NOTICE: This post references card features that have changed, expired, or are not currently available

This is an update to a post of the same name published a year ago. A lot has changed since then so I thought it would be good to create a new post rather than edit the old one.

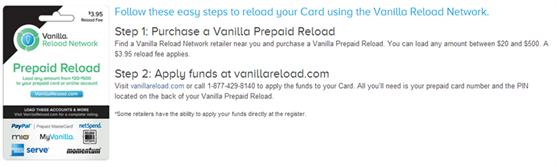

Vanilla Reload cards can be a terrific tool for increasing your credit card rewards: 1) purchase a Vanilla Reload card with a rewards credit card (to earn rewards); then 2) Load the value of the card onto a prepaid card; then 3) Use the prepaid card for expenses where credit cards are not usually allowed: bill payments, ATM cash withdrawals, debit payments, etc.

Vanilla Reload cards are not the only type of reload cards available. There are also MoneyPaks, REloadit cards, PayPal load money cards and probably more (see “The reload game is on“). This post, though, focuses only on prepaid cards that can be loaded with Vanilla Reload cards.

Amex vs. Visa/MasterCard

All of the cards detailed below are issued by American Express or Bancorp Bank. Unlike the American Express cards, the Bancorp issued cards are either Visa or MasterCard cards, and can be used as debit cards. The American Express cards are similar to debit cards in that they can be used at ATMs to withdraw cash, but they cannot be used in any other transaction where a debit card is required.

Two types of Vanilla Reload cards

There are two distinct types of Vanilla Reload cards, but they look virtually identical. With the most common type, you can purchase the card at a store, bring it home, and transfer its value to a prepaid card. With the other type, you must bring the card to the counter in-store and use it in-store to reload your prepaid card. This second type can only be used with true debit card prepaid cards (i.e. MasterCard and Visa cards). For more details see “Pursuing the Other Vanilla Reload card“.

Many types of Vanilla

In addition to the fact that there are two different kinds of Vanilla Reload cards, it is important to understand that there are also multiple kinds of Vanilla cards. Depicted below are a few varieties. None of these can be used to reload other prepaid cards:

Prepaid cards compared

The tables below summarize the fees and limits of each prepaid card that can be loaded with a Vanilla Reload card. Note that most of the numbers below were taken from publicly available member agreements and FAQs. In some cases, these online documents have not been modified in years and so may be inaccurate. Please help me correct these tables if you have recent experience that contradicts these numbers.

Fees:

|

|

Credit transaction |

Debit transaction |

ATM withdrawal |

Cash Advance |

Foreign Xchange |

Other fees of note |

| Amex Bluebird | $0 | N/A | Free at MoneyPass ATMs*. $2 elsewhere | N/A | $0 | $2 for online load from debit card (but free at Walmart) |

| Amex Serve | $0 | N/A | Free at MoneyPass ATMs. $2 elsewhere | N/A | N/A | No other fees |

| Amex Prepaid | $0 | N/A | $2 (first per month free) | N/A | $0 | No other fees |

| Mio MasterCard | $0.50 | $0.50 | $1.50 | $4 | $2.50 per transaction ($3.25 per ATM use) | Fees published online and in cardholder agreement are inaccurate. $2.95 activation/purchase fee (in store). |

| Momentum Visa | $1 | $1 | $2 | ? | $1 + 3% | Optional $10 per month plan eliminates per use fees. $10 Activation fee. |

| MyVanilla Visa | $0.50 | $0.50 | $1.95 | $1.95 | 3.5% | $3.95 per month inactivity fee after 90 days; |

| NetSpend MasterCard or Visa | $1 | $2 | $2.50 | ? | 3.5% | Monthly plans available to eliminate per transaction fees. $1 per check bill payment. Check refund: $5.95 |

| PayPal MasterCard | $0 | $0 | $1.95 | $2.50 | 2.5% | $4.95 mandatory monthly fee |

* Free MoneyPass ATM use is supposed to be contingent upon setting up direct deposit to Bluebird, but I haven’t found that to be necessary in practice. See “Bluebird: Are direct deposits necessary for free ATM use?“

