| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

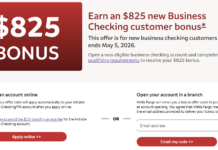

US Bank has a promotion for new Business Checking accounts that offers either a $350 or $800 bonus with very simply requirements. This deal is available in states within US Bank’s footprint (or for US Bank cardholders) and requires making one or more deposits totaling either $5,000 or 25,000 within 30 days, then holding that money in the account until 60 days after account opening. The total of the deposits will determine the bonus amount. $5,000 gets you $350; $25,000 gets you $800.

US Bank used to allow $3,000 of credit card funding on new accounts, but that’s been reduced and is now only $250 (still, use it if you got it).

The Deal

- US Bank is offering a bonus of $350-$800 when opening a U.S. Bank Business Checking account (Silver, Gold, Platinum) using promo code Q1AFL24 and complete the following requirements within 30 days of opening:

- For the $350 bonus, complete one or more deposits totaling $5,000 or more and maintain the balance for 60 days from account opening

- For the $800 bonus, complete one or more deposits totaling $25,000 or more and maintain the balance for 60 days from account opening

- Expires 4/23/2024

Terms and Conditions

- Promo code Q1AFL24 MUST be used when opening the business checking account.

- Limit of one Business Checking bonus per business.

- Earn your $350 Business Checking bonus by opening a new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account between 2/1/2024 and 4/23/2024. You must make deposit(s) of at least $5,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $5,000 until the 60th day after account opening. The new money cannot be from an account at U.S. Bank or its Affiliates.

- Earn your $800 Business Checking bonus by opening a new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account between 2/1/2024 and 4/23/2024. You must make deposit(s) of at least $25,000 in new money within 30 days of account opening and thereafter maintain a daily balance of at least $25,000 until the 60th day after account opening. The new money cannot be from an account at U.S. Bank or its Affiliates.

- The business checking bonus will be deposited into your new U.S. Bank Silver, Gold, Gold with Interest, Platinum, or Business Essentials (Only available in certain markets) Business Checking account within 30 days following the last calendar day of the month you complete all of the offer requirements, as long as the account is open and has a positive available balance.

- Monthly Maintenance Fee Waiver Options: Gold Business Checking: U.S. Bank Payment Solutions Merchant Banking OR $10,000 average collected balance OR $20,000 combined average collected business deposit balances OR $50,000 combined average collected business deposits and outstanding credit balances. Platinum Business Checking: $25,000 average collected balance OR $75,000 combined average collected business deposits and outstanding business credit balances.

Quick Thoughts

This is an easy checking account bonus, as the requirements are very simple: make deposits totaling $5000 or $25,000 within thirty days of account opening, hold the money in the account for 60 days after account opening and sign-up for online banking. That’s it.

Since you can open an account with as little as $100, you don’t need to deposit the remainder until day 25-30. After 60 days (from account opening), you just need to maintain a positive balance until the bonus gets credited (US Bank gives themselves up to 45 days to do that). So, you shouldn’t have to leave the full amount in the account for longer than 30-35 days.

There’s three different types of business checking, but you can get the bonus by signing up for Silver, which has no maintenance fees. The account is limited to 125 transactions per month and then each transaction gets charged a $.50 fee, but, why would you do more than 125 transactions in a month?

There’s two other levels that have increased transactions levels, but also have maintenance fees that require a relatively significant balance to waive, so there’s really no reason to do one of those instead of the free Silver account.

US Bank bonuses hare usually been limited to those states that have a US Bank branch (which is a wide net…see locations here). If you live in one of the states that doesn’t have a branch, you used to be able to get around this requirement by opening a US Bank brokerage account first and then opening the checking account afterwards. Based on previous comments, it sounds like US Bank may have closed that loophole but instead is now allowing folks with a US Bank credit card to open checking accounts, even if they’re outside of the US Bank footprint. YMMV.

US Bank seems to be fairly strict on its churning rules so I wouldn’t mess with it if you’ve had an account or received a US Bank bonus within the past two years. If you haven’t, this is easy money.

Just signed up for the basic silver checking, was approved, and was allowed to fund with $3,000 via credit card! This was all online on a Sunday.

I was able to fund $3,000 with a credit card. Does that funding count towards the $5,000 or do I need to deposit an additional $5,000?

Did you open in branch or online? I stopped by at a branch and was told they take only cash/cheque..

opened online and was able to fund 3k.with chase Marriott credit card Opened Friday and approved today.

“Deposit $5,000 or $25,000 in new money within 30 days of account opening and *maintain at least that balance for 60 days* after opening the account.”

I dunno, that sounds like you need to keep the money in for 60 days regardless of when it’s deposited

No it doesn’t. Both deposit and balance are measured from the same day: account opening.

So, if account open is on January 1st, you’d have until January 30th to deposit the money (technically 31st, but I wouldn’t push it that close). Now you have to maintain that balance for 60 days, from account opening, which is January 1st, not from deposit date, which would be January 30th. 60 days from account opening would be February 29th, or 30 days from deposit (if you put the money in on the 30th).

I wouldn’t cut any of it that close, so probably would deposit the money around day 28-29 and then leave the balance in until day 62…but that’s me.

Heads up, your application may glitch out after you hit the final submit button. Apparently they’re updating their site and it’s a known issue. The applications are still going through and in my case show up under my existing accounts, but there’s no option to do the initial funding when applying. The rep said I should receive an email in a couple days that will allow me to select how I want to do the initial funding, including the option to fund via CC.

What caught my eye in Dr of Credit’s post on this is you can load up to $3K on credit card. Do you know if that’s possible?

Did this in 2023 and funded 3k with Chase Visa.

It used to be possible to fund up to $3K on new accounts, but that was reduced to $250. ASFAIK, that’s where it stands now.

Did it last week for 3k

Great to know it’s back again!

Did it on feb 11 for $3,000 as well.

Would the 3k count towards qualifying spend for a CC sign up bonus?

Tim, can you check the numbers again? The article’s numbers are all over the place, is it $25,000 or $15,000, is it $500 or $350, and is it $800 or $750?