Some of the best credit card welcome bonuses around also happen to come from some of the best point earning cards around: the Chase Ink Business cards. These include the Ink Business Preferred, Ink Business Cash, and the Ink Business Unlimited. You do have to have a business to apply, but you might be surprised by how many of the things you already do that legitimately count as businesses. This post explains why points earned from these cards are valuable, how to know if you have an eligible business, how to fill out a business card application, and tips for getting approved.

Watch the Video

If you prefer watching an online guide to applying for Chase Ink cards, check this out:

Multiple Ink Cards

Chase offers four different Chase Ink cards: Ink Business Preferred, Ink Business Cash, Ink Business Unlimited, and Ink Business Premier. Here’s a brief intro to each card:

Ink Business Cash: No annual fee; offers 5x categories on up to $25K spend per year; points are worth only a penny each, but can be moved to a premium card to make points more valuable. This is THE card for points enthusiasts thanks to its generous 5x categories.

Ink Business Unlimited: No annual fee; offers 1.5 points per dollar for all spend; points are worth only a penny each, but can be moved to a premium card to make points more valuable.

Ink Business Preferred: $95 annual fee; offers 3x categories (including travel) on up to $150K spend per year; points can be worth up to 1.75 cents each towards flights and up to 1.5 cents each towards hotels when Points Boosts are available through Chase Travel℠; points can be transferred to airline and hotel programs for even better value.

Ink Business Premier: $195 annual fee; offers 2% back on all spend or 2.5% back on purchases of $5,000 or more. This one is really a straight cash back card: points cannot be moved to any other Chase card nor can points be transferred to airline or hotel programs.

Valuable Rewards

Even though the Ink Business Cash and Ink Business Unlimited cards are advertised as cash back cards, they actually earn Ultimate Rewards points. $750 in “cash back” is really 75,000 Ultimate Rewards points that can be redeemed for $750 in cash back.

The Ink Business Preferred Card is great for its 3X categories. The Ink Business Cash is awesome for its 5X categories. And the Ink Business Unlimited is a good choice to use as your “everywhere else” card thanks to earning 1.5X everywhere.

The Ink Business Premier is unfortunately different from the rest. This one doesn’t allow moving points to transfer partners or to other Chase cards. As a result, it is only good as a cash back card. Details here: Ink Business Premier Review.

You must have a business (and you probably do)

Chase Ink cards are small business credit cards. You must have a business to apply. That said, almost everyone does something that can be legitimately considered a business. Legitimate businesses include selling things on eBay or at yard sales, being an aspiring musician or author, owning rental property, driving for Uber or Lyft, etc. The list is endless.

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

Get the same card again

Similarly, if you have more than one business, it’s possible to get the same Chase Ink card and welcome bonus for each business you own. This is true even though the application terms state otherwise: “I understand that any new cardmember bonus offers for this product are not available to either current or previous cardmembers of this product who received a new cardmember bonus for this product in the last 24 months.” Despite those terms, it's very common for people to successfully apply for more than one of the same Ink card across multiple businesses.

Even better, experience has proven that it is possible to successfully apply for the same Ink card for a single business multiple times even if you still have the older Ink card open. As long as your application is approved, you should qualify for the welcome bonus.

Watch out for 5/24

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

All of the Ink cards are subject to 5/24. This means that you probably won’t be approved if you’ve opened 5 or more cards across all banks within the past 24 months. Fortunately, the Ink cards do not add to your 5/24 count. That is, if you are approved, they will not hurt your chances of future approvals due to 5/24.

How to Apply

Application links can be found by following the “click here to learn how to apply” links within these pages:

- Ink Business Preferred

- Ink Business Cash

- Ink Business Unlimited

- Ink Business Premier (this is the oddball who’s points can’t be moved or transferred)

