NOTICE: This post references card features that have changed, expired, or are not currently available

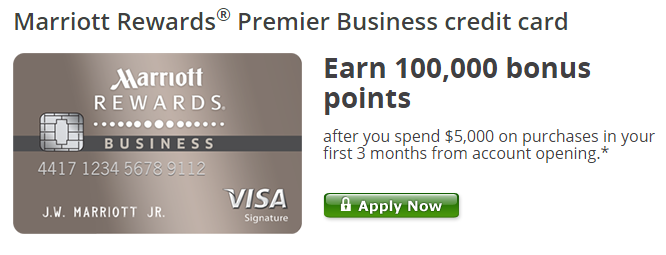

Last week, Marriott introduced a new 100,000 point offer for their Marriott Rewards Business card. When combined with the current offer for the personal Marriott card, it’s possible to rack up a huge number of points quickly.

Offer Details

Both offers can be found on our Best Offers Page:

- Business card: Earn 100,000 bonus points after $5,000 spend in 3 months. $99 annual fee is not waived for the first year.

- Personal card: Earn up to 87,500 bonus points. $85 annual fee is not waived for the first year.

- Earn 80,000 bonus points after $3,000 spend in 3 months

- Earn 7,500 bonus points for adding an authorized user

If you sign up for both cards: After adding an authorized user to the personal card, paying the annual fees, and meeting minimum spend requirements (remember that the annual fee does not count towards minimum spend), you should end up with:

- Total spend: $8,000

- Total fees: $184

- Total points earned from spend (assuming no spend is in 2X or 5X bonus categories): 8,000

- Total bonus points: 187,500

- Total points overall: 195,500

Why strike now?

There are several reasons why I think this is a great time to go for these offers:

- Both offers are the highest we’ve seen. It’s unlikely that they’ll increase these offers, and pretty likely that the offers will decrease.

- Chase has not yet implemented their dreaded 5/24 rule for business or co-branded cards. If you have opened 5 or more credit card accounts in the past 24 months, you should still be able to qualify for these cards, but that could change at any time. See: Chase calls an end to the game. Should we seek quick wins or long term benefits?

- Marriott’s acquisition of Starwood may create short term opportunities. For example, if Marriott allows moving points between programs, even a 2 to 1 ratio (2 Marriott points to 1 Starwood Starpoint) would represent great value. There’s absolutely no guarantee that anything like this will happen, but I think it makes sense to be ready with a stash of points just in case.

How good are these offers?

A common signup bonus for hotel branded cards these days is for 2 free nights rather than points. Both of the Marriott cards offer enough points (after meeting minimum spend requirements) to stay two nights at a top-tier Marriott property (which requires 45,000 points per night), but points are more valuable because they are much more flexible. Unlike free night certificates, points do not need to be used in the first year, they can be used for more than 2 nights if applied to lower category properties, and can even be used for other purposes altogether such as buying travel packages or converting points directly to airline miles.

Marriott’s travel packages, in my opinion, are the best use of Marriott points (see: Analysis of Marriott Travel Packages: 5 Night vs. 7 Night). If a couple were to apply for 3 or 4 of these cards, they could easily afford to purchase a package consisting of 5 to 7 nights at Marriott and 120,000 airline miles (or 132,000 United miles if they prefer). One of the best options is to get Southwest points from the travel package in order to qualify for the Southwest Companion Pass. After earning 110,000 Southwest points in one calendar year, your companion can fly free with you on all flights for the rest of that year and all of the next.

Note regarding the Southwest Companion Pass: A somewhat easier way to get the Companion Pass quickly is to sign up for two 50K Southwest credit card offers and then spend a total of $10,000 across the two cards.

Note regarding 5 Night Travel Packages: Officially, 5 Night Packages are available only to Marriott Vacation Club owners (e.g. timeshare owners), but many people have had luck getting Marriott representatives to make an exception for them. That said, I’ve heard from at least three people who say that they’ve called many times, and talked with many supervisors, and have not had any luck getting a 5 Night package.

Requesting a 100K match

My wife and I each signed up for the personal and business cards in March (See: Chasing 395,000 points. Final results). At the time, the business card offer was for 80,000 points after $3,000 spend. When the new 100K offer appeared, we immediately logged into our Chase accounts to request that they match us to the 100K offer. Chase will usually do this if the request is made within 90 days of applying. Our request was 71 days after applying, so we should be fine. If you’re in a similar situation, I highly recommend requesting a match right away (assuming you’re OK with spending another $2,000 to get the bonus points).

