We’ve written about Visa SavingsEdge before, but it’s been a couple of years since we last published anything about this card-linked program and so I wanted to publish a reminder that it exists and can be a great way to earn cashback on stays at Wyndham and MGM properties, as well as with a wide range of other retailers, restaurants and services. They’ve also started offering discounts and/or bonuses on a whole host of other business-related services that could save you money on services like Google Ads, Aweber, Constant Contact, etc.

The Deal

- Earn cashback via Visa SavingsEdge when paying with a linked Visa business card.

- Direct link to offer.

Key Terms

- Some offers require promo codes.

Quick Thoughts

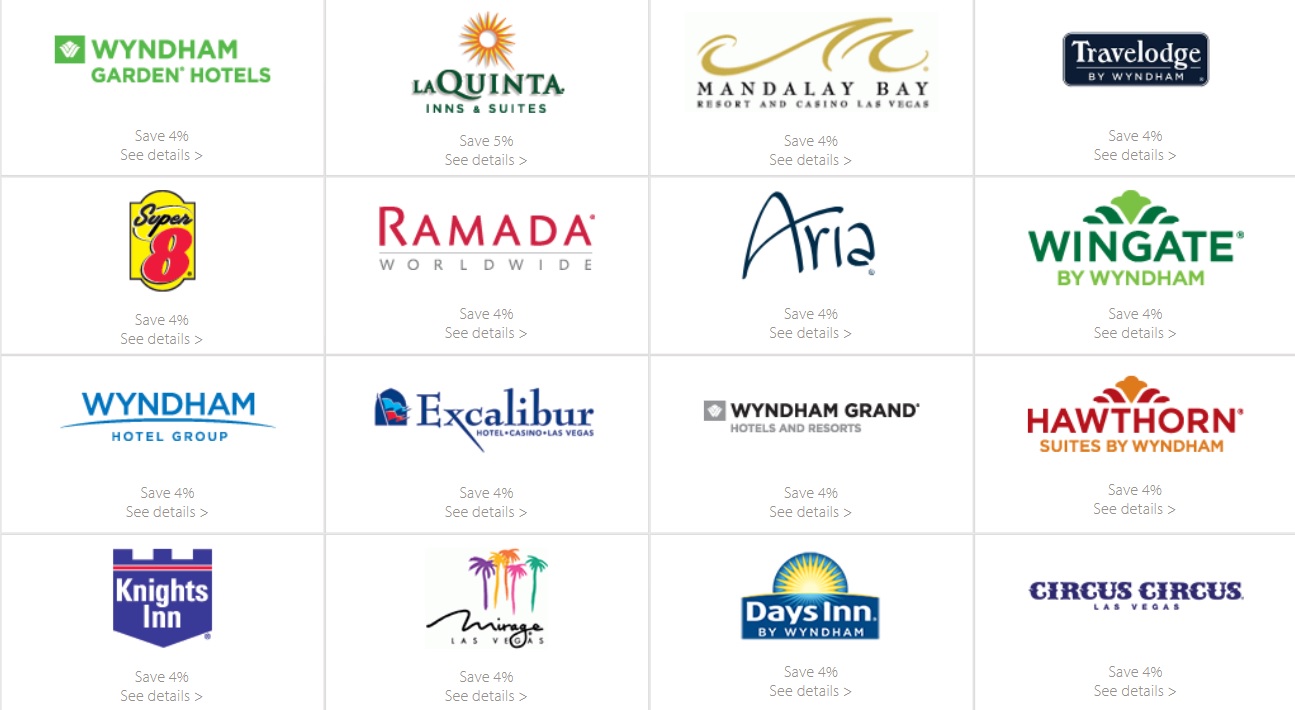

Two of the most widely useful Visa SavingsEdge program partners are Wyndham and MGM. At the time of writing this you can earn 4% cashback on stays, although for some reason with Wyndham’s La Quinta brand you earn 5% cashback. The way this program works is that you link one or more Visa business cards to your Visa SavingsEdge account. When you pay for stays at their properties (or at other participating restaurants, gas stations, etc.), you’ll subsequently receive a statement credit.

