NOTICE: This post references card features that have changed, expired, or are not currently available

Note: As of October 13, 2015, the Target REDcard (REDbird) can only be loaded with cash in-store at Target. Gift cards and/or debit cards no longer work to load REDcard. For more info, see: Here is the REDbird memo, “Cash is the only tender guests can use”

As of May 6, 2015, Target no longer accepts credit cards for in-store REDbird reloads. For more information, please see “REDbird Post Memo Answers“, and “REDbird grounded. Now what?“

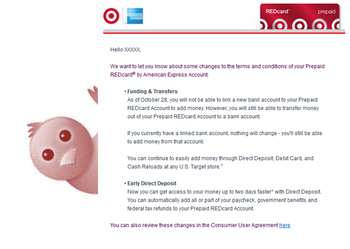

REDbird (technically, the Target Prepaid REDcard) is an amazing product from Target and American Express. You can load money to REDbird at Target, for free, with a debit card or credit card (and earn points). Use it to pay at Target and you’ll receive an automatic 5% discount. Use it to buy things online at Target.com and you’ll get not only the 5% discount, but free shipping as well. Withdraw money at Allpoint ATMs, or withdraw electronically to your bank account – either way, it’s free. Pay bills to large companies or to individuals – for free.

So, yes, REDbird is great, but it is a new product and so, unsurprisingly, there have been a number of issues that have come up over and over. Here are the solutions…

Website down

Occasionally you may browse to target.com/prepaidredcard and get a message indicating that the website is down. That particular URL is just a redirect, though. So, if you have trouble with the target.com/prepaidredcard URL, simply browse to one of these instead:

On hold… forever

A number of things can go wrong that will lead you to call the Prepaid REDcard team for help. Unfortunately, you may find yourself on hold for a very long time only to be ultimately transferred to another place. Here are a couple of numbers that can help you jump the line:

- Card activation issues: 800-438-6468 (REDcard resolution center)

- Identity verification issues: 800-660-2454 (Amex fraud protection)

REDbird email never arrives

So you just brought home your shiny new temporary REDbird card and tried to register it online. The system then asked you to call to prove your identity (that happens sometimes). The phone agent then tells you that you’ll receive a verification email to click through. It never comes. You check your Spam folder, but its not there. What to do?

First, avoid this situation in the first place by avoiding Hotmail. Most people who have encountered this issue have Hotmail email addresses. If that’s you, I recommend creating a Gmail email address for this purpose.

If its too late and you already have a lost email, you’ll have to call again and ask to have the email sent to a different email address.

Hat Tip: Rapid Travel Chai via personal communication

Fraud alerts never stop

A common problem with REDbird is that the first time you pay for a reload with a particular credit card, you are likely to get a fraud alert on that transaction. With some cards this means that the transaction won’t go through. With others, it means that future transactions won’t go through – until you let the bank know that it was an intended payment. With most cards, you can call you bank (or text, or click an email link) to verify the charge and then all future REDbird reloads will go through fine (with that credit card). Or, you can be proactive and call the bank before your first REDbird reload to let them know that you’ll be making large purchases at Target. Either way, you should be good to go afterwards.

One big exception is US Bank. For some reason, according to several friends who have tried, US Bank almost seems to be hard coded to deny REDbird reloads. People have tried calling before, during, and after the transactions. Unfortunately, even if they’ve been able to get one transaction through, US Bank reportedly continues to block future reloads. It sounds completely maddening.

The easiest workaround is to use cards from other banks. That would be a shame, though, if you were counting on the FlexPerks card’s grocery store bonus (since some Target stores are coded as grocery stores), or the Club Carlson card’s 5X everywhere earnings. Another option is to ask the cashier to type in your credit card number rather than having you swipe the card. Supposedly this will get around US Banks overzealous fraud protection.

Hopefully readers will have other, better solutions. If so, please comment below.

Bill pay broken

If you get an error when trying to use REDbird’s bill pay function, there may be a simple solution: check the phone number on your Profile. Make sure that the primary phone number in your Profile correctly displays all 10 digits of your phone number. For some strange reason, when your profile has only a 7 digit phone number, bill pay won’t work. Update your profile and try again.

Withdraw to bank account… how?

