Last month, Southwest announced that it would be launching a Rapid Rewards Debit Card in conjunction with Sunrise Bank, which also issues the Wyndham Rewards Debit Card.

It looks like Southwest won’t be the only one. Last week, MilesTalk reported leaked info that was shared by an X user, SoFi Insider. It shows an image that seems to suggest the United will be joining the debit party as well, with a card that has almost a very similar structure to the Southwest version.

The News

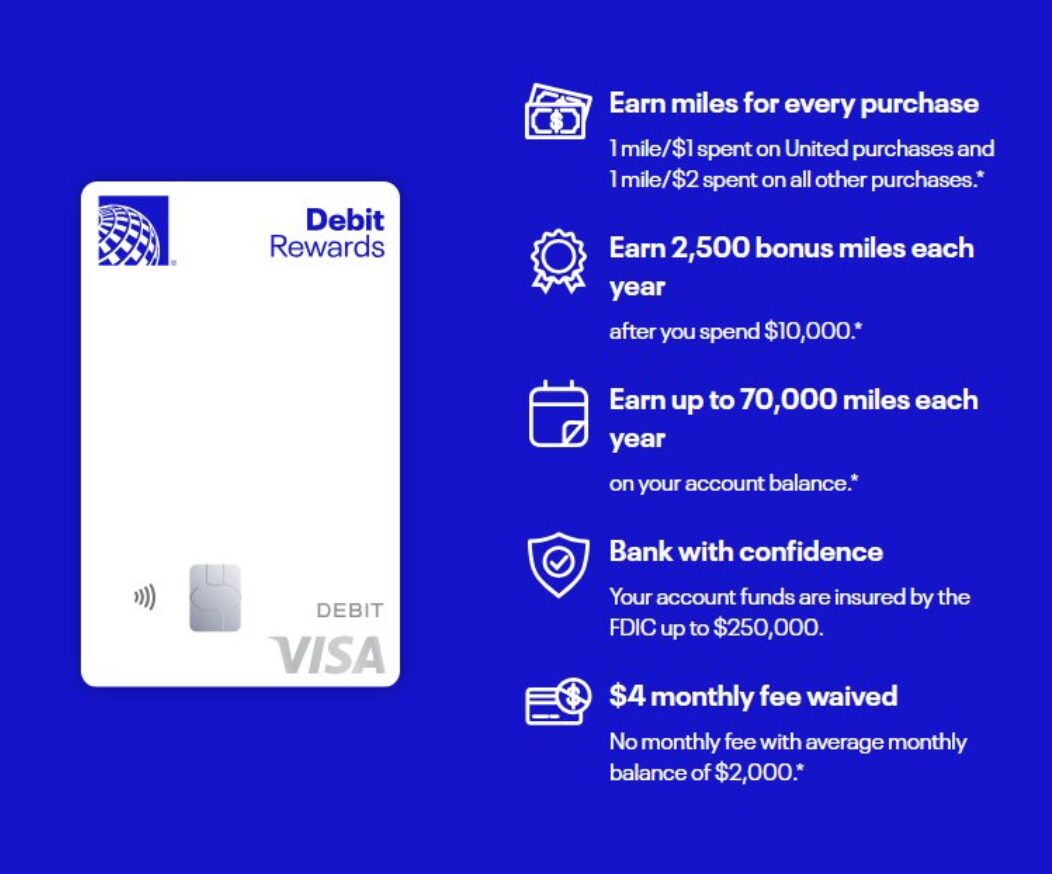

- A leaked image shows that United intends to release a rewards-earning debit card.Based on what’s listed in the image above, when the card launches, it will:

- Have a bonus of 2,500 miles per anniversary when you spend $10K within a (cardmember?) year.

- Earn a maximum of 70,000 United miles per year on your account balance (?)

- Earn 1 mile per dollar on United purchases

- Earn 1 mile per two dollars spent everywhere else

- Have a $4 monthly fee that will be waived with an average monthly balance of $2,000

Quick Thoughts

Similar to the Southwest and Wyndham debit cards, there isn’t a lot that’s of interest here for United loyalists or points and miles enthusiasts. Chase’s suite of United cards is far more appealing in terms of perks, welcome offers, and rewards for spend.

That said, there may be a limited use case for debit card transactions where credit cards aren’t accepted, or where debit cards have much lower fees. For example, tax payments with debit cards usually have a ~$2 fee added, instead of the ~1.8% fee that comes with credit cards.

In many of those cases, it will be far more rewarding to open a new credit card, pay the higher fee, and then be able to complete minimum spend on a high-value welcome offer. However, for those who already use a debit card, getting some rewards is better than nothing. In addition, credit card-skeptical folks who will only hold a debit card might find something to like here (or with the Southwest and Wyndham versions).

There is another potentially interesting feature here. The bullet points say that you can earn up to 70,000 miles per year on your account balance. That seems to indicate that you’ll able to earn miles on the amount that you have deposited in the account, similar to how interest would work. We obviously don’t have any terms to look at yet, but I’ll be interested to learn more about how this feature works.

All that said, for most readers of this blog who are looking for rewards, this won’t be the place to put your spend.

I used to have the Hawaiian National Bank United debit card, but it seems like they discontinued it some time ago. What’s old is new again.

Meanwhile Delta and Suntrust are ending their debit card relationship that originally started with Suntrust.

Your previous article is about T-Mobile phasing out the ability to get the autopay discount and still pay with a credit card. Limited situations?

Earn miles on deposit to get the 70k. I hope it’s not for spending $140,000 😀

Given debit transaction dollar caps, tax payments for some might be off the table.

Then, there’s the interest opportunity cost of deposit amounts.

Queue in the Dave Ramsey fans!