NOTICE: This post references card features that have changed, expired, or are not currently available

The offer described in this post has since expired.

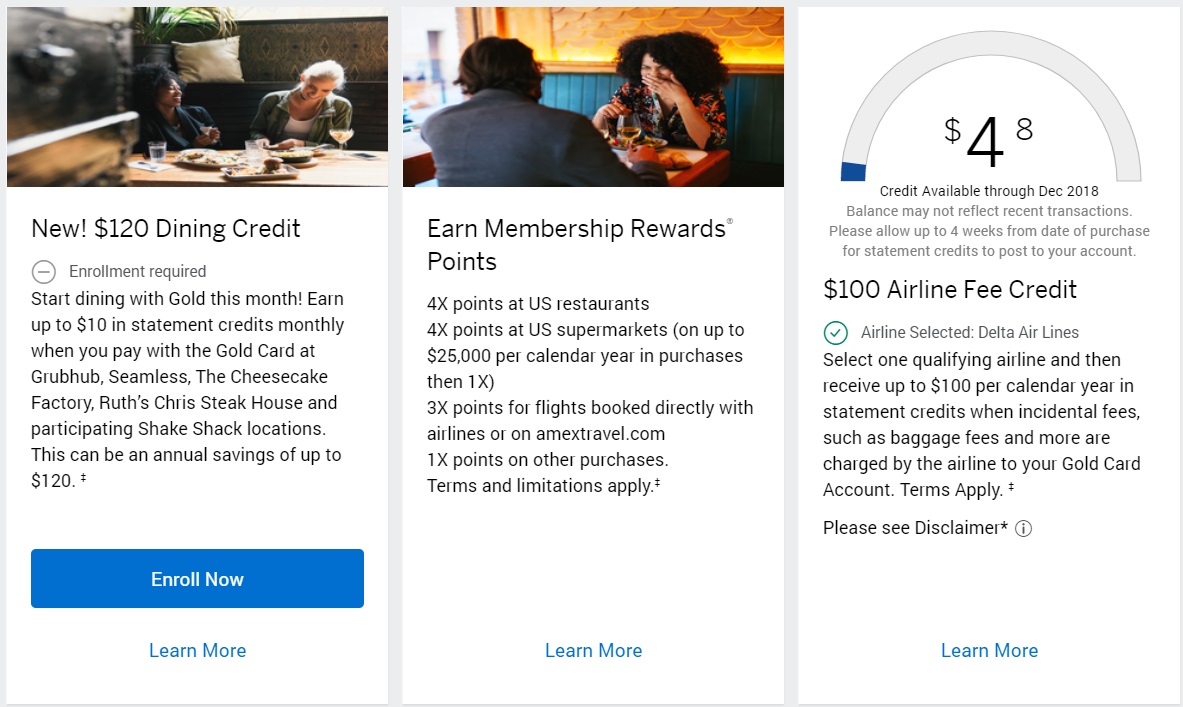

Update 10/4: The new card benefits are now live (and with “enhanced” annual fee):

- The card has been renamed to “American Express Gold Card“

- New benefits:

- 4X at US Restaurants

- 4x at US Supermarkets on up to $25K per calendar year in purchases (then 1x)

- 3x flights booked directly with airlines or on Amextravel.com (unchanged benefit)

- No more 2X gas at US gas stations

- $120 dining credit: $10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations

- $100 Airline Fee Credit (unchanged benefit)

- Note that these changes only apply to cards previously called “Premier Rewards Gold”. Terms state: “Traditional Gold, Senior Gold, Classic Gold and Ameriprise Gold Cards are not eligible.”

- The annual fee

will remain the same ($195)is now $250. The new fee will go into effect for current Premier Rewards Gold Card Members beginning April 1, 2019 on their account renewal date. - The new welcome bonus is 25K points after $2K in spend plus 20% back as a statement credit on purchases at U.S. Restaurants, up to $100 back. $250 annual fee is NOT WAIVED first year.

Original post follows:

If you have logged into your Amex Premier Rewards Gold account today, you might have been surprised to see an awesome new set of benefits — including 4x at US Restaurants, 4x at US Supermarkets on up to $25K per calendar year in purchases (then 1x) and 3x flights booked directly with airlines or on Amextravel.com. The current benefit of 2X gas at US gas stations will no longer be available. There is also a new $120 annual dining credit split up monthly (similarly to the way Uber credits are split on Platinum cards). This is an amazing list of changes that suddenly makes this card incredibly relevant. Note: Not all users are seeing these new benefits. We do not yet know if these are going to roll out to all cardholders, though we expect they likely will. We will update with a new post if and when that happens.