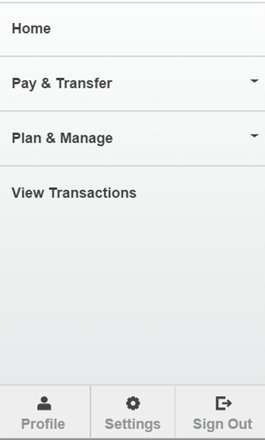

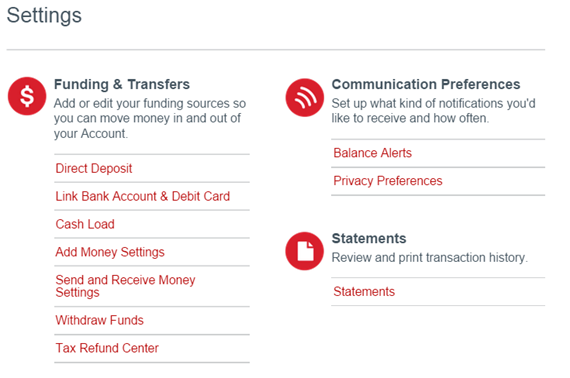

I get asked this one a lot. A new REDbird owner wants to withdraw money from REDbird to their bank account. They remember that I’ve written that it can be done, but they can’t find the option. Here’s the REDbird menu:

One would think you could find the ability to withdraw money under “Pay & Transfer”. Nope, it’s not there. “Plan & Manage”? Nope. Click Settings (at the bottom of the menu). “Withdraw Funds” is second from the bottom:

Read more about REDbird:Also: |

|---|

I’m having trouble with Redbird Bill Pay. I used it to pay my student fees and my landlord last Saturday. My university received the payment by Thursday which is great. But it’s Saturday now and my landlord has yet to receive the payment. I’m thinking of giving them a check now and asking them to use the Redbird check (when they get it) for my next month (but then I won’t be able to pay one of the months with Redbird). I guess the lesson I’m learning from this is to not trust their 4 business day claim. I’m coming up on 6 days now, and I wouldn’t be surprised if it didn’t arrive until later next week. Anyone else have trouble with this?

Yes, they do frequently take longer than advertised to pay bills

Eh, trusting LANDLORD?

[…] at Club Carlson properties, 5X for reloading REDbird can be a great deal. Unfortunately, US Bank can be very difficult with respect to reloading REDbird. See also: Club Carlson rocks our world… […]

Went to target last night and was only allowed to do $1k. The system kept rejecting after that. It was on my wifes card and I still have $1,500 left for the month. Anyone else have any issues? Thanks.

I had no problem at Target yesterday or today

My Citi card gets flagged every time I make a $1,000 purchase. I was told by a representative that ever since the Target breach, Citi has been flagging purchases that look like gift card purchases. She told me to avoid spending exactly $100, $250, $500, or $1000 or else I’d continue to get flagged.

If this is happening to you too, you might want to start mixing things up a little. Instead of 4x$1000 and 2x$500 go with 4x$833; and 2x$834.

As it was mentioned before there is no need to do multiple swipes w/ your CC.

1. Give your RB card to cashier

2. Ask/tell her lo load $1000

3. Ask/tell to do one more load $1000, again

4. Ask/tell to do one more load $500

5. Optional: buy a pack of gum (*must be done last*)

6. Swipe your CC

Here’s a data point: I received my Club Carlson card a couple weeks ago. I have made a couple small purchases. Today I used it to load my Redbird with $1k. Then I loaded another $1k to Redbird with a different account. Then I loaded $500 to Redbird with Club Carlson. So total was $1.5k from Club Carlson and no fraud alerts. I plan to load another $1k tomorrow.

Wow, you were lucky!

[…] Top 6 REDbird solutions by Frequent Miler […]

[…] your card. Saves time, less receipts, transactions, and less likely to trigger fraud alerts,” MSPDeltaDude on FrequentMiler’s Top 6 REDbird Solutions. I finished my REDbird’s and AFT’s for […]

Loaded 2 Redbird’s tonight for $5K and always speak w/ the easy going Woman @ customer service. She’s the one who told me I could swipe the card 3 times for $2.5K and only have to swipe my credit card once. She told me that she has one guy who comes in w/ 10 Redbird’s and loads $2.5K on each. That’s some serious MS!

