| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

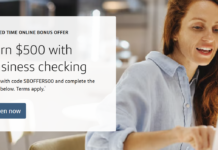

US Bank has another promotion for new Bank Smartly checking accounts that offers up to a $500 bonus with fairly simple requirements. This deal is available in states within US Bank’s footprint and requires signing up for online banking and making at least two direct deposits within the first 90 days. The total amount of the direct deposits will determine the bonus. In order to get the full $500, your direct deposits must total $10,000 or more.

Note that there’s also an optional savings account component to this deal, but you get $300 for holding $25K in a 0.01% savings account for six months. I’d pass.

US Bank used to allow $3,000 of credit card funding on new accounts, but that’s been reduced and is now only $250 (still, use it if you got it).

The Deal

- US Bank is offering a bonus of up to $500 when you open new Bank Smartly checking account using promo code 2023DEC and complete the following requirements within 90 days:

- Enroll in online banking or the U.S. Bank Mobile App.

- Complete two or more direct deposits within the first 90 days

- Your bonus is determined by the total amount of your direct deposits

- Earn $300 when your direct deposits total $5,000 to $9,999.99.

- Earn $500 when your direct deposits total $10,000 or more.

- Expires 12/29/23

- $6.95 monthly fee (waived if you have a US Bank Credit Card or maintain a $1,500 monthly balance or have monthly direct deposits totaling $1000+)

- Check US Bank locations here

- See Doctor of Credit’s list of what counts as direct deposits with US Bank (it’s a lot)

Terms and Conditions

-

To be eligible, you or any owner(s) on your new Bank Smartly Checking account cannot have an existing U.S. Bank consumer checking account, had a U.S. Bank consumer checking account in the last two years or received other U.S. Bank consumer checking bonus offers within the past two years.

-

You must also use the promo code at account opening.

-

To receive the bonus, you must open a new U.S. Bank Smartly® Checking account with a minimum deposit of $25 either online, in a branch or over the phone from December 1, 2023 through and including December 29, 2023.

-

Additionally, you must enroll in the U.S. Bank Mobile App or online banking within 90 days of opening your account.

-

You must also complete two or more direct deposits within 90 days of opening your account that total: $5,000 to $9,999.99 to earn the $300 bonus or $10,000 or more to earn the $500 bonus.

-

A direct deposit is an electronic deposit of your paycheck or government benefits, such as Social Security, from your employer or the government. Other electronic deposits or person-to-person payments are not considered a direct deposit.

-

Your checking bonus (“adjusted interest”) will be credited to your new checking account within 60 days following the end of the calendar month during which you completed all of the offer requirements. Account must be open and have a positive balance to receive the bonus. Bonus will be reported as interest earned on IRS form 1099-INT, and recipient is responsible for any applicable taxes. This offer may not be combined with any other checking account bonus offers.

Quick Thoughts

This is a good bank bonus opportunity that comes around regularly; we’ve covered $400, $500 and $600 versions before.

The requirements for the bonus are fairly simple: make at least two “direct deposits” within ninety days of account opening and sign-up for mobile or online banking. US Bank is known as one of the easier banks in terms of what’s considered a direct deposit and ACH transfers work from many common banks (you can see the full DOC list here). While the direct deposit totals are relatively high, there’s no requirement that the money stay in the account, so you should be able to transfer the money back out after it goes in.

If you don’t have a US Bank credit card, the Bank Smartly account is easy to keep free, requiring a $1500 annual monthly balance or monthly direct deposits totaling $1000+. If you have a US Bank credit card, the monthly fee is waived. Members of the US Military also get the fee waived.

The bonus is limited to those states that have a US Bank branch (which is a wide net…see locations here). That said, if you happen to live in one of the states that doesn’t have a branch, you can get around this requirement by opening a US Bank brokerage account first and then opening the checking account afterwards. There’s no need to have any activity on the brokerage account.

US Bank is fairly strict on its churning rules so I wouldn’t mess with it if you’ve had an account or received a US Bank bonus within the past two years. If you haven’t, this could be easy money.

Is there early termination fee is I close the account right after the bonus is posted? Thanks!

if you happen to live in one of the states that doesn’t have a branch, you can get around this requirement by opening a US Bank brokerage account first and then opening the checking account afterwards.

Has anyone else tried opening a US Bank brokerage online recently? I’m trying to do so, but their website will only let me proceed with the application if I first log in as a current customer. Which I’m not–that’s why I’m trying to open the brokerage. 🙂

Update: it looks like US Bank has closed the “open a brokerage account in order to open a checking account” loophole. The website now requires you to log in as a current customer in order to apply for the brokerage account. I called US Bank and was told that you have to have a checking or money market account in order to apply for the brokerage account. I have applied for both checking and money market accounts, but those applications were denied since there is no branch in my state.

Oh, wow. That’s a change, if that’s universal. Can I ask which state you’re in?

Virginia.

Having a credit card may still be enough. No branches in my area or all of New England other than some mortgage officers. I have 2 US Bank credit cards, one converted from the old Northwest Visa, and the other converted from the old Radisson. After logging in I have an option to create a checking or other account and have been offered $400 before. Edit: I have a $500 offer in the app right now plus $300 more if I open savings.

[…] I don’t remember seeing that on a Bank Smartly promo before and it’s hard to know if, or how well, it will be enforced. US Bank has plenty of promos, so the best choice may be to wait until the next one comes around. Your mileage may vary. (h/t: reader Chris) […]

According to DOC, it seems this code is targeted, single use and only available to one person.

I signed up before seeing the disclaimer…so will see if it’s attached, but probably worth a significant YMMV warning on this one.

Wow. Those terms were added to the landing page since DOC (and we) first wrote about it…and it specifically mentions a deals website. You’re right, that may not actually be enforced, but a YMMV is definitely warranted.

I don’t recall seeing it before as well when it was posted in both places…might not have looked close enough…but calling out a deals website definitely is a recent edit…don’t think I’ve seen anyone do that before!

The same thing caught my eye…I’ve never seen the “deals website” terminology.

[…] articleUS Bank: Easy $500 bonus with a new checking account Next articleChase Freedom Unlimited Credit Card Review […]

One can easily earn $500 on a $10k deposit in interest in a Fidelity money market account without going through the hoops.

Probably not in 90 days, though? And you don’t have to deposit $10k, you have to make a total of $10K in deposits. There’s no requirement to leave the money in the account. You can repeatedly deposit the same $50 over and over again if you want (although that would take awhile).

Not so easy, to be fair

Why do you say that? I’ve done this one myself and found it to be pretty simple.

I was comparing to the Capital One 360 bonus. You could transfer even through Venmo. Just 2 deposits of $250 and done. This one seems to be more steps and needs more money. You mentioned it can be many smaller deposits. But I still don’t understand how you can deposit. It said only government or employer or social security checks only?

The Capital One deal actually had the same (or nearly the same) terms; many bank bonuses do. But, they often aren’t enforced (or banks don’t bother with the IT necessary to enforce them). Doctor of Credit keeps a list of what various banks count as direct deposits and that’s linked in the post. When I did the BOA deal last year, I just set-up repeating transfers from one of my personal accounts and then transferred it back to the same bank account after it went through.

cool beans not unlawful just a legal loop hole they will eventually close