NOTICE: This post references card features that have changed, expired, or are not currently available

A couple of days ago, I received this letter in the mail:

It was from Citibank. It said, “exciting account changes are coming soon.” Uh oh, I though, this can’t be good..

On the back it said:

“A more rewarding experience begins July 28, 2013.” OK, I thought. I don’t know what this is, but I have about two months until the shoe drops…

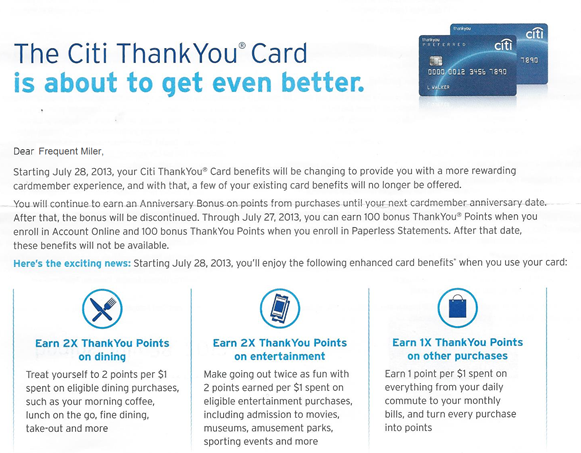

Inside was a letter:

I can now get 2X on dining and entertainment. That’s nice except that I already get 5X for those categories with my Citi Forward card.

Wait a minute… Entertainment now includes museums, amusement parks, and sporting events. That’s new! 2X isn’t exactly exciting, but it’s better than a hole in the head.

It is the back of the letter where things get really interesting:

I know you can’t read that. Sorry. Here’s what the first paragraph says:

Citi ThankYou® Rewards is offered to certain cardmembers (“you”) at the sole discretion of Citibank, NA. (“we”), the issuer of your card account (“Card Account”). ThankYou® Rewards or any portion (hereof may be revised or terminated with 30 days prior written notice. Any revisions may affect your ability to use the ThankYou® Points you have already accumulated, If ThankYou Rewards is terminated, you will only have 90 days from ThankYou Rewards termination date to redeem all your accumulated ThankYou Points (“Thankvou Points”). Rewards offered by ThankYou Rewards and the ThankYou Point levels required for specific rewards are subject to change without notice.

OK, they’re basically telling us that they can do away with ThankYou awards at any time with 30 days prior written notice and then we would have 90 days to redeem our points. Got it. Nice cheerful message.

The next section says:

Unless you are participating in a limited-time offer, you will earn:

Wait, stop. I am participating in a limited time offer. I signed up for the Citi ThankYou Preferred card with a 12 month offer for 5X points at gas stations, groceries and drug stores. So, does this mean that the new terms don’t apply to me? I don’t think I’ll know for sure until my statement closes after July 28th.

Here’s the rest of that section:

Unless you are participating in a limited-time offer, you will earn:

• 2 ThankYou Points for every dollar you spend on purchases at restaurants and on select entertainment merchants, including sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores:

•1 ThankYou Point for every dollar you spend on all other purchases.

OK, so that’s good to know. I’m not aware of any other card that offers bonus points for “sports promoters,” “theatrical promoters,” etc. Citi gives more detail next:

Restaurants are classified as dining establishments that primarily prepare food and drinks for immediate consumption by consumers, either on the merchant’s premises or packaged for takeout, and include bars,cocktail lounges, discotheques, nightclubs, taverns and fast food restaurants. Sports promoters are classified as merchants that operate and promote live sporting events

(professional or semi-professional), and may also include sports stadiums. Theatrical promoters are classified as merchants that operate live theatrical productions or concerts, and include ticketing agencies. Movie theaters are classified as establishments that sell tickets and refreshments for movie productions. Amusement parks (including zoos, circuses and aquariums) are classified as establishments that operate parks or carnivals and offer mechanical rides and games and/or live animal shows. Tourist attractions and museums (including art galleries) are classified as establishments that operate attractions and exhibits for tourists. Record stores are classified as establishments that sell COs and related items, including online record stores. Video rental stores are classified as merchants that rent DVDs and/or games and related equipment for consumer use, including online video rentals.

We do not determine how merchants or establishments are classified: however, they are generally classified based upon the merchant’s primary line of business. We reserve the right to determine which purchases qualify for this offer. Purchases not eligible to receive the additional ThankYou Points include, but are not limited to, purchases made at warehouse clubs, discount stores, department stores and convenience stores.

OK, so that wasn’t interesting at all. Sorry. I hope you skipped over it.

The next part is interesting given the apparent fact that Citi has been closing people’s accounts left and right:

You may earn ThankYou Points as long as your Card Account is open and current. If your Card Account is closed, you will not be able to earn ThankYou Points and you will lose any accumulated ThankYou Points that have not been transferred to your ThankYou Member Account. …

There seems to be a grain of hope in there. It says that you will lose ThankYou points that have not yet been transferred to your ThankYou account. So, by implication, you get to keep the points that have been transferred. Right?