@DavidNJ I want to meet the guy with 10 RedBirds…….I tried to register one for my dead Mom and they have that review”……And I am her executor………bast..s……………So do I need to have my dog get a social security number or do I just go to the post office and see who has a son to lend for a few bucks? I am so so tormented by this………

“under review”

I’m thinking you need family and friends who couldn’t care about what you do with a card in their name. Sorry if I’m repeating myself. Can you get multiple subaccounts from friends and family so it’s all on the up-and-up? I can only charge up REDcard at customer service. It’s the same few people. Charging cards under different names is going to attract attention, maybe? Certainly it’s not legit to manage funds not in my name.

You can get subaccounts in any names you want, but you can’t reload to a subaccount. You need the primary account holder card to reload.

So once I get my permanent card I can use the bill pay function? Also, can I use bill pay to pay the credit card I loaded it with. Just hearing of this and trying to catch up with all the details

Yes and Yes.

It would be nice if Amex made a Redbird app. I don’t know why it is taking so long to make a redbird app. Bluebird and Serve have one already and it makes managing the REdbird account much easy on the go.

Definitely

Can you load vanilla gift card to redbird?

Yes

@paul , that’s cos once they shut down, they also shut down your checking and they are clever to just mention checking when it is the CC that led the shut down for abuse

the letter you posted is dated feb 2014, way before redbird..it does not really mean much..could be various reasons for closure.. you mentioned 15 MSers were shut down according to report.. what report are u talking about?

@sammy

click & read here, Chase canceled it

http://i.imgur.com/9oEBp3h.jpg

This letter appears to refer to a bank account

the chase rep and us bank rep seem to follow the blogs i guess. US bank just shut him down no question asked. chase guy called him and gave him warning about the load and told him would shut him down next time

where do you get your info from? who is “he”?

Any issues with a spouse using their credit card with a different last name to load a Redbird????

Am thinking of the fact that Serve has spouse card in purgatory and the system says it isn’t closed (IT IS) so there is a seemingly lifetime ban on any new AMEX prepaid cards although they open up new credit cards in the same names………Rocket Scientists they are!

No, there should be no problem with that

Is there any clarification possible? My wife is changing her name in a couple of weeks. Is she not going to be able to use her card any longer? Will we be able to get another card? Will we be able to use all three cards, or just two? What if we have to change her SS# too?

Also, is it possible to get subaccounts on family members cards while having your own REDcard? I get it that it’s nice to get miles, hotels, cashback, and all; but some people would actually like to do society a service and fix up all these turd foreclosure homes still around since circa 2008. Interest payments cut into profits and banks always upset about granting HELOC to fix up foreclosed homes; they want their points and higher interest.

I don’t think your wife’s card will stop working when she changes her name, but it would be a good idea to call and have them update her name (and SSN if necessary) in the system to correct it just as you should do with any accounts she has.

That’s a sensible reply. I will have to call to find out about this special condition at some point. Customer service is awful though. Even the call center super is admittedly just guessing.

It would be a shame not to have our full spend while she’s in limbo. And new credit acceptance may take a while to come back online for her too.

Back to the call center, and troubles to be aware of, with the use of a new card, as always, big spending can cause red flags and near suspension of the credit card. This happened to me with two new AMEX cards. They were basically shuttered after one last load that I needed, I could still load a dollar or less. Apparently when purchasing card gets declined, the REDcard also becomes locked.

Next what happens when you call customer service when your REDcard is locked up, you call customer service. Once you press “0” to get a rep on the line, there is aparently SUPPOSED to be a call hand off to an outside security firm. The call is perhaps only handed off randomly. I got through to security sometimes yes and sometimes no. If you get to security, press “0” again for a security rep.

Security handles everything easily if the call can connect and you can actually hear each other on both ends of the line. If there is no call hand off, the rep you get (note pressing “0” a second time does not happen), this rep knows nothing about why your card is not working. They will tell you to try a different this or that and the card is enabled and working perfectly. This is very frustrating. When you ask for the super, they have perhaps a 50/50 chance of knowing what to do, though I think they have to call security on their own, and that takes longer than you want to wait on hold. Though if they do place you on indefinite hold, they will likely resolve the issue without further need to talk to you. Hang up and check later if your card is unlocked.

When the super doesn’t know what to do, it’s another long hold time and no good result for you. If you keep calling customer service, you can play the “2x coin-flip” call hand game until both are a head’s up and you are a winner.

As you might expect, it is likely better to preauthorize the initial large purchases in advance to avoid all this mess in the first place.

Thanks for the info!