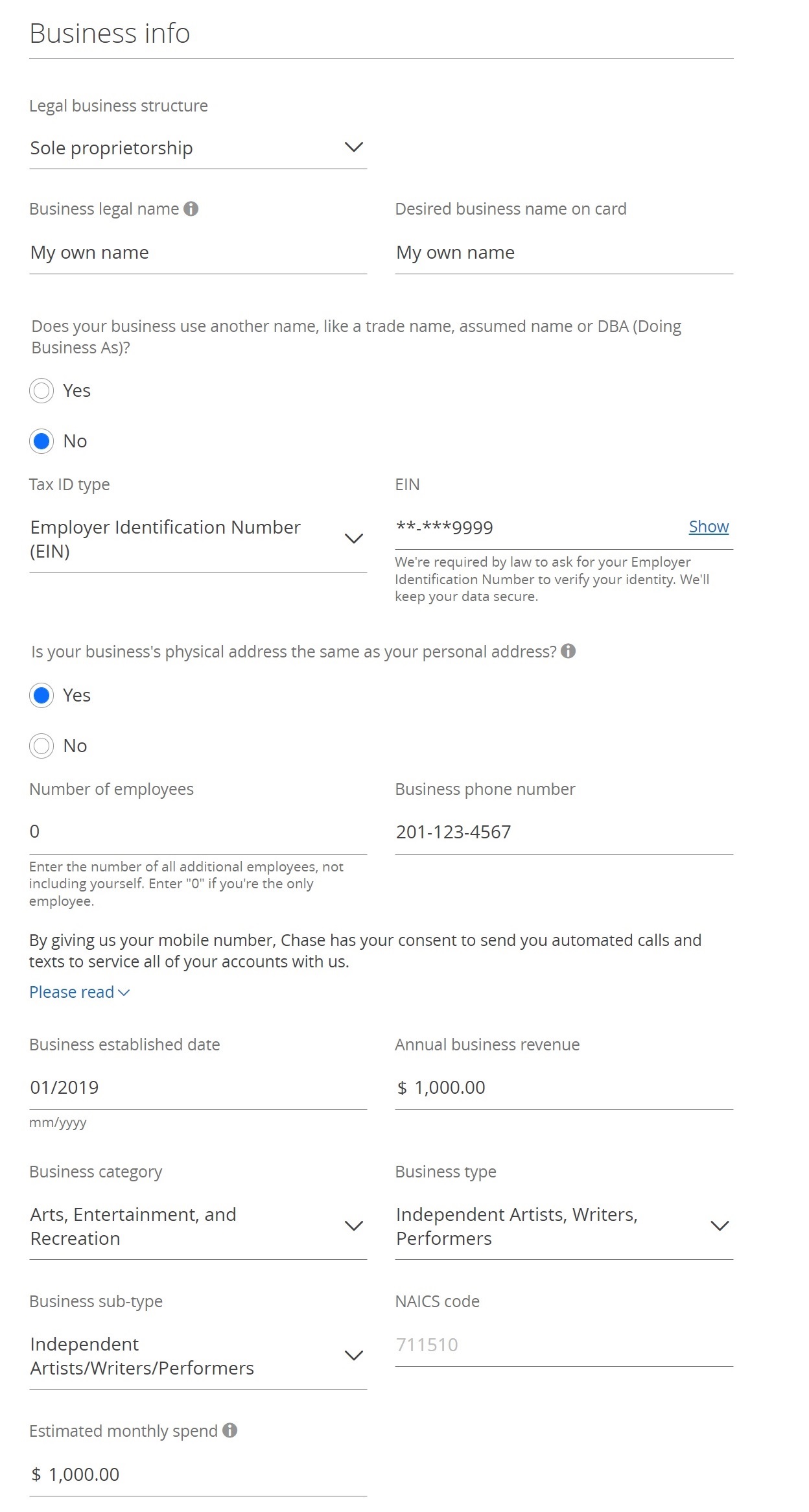

![]() Here are example answers for the business part of the application:

Here are example answers for the business part of the application:

Keep records of your answers

In some cases Chase will ask to speak with you before approving your application. In those cases, they are likely to ask some of the same questions (annual business revenue, number of years in business, total gross income, etc.). Ideally you'll answer the same as you did on the application.![]() Check Application Status

After submitting your application, you can check status by calling the automated status line: (888) 338-2586

Check Application Status

After submitting your application, you can check status by calling the automated status line: (888) 338-2586![]()

How to improve your chances of success

The following tips may help with approval, but none are required:

- Sign up for a Chase business checking account

- Use an EIN instead of your SSN when entering your Business Tax ID on the application

- Do not call if your application goes to pending

- Call if your application is denied

Below you’ll find more info about each of the above suggestions:

Sign up for a Chase business checking account

Business checking accounts must be opened in-branch. At the end of the process, you are likely to receive pre-approved offers for business cards. Go for it. While pre-approval doesn’t ensure final approval, in this case it does make it very likely.

Make sure to be prepared with necessary documentation and identification. Chase has a checklist here for sole proprietorships. You’ll see that you may need an Assumed Name Certificate, often referred to as a DBA (Doing Business As). Usually, you can get the certificate by registering your business name with either your local or state government for a small fee.

Use an EIN instead of your SSN as the business Tax Identification Number

To apply for a business credit card, you’ll need a business Tax Identification Number. Sole Proprietors can use their own social security number as the business Tax ID or they can use their company’s EIN. While either will work, it can’t hurt to have an EIN and may help give your business more credibility. You can sign up for an EIN, for free, from the IRS: Apply-for-an-Employer-Identification-Number-(EIN)-Online.