Two days after sending the message we each received a positive response that read, in part:

Your current enrollment offer is to receive 80,000 points

if you spend $3,000 on purchases in the first 3 months

from account opening.We’re pleases [sic] to be able to match another enrollment offer

to receive 100,000 points if you spend $5,000 on purchases

in the first 3 months from account opening.Here’s what you need to do next:

Spend $5,000 within the first 3 months of opening your

account and then,You need to contact us through the secure website to

process your request for the additional points. They will

not post without this second contact after the $5000 spend

is met..

Great!

Combined Credit Inquiries?

Whenever I apply for 2 Chase cards in one day (even if one is a personal card, and one is business), I’ve found that the credit inquiries have combined into one. That is, within a single credit bureau, I might temporarily see two inquiries, but the bureau has always combined those inquiries into one after the fact. This is great because, for those who always pay their bills on time, one of the few downsides to opening additional cards is the temporary hit to your credit score caused by “hard pulls” (credit inquiries). When inquiries are combined into one, the “cost” of multiple applications (to your credit score) is about the same as for a single application.

It is important to note that some readers have reported different experiences. Some have reported that personal and business inquiries were not combined on their credit reports. Banks often make credit inquiries to different bureaus in different regions of the country. So, it may be that the details of the inquiries differ as well, and that may lead to different results for different people who apply.

[…] 195,500 Marriott points. Strike now? – With both Marriott card bonuses at record highs, is now the best time to apply for these cards? […]

Is there some kind of max number of replies on this thing? This platform needs to be redeveloped and patched. Limits need to be fixed. Pretty stupid.

Yeah, actually I set the max number of replies in the WordPress settings. If there are too many replies it becomes impossible to write or read comments from the mobile view. I will look into changing the mobile view so that we can nest deeper

Oh I see. Makes sense. Then thats definitely a WP issue. I would think there is already a solution out there for the BoardingArea guys to implement and make everything mobile friendly. Otherwise, we cant keep the conversation going. Thank you again Greg!

With all the people that read these blogs, has there been anyone that reached out to you to say they work for Chase and “this is what we do/don’t do?” I’m surprised that no one has come clean.

There used to be a Chase employee who was a fan of this blog and gave me some inside tips, but he left Chase before all of this 5/24 stuff started. No one else has come forward.

Got denied for the personal card under the 5/24 rule today

Sorry to hear that. Did they tell you that you were denied due to having 5 or more new accounts?

Hey Greg. Awesome blog. While its not discussed on this post, I think it should be mentioned about Chase’s recent heavy handed shutdown practice. People just keep applying and applying and MS more to meet min spend, but do you plan on covering this topic in more detail or mention the risks associated to “over applying”?

While, I dont have the reference links, its been noted several times that the reasons of shut down are pretty extensive.

1) Obvious one are the “suspicious” purchases where its clear VGC are being bought at grocery stores, office stores, CVS, etc etc in large quantities

2) Even small quantities of MS are getting shut downs!! Maybe $2k/mo.

3) Anything related to MOs

4) Too many inquires and/or having “too many” Chase CC EVEN AFTER being approved which led to shut down. This one really makes no sense since they approved you after reviewing your credit profile.

4) “Reassessment” of your credit profile leads to adverse action because Chase is no longer interested in your relationship for whatever bogus reason.

The list goes on, but my primary concerns are that Chase is hyper sensitive to the MS community now. Even your situation of quickly acquiring 4 Chase Marriott CC is surprising and would make me worried.

Your thoughts would be appreciated.

Thanks for this. To tell the truth, I don’t have much info about Chase shutdowns. I know that Miles Per Day was shut down apparently for hitting his Ink card too hard and I know people who were shut down due to cashing in tons of money orders at a Chase bank. I’d be interested in where you got your data points?

Really? Im surprised with your vast network that you have not heard more about Chase shut downs. Towards the end of 2014 and the start of 2015, Chase started to clean house like BlueBird and sounds like they are still doing it. The data points are all from many days and days of reading countless forums and threads, but one of the popular ones is FT.

http://www.flyertalk.com/forum/chase-ultimate-rewards/1526572-consolidated-chase-closed-my-credit-card-account-s-48.html

There are many more. Some are obvious like $50k/mo MS shut down, but MS is not the only reason which has me concerned.

Here’s an old post Ive found:

http://www.flyertalk.com/forum/chase-ultimate-rewards/1321532-chase-closed-my-credit-cards.html

Everything that I have read points to Chase being hyper sensitive to MS now.