The Deal

- Existing Premier Rewards Gold customers are reporting a new set of benefits in their online logins, though these benefits do not show up on the application page yet

Quick Thoughts

We’re not positive whether this will only take effect for existing cardholders, but at least one member of the Frequent Miler team has a Premier Rewards Gold card and saw these new benefits when logging in to their PRG account. We expect these benefits will likely get rolled out shortly for new applicants and all US cardholders, but we can’t be certain at this point. We will certainly update with a new post if and when we see that change.

As noted above, the new bonus categories show as following:

- 4x US Restaurants

- 4x US Supermarkets (on up to $25K per calendar year in purchases, then 1x)

- 3x flights booked directly with airlines or on Amextravel.com

- 1x on all other purchases

Earning 4x Membership Rewards at US Restaurants sounds awesome and might make these the top-of-wallet dining card for many readers. Earning 4x on up to $25K per calendar year at US Supermarkets is also awesome for the generous cap. Amex is certainly making a play for this to become a daily driver card. Additionally, the card now carries a $120 annual dining credit in addition to the annual $100 airline incidentals credit that is unchanged. The new dining credit is split up as up to $10 per month in automatic statement credits when you pay with the Premier Rewards Gold card at:

- GrubHub

- Seamless

- The Cheesecake Factory

- Ruth’s Chris Steakhouse

- Participating Shake Shack locations

Again, that’s awesome as I’m sure that many readers will find it pretty easy to hit $10 per month, especially with the inclusion of food delivery services GrubHub and Seamless. If you have never used GrubHub before, you can get an additional $10 off your first order when singing up through a referral link. Here are ours:

Bottom line

These are awesome, massive changes to the Premier Rewards Gold card that will immediately shift it from being a card you might have considered just to earn a welcome bonus to being a long-term keeper that could get a significant portion of annual spend from many readers. Considering my post the other day about the Strengths Membership Rewards has over Ultimate Rewards, this new set of benefits looks very attractive indeed.

H/T: US Credit Card Guide

[…] As we reported earlier, the card formerly known as Premier Rewards Gold now has a new name and new benefits: […]

The changes described in this post are now official and live. One big difference is that the annual fee has increased after all. It was $195, but is now $250 for new cardmembers. Also note that the new welcome bonus is worse than we would have predicted since the first year annual fee is not waived.

Amex must be feeling the pressure from the refreshed Capital One Savor Card, which earns 4% cash back on dining and entertainment and 2% cash back on groceries.

I have a Platinum and a Preferred Cash Amex and the Cash Amex gives 6x grocery store purchases up to $4k or $6k I think. I hope they extend the restaurant benefit to Platinum card holders too, that would be awesome.

[…] Wow: Amex knocks it out of the park with new 4x dining / $120 credit benefits… […]

So you’re advertising your web site — which doesn’t permit questions and discussion. So I got one for ya, how the heck is this knocking anything out of the park? What exactly are you getting for your unwaved massive $250 annual fee? How many tens of thousands do you need to spend on “groceries” (ahem, gift cards with high fees) before you break even? Will Amex RAT teams ruin the party (as they often do) when they start revoking points earned with cash equivalent purchases? Honest bloggers not selling cards would dare to do the math — Drew TIF style. I’m not buying the hype.

I’m not sure what you’re talking about in saying that we don’t permit questions and discussion — that’s exactly what we’re doing here, no?

The unwaved annual fee is a huge bummer (and one that I think most of us did not see coming).

According to data from the US Bureau of Labor Statistics, families spend on average $2,641 per year on food per person living in the household. For a family of 4, that’s $10,564. I’ll assume that all codes as either groceries or restaurant. At 4x, that’s 42,256 Membership Rewards points per year — without a dime of manufactured spending or a single Amex Offer that awards more points.

If one were to take advantage of a transfer bonus like the current 40% bonus to Avios, that’s more than 59,000 Avios — almost enough for round trip business class using Iberia Avios from New York, Boston, or Chicago to Madrid during off-peak season (68K) or more than enough when they run the period sales for 25.5K each way. It’s more than enough for a family of 4 to travel on the shortest round trips on American using Iberia Avios (11K RT per passenger).

Without the transfer to Avios, it’s still nearly enough to fly anywhere Royal Air Maroc flies in business class (44K Etihad miles), enough to fly first class one-way to Hawaii (30K Singapore miles) — we could go on for a while there.

If that’s not knocking it out of the park…what is? That’s just based on average spending.

If you happen to do any manufactured spending, it could be even better.

