NOTICE: This post references card features that have changed, expired, or are not currently available

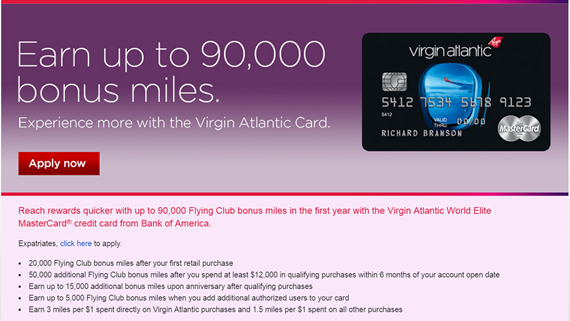

Today I applied for four identical Virgin Atlantic credit cards. The cards are advertised as if they have a 90,000 mile signup bonus, but I think that’s misleading. 15,000 of the 90,000 miles are from the annual anniversary bonus for spending $25,000 in one year on the card. And, this bonus is available to all cardholders – it is not tied to this signup offer. I prefer to think of this offer as a 75,000 miles signup bonus with a very high spend requirement ($12K). You can find my full analysis of this offer here.

Still, despite the offer being less than advertised and despite the heavy spend requirement, I decided to go for it. For background, remember that I pondered recently whether to try to earn 1.2 million Virgin Atlantic miles for a week on Richard Branson’s Necker Island. And, yesterday I declared that, despite all common sense to the contrary, I would go for it but that I was waiting for the Virgin Atlantic offer to reappear. While the e-ink was still drying on that blog post, the 90K-ish offer reappeared!

Going Big

Please keep in mind that things I do are not recommendations for others. I do some crazy things because I can. Today, the crazy thing I did was to apply for four Virgin Atlantic cards at once. In retrospect, the “at once” part wasn’t really necessary, but my hope was to get 4 auto-approvals at once. Here’s what I did and what happened…

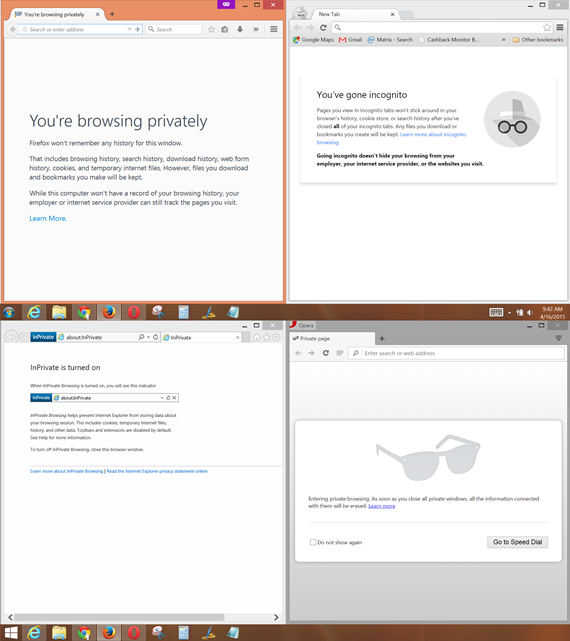

1. I opened four different browsers, each in private / incognito browsing mode.

This was to prevent the chance of cookies from past applications from negatively affecting these applications.

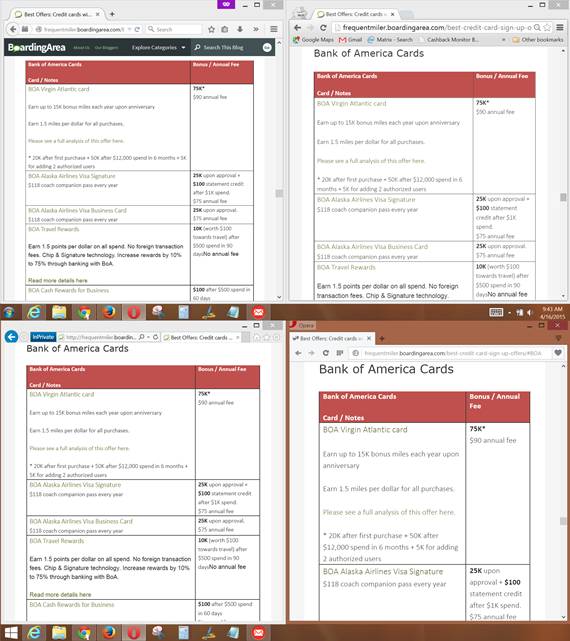

2. I found the application links on my Best Offers page

I used the URL shortcut bestoffers.frequentmiler.net and jumped to the Bank of America section:

Sadly this is not an affiliate link.

