Online shopping portals are a fantastic way to earn extra points, miles or cashback for purchases you plan to make anyway. Simply sign onto your favorite portal, click through to the merchant of interest, and shop. We often write about shopping portal deals and opportunities where it’s possible to earn outsized rewards for your shopping. Sometimes when we write about these deals we get similar questions and comments, many of which are based on inaccurate beliefs about shopping portals. So, without further ado, here are the top 6 myths we’ve observed and our take on the reality behind them…

Myth 1: Bank portals require payment with the bank’s credit card.

Take Chase’s Shop Through Chase shopping portal for example. In the terms of this program, it states

You won’t be able to earn bonus points for online offers on any purchases not made with a Chase credit card that is associated with this Ultimate Rewards program.

In the past, it was possible to use Chase’s shopping portal and earn rewards even when not paying with a Chase card which earns Ultimate Rewards. There have been more data points in recent months where people haven’t been awarded bonus points when paying with a non-Chase card or with a Chase card that doesn’t earn Ultimate Rewards, but that doesn’t seem to always be the case. If you do pay with a card that doesn’t earn Ultimate Rewards points, you won’t have much recourse if needing to make a claim for missing rewards.

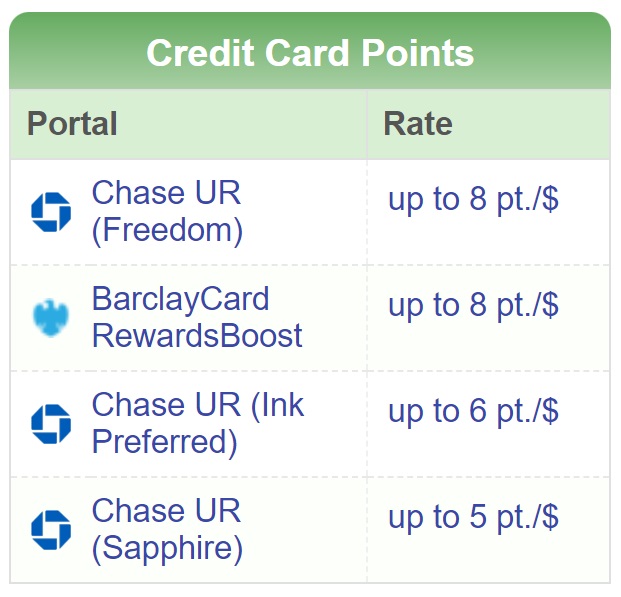

Be aware that the different flavors of Ultimate Rewards earning cards sometimes have different earns rates through the Shop Through Chase Travel℠. In the example below, Freedom cards earned at a higher rate than Ink and Sapphire cards. It’s therefore always worth comparing rates on Cashback Monitor if you have more than one type of Ultimate Rewards-earning card.

Verdict: Somewhat false, but proceed with caution.

Myth 2: Airline portal requires payment with airline branded credit card.

The truth here is very simple. You don’t need to pay with an airline branded credit card. In fact, you don’t need to own an airline branded credit card to take advantage of these portals whatsoever.

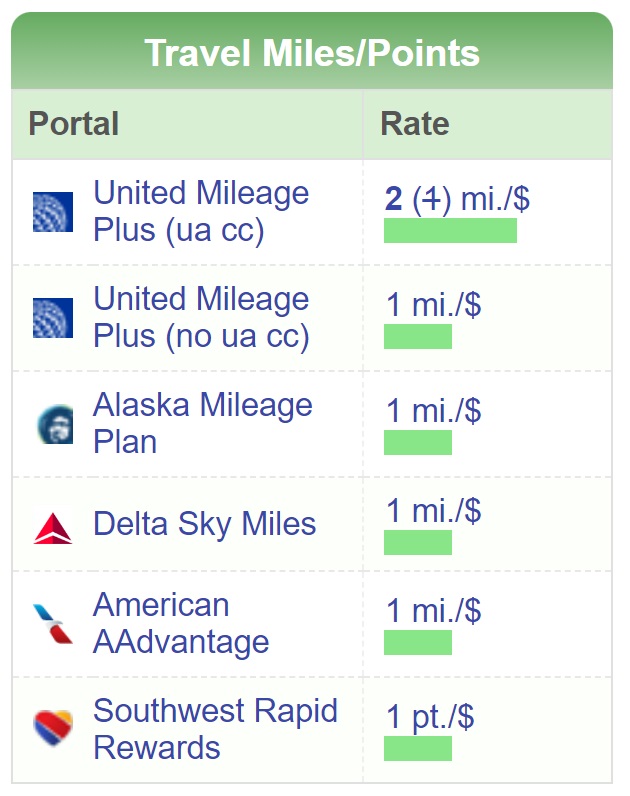

There are times, though, where having an airline branded credit card can help. With the United MileagePlus portal, for example, MileagePlus cardholders are often offered more bonus miles for the same merchants. Even then, though, it’s not necessary to pay with your MileagePlus card to get those increased bonus points!