Limits:

|

Max load via Vanilla Reload (day / month) |

Maximum balance (from Vanilla loads) |

Max ATM withdrawal (day / month) |

Maximum debit transaction |

Other limits of note |

|

| Amex Bluebird | $1K / $5K | $10K | $500 / $2K | N/A | $10K per month spend limit except for checks |

| Amex Serve | $1K / $5K | $10K* | $500 / $2K | N/A | $10K per month spend limit except for checks |

| Amex Prepaid | $1000 | $2500 | $400 | N/A | |

| Mio | $2,500 | $9,999 | $400 | $9,999.99 | |

| Momentum | $2,500 | $10,000 | $1000 | ? | |

| MyVanilla | $2,500 | $9,999 | $400 | $5,000 | $2500 max cash advance |

| NetSpend | $7,500 | $15,000 | $940 | $4,999.99 | $4999.99 max cash advance |

| PayPal | $2,500 | $15,000 | $940 | ? |

A deeper look at each card

American Express Bluebird

American Express advertises Bluebird not as a prepaid card, but as a checking account alternative. It is the only card in the roundup that not only includes free bill pay, but also provides an option for paper checks that cardholders can write out themselves (Unlike a regular checking account, though, each check must be preauthorized and results in an immediate reduction of available funds). Another great feature of this card (and the Amex Serve card) is that funds can be transferred directly to your bank account for free. This card is also the only one in the roundup that can be loaded for free at Walmart using debit cards or gift cards (see “Gift card PINs“). Overall, Bluebird has an almost perfect combination of multiple load options, easy access to funds, and almost no fees. Grade: A+.

American Express Serve

Serve is so similar to Bluebird that American Express only allows you to have one or the other. One big difference between the two (that I’m aware of) is that Serve allows loads via credit or debit card for free (limited to $200 per day and $1000 per month). Also, while Serve has the same bill pay feature as Bluebird, it does not have a paper check option for writing out checks yourself. Overall, the two products are so similar that they’re hard to differentiate. They’re both terrific products for loading up from Vanilla Reload cards. Grade: A+.

American Express Prepaid

Amex prepaid cards are great in that they have virtually no fees, but unlike Bluebird and Serve, they are very limited in options for accessing your money. The only options for accessing your money are to withdraw cash at ATMs or to use the card like a regular credit card (and therefore forego additional credit card rewards for those same transactions). Grade: B-.

Mio

The Mio card is only available in certain regions of the country and must be bought in-store. You can use this web page to search for availability in your area. Mio charges fees for virtually all transactions so I don’t recommend it for daily use. The best use for this card is for high value debit transactions (e.g. purchase money orders, pay federal taxes, Walmart bill pay, etc.). I’ve used this card for over a year now, with no problems. Grade: B.

Momentum

Like the Mio card, the Momentum card is only available in certain regions of the country and must be bought in-store. You can use this web page to search for availability in your area. Momentum charges fees for virtually all transactions unless you sign up for the $10 per month plan, which seems steep to me. The best use for this card is to go without the monthly plan and use only for high value debit transactions. Grade: B-.

MyVanilla

Unlike the Mio and Momentum cards, MyVanilla is available everywhere within the U.S. You can buy the card at a store, or simply order one for free online. Fees and limitations are very similar to the Mio card described above. A number of people who have run very large amounts of money through these cards have had their accounts shut down. When that happens, it can take a while to get your remaining funds back so beware of that. Grade: B-.

NetSpend

NetSpend used to have the option to pay bills via mailed checks, but a reader told me that that feature has been discontinued (can anyone confirm?). While the fees and limits of this card appear to be very similar to the others in this roundup, the NetSpend card has a major disadvantage: they eventually shut down the accounts of almost everyone who loads funds via Vanilla Reload cards. You can read about my experience with this here: “We’re sorry, there is a problem with your account.” Grade: C-.

PayPal

This card has a mandatory $4.95 monthly fee, but then free credit and debit transactions. This card belongs to the Allpoint Network so while the card itself charges $1.95 for ATM withdrawals, you won’t get another fee from the ATM operator if you go to an Allpoint Network ATM. Note that the PayPal card is administered by NetSpend so this card may be just as likely to be shut down as the NetSpend card (but I don’t know that for sure). Grade: D (I don’t like mandatory monthly fees!).

Summary

Bluebird continues to be my favorite Vanilla Reloadable. You just can’t beat its perfect combination of almost no fees, easy load options, and easy access to your money. I expect that if I had a Serve account I’d be just as happy with that too. If you want a debit card for occasional high value transactions, then look for one with no monthly fees and with low per-transaction fees. Mio and MyVanilla are two good examples. If you want a debit card for frequent use, then look for one with no per-transaction fees. For example, the PayPal card offers free transactions but charges $4.95 monthly.

I bought a prepaid Vanilla Visa and it has 10 digits instead of 16. Is it a bad card or is this something new?