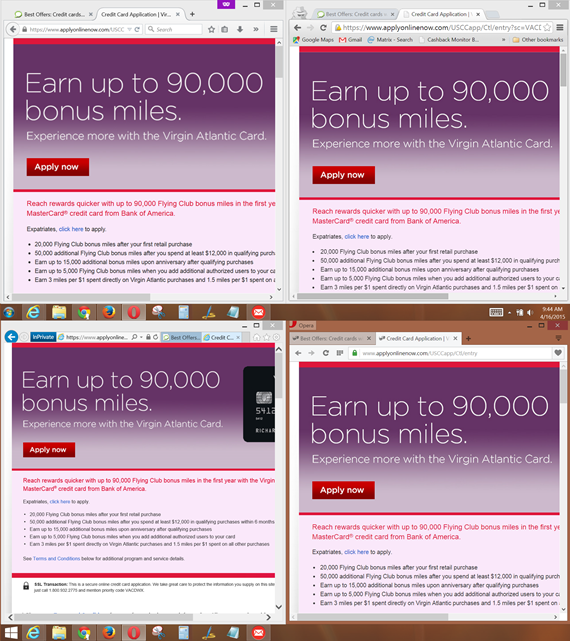

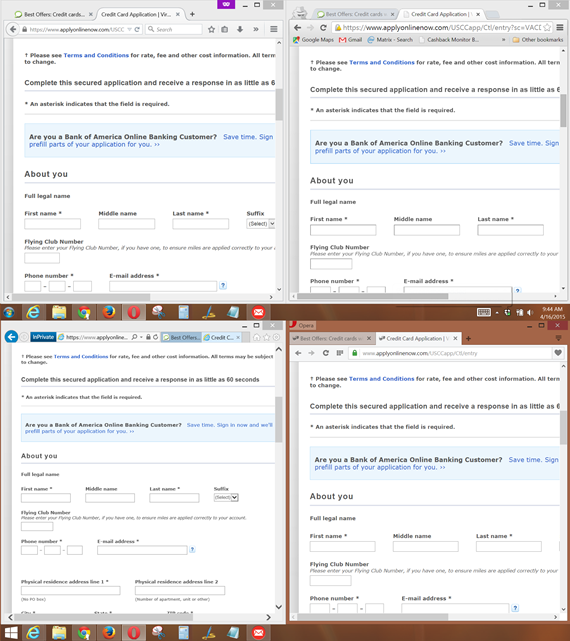

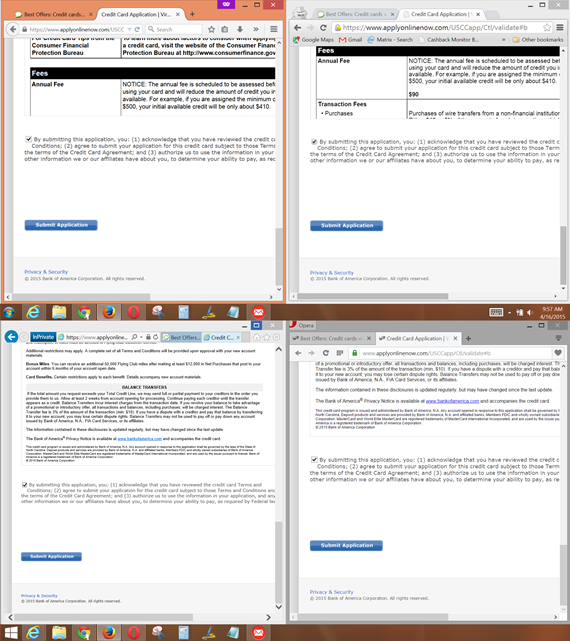

3. I clicked through to the application pages and began filling out the application on each page

For each screen transition / button, I clicked each one as quickly as I could after each preceding one. This was really unnecessary until the final “submit application” button, but I did it anyway.

