| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

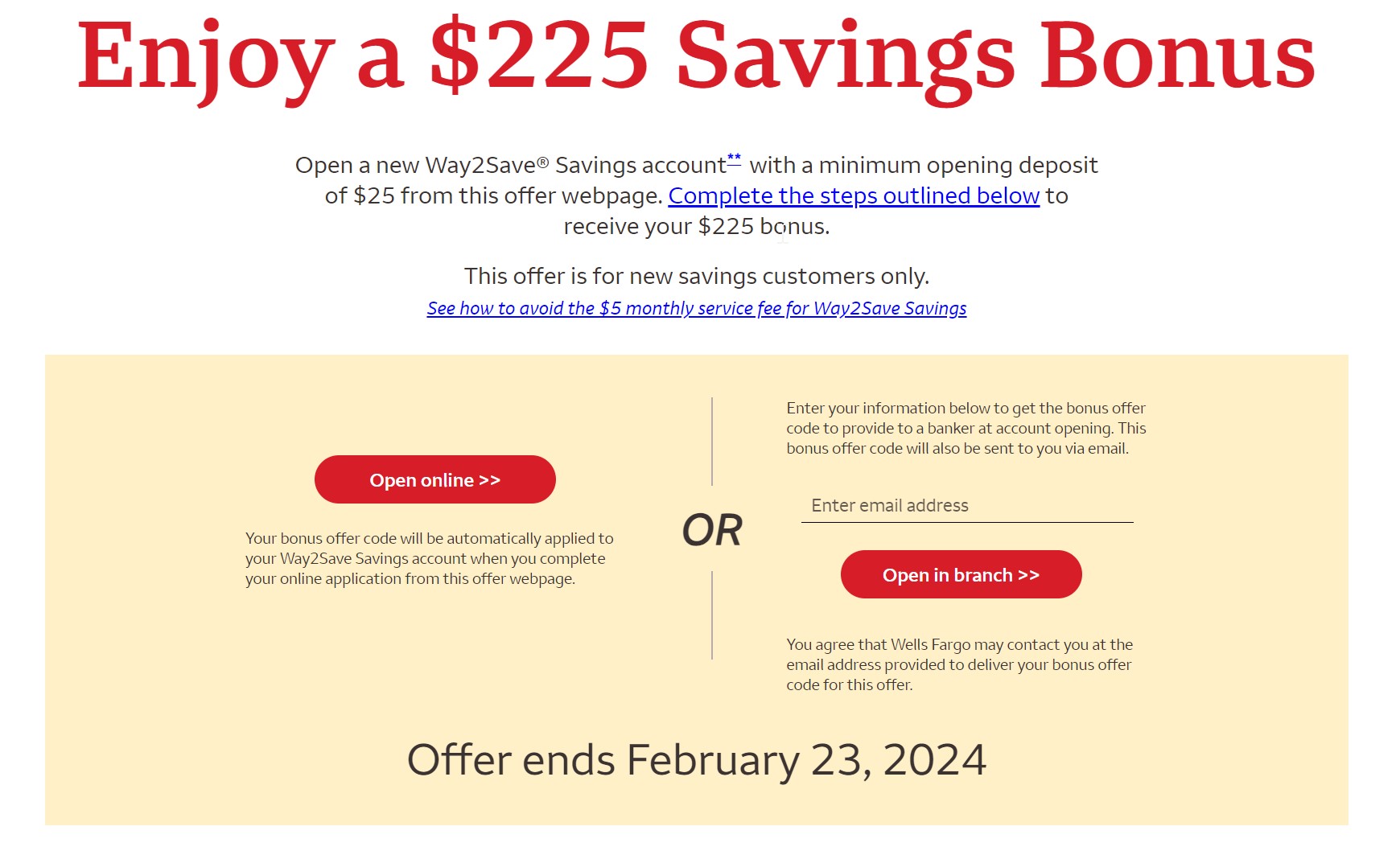

Wells Fargo has launched another new promotion for new savings account customers. This offer is available in-branch or online and gives a $225 bonus when depositing $10,000+ and then maintaining that balance for 61 days. Wells also another promotion that’s in-branch only and gives $525 when depositing at least $25K for the same time period, however that one can’t be done online.