What all stores carry the Vanilla reload cards

Tiffany Norman: try drugstores, especially the one with a three letter name

[…] Vanilla Reloadables […]

justSaying: have you seen my page listing the best big spend bonuses? https://frequentmiler.com/2012/12/10/best-big-spend-bonuses/

.

Pier11: no, I don’t have a Momentum card

Exactly what I was looking for…..at least I have the top two and four of the top ten…….but I didn’t realize that the AMEX Gold had that bonus……….just a great article that ties into the VR and other manufactured spend programs…………

It looks Momentum in its pay as you go version has $2 load fee… Any experience with that?

[…] If you’re still getting up the learning curve, or even if you just need a quick refresher, Frequent Miler has a good summary of the current state of things, though as one commenter pointed out some folks have had problems […]

Glenn: I’ve certainly heard from many people who have had trouble with broken Walmart kiosks, but I haven’t tried to figure out if it is nationwide or not. I hope they’re not trying to “fix” the ATMs 🙂

Bobo: Certainly 5X UR with Vanilla was too good to be true, but there is no reason to give up on VR. VR (and similar products) have continued to be a huge part of the miles and points game for many good reasons. For those who do not live near a store where they can be bought I can understand the frustration.

Casey: That makes sense.

.

HikerT: Thanks for the info about NetSpend. I don’t know why I was told that they took away the feature!

.

JustSaying: Nice analogy 🙂

[…] If you’re still getting up the learning curve, or even if you just need a quick refresher, Frequent Miler has a good summary of the current state of things, though as one commenter pointed out some folks have had problems […]

Thanks for the post. I do not pay any Amex or Chase with my BB. I used other methods to transfer funds out to my checking account. The rest ( Citi , Barclays, US Bank) I dont care much. Granted Amex can FR anybody, but my rule is not to pay any AMex with BB.

To those complaining that this post did not help cause you live in a state that does not have the three letter chain or something else, or that CGC can’t be shipped to your state. Maybe it is time to move to a different state !

Could you please tell me why not Amex and Chase?

@Jason,

Amex will only let you have a Bluebird OR a Serve. You can’t have both.

So I’m curious. Why don’t you have a Serve card? Will American Express only let you have either a Bluebird or a Serve card? I’d think having both would be a good way to buy twice as many reloads.

Thanks for a great post !

How about Gobank, Moven, and Simple? Have you tried some of these?

Jeez, all the bitching. He’s doing you a service people. Read. Read. Read some more. Nobody is going to do all your homework for you. Jeez, I’m going to turn into a cranky FlyerTalker soon.

@justSaying You can certainly buy Vanilla Reload cards at CVS stores in Northern California. If you have had trouble you aren’t trying hard enough. Hint: Try the Pharmacy.

@FM Still seeing lots of Walmarts in Northern California with their MoneyCenter ATMs shutdown, generally with an 8×11 sign taped onto them saying they are out of service. At least 4 or 5 of them now over a period of a month, both in San Jose and north of San Francisco. Is this just this area or is there something more global going on here? The ATMs were so damn convenient when they were working. Some of the Walmarts I’ve hit take just ages to work through the line only to get to the cashier who says it won’t work, can’t work etc. Meaning you have to try another line or another store or another time. Is it just me?

@Glenn You are just too funny and I am singing your praises brother! Soon as I saw your post I got up and went 1 mile to my Charlie Victor Alpha store and was going to walk to the back and check the pharmacy. But I said “No, let’s stop at the rack I have checked 50 times over the past 50 days and see if they are here”. A miracle transpired and there were probably 20-25 on the rack………I lost my air and grabbed 2 and then after a delayed checkout from a rookie clerk learning the system I was out the door with 2 shiny new cards……..it’s easy to be patient when it’s Christmas in September……..I thanked the manager who said he noticed they had just come in and told him he would be seeing me more often in the future………..already dumped and ready to write a check………even my wife is excited and she never touches the checkbook……….I just have love in my heart for everyone right now…………there is hope for the world!

Now that VR have miraculously reappeared at Charlie Victor Sierra stores it seems the right time to contemplate where manufactured spend should go on an “annual basis”. I already am well on my way to Hilton Diamond with the Citi card………..and am somewhat started on the United Explorer that gives 10k bonus after 25k spend making that card worth 1.4 miles per dollar which beats the Sapphire as long as its’ not restaurant or hotel spend………now I am wondering if Delta should be part of the picture as their status can be obtained via this approach? Is there a past post I missed that would compare the options to use that spend on other than minimum spend requirements?