NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

This offer has expired.

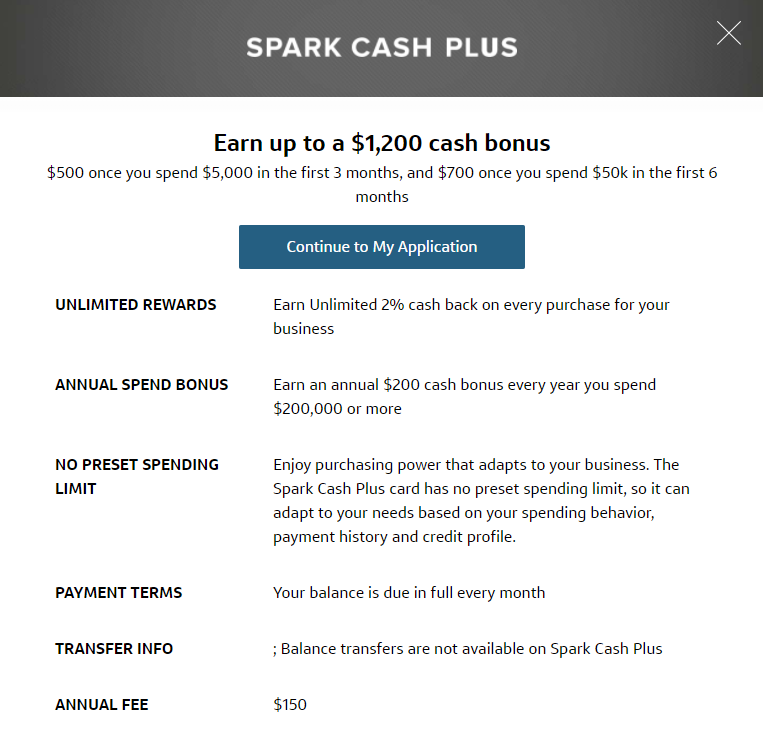

Update 8/18/21: A couple of months ago Capital One – seemingly prematurely – launched the Spark Cash Plus card. It came with a $1,200 welcome offer, but the ability to apply for it disappeared as quickly as it initially came on the scene.

The Capital One Spark Cash Plus card is now back and it’s official. Capital One themselves are marketing this card and so it doesn’t look like there’s any danger that it’ll disappear again immediately like it did in June. There is a key difference this time though – the welcome offer only awards up to $1,000 bonus cashback rather than up to $1,200.

The original version of the offer awarded $500 bonus cashback on $5,000 of spend in the first 3 months, then an additional $700 bonus cashback was awarded after spending a total of $50,000 within the first 6 months. This new offer awards $500 when spending $5,000 in the first 3 months, then an additional $500 (rather than $700) after spending a total of $50,000 within the first 6 months.

The original version of the offer awarded $500 bonus cashback on $5,000 of spend in the first 3 months, then an additional $700 bonus cashback was awarded after spending a total of $50,000 within the first 6 months. This new offer awards $500 when spending $5,000 in the first 3 months, then an additional $500 (rather than $700) after spending a total of $50,000 within the first 6 months.

The other card details appear to be the same as Nick’s initial analysis below. You’ll earn $200 bonus cashback every year when you spend $200,000 or more, so that’s an extra 0.1% if spending exactly $200,000. That’s a useful bonus if you’d be putting that amount of spend on the card anyway, but not a large enough return to make it worth putting a lot of effort into spending $200,000.

The annual fee is still $150 and that’s not waived in the first year. With the card earning 2% cashback on all spend, you’d need to spend $7,500 just to break even with the annual fee. That’s not as much of an issue in the first year seeing as that level of spend would also earn you the first $500 of the welcome offer, but you’ll need to do the math for subsequent years to decide if the annual fee is worth the value you’ll get by putting large amounts of spend on this card versus an alternative. Even in the first year though, that’s potentially a lot of opportunity cost.

Where this card might shine for some businesses is that it appears to function as a charge card rather than as a credit card. There’s no preset spending limit and the balance is due in full every month. If you and your business generate a lot of spend that could exceed the credit limit on other cards you hold, a card like this that earns 2% cashback but which allows a much higher level of spend could prove to be both useful and rewarding.

