24 and as of 08/31/24 I no longer start seeing the offer a full 4 months prior to the offer expiration. And I would check almost daily and the offer would never return. Plus I never activated the offer on any other card.

You are absolutely right. Somehow I glossed over that really important detail!

The offer I got was horrible. “Spend $35,500 with your enrolled card. You’ll earn 9,000 points.” Nope thank you.