NOTICE: This post references card features that have changed, expired, or are not currently available

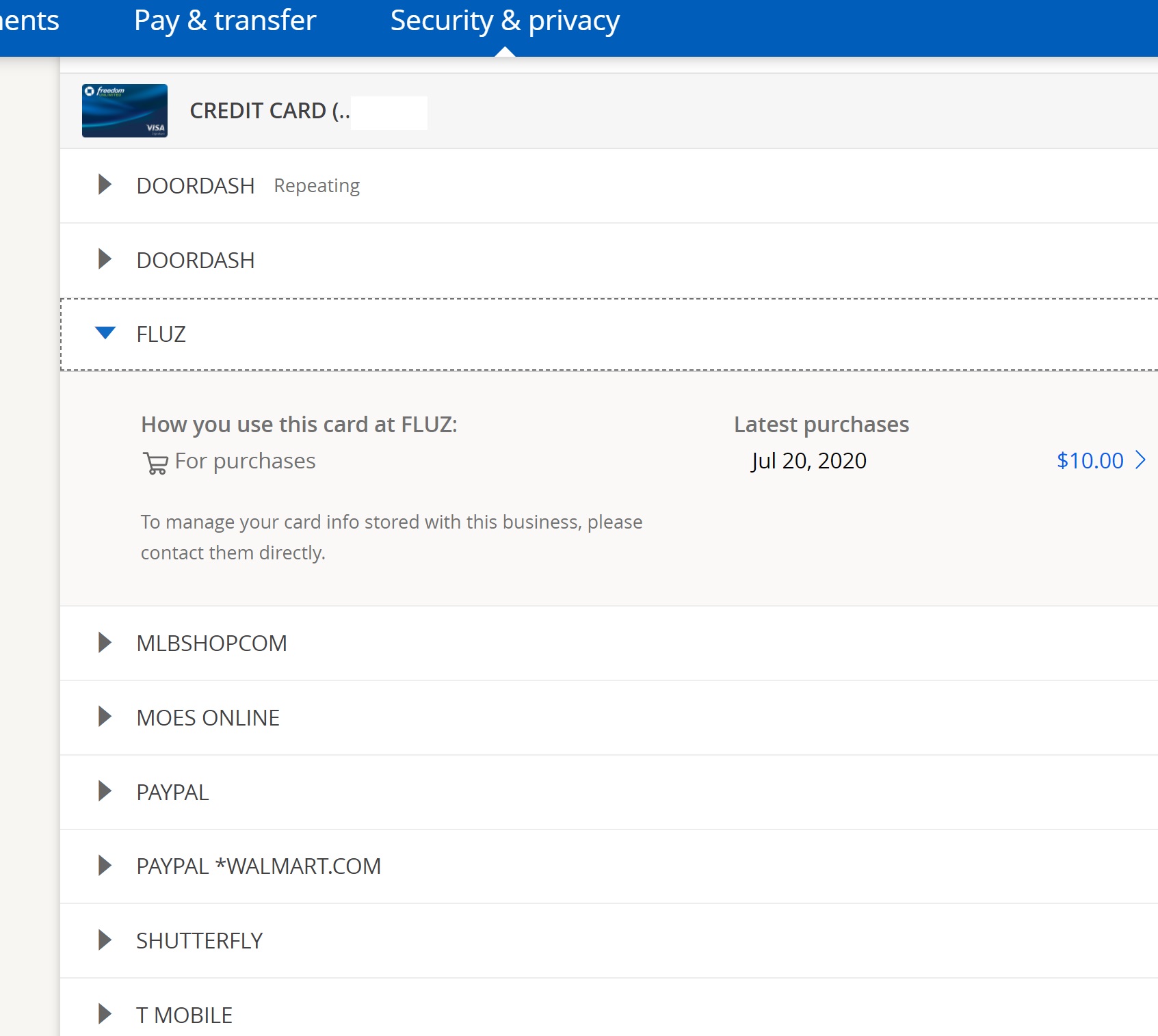

Grant at Travel with Grant has uncovered a really cool feature that Chase has recently rolled out: you can now see which mobile wallets and websites have your credit card information saved. Have you ever wondered how many sites have your credit card stored? Or wondered whether you had remembered to sync a particular Chase card that’s offering a grocery bonus to your wife’s Google pay account at the moment when you realize that she is on her way to the grocery store without the Amex Platinum card that earns 10x at US Supermarkets? (Had to try to make a save this week!). Chase can now give you that information at a glance.

Unfortunately, this obviously won’t help you know which Amex, Barclay’s, Citi, or US Bank cards are synced to your mobile wallet as it only works with Chase products. Still, this is an innovative tool that I hope to see adopted by other credit card issuers.

I was recently helping my wife add a card to her PayPal account and found it interesting to note that PayPal offered the option to log in to the bank and add her cards that way, which presumably would have been useful if she didn’t have the physical card on hand. But this ability from Chase to access which sites and wallets have your information is a nice bit of protection / peace of mind. It is also a good reminder to delete cards from places where you don’t want them stored long term. For example, my wife has used her Chase Freedom card at Amazon a few times when she didn’t intend to do so because the card has been stored at Amazon since there was last a quarterly bonus at Amazon. Using a tool like this would help her see sites like Amazon from which she should remove her card after a short-term bonus like that has ended — thereby avoiding the use of a card that earns a suboptimal return.

Further, it will even show your most recent purchases from the various merchants in your list.

Again, that could be particularly useful. A quick glance at the tool showed me a number of places where I don’t really want my card information stored and/or where I’d like to at least replace the card with a better option to avoid using the wrong card in the future.

Grant has full instructions for where to find this, but the short explanation is to log in, click “security & privacy”, and then find the “saved account manager”. See Grant’s post for more detailed instructions.

Today Chase sent me an e mail announcing this service. I don’t know if that is because I have the CSR or if everyone is going to get an e mail.

This is a great add, thanks for the info. So far my view only shows 3 cards in “businesses with card” but 6 in “digital wallets” not sure if it is still rolling out or you need more activity to trigger the reporting.

Hey Nick, thanks for linking to my post. It definitely is a cool feature. Wish other CC issuers (especially AMEX) had a similar feature. Have a great weekend.