Verdict: False

Myth 3: The portal determines which purchases qualify for points or cashback

It’s not the portal, it’s the merchant that decides which purchases qualify. When a person clicks through from a portal to a merchant, the portal earns a commission on any resulting sales. Then, part of that commission is used to pay for the points or cashback that you earn for your shopping. If the portal earns a commission, then you’ll earn your bonus points. Often, merchants won’t pay commissions for things like gift card purchases. Some have even more restrictions (e.g. Apple often excludes its newest products from earning rewards through a portal). So, it’s not the portal that determines which purchases result in bonus points, it’s the merchant.

Verdict: False

Myth 4: Portal says “not eligible on gift cards” so I won’t get points for buying gift cards.

Most portals have standard language that appears for most merchants that says that gift card purchases are excluded. The truth, though, is that it depends entirely on how each merchant reports sales to the portal. Some merchants report gift card purchases as regular purchases. Others do not. Unfortunately in recent years, more and more retailers have stopped their affiliate programs from paying out on gift card purchases, but not all.

Airline shopping portals tend to run monthly promotions along the lines of ‘Spend $100 & earn 500 bonus miles’. Those promotions exclude gift card purchases, but purchases from Giftcards.com (which only sells gift cards) do count towards the spending threshold.

Verdict: Varies by merchant

Myth 5: Portal says “not eligible on gift cards” so I won’t get points for using gift cards.

With most merchants, you’ll get points or cashback regardless of how you pay. There are some exceptions, though.

Even if a portal states that purchases made with gift cards won’t earn cashback/rewards, that doesn’t necessarily mean that’s how it’ll be enforced. As with myth 1 though, you won’t have much recourse if your purchase with a gift card doesn’t track after their terms state that that’ll be the case.

Verdict: Sometimes false, but varies by merchant

Myth 6: When things go wrong it’s the portal’s fault

When shopping through a portal, it’s not unusual for your purchase to go untracked and unrewarded. It’s natural to think that the portal you shopped through was at fault, but it probably wasn’t. Many things can go wrong, very few of which are under the control of the online portal. Here are some examples:

- You already had items in your shopping cart.

- You used a coupon code not listed on the shopping portal’s website.

- Your computer’s configuration may prevent the portal from tracking your purchases. For example, some portals require the use of Javascript and/or Cookies. If your browser has either of these turned off, the portal may not be able to work correctly.

- Software on your computer may prevent proper tracking. Things like ad blockers, spy ware, and third party browser toolbars can silently ruin your chance for portal points or cashback.

- For whatever reason, the merchant may not have accurately reported your purchase.

- Usually there’s an affiliate network between the merchant and the portal. If the affiliate network has technical problems, then you’ll experience portal problems.

All shopping portals provide the ability to make a claim in the event that your purchase hasn’t tracked, but making a claim doesn’t guarantee that they’ll eventually pay out. Most portals will (or at least they say they will!) investigate the transaction, but if they don’t get paid by the affiliate program for your purchase, you’re not going to get paid either unless the portal happens to add your expected rewards as a gesture of goodwill.

Myth #1: The bulk of what you wrote is contrary to your conclusion “Verdict: Somewhat false, but proceed with caution”

The conclusion is as about milquetoast as you can get. 🙂

I don’t think the Citi Bonus Cash Bonus Center requires that you pay with a Citi card though, so the conclusion still stands. We’d just wanted to highlight the Chase shopping portal as that’s one that people are probably more likely to use and it doesn’t seem to be the case that paying with a non-Chase Ultimate Rewards-earning card always fails.

Point taken

I made a purchase through AA’s portal with Microsoft that didn’t track. It was for a $2k laptop and when I followed up, the portal cited the exclusions, which include “computers”. The crazy thing is that every offer listed on the portal is for laptops, and the list of Microsoft exclusions are literally everything they sell. When I pointed this out to the portal, I got no reply. I did notice the exclusions when I made the purchase, but assumed it must be an error since they were advertising laptop offers on the portal. But apparently Microsoft is just a bait and switch, as nothing qualifies.

WHEN SOMETHING DOESN’T TRACK . . . and you submit an inquiry, some stores don’t respond to the portal’s investigation. It’s not the portal, it’s the store. Some stores are notorious for this. And, some stores state they can only investigate for X days and then you’re out of luck. So, once you’ve started an inquiry, you ought to “reply” and ask for status every seven days until it is resolved. Of course, weigh the value of your time. Best of luck.

Is there any harm in installing portals’ web plugin? They sometimes run promos for using it, but I fear it hijacks all earning opportunities. I like to make purchases via various portals, because I want to go with the portal that offers the highest rebate.

No, it shouldn’t hijack earning opportunities. What’ll happen is that when you go to check out the browser extension will give a popup asking if you want to activate rewards. Provided you decline that or ignore it, it shouldn’t hijack earnings.

Be careful when checking out though as sometimes the popup will appear where you’re about to click to continue through the checkout process and so you could accidentally activate rewards from a different portal. If that happens, the best thing to do would be to empty your cart, then do the purchase in an incognito window after clicking through from your desired portal.

Microsoft Rewards will hijack it if not explicitly turned off in the Edge browser. Found that out the hard way.

How about portals track your purchases, sell the data, and you get targeted easier in the future…

I see it as more positive than negative. Topcashback and AA know that I often book with IHG and Agoda (and other OTAs) through them, so everytime they have accelerated offers, they send me emails.