NOTICE: This post references card features that have changed, expired, or are not currently available

As of May 6, 2015, Target no longer accepts credit cards for in-store REDbird reloads. For more information, please see “REDbird Post Memo Answers“, and “REDbird grounded. Now what?“

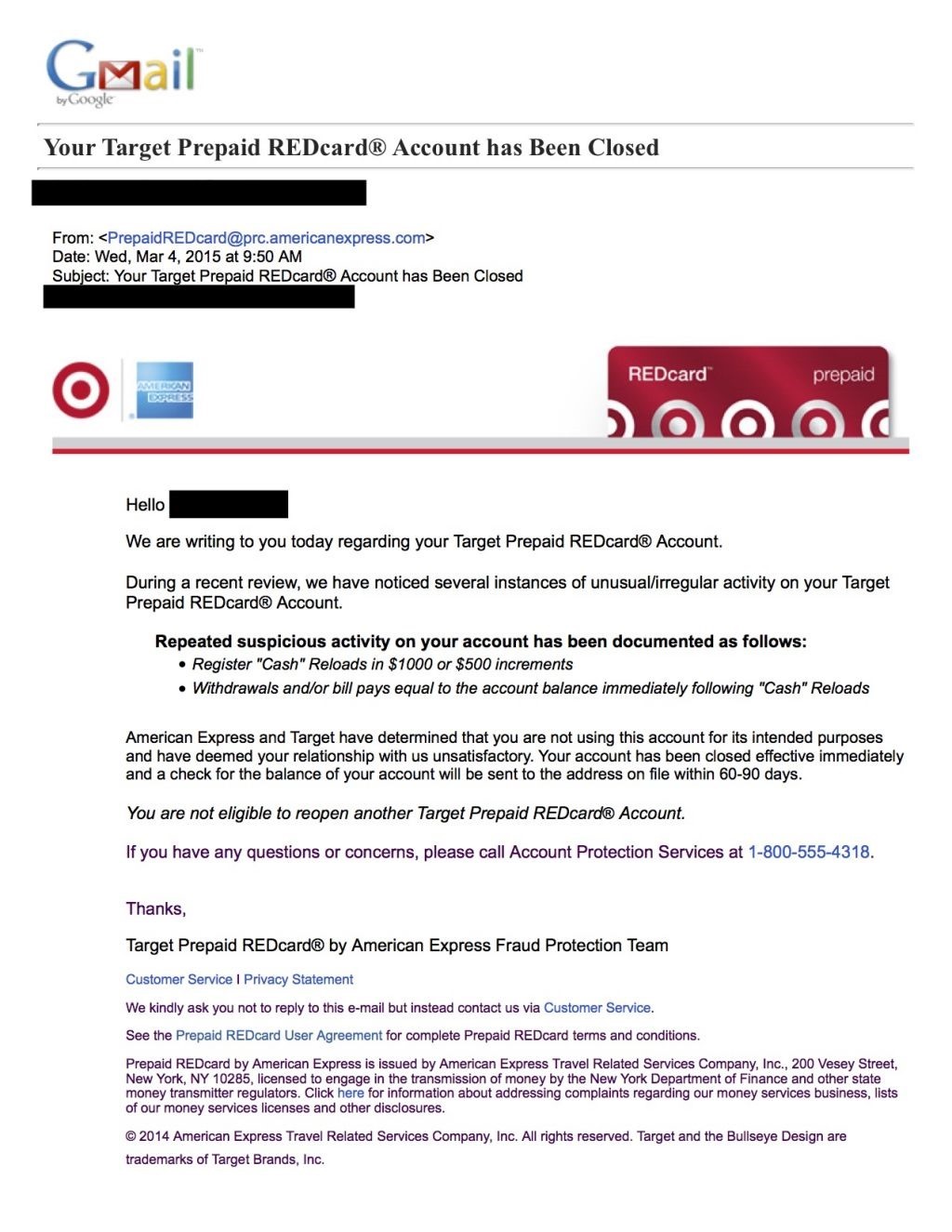

On Flyertalk, RFDMinnesota set off a firestorm today by posting an email purportedly from American Express stating that they were closing RFDMinnesota’s REDcard account for using it in ways not intended (found here). The email describes as “suspicious activity” the behavior of loading the card in $500 and $1000 increments and then immediately unloading it through withdrawals or bill pay.

I find this surprising for a few reasons:

- People have been doing the exact same thing with Bluebird and Serve for a couple of years now yet there have been no reports of shut downs.

- Usually when something like this happens, there is an immediate flood of people reporting that the same thing happened to them. At the time I write this, I haven’t seen evidence of that yet.

I’m posting this information not with the intent of scaring anyone, but rather to try to collect information. Do you load and then immediately unload your account? Have you received an email like this one? I manage four accounts, but all are fine so far. That said, I always keep an odd balance on each card, and I pay bills in odd increments.