~

Update: As pointed out by Tim T in the comments, it appears that Capital One has pulled the offer / link, so this one is dead for now.

Doctor of Credit reports on a link first shared by JonLuca at reddit for what appears to be a brand new credit card: the Capital One Spark Cash Plus card. While the card looks very similar to the Spark Cash at first glance, the current welcome offer is good for up to $1,200 cash back and that makes it worth a look.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1520 1st Yr Value EstimateClick to learn about first year value estimates $2,000+ Cash Back ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn a $2K cash bonus when you spend $30K in the first 3 months + earn an additional $2K bonus for every $500K spent within the first year.$150 Annual Fee Recent better offer: Expired 3/14/22: $3K after $50K spend in the first 6 months FM Mini Review: This may be a good option for business owners who prefer simple cash back rewards. Note that this is a pay-in-full card, so your balance is due in full every month. Earning rate: 2% everywhere ✦ 5% on hotels and rental cars booked via Capital One's travel booking site Base: 2% Portal Hotels: 5% Card Info: Visa issued by CapOne. This card has no foreign currency conversion fees. Big spend bonus: Spend at least $150,000 annually and get $150 annual fee refunded. Noteworthy perks: No foreign transaction fees ✦ No preset spending limit |

Quick Thoughts

My initial reaction was to think that this was a typo and that it was the Spark Cash card, but the landing page clearly says Spark Cash Plus. Furthermore, the Spark Cash carries a $95 annual fee, whereas the Spark Cash Plus card shows a $150 annual fee.

(n.b. The screenshot below was taken from the original welcome offer. As noted at the top of this post, the $1,200 cash bonus is now a $1,000 cash bonus.)

Apart from the difference in annual fee, I can’t see many differences distinguishing this new Spark Cash Plus card. The only additional piece I see in the terms are a $200 bonus for spending $200,000 in a calendar year.

How does my annual bonus work?

You will earn a $200 cash bonus each year when you spend at least $200,000 in net purchases by your rewards membership anniversary date. We will apply your bonus within two billing cycles following your rewards membership anniversary date.

An extra one tenth of one percent seems like a meager bonus to award someone who spends two hundred grand, but on the other hand you could look at this like paying no annual fee (and rather getting paid $50 to have a 2% back card). For really heavy spenders, that makes more sense than other 2% back cards. We have reached out to Capital One and are waiting to receive more information about this card (and whether or not there is a Spark Miles Plus card in the works).

Ultimately, I’m not surprised to see something new from Capital One. However, I hope that this is set to somehow be a new product rather than an increase in fee without an increase in benefits on the current Spark Cash card. A 2% cash back card with a $150 annual fee feels awfully steep. I hope there is more to this card than meets the eye.

Still, given that cash back earned on a Spark card can be transferred to a miles-earning card and become transferrable miles, the bonus on this card could be worth either $1200 or 120,000 miles $1,000 or 100,000 miles (or some split combination depending on your needs). That is a high number. On the other hand, the spending requirement is also quite high. We’ve previously seen Capital One offer $2,000 / 200,000 miles on the Spark cards with $50K spend. I’d he hesitant to jump on this deal in the hopes that we see a better deal like that coming if they are indeed releasing new products or updating the current cards.

This is now a $3k cash back with $500 back after $5k in 3 months, $2.5k back after $50k in first 6 months.

This card is only available from Capital One Reps directly and it’s a charge card, not a credit card. Also this card is intended for businesses that are established with high revenues. NPSL is extremely high due to requirements

Nick — the FM dialogue box on this seems to suggest that this card will not count toward 5/24. Do you have some info on that or are you presuming it because the spark cash did not count toward 5/24? Until we know exactly what this new “plus” card is, I wonder if that’s not necessarily a valid assumption. Just a thought.

I was really hoping that the $2000 offer would come around again this year like it has the past couple of years now that we know that cash can be treated as points. A higher annual fee and a $1200 sign up bonus on $50k in spend seems like it makes it pretty unlikely we’ll see another $2000/200k this year.

The link takes you to a page not found error. Went to Capital one main page for business cards and cant find this anywhere. Other blog sites also referenced this card. But their links are also not working. Looks like Cap 1 pulled the plug.