NOTICE: This post references card features that have changed, expired, or are not currently available

One month… $5,000 bankrolls… How much cash and how many points will be earned?…

The first week of the #milemadness manufactured spend tournament has completed, and a new week is under way. For review, the general idea of the tournament is that each player starts with $5000 (of their own) to spend in ways that will return their money and earn extra cash and points. Contestants are judged by 3 factors: amount earned, efficacy, and artistry. In case you missed the details, please see these prior posts:

- The Manufactured Spending Tournament

- The next mad challenge

- Manufactured Spend Tournament FAQ Post and Thread

- #milemadness Manufactured Spending Tournament meet the Players

Miles per hour

In response to feedback, we’ve added two new types of metrics to the #milemadness 2014 scoreboard: time on task, and points & miles earned. For fun, I also added up all of the points and miles earned by each contestant and divided by their hours spent. Now, to be clear, adding up points and miles produces a not very meaningful metric since the value of each type of point varies tremendously. But, I calculated it anyway. The leaders of this mostly meaningless metric were:

- The Miles Professor: 19,384 miles per hour

- Giddy for Points: 17,994 miles per hour

- Milenomics: 15,541 miles per hour

Just think, if The Miles Professor were to do this 8 hours a day at 19,384 miles per hour, she would earn over a million points in a week! That would beat the pants off my million miles in a month adventure. Of course, in reality, most manufactured spend techniques cannot be scaled up indefinitely. Limitations include credit card limits, store gift card supplies, cash out opportunities, etc. Also, it would be very risky. If she (or anyone) were to push that far that fast, they would likely get their accounts shut down.

UPDATE: I miscalculated the above results. The actual results (assuming my math is any better the second time) are as follows:

- The Miles Professor: 38,976 miles per hour

- Miles Abound: 13,815 miles per hour

- Quick City Visits: 11,474 miles per hour

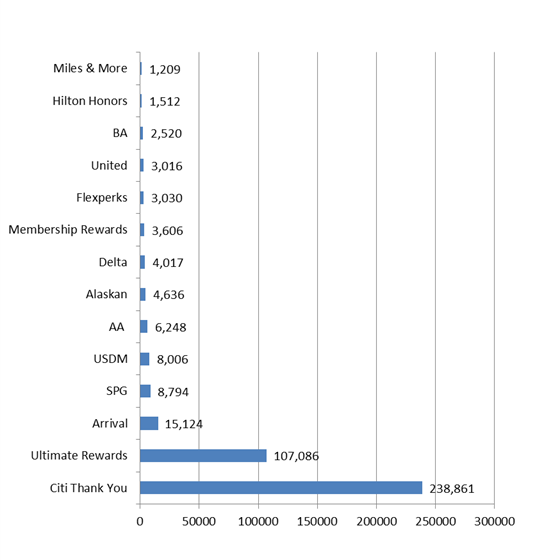

Types of points earned

Here’s a look at the types of points and miles earned, across all contestants in week 2:

The main takeaway here is that the big points are, unsurprisingly, in the programs where contestants can earn 5 points per dollar. Ultimate Rewards points were earned primarily with Ink Plus or Ink Bold cards at office supply stores. And, ThankYou points were earned primarily at drug stores with the old ThankYou Preferred card that used to offer 5X at drug stores, groceries, and gas stations for 12 months.

Great Bridge

In last Thursday’s post “Good stuff gleaned from #milemadness” I listed a number of rewards programs in which you can earn rewards by enrolling your credit cards. One that I forgot was Great Bridge. Great Bridge is a market research company that rewards consumers in exchange for permission to use their transaction data for market research. According to this Flyertalk thread, Great Bridge pays one fourth of a penny per dollar spent on linked cards (but not for all transactions). And, they limit rewards to $60 per 90 days. It’s not the most lucrative program in the world, but could mean an easy $240 for those who spend $96K or more per year. Milenomics reminded me about Great Bridge by using it to boost his profit for this tournament.

Will spending so much in such a short time cause any problem? Like catch the attention of the bank? I got Dividend this month, I am really worried if I spent all 6000 in one month they are going to shout down my account.

It depends on many factors, but as long as you have a credit limit over $6K, there shouldn’t be much risk of a shutdown.

Dear Ms. Prof. And Mr. Abound:

Thank you both for jumping in on this, and for sharing your experiences in this competition! And power to you both as well that you have the TYP. I am aware of the other 5ers out there, and I just got the BC card last month.

