| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 9/4/24: Just a quick reminder that this increased welcome offer ends at 7am EST tomorrow – September 5.

Update 8/30/24: This increased welcome offer is going to be ending at 7am EST on September 5, 2024. Note that, for folks using household referrals, the current 40K referral bonus will be going down to 20K on September 2nd.

~

There is a fantastic new offer out for the Chase Ink Business Preferred that is good for 120,000 points after $8,000 in purchases in the first 3 months, matching the best that we’ve ever on the card. This offer has been available in-branch for a couple of weeks, but now it’s available publicly online.

Referral links are still showing the old 100K offer, but we’ve seen numerous data points of Chase matching folks to the 120K offer. If you applied recently through a referral, it’s worth checking in to see if you can be matched to this offer.

The Offer and Key Card Details

Click the name of the card below to go to our dedicated Frequent Miler page for this card, where you’ll find more information and a link to apply.

| Card Offer and Details |

|---|

ⓘ $1127 1st Yr Value EstimateClick to learn about first year value estimates 90K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 90K after $8K spend in 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth up to 75% more when redeemed for travel with Points Boosts ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

Quick Thoughts

Any opportunity to earn 120,000 Ultimate Rewards is incredible and the modest spend requirement will make it much easier for many people to reach it here. Based on our current Reasonable Redemption Value (RRV) for Chase points, you should expect to get at least ~$1,800 in value from this offer. Wowza.

However, if you have someone in your household that already has an Ink card, it might be better to wait to see if the referral offer changes in the coming days. If the referral offer changes to this 120k/$8k offer, you could earn 120,000 Ultimate Rewards while your family member could pick up 40,000 Ultimate Rewards for referring you. That said, we have received numerous data points saying that Chase is being very generous in matching folks to this offer who had applied for the old 100K bonus, so there may be no need to wait. 🙂

Note that although this card is subject to Chase’s 5/24 rule, although you won’t be adding to your 5/24 count if you’re approved for it due to the Chase Ink Business Preferred card being a business card rather than a personal card. Learn how to check your 5/24 status here.

Am I eligible for a business card?

