NOTICE: This post references card features that have changed, expired, or are not currently available

Citibank’s AT&T Access More card has an excellent but unusual signup offer. Instead of points or cash back, you get a new phone. The deal requires having (or getting) AT&T wireless service, so its best for those who are already with AT&T, or want to be. In my case, my family is on AT&T’s mobile share plan, so the deal makes a lot of sense for us.

Citibank’s AT&T Access More card has an excellent but unusual signup offer. Instead of points or cash back, you get a new phone. The deal requires having (or getting) AT&T wireless service, so its best for those who are already with AT&T, or want to be. In my case, my family is on AT&T’s mobile share plan, so the deal makes a lot of sense for us.

I had occasion to make use of the deal recently when my niece mentioned that she was planning to get a new iPhone. Her birthday was coming up, so I told her to hold off just in case she were to get a nice birthday present. And, by the way, I asked her, exactly what model and color iPhone would you want if you got one?

My first step in securing her birthday present was to sign up for the AT&T card. After activating the card, a link appeared on my account to purchase a phone. The idea is that cardholders can go through that link to buy a phone and, after meeting the card’s $2,000 minimum spend requirements, they’ll get a credit applied to their account, up to $650.

The phone purchase and minimum spend requirements

My niece’s new iPhone cost $850 before taxes, so I knew I wouldn’t get all of the money back, but I didn’t mind springing for the difference. It’s great that the cost of the phone actually applies towards the card’s minimum spend requirement and the purchase earns 3X ThankYou points. I quickly finished the rest of the $2,000 minimum spend requirement with a few miscellaneous purchases and a couple of Nationwide Buxx card reloads (this was before Nationwide limited reloads to $200 at a time). I thought I was all set.

The waiting is the hardest part

In early January, I noticed that I still had not received a statement credit for the phone. I called to ask about it. The agent I spoke with verified that I had met the minimum spend requirement, and then told me that it can take two or more statement cycles before the account is credited. In other words, I had to wait.

Fortunately, someone at Citibank is seriously on the ball. I received a letter about a week later telling me that they were following up from my call. After investigating, they found that my Buxx card reloads were financial transactions that did not count towards the card’s minimum spend requirements (for the record, note that I did earn points for those transactions and was not charged a cash advance fee). The letter went on to tell me the exact amount I still had to spend, and the exact date by which that spend was required. I had about two weeks remaining. Thank you Citi for proactively sending me that letter!

For the next two weeks, the AT&T card became my primary card for all purchases. I finished off the final bit of the spend requirement by making a few Kiva loans. Not only was this easy and convenient, but also I was curious if Kiva would somehow count as online retail or travel so that it would earn 3X points (it didn’t).

Still no credit, but a great phone agent

After really meeting the minimum spend requirement, I hoped to see my $650 credit appear with the next statement close. It didn’t. I called again. The agent I spoke with was great. He told me that he wanted to investigate to see what was going on, but he didn’t want me to have to wait on the phone. So, he verified my phone number and told me that he would call me back.

A few hours later, he called just to let me know that he was still working on it. He didn’t want me to think he had forgotten about me. Then, a few hours after that, he had the answer for me. Apparently, that link that I clicked to buy the new phone is supposed to work a bit like a shopping portal. Tracking information is sent to AT&T along with the click, and when you buy a phone, AT&T reports the transaction back to Citibank (AT&T probably pay’s Citi a commission for the sale, too). Anyway, in my case, the tracking didn’t work. The agent didn’t know why it didn’t work, but said that it happens often.

$650 credit finally received

The solution was for me to dig out my email confirmation of the phone purchase and mail or fax it to Citibank along with my name and account number. I used FaxZero to fax the information since I gave up my fax machine sometime last century. Two days later, I received the following secure message from Citibank:

Thank you for contacting our Customer Service Team. We have credited your account $650.00 for the AT&T Access more card. If you have any questions or are in need of further assistance, please call us at 1-855-488-6642…

Yahoo! Strangely, it took another two days for the credit to actually appear in my account. The important thing was that it did appear… Finally.

Wrap Up

As you can see from my experience, things can go wrong when trying to secure the AT&T card’s signup bonus. If you used the card for any financial-ish transactions, you may need to confirm with Citi that you have really met the minimum spend requirements. And, if you still don’t get the credit, check with them to see if they have a record of your phone purchase. If not, you may want to dust off your fax machine ![]() .

.

I, too, had a miserable experience with this card. ATT and Citibank is a very bad combination. The link to the phone purchase did not work, no one knew how to get the transaction done, my card did not show up in the mail, credit was slow in posting, etc. After about 10 separate phone calls, I finally got the credit and moved on. Citibank customer service was very friendly and nice but incompetent.

Purchased $690 iPhone 6s through AT&T portal made the $2000 purchases. I thought. Very disgusted to find out that the $95 annual fee did not count towards the $2000. Came out $30 short contacted several times to plea my case. No luck. Will no longer be doing business with AT&T and might do the same with Citi.

@James Callahan

No card issuer counts the annual fee towards the actual purchasing spend on a card. NONE. Why? Because you are not making a purchase. Is this your first credit card or something? Why blame AT&T or the card issuer for a careless error that you made?