OK, I now remember reading a few such reports, but no-one I know has told me that it has happened to them. Contrast that with the Citibank shutdowns that happened late last year (I think) — In that case, lots of people I know were shut down.

right right. Citi is a terrible situation as well. I am glad nobody you know got the Chase hammer, but at this point, its too obvious all the banks know the game already.

so its very concerning to read reports of shut downs thats not obvious (e.g. MO, cash deposits, huge MS, etc). matter of fact, its just too confusing. why do “heavy hitters” sometimes dont get shut down (altho sounds like most do) and some smaller guys get hit?

Especially something like this:

http://www.flyertalk.com/forum/23360435-post477.html

I think its important to keep in mind that almost anything can lead to a shut down now when you are a Chase “Data Point” outlier compared to a normal customer.

I see you applied for these cards in March. Did you receive 15 nights credit towards Marriott status or 30? I’ve seen conflicting information online about whether the nights for these two cards will stack or not and thought another data point wouldn’t hurt.

15 nights. As expected, the elite nights from the two cards did not stack.

Thanks for the quick response. The following two posts from the points guy gave me hope, but I guessed as much:

http://thepointsguy.com/2016/04/marriott-gold-from-credit-card/

http://thepointsguy.com/2016/03/stack-elite-credits-marriott-cards/

Of note: One person in the comments says he is able to stack. Could be a glitch, could be luck, or could be false hope.

Thanks Greg. I feel NO I know YOUR blog and others has helped me and my family travel places the past two years we never would have been able to. THANKS.

Madison

Thank you Madison

I’ve looked at this card before (several times and every time the sign up bonus goes up_ but because the anniversary night is unusable in Hawaii, I’ve always passed. I think with the addition of the Starwood properties in Hawaii, the anniversary night will still be unusable. I think the lowest category hotel in Hawaii right now is the King Kamehameha Hotel (Cat 6) and the lowest category Starwood hotels are Sheraton Kona Beach Hotel and Princess Kaiulani. But I think these two hotels would probably placed in Category 6 or 7 under Marriott. As someone who keeps a card more than a year, I don’t see enough value with this credit card even with the higher sign up bonus.

Will think about it again

Also if someone applies for a Amex card and a Chase will credit bureau’s still combine the pulls?

No, they only combine when the pulls are from the same bank (even when from the same bank they don’t always combine. For example, if you do a Citi personal and business same day, in my experience they don’t combine).

What about applying for Ink + and the Marriott business card in the same day?

Obviously I wouldn’t do it unless immediately accepted for the Ink+. But let’s just assume I am accepted instantly with the Ink+, does it make sense to even try getting the Marriot Business card?

Yep, I would do that. Just keep it to only 2 Chase cards total.

8k min spend is very hard now a days. Maxed my safe level on spending in Kiva…and no money orders seem to work

I must be lucky. I have been MSing $2k+ a month just from Paypal Cash, and I also can still load my Serve with OneVanilla GCs. The best part is Family Dollar is across the street from my CVS.

Be careful paypal cash will catch up with you if you are withdrawing to your bank account

I have a targeted AMEX business gold offer for 75K MR points after $5k spend that expires this week and I was going to apply for it, but now I’m not sure. I’ve never had any points in either membership rewards or Marriott. Which offer would make better sense to you,the Marriott business 100k offer or the AMEX business gold 75k offer?

In general, airline miles are usually much more valuable than Marriott Rewards points, so if you think you’ll use the points by transferring them to airline miles, I would go with the Amex 75K offer. Or, if you can swing it, consider doing both.

Thanks!

Greg,

Any word on expiration date for this offer?

I would love to take this card, but I am working on 2 new cards for $5000 minimum spend right now and can’t take up another $5000…

No, I don’t know how long it will last.

Back in March my husband applied for southwest personal and business and was denied the personal due to too many inquiries. So I am not sure if Chase implemented the rule lightly and then pulled back but there is truly no way to prove that the 5/24 rule is not in effect.

Being denied due to too many inquiries is different from the 5/24 rule in which people are denied due to having too many accounts open in the past 24 months. They have always used number of recent inquiries as one of the factors that can lead to a denial. However, with # inquiries, you may have luck calling to ask that the decision be reconsidered. With the 5/24 rule, I can’t remember hearing of people getting the decision changed.

Quick! Sign up. I need those CC refferals monies. Gotta keep this blog alive!

Why be a troll?

Don’t like Greg’s business? Don’t swing by and read his content.

@ NetSpender

This blog provides great value to me. How can someone do this for free? Doesn’t someone deserve to earn compensation for their work?

Thank you RS_WI & Danny. For the record, I do not have affiliate links for the Marriott business card. I do have a very indirect affiliate link for the personal card though.