This is obviously a significant deposit requirement for many and there is some loss of interest on the funds while they are deposited in the savings account (more details below). That said, it could be an rewarding option for those who can swing it.

The Deal

- Wells Fargo is offering a $225 bonus when opening a new savings account, depositing $10,000 and maintaining that balance for a minimum of 61 days.

In order to receive the bonus you must:

- Go to this link and apply or enter an e-mail address to receive a promo code.

- Open a new Way2Save savings account with a minimum balance of $25 in-branch using the promo code by 2/23/24.

- Deposit at least $10,000 by day 30 after account opening and maintain that balance until 90 days after account opening.

Terms and Conditions

- This offer is for new savings customers only. All Wells Fargo consumer savings accounts are eligible for this offer with the exception of Time Accounts (CDs) and savings accounts offered by Wells Fargo Private Bank.

- You must use your bonus offer code at account opening when you apply for a new eligible Wells Fargo savings account

- You are not eligible for this offer if:

- You are a current owner of a Wells Fargo consumer savings account

- You have received any other consumer savings offer bonus or promotional rate that required a bonus offer code within the past 12 months.

- You are a Wells Fargo employee

- To receive the bonus, you must:

- Open a new Wells Fargo consumer savings account with a minimum opening deposit of $25 in a Wells Fargo branch by February 23, 2024. All account applications are subject to approval.

- Bring $10,000 or more in new money to your new savings account by Day 30 and maintain at least a $10,000 balance through Day 90 after account opening.

- New money is money that is new to the customer or new to Wells Fargo (deposited into the customer’s new savings account directly from outside of Wells Fargo and Company and all affiliates, or from a Wells Fargo account not owned by the customer).

- The Wells Fargo Way2Save® Savings account monthly service fee is $5. Minimum opening deposit is $25. The monthly service fee can be avoided with one of the following each fee period:

- $300 minimum daily balance

- 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account

- 1 automatic transfer each business day within the fee period of $1 or more from a linked Wells Fargo checking account

- 1 or more Save As You Go® transfers from a linked Wells Fargo checking account. A qualifying Save As You Go transfer is an automatic transfer of $1 from your linked Wells Fargo checking account to your Way2Save Savings account each time you (or any authorized signer or joint owner) use your debit card for a one-time purchase or complete a Bill Pay transaction through online banking, and the one-time debit card purchase or Bill Pay transaction posts to the account. We reserve the right to determine through our sole discretion if a particular transaction is a qualifying transaction.

- Primary account owner is 24 years old or under. (When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee.) Customers 12 and under must have an adult co-owner.

Quick Thoughts

Based on how I read the terms, you only have to leave the $10K in the bank for ~61 days to get the bonus. This is because you have to deposit $25 initially and then add the remainder of the $10,000 by 30 days from account opening. Then, you only have to maintain that balance for 90 days after account opening.

This is exactly the same as the current $525 offer, but with a couple of key differences. Obviously, the deposit requirement and bonus are lower here (although the effective interest rate is actually higher).

More importantly for some folks, this one can be done online as opposed to the larger $525 bonus that must be done in-branch. That will be a significant upside for those who don’t have a conveniently located Wells branch nearby…or who just don’t want to spend 30 minutes of their life inside a physical bank opening up a savings account.

It’s important to note that the net upside here is lower than $225. There are plenty of ways to get ~5% interest right now with savings accounts, CDs and T-bills. These savings accounts offer a paltry 0.01 – 0.15%, so you’re effectively losing 61 days of interest on $10,000. Given that, the opportunity cost is ~$85 in interest, making the incremental gain closer to $140 than $225.

That said, this bonus corresponds to a ~13% annual interest rate, a very good return. At the same time, there’s minimum time commitment and more flexibility with your money.

We would normally jump at this kind of return were it not for the largesse of current interest rates. While it doesn’t seem quite as earth-shattering now, I’d probably still take the plunge on this if my cash flow allowed, simply because it’s easy and the funds are tied up for a relatively short amount of time when compared to many other bank bonuses or CD’s.

Not for 10k would i open an account with that bank … the worst.

I attempted and was told it had to be 1 year between last promo and this one…

“Largesse of current interest rates” lmao oh my sweet summer child