While I have been in the financial/investment industry for a long time, this little hobby is, well, let’s just say it’s an awful lot of fun! I am setting myself up for consistency – for a long run at this – but it’s great to see what can be done with a little sprint once in a while.

Question: The way I am approaching it is to ramp up slowly – like increase my spend in increments every 3 or 4 months. I am thinking about how I’d like to be set up a year from now, should some form of this game still be around. I am not cycling through credit limits and spending in ways I can justify relative to my income. How did you approach ramping up?

Let me be honest I am using the Citi 5x because it earns the most under the competition rules. 5x at 0.0123 valuation is better than Amex 5x at 0.01. It really should not take much imagination to work out the exact same could be done with Amex Blue, TD, WF, First Citizens etc. And the tournament is not about revealing new secrets, it’s more about showing how what we all know and love can be scaled up, and some fun.

My 12 months of 5x TY points at drug stores, gas stations, and groceries just ended a couple of weeks ago, so the technique being used by some of the players is not particularly useful to me right now. Plus I was careful not to push the limits based on reports of Citi shutdown of accounts and zeroing out point balances a few months ago. And nothing new about running up purchases at office supply stores, cable bills, and phone bills on Chase Ink for 5x. And using Chase Freedom 5x and Discover 5% quarterly bonuses is a given. So, what other new and useful bonanzas are out there?

Nice post 🙂 Like you said, going from 30 minutes a day to 8 hours would be like comparing the MPH from a 100 meter dash to a marathon. My strategy then becomes very much a grab of the low-bearing fruit although that fruit can take us pretty far! We’d need infinite credit limits, Bluebird space, Paypal accounts and the ability to istantly teleport from one CVS and Duane Reade to another (they’re not all on my walk home).

@Rick – The TYP strategy should just be thought of as representing a general 5x at drugstores, however it’s done. While the TYP card is no longer available, MilesAbound and I think of it as our current 5x vehicle stand-in. That is, if we didn’t have it – we’d go with another currently available card – Wells Fargo/Amex Blue Cash/Citizens Bank that offers the same. As MilesAbound tends to put it, we use the current 5x as our big guns and this tournament is a good way to gage exactly how lucrative and efficient that strategy is vs. others. Myself, I’ll be mixing in a few cashback cards fairly soon because everyone needs cash on vacation!

Regarding TYP, I’m about to jettison my Citi Thank You Preferred to convert to the Citi Dividend 5% CB card (no TYP) unless someone can hurry up and convince me its a bad move. The Citi TYP Preferred is 2% on restaurants/entertainment and seems to fall short of the Dividend card.

I am doing the same. I think dividend is a better move for the $300 a year, plus, you can wait a bit and get another preferred when a 30-40k typ bonus comes around. my humble opinion at least.

Why bother? I can barely use up my $1500 allotment of Chase UR category bonuses outside of grocery / gas / drug stores.

With Citi, it’s a huge pain to reassign credit limits so I’d rather just close it and save room for better cards.

It been great following all these participants! I do wonder, though, if this would be more aptly titled the TYP extravaganza. For those of us who do not have that card, it would be nice to see highlighting of other techniques. All in all, though, in my short time in this I have seen multiple new avenues arise. Being ready to pounce responsibly seems to be key to this game, as in any game.

I’ve had my ups and downs with Great Bridge Group. I earned over $100 from them over the months, but they started closing accounts randomly (see post: http://travelwithgrant.com/2013/12/09/great-bridge-group-breaks-hearts/). I though it earned 1/10th of 1 percent (1 penny per $10 transaction). They do round up though, so a $5 purchase will still earn 1 penny. Great if you can link an Ink card to your account.

Yeah, I believe that is how it is, except if you have a debit card linked, then you get an extra 50% on top of all your earning.

typ is worth more than blue because you can use for flights at .0125 or .016 or you can get the same value as blue for cash out as well. Which would put it a neck ahead in value

TYP aren’t really worth more. There’s only so much cash a regular person can spend on flights per year and almost all other uses for those points are a waste of money….except WM gift cards, which can be used to buy Visa GCs through WM website and generate cash.

Seems to me that TYP are worth more than the Amex blue, but I agree I would have thought to see it more from some players.

Is there a reason no one is using the old amex blue cash card?

One question: Is the Miles Professor married?

seeing as the top article on her blog is: Family Trip to Europe with Miles Tutorial: Paying $1000 Taxes + Surcharges with Barclaycard Arrival Miles

I’m leaning towards ‘yes’ lol