Do not call if your application goes to pending

When applications go to pending, people frequently find that they get approved without calling. When people do call, they may get tough analysts who deny the application.

The approval process goes through up to 3 “gates”:

- Instant Approval (this is rare with Ink cards)

- Automatic Approval, sent by mail (may take several weeks)

- Analyst Phone Approval

If you’re not instantly approved, then calling bypasses gate 2 and may reduce your overall chance of approval. Instead, I recommend waiting to get a letter in the mail. Hopefully it will say “congratulations”.

Of course, if Chase contacts you asking for more information, you absolutely should talk to them on the phone. In some cases they’ll simply need more information about you or your business before your application can go through the next review stage.

Call if you are denied (and call again)

If your application is outright denied (either instantly or by mail), then call Chase’s business reconsideration number, which is open Monday through Friday during business hours. There are many cases where analysts have overturned denials over the phone. Up-to-date reconsideration phone numbers can be found here.

The analyst will likely ask a lot of questions. Make sure your answers match your application. Also, if you have multiple Chase business cards, make sure to let the analyst know that you don’t need Chase to extend you more credit. Tell them that you are willing to move available credit from another card or to cancel another card if necessary. Be prepared to answer financial questions about your business. Be prepared to answer questions about why you want the card and how you expect to use it. There is absolutely nothing wrong with saying that you were attracted by the welcome bonus and by the 5X spend categories (for example).

If the analyst doesn’t approve your application, call again. Many people have had luck simply calling a few times until the reached an analyst willing to take a chance on their business.

I got the Ink Business Cash recently. How do i move points to my CSP? When i go to “Combine points”, it tells me that there are no other cards to combine points with.

I applied for IBC under my own SSN, but it created a separate Chase log-in for me — could that be the issue?

thanks!

Answering my own question: i needed to link accounts 1st. There’s a Frequent Miler post about how to do that (of course!). I suggest you add it to your “Complete guide to UR points”. thanks!

Just curious, but what do people say when Chase says they won’t issue a card due to too many applications? I’m well under 5/24 but have experienced it due to multiple Ink applications.

This is great – I have followed a similar application process – but never knew about the monthly spend – it does make a difference in higher CL. But have typically always been issued at least $6K on Biz cards.

One of the first things I do – request expedited cards (just learned – you can track card delivery under account management in the App.)

On the same call I move CL from other Biz cards that get limited spend after SUB I keep $1.5K CL on them.

This is esp helpfully for the 0% cards – in the past (2017-18) I had floated almost 95% of CL then paid it off in full the day before the promo 0% ended – then had a terrible time for years getting approved for more biz cards, personal cards no problem.

My last CIU I floated just under 50% and paid off 50% of that a few months out then paid 49% and let 1% close and paid a token amount of interest. Oddly it wasn’t 12 months but actually 15 months with no interest – not complaining.

But no issue with Ink Approvals since the CIU.

I just recently came across that there’s no longer a limit of one bonus every 24 months. I looked into the terms and couldn’t find the limit either. Can anyone confirm?

Has anyone had success getting an EIN by faxing in the paper application? I got an error message when I applied online, and I am getting antsy waiting to hear back from the IRS.

FWIW, my P2 opened a Chase Business Checking account online a couple weeks ago, so I think that in-branch is no longer required.

[…] How to Sign up for Chase Ink Cards […]

It’s nice that it seems this will be a regular event! That being said, I got two of these last time and I’m wary of drawing attention from Chase. Any idea what a “safe” rate of churning these might be?

I really wish I knew the answer to that

[…] How to Sign up for Chase Ink Cards […]

[…] How to Sign up for Chase Ink Cards […]

[…] How to Sign up for Chase Ink Cards […]

[…] How to Sign up for Chase Ink Cards […]

Ahhh found the fix. When you use a referal link from say your spouses account and use that link to apply you have a menu of ALL the Chase Ink cards to apply for. You need to scroll over to the left till the Chase Ink preferred card is NOT grayed out. I applied and was approved instantly 100k plus 40k my spouse will get for a referal. Nice!!!

I was able to generate a referal from my wifes account for Chase Ink preferred at 40k points but when I use the generated link Chase Ink preferred option is grayed out

I always have enjoyed the chase reconsideration calls I make every month now when opening a new ink cash card. I always get denied, then have the pleasure of having a detailed call, credit exchange and love it when they ask about my revenue versus profit each year I made for the business. After the call/ approval I invite the specialist out to dinner

Curious about your % of profit. Have you actually gone out to dinner with anyone from Chase?