You can find a list of these card-linked offers under the ‘Everyday Savings’ tab on the Visa SavingsEdge website, or by clicking here. Other partners include Panera Bread, Jiffy Lube, Papa Johns and more. Many of those other retailers aren’t very exciting though because you can usually save 10% or more buying their gift cards from Raise.com (or for larger discounts during sales from other retailers) which far outweighs the 2% you get back as a statement credit via Visa SavingsEdge.

Having said that, there are potentially some exceptions. For example, we sometimes see Chase Offers for participating retailers like Chevron/Texaco and Panera, so if you have those on a Chase Visa business card, the statement credit from the Chase Offer will stack with the Visa SavingsEdge cashback offer. If the Visa business card you load the Chase Offer too offers bonused spend in that category (e.g. gas, dining, etc.), you’ll also earn those bonus points which makes the stackage even better.

Even with Chevron/Texaco though, you’ll still likely save more by buying a Choice Pack & Go gift card when discounted elsewhere and redeeming that for a Chevron/Texaco eGift card which can be used in Chevron app.

A potentially great deal might be possible with TaxAct. Visa SavingsEdge states that they’ll offer 30% back as a statement credit when paying for state and federal online returns with a linked card. During tax season there are often TaxAct Chase Offers giving 30% back as a statement credit which should stack with Visa SavingsEdge. Although the Visa SavingsEdge website states that the TaxAct offer is “Intended only for Visa SavingsEdge customers using the offer link provided directly by Visa to create a new return”, the link they provide seems to be generic. As a result, you should also be able to stack with cashback/rewards earned through a shopping portal which, based on recent history, will be at least 10% cashback.

Visa SavingsEdge is a program aimed at helping businesses save money, but some of these offers can be stacked with promotions from other businesses doing the same thing. For example, Capital One Business Deals (formerly Capital One Spring) offers 50% off your first three months of Mailchimp service. Visa SavingsEdge meanwhile gives a 5% statement credit on Mailchimp payments, thereby saving you even more money.

It’s important to check the terms and conditions of each offer though as there are sometimes limitations. For example, with Mailchimp specifically there’s a lifetime limit of $200 back in statement credits per enrolled card. I’m not sure how sophisticated their tracking system is, so if you accidentally lost your Visa business card where you’d already maxed out that lifetime credit, I don’t know if you’d be able to continue earning 5% back on the replacement card due to it being a different card number, or if behind the scenes Visa SavingsEdge would know it’s the same account.

In addition to the card-linked Everyday Savings offers, there’s a separate tab for Instant Savings.