So let’s take the other extreme and assume that you don’t buy yourself a dime in groceries and you just MS the entire $25,000 per year. That’s a cost of $341.50 between activation fees and liquidation (not including your time or gas) assuming you don’t take advantage of a single fuel point promotion or fee-free something-or-other or other means of reducing costs — that’s just full costs. Add with that your $250 annual fee and your cost runs up to $591.50. For that price, you’d have enough Membership Rewards points to fly round trip in business class to Japan or other parts of Asia on ANA. You’d be 15K points shy of a decent round-the-world business class redemption with ANA. There are plenty of other good redemptions — but I think those two illustrate that six hundred bucks is a decent trade.

Of course that may come with risks that you highlight. But if it’s math you want, that math looks pretty darn good to me either way — and note that the above assigns absolutely 0 value to the $100 annual incidentals credit or the $10 per month at the select dining merchants. I don’t often dine with any of those as they do not exist where I live — but I’ll be visiting friends in a bigger city tonight and ordering dinner on GrubHub. I’m sure I’ll use those credits 3 or 4 times a year at least, and I know I’ll get good value out of the airline incidentals credit — in fact, we’ve got a flight booked on Spirit later this month and we’ll be using that up for baggage fees we would have paid anyway. Note that the math is also ignoring the value of the bonus (better if referred by a friend).

Will this card work for everyone? Of course not — that’s why there are more than 100 different cards on our Best Offers page. Different cards will appeal to different people. But I’ll gladly stand by my assertion that this card is a home run. I’ll happily listen to your arguments about why it’s not for you — and there’s nothing wrong with it not being a good deal for you. But this card knocks a couple out of our wallet — so while I’m surpremely disappointed in the fact that the fee is not waived in Year 1, it’ll make up for it in helping to make it easier to cancel / product change other cards.

And here’s a little more math :-):

https://frequentmiler.com/2018/10/05/is-4x-worth-250-per-year-how-much-are-those-amex-gold-4x-categories-grocery-dining-worth/

I’ve been considering adding a premium AMEX card to my wallet for a while now….

What are AMEX points valued at compared to Chase Ultimate Rewards points when you have the Reserve card at 1.5% bonus value?

And this is a points game right? 25k sign up bonus seems low?

Also, I fly 99.9% United… For flying United, does any of the AMEX (Platinum or Gold) products compete well (or complement) the CSR?

Amex points (mostly) aren’t great to use to pay for travel through Amex Travel. When you do that, you’ll usually get 1 cent per point value or less. There are two significant exceptions to this:

1. If you have an Amex Business Platinum card, you get 35% of your points back when you redeem points through Amex Travel for either a First or Business class flight on any airline, or for any flights with your selected airline. This makes your points worth slightly over 1.5 cents each.

2. If you have the Schwab Platinum card you can redeem points for cash (deposited to your investment account) at a value of 1.25 cents per point.

The best use of Amex points, though, is to transfer to airline partners to use for high value awards. Nick wrote about some of the best uses here: https://frequentmiler.com/2018/09/18/stengths-membership-rewards-has-over-ultimate-rewards/

25K signup bonus: yes, that’s low. Look for a targeted 50K offer. They’re common with this card.

Is the best play to get the prg now, unless the new benefits come with lower sign up offers or higher annual fees?

I was thinking the same thing. Lock in the 50k sign up and keep card for grocery purchases after they convert.

For what it’s worth, I called in today and the rep said the benefits would go live in October.

Expect AF increase to $220-250

Can we not call it a $120 dining credit? It’s really misleading. It’s a $10/mo credit at two food delivery services and a couple of limited-presence chains. Nice to see the 4x, but the monthly credit is worth about nil unless you’re a regular user of GrubHub.

It looks like we killed this before it even started. If Amex is reading the forums and the blogs, they know we like and want this. Now, they will NEVER give it to us! 🙂

[…] HT: Frequentmiler […]

This is terrible news for the MS world.

How?

I’ll just say this, compare the old category earning rates and spending caps to the new category rates and caps.

absolutely agreed….no way to accumulate a lot of membership points once the capping is in place….capping is always a bad thing

I love the amex Hilton ascend; 6 points on each dollar in restaurant, supermarket and gas. Every day expenses. Spend $15000 a year and get a free night in any Hilton brand inc Waldorf Astoria

I agree…but if these changes turn out to be true then you could earn 4 points per dollar on the PRG at restaurants and grocery stores, transfer them to Hilton at the current 1:2 ratio and come out ahead of the Ascend (not that I think that’s the best use of MR).

Amex is smart with this move. Some people cancel the card and some people MS tens of thousands each month on groceries. People like me who can’t MS that much or don’t see a lot of value on MS-ing on 2x only on grocery spend go back and forth between keeping or canceling the card. But with higher earning, I’ll definitely keep the card even if I can’t exceed the 25k limit. So, as a result maybe more people will keep their card, giving more annual fees to Amex.

I was planning on cancelling mine when the AF hit, if this is real it becomes a no-brainer keeper instead.