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

How to apply for a Chase business card

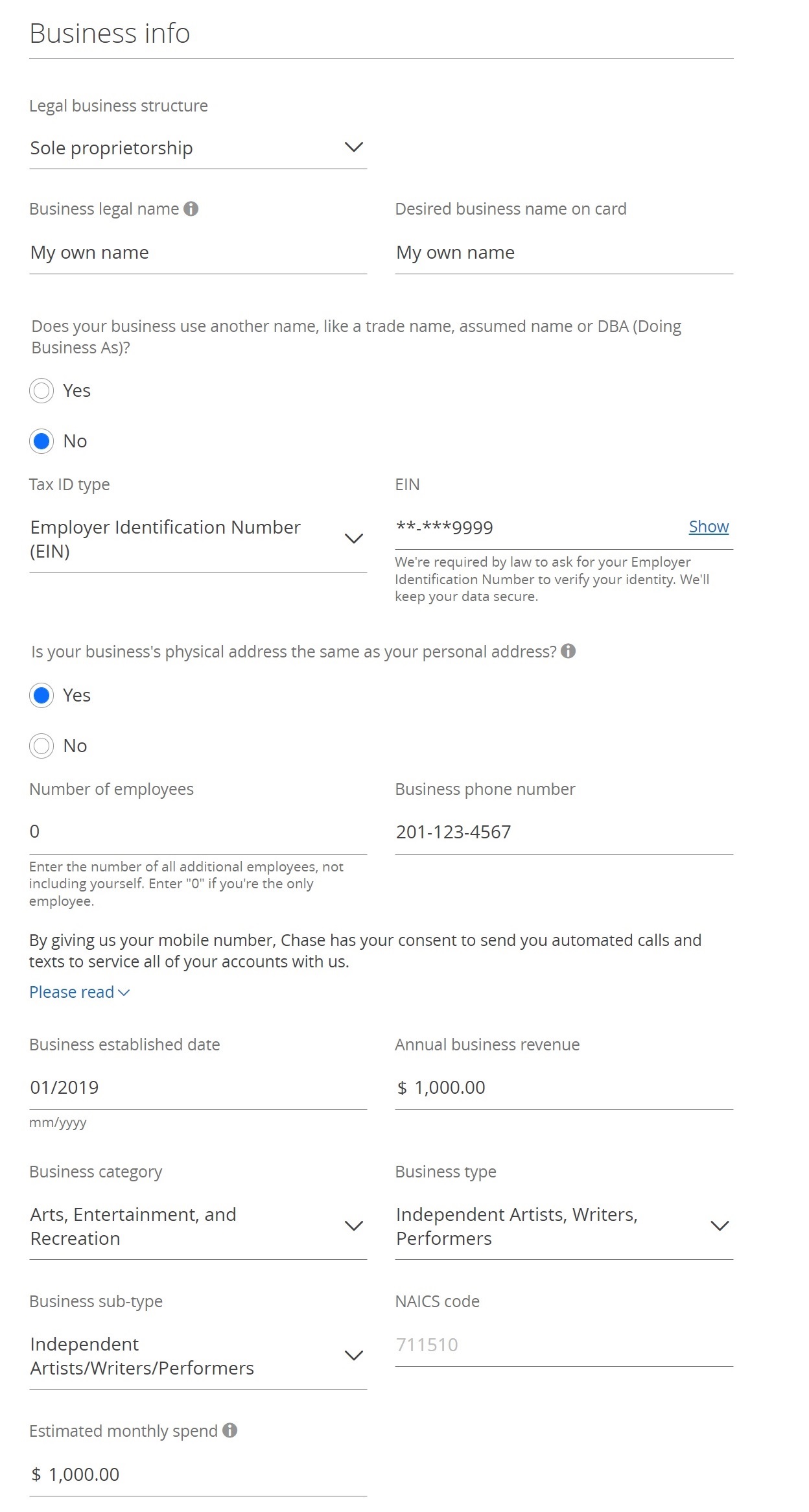

- Legal business structure: Sole Proprietor

- Business legal name: If you don’t already have a business name, I recommend using your own name as the business name.

- Desired business name on card: Again, this can be your own name if you don’t have a business name to use.

- Does your business use another name? No

- Tax ID type: EIN (you can get an EIN quickly and for free from the IRS here) If you'd prefer to use your social security number as your tax ID, select SSN rather than EIN.

- Is your business's physical address the same as your personal address? Yes

- Number of employees: 0 (the instructions say to enter the number of employees you have, not including yourself)

- Business phone number: Your phone number

- Business established date: When did your business start? If you've been doing your business for years (selling stuff at yard sales, for example), it's fine to estimate the starting date.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Business category, Business type, Business sub-type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: "Arts, Entertainment, and Recreation" and "Independent Artists, Writers, Performers."

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it's too high it might negatively affect approval).

I thought this 120k offer would become public on 7/3 per FM initial comment when they broke this news. I got my p1 to send me a referral link off his Pref card but it is still saying 100k for the Pref 3mo/8k spend. So p1 gets 40k but p2 gets only 100k. It is possible to get 120 for p2 and 40 for p1?

From my experience any in branch offer is not eligible for a referral bonus as well.

I went in branch today. There is a 120k sub for ink unlimited BUT you need to do the docusign review, which could take two weeks. I opted for the Chase Ink Preferred. Apploed, got in review (not approved immediately). Spoke to Chase in the afternoon, got approved for my first Ink! You rock Frequent Miler

were you under 5/24?

Yep! Just got under 5/24 in July 1st. And also downgraded CSR and and got the CSP elevated bonus June 1st

I generally don’t apply if I’m at or over 5/24

I went in branch Friday and through the business manager there was also 120k sub for ink unlimited with 6k spend in 3 months and 0% apr for 12 months

If I got the card a month ago, and in its first statement period hit the spending target (currently still in that first period), seeing the points pending, do I have any chance of Chase matching the new bonus?

