The Wyndham Earner Business card feels more valuable to me lately than ever before. It’s been fun writing about all of the possible status matches and how you can (at least at the time of writing) get fifty seven nights of free hotel rooms and nearly-free cruises by starting with this $95 card. And I’m not just being theoretical about this stuff — I’ve booked a bunch of this stuff myself. Now I’m getting some family members on board, too. But it isn’t all smooth sailing: one family member recently had a difficult time getting approved for the Wyndham Earner Business card — and from the sounds of it, she’s not alone. I’ve seen a number of reports lately of Barclays following up for additional information for some applicants. The good news is that people seem to typically get approved after providing the requested information, but I wanted to share the two very different experiences of family members who recently applied.

Instant approval for one family member. The polar opposite for another.

There were plans in my family for a 2024 family cruise that existed before we had taken the first of our “free” cruises last fall. Everyone had expected to pay full price for this family cruise that has been under discussion for years. However, thanks to the opportunities to snag free cruises via casino status matching, a couple of family members decided to get on board with the process so that we could bump that family cruise up to 2023 at a steep discount.

To that end, two family members recently applied for the Wyndham Earner Business card and had very different experiences with the approval process. I’ll change the names to protect the innocent and we’ll call them Pat and Jan.

To my knowledge, Pat has just a few credit cards (think something like 2-3 cards, consumer cards only) and a shorter credit history than Jan. She applied as a sole proprietor (she has a couple of legitimate side hustles, like delivering groceries for Instacart) and much to my surprise she was instantly approved.

Jan only has two rewards credit cards, one of which is about 30 years old and the other of which is about 2 years old and she has no blemishes on her record and no debt at all (no mortgage, car loan, etc). Her application went pending and quickly became a denial. In hindsight, I have a guess as to one problem: she used her cell phone number on the application, and while she’s had the number for a couple of years, the bill for it is not in her name and it is not associated with her other cards or bank accounts. She probably should have entered her landline for her phone number on the application since that probably matches her public profiles.

At my suggestion, she called reconsideration a couple of days later. Barclays asked her to provide proof of identity: she had to fax a copy of her driver’s license, social security card, and a recent utility bill. They called her a day or two later to ask her to re-send because the quality didn’t come through clear enough (oddly, I’ve heard many other people report the exact same thing recently…..or maybe it’s not odd since we’re talking about ancient technology — why are we faxing stuff?). Additionally, Barclays initially didn’t want to accept the utility bill provided because it had Jan’s landline phone number on it, not her cell phone number. She only had one utility bill in her name, so they eventually called her back on the landline and then relented on that issue.

However, about a week later, she received a letter in the mail asking for a 4506-T to prove her income. When I explained to her what that meant (it’s a tax transcript that essentially shares whatever information is reported on your federal tax return), she was (understandably) annoyed. She’s rarely ever sought financing for anything, but never had trouble getting approved for anything when needed. It may be that she has a relatively thin credit profile given no installment loans and only a couple of credit cards, but her Average Age of Account is high and payment history flawless. I was annoyed for her that they wanted tax transcripts for relatively low-profile business credit card. I felt bad that this was her first experience with a business credit card because it did not at all reflect what the experience is usually like with most banks.

Nonetheless, we she wanted in on the cheap family cruise, so she provided the 4506-T even though I was actually lukewarm on the idea (at that point I was ready to throw in the towel and help her get FoundersCard for Caesars Diamond status). She mailed the 4506-T on a Wednesday afternoon. She had asked the postmaster when it would be expected to arrive and she was told that the earliest it would arrive would be on Saturday. I didn’t even check the application status for several days after that because I figured that it would take them at least a week once they received the 4506-T before they would approve the application.

But the following Tuesday I was surprised to check on the status for her and see that the application was approved — on Friday. That was 2 days after she mailed the 4506-T. I think it is very highly unlikely that they received the 4506-T and reviewed it and approved it that quickly (and I also doubt that happened because after seeing proof of income I’d think they might have approved her with credit limit of more than $1,000). She got the result she wanted (getting approved so that she could go after the free cruises), but why request the 4506-T if you don’t need it to make the decision?