[…] http://frequentmiler.boardingarea.co…me-full-price/ He says he was told that Buxx loads don't count toward minimum spend, though one of the commenters speculates that it was a tracking issue the whole time. I'm currently trying to use Buxx loads toward an AA Plat minimum spend – has anyone else recently used Buxx toward a Citi minimum spend? If so, success/failure? Thanks! If not, I'll keep going with it and post my results in a few weeks. […]

Does this card earn 3x at Amazon?

Yes, I believe so

I have service with AT&T. Do I have to open a new account for this offer?

No, you can get a new phone and use your existing account.

I pulled this off in December plus the Plenti program had multiple credits for starting g new AT&T accounts.

I kept my account for 1 month and 1 day and got ~$20 in Plenti over the cost of the cheapest plan.

I also got my credit from Citi seamlessly. My only complaint was the AT&T purchase was supposed to be interest free, but despite leaving only $700 on the account (phone was $800) they tagged me for 50 cents.

For me this has been the best and easiest bonus offer yet.

Any idea if this is a long-running sign-up offer versus time-sensitive? I’d like to wait and see what new features they have on the next iPhone but it might not be worth missing this deal.

My guess is that it is a long term offer.

Do you have to be a AT&T customer until you receive the $650 credit back or can you cancel it after one month of service without any contract/ETF? Thanks.

You only need to keep it 15 days. Since you are required to pay full price for the phone there is no ETF fee.

I suggest checking Plenti offers and calculating whatever AT&Ts offers there are for new sign-ups. It may be more worth it to pay for a month and take the plenti points. (You can use those points to pay the bill in an AT&T corporate store too)

Had no trouble getting a Galaxy note. Credit posted fast.

After reading that painful missive I think God will pity you with good weather today.

I’m with Sandy….life is WAY too short to do business with AT+T (actually SBC, who hijacked AT+T’s great name when they acquired AT+T). I’d almost rather fly Spirit Airlines!!

I wonder if the Buxx spend counted all along and it was always a tracking issue.

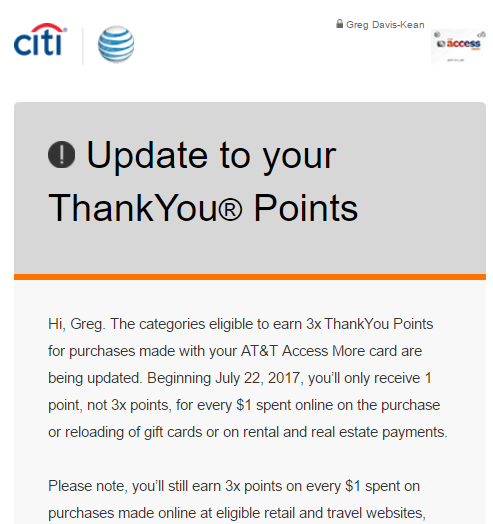

Good thought. Maybe. However, with bonus point retention offers I’ve found that Buxx spend only counted for 1X, not for the additional 2X, so they do have the ability to discern this type of spend.

I was lucky. 2 iPhones, credits received after 2 statements.

Surprised your niece went for the phablet. Does she have big hands?

She got the 6s with extra storage not the Plus

you probably got your call because you’re their co-conspirator in pimping credit cards is my guess- they’d hate a fatal review of one of their products. anyone else would have had all their accounts closed by this review of non-financial transactions, which would have then led to all your wife’s accounts being closed too.

i find it curious that, while you get normal shutdowns of debit products where you’re not an affiliate, you and all the bloggers somehow are unscathed by shut downs by the major CC companies you work for. you MS and churn more egregiously than anyone, AND… write about it!!! nonetheless, you’re somehow the teflon man. i have been blackballed by citi and barclay. barclay even shut down the primary on an acct i was AU on, who lives 2000 miles away, when they canned me (i hadn’t used that card in 5 months!). of course, i’m not a blogger with affiliate deals.

i find it very odd and frankly worthy of an ‘unfair business practices’ investigation of the card issuers that they can heavily compensate people to pimp their cards by way of teaching people to MS and churn their cards, and then shut down and confiscate points when people do a fraction of what you do.

and, yes… i see your advertising disclosure. it would never hold up; as it is documented that the issuers do have a history of ordering content taken down or changed. your disclaimer SHOULD say, ‘i can do whatever i want because i’m in bed with these guys. you’re not, so you can’t’.

Would love to hear more about your volume/activities.

zero churning- which seems to me the most abusive. no multiple cards. i do a lot of MS, but those cards the amounts were paltry- less than 10k/mo spread out and lots of regular spend. according to citi executive offices, i am banned from any/all citi products for life. ridiculous. i know of no major full time affiliate compensated blogger who has had the same. curious. i imagine it’s a phone call that fixes it if they are accidentally ensnared. they know exactly what FM is doing- they read about it. nonetheless, he’s teflon. why. (rhetorical, as the reason is obvious).

i just think it’s bad pool. if they’re going to shut down people and confiscate points/$, they cannot compensate people whose sales technique is to tell people how to churn and MS!!!! it’s a class action, deceptive and unfair business practices suit, waiting to happen.

You did something that made the banks think you were money laundering or something else illegal. That is why they shut you down. They don’t shut people for churning, they just deny them more cards.

Citi (and Chase too) dropped me as an affiliate partner quite a while ago. My affiliate links are indirect through a 3rd party. Citi has no reason to protect me.