An update.. I wrote Chase via Secure Message, and after a few days of waiting, they responded back saying they’re adding 20,000 bonus points to my already achieved 100K signup bonus that is pending statement. Now it’s 120K pending 🙂

Can I get the bonus if I currently have a business ink card?

Yes. Having other Ink Card doesn’t prevent you from applying for and getting additional Ink Cards and the Sign Up Bonuses. Between me and my wife we have 10 Ink Cards and each one earned a sign up Bonus. The same person can’t apply for the same version of the Ink card with the same tax ID # (SSN or EIN), and you should space applications out every 3 months or so at a minimum, but you can definitely have more than 1 Ink card and receive SUB for each.

Thanks you guys for keeping us so updated with these! Just applied and got approved with the 120k bonus! You all are THE BEST!

This link doesn’t seem to work anymore. I applied for this card two days ago at 100k was hoping the link would still work and I could call and try and get the increased offer. I was approved with 12 recent inquires and at 5/24. Went to review and was approved in about 8 hours with out having to call recon.

This is not a new deal – I got a mailer for this about 4 months back but with only $6K spend. Did the $6K spend and got the 120K miles.

I went for it and applied for the 120k offer. I was turned down for the same card 45 days ago saying I had too many recent Chase cards. This time instead of using my company’s EIN#, I went with my SS# and made up a business name. Initially I got an email that they would need to review my app. It’s now an hour later and I just received an email stating I’m approved. Thanks for posting this!

Congratulations! Can you confirm the offer is indeed for 120k/$8k spend?

Also if you are comfortable can you share your 5/24 status and if you’ve had any recent inquiries on your credit report?

I assume you’ve not had this card before on under your SSN.

If I applied it would be my 5th. (I’ve product changed the other 4 so don’t hold any right now )

Sure, happy to give details. I’m was 2/24 and am now 3/24 after setting up for this card. For some reason the business cards I’ve been signing up for have been hitting Experian, or I have six recent inquiries. My other two reports have two or less inquiries. No, I’ve never had this card tied to my personal social security number. The best amount of my cards are through my company I own. I took a screenshot of the page showing the 120k/$8k promotion but of course the acceptance email from Chase does not list the terms signed up under.

This card will not increase your X/24 count.

This is a business card, so won’t affect your 5/24.

Good point! I was in such a rush to reply to the post that I didn’t stop to think of that.

thank you for this information. very helpful! I’m glad you got approved despite the six recent inquiries on Experian. hopefully this goes public and P2 can refer me and It’ll be a 160k point total for the 2 of us. I’ve been denied the Citi AA card and P2 the BofA AS biz card, so wasn’t sure how chase would be with those recent inquiries.

Also wanted to reply to say that it wouldn’t matter whether he has or has had this card before under his SSN. It is possible to get the same card for the same business again on the business side, even if you currently have it.

Good point, especially since I’ve done this 4x already under my SSN (don’t have an EIN).

Nick: any insight into what velocity Chase will allow you to churn these cards? I last got this card(my 4th time) in 3/23, got the SUB in 5/23 and product changed the card in 4/24. (prior to that I had the same card in 3/21).

Would applying again when the 120k offer with the 40k P2 referral goes live (hopefully) be too soon? Never know when “too soon” is as with chase I *thought* they stated (although not really enforced) a 12 month (or 24 month)? rule. perhaps I’m not remembering correctly

I just got approved for the 100k offer. I haven’t been targeted so probably won’t be able to push for the additional 20k.

never hurts to ask! Chase has been helpful to me in the past…

Will wait and see if it stacks with a referral offer. 160k pts in 2-player mode would be awesome.

I was hoping to do a referral too… doubtful it will happen though…

100k + 40k is still a better deal for most people, even if 40k get taxed. If elevated offer does not show up via referral, it might still be worth doing the referral and asking for a match.

Taxed???

When you refer someone for a personal or business card the bonus is considered a taxable income. That’s different from a SUB, which is treated as a rebate on the purchases.

I did a referral for SO at the 100K rate (I already have the 40K in my account), so I’m going to try to get them to match the offer (100K -> 120K) if it looks like this offer becomes a public one.

Please update here and let us know how it goes!