NOTICE: This post references card features that have changed, expired, or are not currently available

Most credit card signup bonuses follow a simple pattern: Spend $X in Y months and get bonus Z. For example, quite a few offers are: “Spend $3000 in 3 months and get 40,000 points.” Some offers are more complicated, such as the Citi ThankYou Premier 50K offer which requires spending $2K in the first 3 months of card membership and then $3K in the first 3 months of year 2. And some are much more complicated, such as the latest Virgin Atlantic offer (for details, see “Will the real Virgin Atlantic offer please stand up?”).

There is whole other class of signup offers in which, instead of a lump sum bonus, you get increased rewards as a percentage of spend for a set number of months. Here are a few simple examples (more details can be found here):

- TD Easy Rewards Visa Credit Card. Offer: 5% cash rewards on dining, grocery, gas, cable, phone and utility bill payments for 6 months (1% thereafter) + $100 cash back when you spend $500 within 90 days.

- Wells Fargo Cash Back Card. Offer: 5% cash rewards on gas, grocery, and drugstore purchases for the first 6 months (1% thereafter).

I think of these as variable spend bonuses. The more you spend, the greater the bonus. For example, the Wells Fargo card usually offers only 1% returns, so the signup bonus is the extra 4% earned in the first 6 months on gas, grocery, and drugstore purchases. If you make $10,000 worth of such purchases, then you can think of the signup bonus as being $400. Spend $100,000 and your bonus is a whopping $4,000.

The way I defined variable spend bonuses above may not seem right to you. In the Wells Fargo example, I said that 4% of the 5% earned can be thought of as the signup bonus. This makes sense when compared to more traditional signup bonuses (e.g. “spend $2000 and get $100 cash back”) since traditional signup bonuses are always the amount you get in addition to the card’s base earnings. That said, it doesn’t make sense when you think of the word “bonus” as meaning the incremental value of using this card over other options for the same spend.

The 2% benchmark

For years, I’ve used flat 2% cash back cards as the benchmark upon which to measure other rewards. Please see, for example, “The Cost of Credit Card Points” which I published in December 2011. Even with the introduction of the Arrival Plus card (which effectively offers 2.2% returns), I think that the 2% benchmark is fair. With both the new Citi Double Cash card and the old Fidelity Investment Rewards card, both with no annual fee, you can effectively get 2% cash returns (or, for those good at math, 1% + 1% with the Citi card). With the Arrival Plus card, the 2.2% returns are in the form of statement credits to offset travel expenses. If you travel often, it’s as good as cash. If not, you may have to resort to tricks to try to get your money. Plus, the Arrival Plus card charges an $85 annual fee after the first year (unless you call and get a nice rep to waive the fee). So, while the Arrival Plus card can offer better than 2% rewards across the board, it’s not for everyone.

So, back to the Wells Fargo 5% offer… If we compare the 5% returns to the alternative readily available (from other cards) 2% returns, we can calculate the bonus as being 3% for 6 months. Spend $10K and the bonus is $300. Spend $100K and the bonus is $3,000. If you have other cards with better than 2% returns within the same categories (see “Best Category Bonuses”), you might want to compare the 5% returns to that amount instead so as to calculate your own variable signup bonus.

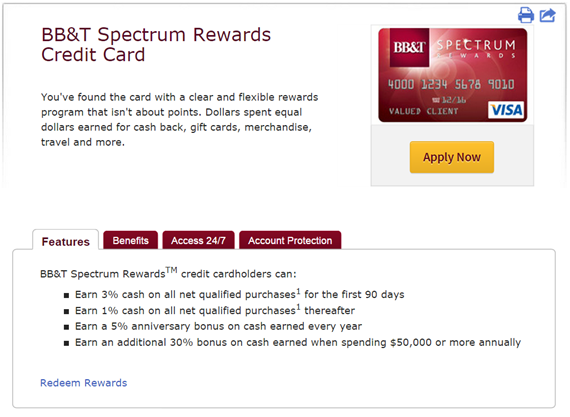

The Spectrum Rewards offer

Via Miles4More, I learned about the BB&T Spectrum Rewards Credit Card that offers up to 4.05% cash back on all purchases for the first 90 days. Besides the 90 day requirement, there are a few catches:

- You must live in BB&T’s service area: Alabama, Florida, Georgia, Indiana, Kentucky, Maryland, North Carolina, South Carolina, Tennessee, Texas, Virginia, West Virginia or D.C.

- You must spend $50,000 in order to kick in their 30% big spend bonus

- You’ll have to wait at least a year to collect some of the cash

For people who live in the right place and can easily spend a lot of money in a short period of time, this could be a really attractive offer:

- Compared to a 2% cash back card, this offer will net an additional 2.05% on $50,000 worth of spend. That comes to $1,025. It’s not as big as the Wells Fargo offer described above, but this one works in all categories of spend not just gas, grocery, and drugstores.

- If you have a huge federal tax payment, you could potentially use this card to earn a nice profit paying taxes. PayUSATax currently charges a 1.87% fee. So, if tax payments alone would get you exactly to the $50K spend threshold, this would be a nice quick money maker. For example, pay $49,083 in taxes with this card and you’ll incur a fee of $917.85 for a total credit card charge of $50,000.85. With 4.05% returns, you should get $2025.03 cash back. That’s a profit of $1,107.18 just for signing up for this card and paying your taxes! Note that you’ll have to get a very large credit limit to do this since you’re only allowed to make two credit card payments per tax service for each type of tax payment.

What about those who can’t spend $50K in 90 days? You’ll still get 3% returns for 90 days plus a 5% anniversary bonus for a total of 3.05% returns. Compared to a 2% cash back card, this one offers a 1.05%incremental bonus. For $10K spend, the bonus will be $105. For $20K spend, the bonus will be $210. And so on. These are not exactly big numbers. My advice: It is not worth the extra credit pull for less than $50K spend.

What do you think of the BB&T Spectrum Rewards offer? Do you plan to go for it?

greg .. any idea if the spectrum card earns points on AGC purchases?

I would expect so, but I don’t have any data on that.

BBT sucks…I signed up for a checking account with a $150 signup bonus here in Texas and it took them over 120 days to credit the account (supposed to be 60-90). They had no online or phone support, and you had to go to the branch to open (or close) an account. If their card is anything like their checking bonus, you will have to jump through hoops and chase them down for your bonus.

Greg, I was trying to apply for the BofA Virgin Atlantic Cards, but it seems like they pulled both offers, including the ones on your credit card page. Any luck finding a working link? Thank you!

Yikes, I didn’t know that. I’ll see if I can find any working links.

Too complicated for me… but I haven’t maxed out the easier 5% routes yet. and I don’t live in their service area, which makes it even more complicated.