Other readers report similar experiences

I’ve been surprised to see a number of readers report very similar experiences in terms of needing to fax in identifying documentation — and then being asked to fax it again because it couldn’t be read.

From there, experiences diverge a bit. Barclays did call Jan a couple of times following up, but other readers report going weeks in without any word from Barclays (or in some cases readers reported calling Barclays weeks later for an update only to be told that they needed to fax another copy of the identity documentation to move forward).

Requesting proof of identity doesn’t seem unreasonable to me. I know that most banks don’t do that and in stark contrast tend to instantly approve large credit lines in seconds. Frankly, I have always thought that the system as it works is kind of nutty in terms of the ease of getting credit. But the tough thing here is that Barclays is requiring proof of identity to be provided via fax. Besides the fact that nobody has a fax machine at home anymore, I don’t love the idea of my personal information sitting out on a fax machine waiting for anybody in the office to grab it. I would think that in 2023 there would be a secure electronic means of confirming identity (even the IRS does this online when you sign up for an account!).

Tied together with the fax issue is that many readers report Barclays failing to follow up at all, even when they need additional information. If you get stuck in this sort of loop, it seems that the best course of action is to call Barclays at least once a week to see if there is anything else you can provide.

Bottom Line

Ultimately, both Pat (instantly) and Jan (after a few weeks) were approved. Barclays never sent Jan any notification that she was approved. We only know she was approved because the online application status changed from “Sorry, we can’t issue you a credit card” to “Congratulations! You’ve been approved!” (she hasn’t yet received the card). Communication definitely isn’t a Barclays strong suit.

That said, the moral of the story is that if you are not instantly approved, don’t give up. In almost all cases I’ve heard, people who continue to follow up and submit the additional documentation seem to eventually get approved. Obviously everyone would prefer instant approval, but while that is possible, it definitely doesn’t seem to be guaranteed here. Still, good things can come to those who wait — that family cruise is probably going to happen this year and cost all of us far less than it otherwise would have thanks to the Wyndham Earner Business card.

Info sent to a company by “fax” arrives in electronic form like an email. It’s not printed out like in the 80s and 90s. And almost nobody is using a machine to transmit a fax. Almost everyone uses a fax app. You just send the file from you phone like you would an email. Fax is basically a parallel to email now, except you transmit via phone number instead of email address.

Are you more likely to get approved for the business card if you have a savings account with a substantial positive balance with Barclays?

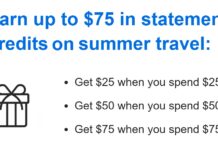

Similar experience, had to fax info multiple times, never clear enough, eventually had to mail requested info. After numerous phone calls and jumping thru several hoops my application was finally approved 2 months after initial application date. To make matters worse, Barclay awarded me the lower spending bonus (45K) in effect at that time, rather than the 75k bonus offered on the original date of application.

Hello Nick,

Do you know how strict Barclays is with buying gift cards at gas stations? I wanted to use the Wyndham earner business card to buy MasterCard gift cards at my local gas station, but I obviously would prefer my account to not get shut down. Appreciate the feedback.

Not very.

Adding to your family member’s odd experience, I applied for the business card a couple hours ago on a whim and wasn’t expecting a win. I’ve been denied in the past and I’ve recently gotten three Inks and a Hilton biz card, not to mention all the business platinums and golds since the pandemic. Sure enough, no automatic approval, the application went to pending. Email saying the same thing came shortly thereafter.

A couple hours later, however, I get an email from Wyndham/Barclays that says, “Thanks for going paperless!” Nothing about approval or anything of the sort, but it depicts the card at the top and lists the last four of a new account number, so I know they’re not talking about my JetBlue card. Load up the app, and yep, there’s a new Wyndham Earner Business card in my account. Weird, but I’ll take it!

I also applied on a whim this week. I actually got instant approval, but as you note there was not the typical “Congratulations, your application has been approved” type of email — just an email thanking me for going paperless.

However, it was helpful that the paperless email had the last 4 digits of the card number. I called and was able to get them to expedite the card. I think having the last four helped the phone agent find my account.