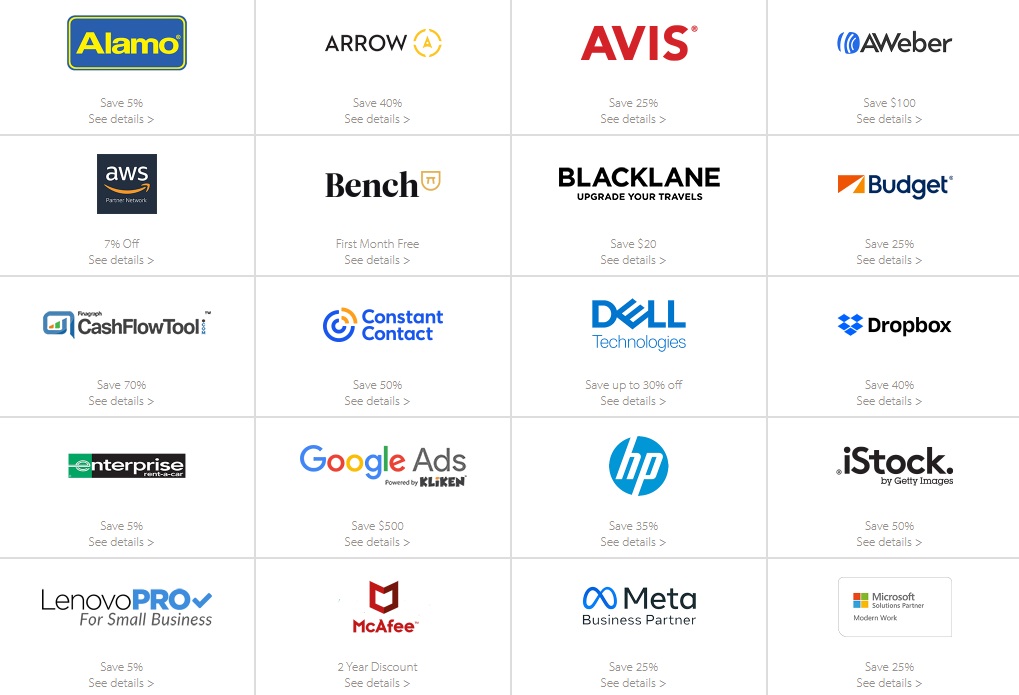

What’s important to note here is that unlike Everyday Savings, Instant Savings offers aren’t card-linked deals. Instead they give you instant savings (as the name suggests) via the usage of a specific link and/or a promo code. There are some travel-related deals here, particularly for rental car companies such as Budget, Avis, Alamo, Enterprise and National. I’m not sure how those discounts compare to other promo codes, but it could be worth checking them out just in case they save you more money than your usual promo codes. With most of these car rental offers, Visa SavingsEdge lists the code(s) you need to enter. As a result, you shouldn’t need to click through from their website; instead, click through from a shopping portal to earn cashback/rewards.

If you have a business and pay for advertising, there are savings on offer for advertising packages with Google Ads and Meta. With those particular offers (as well as a few others like AWS), the savings come via one of their partners. For example, the Google Ads offer involves using Kliken to run your Google Ads advertising program. The $500 of free Google Ad spend when spending $500 in your first two months might be worth it, but be sure to read the terms and conditions and take into account any additional fees and contracts before signing up.

Hi Stephen, have you ever gotten the 4% back at a Wyndham hotel? I don’t want to lose cashback from another travel card if the Wyndham doesn’t actually pay 4% on Chase Ink (or other Visa business cards) as some of your readers have said below.

I’ve only had one paid Wyndham stay in the last year; it doesn’t look like I got the 4% back either.

Thank you for confirming. Sadly, this one looks like a pass for me.

savings edge is arguable one of the most forgotten programs…I guess they need to make it better

Visa Savings Edge is the most dysfunctional, incompetent organization I’ve ever dealt with. Registered, used my Visa business card at a Wyndham. Never got the rebate. Called them multiple times for resolution. Hole-in-the-wall customer support team. All they can do is send messages for a callback. The backend team promise resolution; it never happens. Rinse, repeat. Hours of my life I’ll never get back.

I never got my teenage either! Gave up trying to contact them again after first call since they wanted me to wait like 2-3 billing cycles. When the credit didn’t show up, I realize it’s basically a sham.

Wyndham $100 max per enrolled card.

I forgot about this also, thanks!

Regarding the MGM properties, this is only for lodging costs or does this work on things like restaurant spend?

If you charge the restaurant bill to your room at an MGM property, that will count too. This works at all MGM restaurants, even if you’re not staying at that specific hotel. e.g. you could eat at a restaurant at Aria and charge to your room at Luxor.

Hmmm…tried to load both my Chase Sapphire Reserve and (legacy) Chase Freedom…received a response that both cards were ineligible! Are Chase Visa cards excluded? Is something else going on (that might make a helpful addition to this post)?

Ignore my post, please…I didn’t read closely enough. This program applies only to Business cards. Chase Ink cards, here I come….