Not so fast… It goes on to say:

ThankYou Points may not be redeemed and may be lost if your Card Account is not open or current.

OK, so you “may” (read: “will”) lose points pretty much no matter what happens. There’s more…

Your Card Account may be closed based on signs of fraud or abuse relating to the earning or redeeming of ThankYou Points. If your Card Account is closed for any of these reasons, you may not be approved in the future for a Citi Credit Card account.

Reiterating… “If your Card Account is closed for any of these reasons, you may not be approved in the future for a Citi Credit Card account.” Ooh, bad news for those who get shut down. I can see why they put all of this stuff in the back in tiny font.

Returning to the front of the letter, here is the Stork’s signature:

Did you get this letter from Citibank? What are your thoughts about it? Did you notice that while there is a picture of the “Preferred” card, they only refer to the card in text as the ThankYou card? I’m thinking that Citi is in the midst of rebranding this card…

sbjnyc: I expect you’ll be OK, I just hope that it gets classified correctly for you!

I’ve never seen a card with a special entertainment category, which is the vast majority of my spend. I normally use it to satisfy minimum spend for new card. I hope charging $20k for season tickets at 2X points is not considered fraud! 🙂

I am just saying that it may look similar to Citi. BTW, I think money launderers would just buy the VRs with cash

[…] Citibank Stork delivers news […]

Jorge: In your scenario the dirty cash buys MOs, not VRs. So if the bank suspected such scheme, then MO payments would have to be their trigger.

I think what is happening is money laundering:

The crooks have a lot of cash. If they go and buy $20,000 in VRs with cash, the cashier calls the police.

They rather pay a third party (the banker) to clean up the money for them.

Bankers might be doing what we do: buy VRs in bulk with CC and loading Bluebirds. At that moment the money is clean, it can be transferred to bank accounts, checks can be sent, etc.

The next step is to take the cash and buy MO to pay the CCs. I bet is something like that but with more intermediate steps.

Citi may not want to be in the middle of that

Charles: Your “impression” (#31) makes sense, but it’s different from “your friend’s” story (#29). Perhaps the bank is concerned about large purchases of drugs from CVS using their CC to be later resold on the black market.

I didn’t ask about VR’s.. but I should have. Although, my impression is citi simply sees large amounts of money going to “gift cards” and that is what triggers the problem. I’m not sure how much info they get from CVS on which gift card, etc… but this is now outside my area of knowledge.. so perhaps someone else who is on the inside can chime in. And even if I knew how to money launder with VR (which I don’t)… probably not a wise idea to be posting on a public forum.

Charles: If you understood your friend’s explanation, could you please clarify the following. Are there any “government regulations” for purchasing VR’s with a credit card? Can VR’s charged to a credit card be used to launder money, and exactly how?

I was just at a party with a friend who works high up at Citi. I was telling him about these posting and he laughed. Similar to what I’ve heard before Citi has no interest in churners. Their concern is fraud and money laundering. Prepaid gift cards are a huge source of problems due to them not being traceable. Since money laundering is associated with terrorism, guns, drugs, etc… the government has strict requirements that banks stay on top of this. His explanation of shutting down accounts was to comply with government regulations. He said they could care less about giving away points. Just one person’s take on this.

I’ve had limited experience with Citi. Once years ago I opened an account because they offered me $100 to open it. Then a year later I closed it.

Then during the 75K AA offers I got both cards but when the $75 per card fees were due I canceled the cards. Citi screwed it up and I started getting daily automated calls about being behind in my account. I had no balances but they were charging me on the “late” annual fees.

After about 6 calls including 2 supervisors I stopped getting the calls but then getting bills with an account balance of -$75.00.

Yeah they couldn’t even cancel a card correctly and I ended up netting $150.00 in payout ($75 per card) from the company. Sad state of affairs.

After a year I am trying the Citi AA Business card (I do have a legit business) so we will see how this one goes.

“you MAY not be approved in future” does not mean you WILL not be approved.

Citi now becomes the company that you only churn cards. Do the min spend and toss in a drawer.

I wonder what they will do with the basic TYP card you get from branches? I just got mine in the mail yesterday – proud to say my first purchase wasn’t a VR (but it was the second).

This latest development makes me not so sad getting denied for this card a few months ago!

TBB stands with you, ouch!

@Marcus: Loved this “The large type tells you what you get–the fine print tells you what you lose.” So true so true

Guys

I have 71k points on my TY premier card, I don’t have travel coming up so no need for airfare, I don’t own home so no need for homedepot gift card. They have pulled out amazon gift card. I don’t know what to do. I don’t want to get a mortgage check only to find a stop payment.

I have been saying this for a long time, but was told I was a naysayer. Not only is Citi closing the TYP, but they are closing ALL your cards, confiscating TYP for no reason and blacklisting you. No argument persuades them and it applies to people that just bought a few GC, so the belief that it only happens to big spenders is not true here. FM is right, do not buy GC on any cards for the time being!