Could any of you share any tips during the application process? For instance, did you enter your SSN or a business EIN or something like that? Business and home address the same?

Thank you

Hey Nick,

I had a quick question pertaining to the wyndham earner business card. I already have one for my business under my EIN and I was thinking about getting a second card under my SSN. If I were to get both cards, would I be able to generate points under the same wyndham account or would they have to be separate accounts? In other words, can I pool all those points together in one place or do I have to manage two separate accounts for each card? I appreciate your help.

Sorry, I don’t know.

Looks like I’m definitely in Jan’s bucket and will have to call Barclays in a couple of days.

[…] developments with this card by the way. Two very different experiences applying for the Wyndham Earner Business card. Barclays is a weird bank, good […]

You mentioned getting Founders card to get Caesar Diamond. How do you get Founders card in the first place?

Called Barclays a second time today and they’re playing hard ball. I applied 47 days ago and was told too many recent applications (4) 2022 and the number of bank cards opened within the last 24 months (4) they still wouldn’t reconsider my application. Said they’d like to see more time away from those recent applications. First it was my older 2021 accounts and now that they’ve dropped off the focus has shifted to my newer accounts… I mean what gives Barclays!!!

Called recon after reapplying and opening a Biz checking account yesterday. After answering a few questions about my Biz the rep manually approved my application. I was beyond 30 days so had to reapply at the current 75K offer.

It’s unfortunate it’s the 75K offer, but I’ll take it after Barclays recon continue to deny my application at 4/24. They said I need more time away from those 4 accounts or reapply. Not sure how much time they need as the Rep will not elaborate on (time).

No cruise match for me anytime soon as I have to continue waiting…

Pro tip. Barclays is a complete mess & it’s easy to take advantage. Freeze TU, which they will definitely pull. After auto denied, call recon & ask them to manually pull EQ. My reason is always a pending dispute with TU & EX. They will shift credit from personal cards if needed.

I called today exactly 30 days after applying and was told I had to apply again if denial was 5/24.

It contradicts what I was told by them when I called recon the day I first applied, which was call back once I was under 5/24.

Is this a common practice?

The supposed rule at Barclays is 6/24 (though I’ve seen reports of approval over this, so I’m not sure how set the rule is?). I don’t know the answer to your specific question though. I might call one more time.

Just as your article stated there’s no rhyme or reason to their denials or requirements for approval.

The rep just said, if my denial was too many cards then they can’t overturn I’ll have to reapply. She also couldn’t tell me how long I should wait because it would depend on how my accounts were reported to reflect the fact that the account has lapsed the 24 month period. I was 7/24 when I applied, now I’m 4/24 a of April 6th…I’ll call again.

It’s very difficult to predict Barclays. I have gotten denial after 0 hard pull on TU in 24 months, 830 FICO. Then I could get 3 BZ cards in 2 months after many hard pulls and new cards (over 10) in short few months. It all depends on the system logic focus. The associates don’t want to tell the reason or overwrite the denial.

Yea, they really don’t want to budge on overturning a denial. I guess I’ll have to reapply, but how long to wait before applying again is a mystery.

Which fax number do you use? I am trying this one today but not able to connect. +1 866 836 9595

I’ve been wanting to get this card for awhile now. I got the AA aviator card personal card in January. Is it too soon to apply for this card? How long do Barclays higher SUB stay around? I want to take advantage of the higher SUB if possible.

The business card has a low intro bonus right now. We’ve seen higher.

I applied back when the bonus was 90k. Have had chase, amex, WF, BOA business accounts for several years, but was straight up denied. ~800 credit score, 15+year clean credit history, no reason, no please verify anything. Just denied. Literally the first time I’ve been denied for credit.

Regarding the 4506-T. I did the Amex Biz Checking bonus recently and they wanted at 4506-T, but when I sent it in they told me that the IRS was so backed up that it could take weeks or months to hear back, so they offered me the option of sending 2 recent bank statements from a personal account. Thought that was kind of odd that they would ask for a 4506 even if they knew it would take months to verify