Safe Practices

Regardless of whether or not the email is real, I think it is a good idea to do the following:

- Always keep a balance on your REDcard. After all, you never know when you’ll need it to buy stuff at Target (and get 5% off).

- Use the card regularly at Target and/or Target.com for regular purchases.

- Unload via a combination of bill pay, ATM withdrawals, and withdrawals to your bank account. Make bill pays in realistic amounts. How many bills really come to exactly $2,500 for example?

- Consider using the card for some regular spend outside of Target as well (I can’t bring myself to do this since it means losing out on credit card rewards from other cards, but its probably a good idea)

There is quite a bit of a debate about whether it helps to load the card in odd amounts too. For example, some people recommend loading something like $468.03 in one transaction and then $531.97 in another. My guess is that the load amounts don’t matter. I think they would expect people to load even amounts. It’s the unloading that is not expected to match exactly the load amounts.

Oh, and here is the image of the shutdown email that was posted on Flyertalk:

Read more about REDbird:Also: |

|---|

[…] Real or hoax? Your Target Prepaid REDcard Account has Been Closed – There have been a few reports of REDbird account shutdowns. Find out what happened & why these accounts were supposedly shutdown. […]

[…] folks have said they’ve received emails from Target which state their accounts will be shutdown for suspicious activity. This could be a hoax. But it’s also important to […]

If you google “redcard resales” they are now offering the target prepaid redcard online. Is this an authorized reseller? Looks like a very legitimate website. May be a way for Target or American Express to unofficially offer the card to people outside of test markets.

Are you joking? You think Target and Amex are teaming up to offer cards where THEY chose not to offer them? Also, the website is in all caps and I’m not sure Amex is using the email address redcardresales@gmail.com

[…] down for rapid loading and unloading of his account. The consensus on that one is that this was probably fake, but hearing that you can still possibly open another prepaid product makes it a little less […]

I went to a listed RedCard seller in North Carolina on Wednesday (3/4) to finally get a card and was told that RedCard had been an experiment and that the experiment had not worked out thus they no longer carried the cards.

That’s true for North Carolina only. They had technical issues with REDbird and withdrew them from stores.

Target cashier asked me about loads: showed me 25 $100 Visa gift cards that someone used this morning to load $2,500.

I know why it was done, but by what math can it be profitable with all those fees?

It makes me think either the person doesn’t understand the cost – or is doing fraud.

What do you think?

There are often deals on smaller denomination gift cards at OfficeMax, Office Depot, or Staples. I publish these often through my Quick Deals page. It doesn’t surprise me at all that someone had so many gift cards to unload.

I’ve now seen 3 different screenshots posted between this blog and View From the Wing. Not a single one includes a piece of the browser or URL in the screenshot, and only one includes the e-mail provider logo. Yet all 3 look identical otherwise, plus minus a To address and a greeting.

But let’s say all 3 use Gmail. Plausible. Except that there is no way this e-mail could have been generated. Why? This is clearly Print-friendly view. But it is not the Print-friendly view you get today; while similar, there are notable differences. The printout of a different browser? Prove it.

In their T&C they state they won’t close an account with a balance on it unless the card owner specifically authorizes them to do so. Basically if they did close your account for suspicious spending you could still get your money out in a timely manner they just wouldn’t allow you to load or spend with it. I believe for that reason this is a hoax. At 60-90 days it seems like something a CC company would do while at the same time scaring people into believing they would have to cover a potentially $5000 credit card bill for 90 days.

I think those Target employees have been wearing their Khakis a bit too tight….

The point of uneven amounts its not for REDcard, its for your credit card. The loads show as Target purchases on your credit card; how many real Target purchases of $1K/month does one do? The thought is that if a bank programs its comp to flag repetitive even amounts, in general or at X store, you might be a candidate for a human reviewing your acct.

As far as the REDcard side of things, I’d suggest stay away/minimal from things that might look like cash advances to yourself or money laundering. This includes repetitive and big ATM withdrawal amounts.

P.S. On places like this blog where anyone can post with any handle, I would take reports of shutdowns with a grain of salt. I’m sure we’ll hear it real fast is this happens for real as there’s thousands of people MS-ing with REDcard (I alone have sold it to hundreds) many of whom like to push the limits.

this event coincide with today’s news of Target cutting workforce. Not sure if Target is tightening the belt.

Can someone with an account that has been shutdown show what their login page shows when you try to log in?

If it still allows you to login, it should mention that your account has been closed.

Can anyone show these as proof?

TIA

[…] Miler had an interesting article out this afternoon called Real or hoax? Your Target Prepaid REDcard Account has Been Closed where he tried to determine if the above email was real or fake. Personally, I think the email […]

[…] Specifically http://frequentmiler.boarding… […]

[…] Frequent Miler wondered if it’s a hoax. […]