The app:

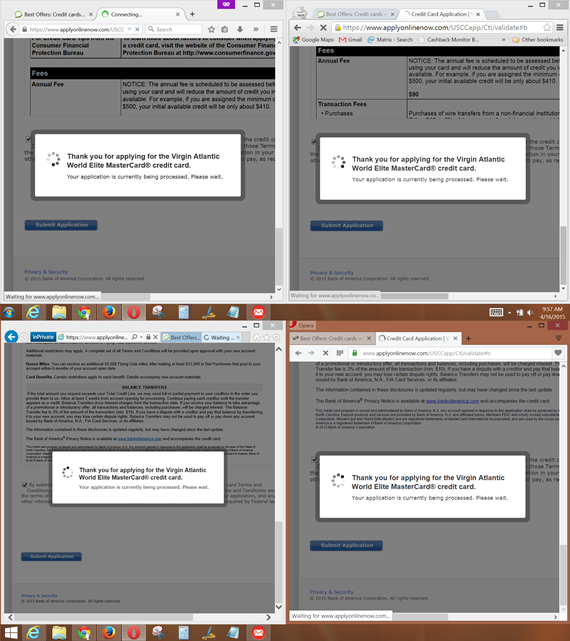

4. I submitted the applications

I raced to click each “submit application” button as quickly as possible after the preceding one:

Then I had a short wait:

After a short wait, only one of the four windows showed an instant approval. The other three said that I would be notified within 30 days. The instant approval was from the first browser in which I submitted the application. I guess my subsequent clicks weren’t fast enough.

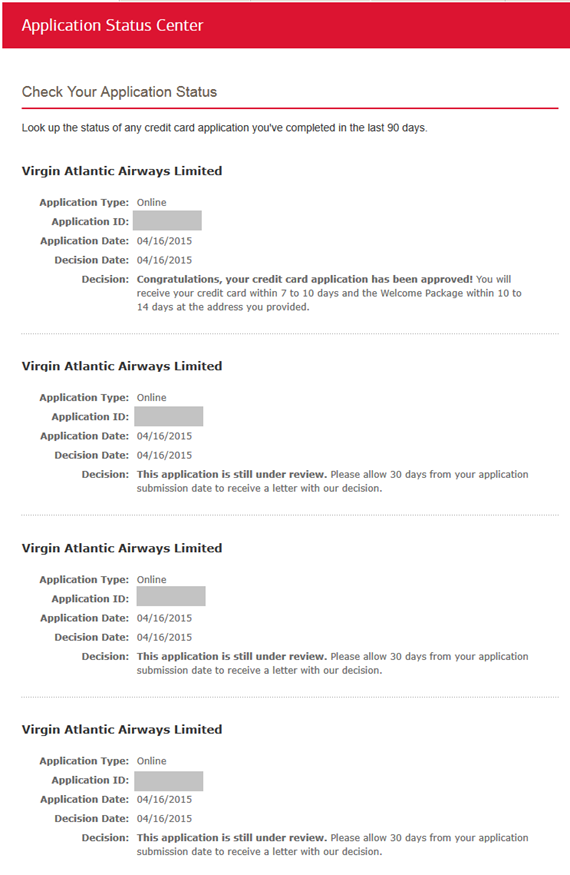

5. I checked the application statuses

A quick Google search told me that you can check on your Bank of America credit card application status here: www.bankofamerica.com/credit-cards/application-status/app-status-form.go. As expected, I found one approval and three “under review”:

6. I called to expedite the process

I called BOA to see if my application reviews could be expedited. I spoke with a wonderfully friendly woman who didn’t bat an eye (as far as I could tell over the phone) when I told her that I was hoping to get approved for four of these cards.

I’m not sure what I would have told her if she asked why I wanted four cards. I considered the old “I want to keep my budgets separate”, but was leaning towards a more truthful “I want to go to Necker Island”. I’m glad it didn’t come up.

After reviewing my account, she saw that one of the four applications had been closed as a duplicate. She re-opened it. She then told me that the auto-approved card was given a $20K credit limit and that she could give me a $5K limit on each of the 3 other cards. I happen to have a BOA Better Balance Rewards card with a $17.5K limit so I asked her if she could distribute $15K of that limit across the 3 cards. No problem. Now I’ll have one card with a $20K limit and three with $10K limits. Success!

How this may add up to 420,000 miles

Each card is worth 93,000 miles within 6 months, as follows:

- 20K bonus after first purchase

- 5K bonus for adding two authorized users

- 50K bonus after $12K spend in 6 months

- 18K mile earnings from $12K spend (this card earns 1.5 miles per dollar)

- Total: 93,000 miles

I could also work towards the annual bonus of 7,500 miles after $15K spend. The cards also offer another 7,500 mile bonus upon reaching $25K annual spend, but I don’t think it is worth it to spend $10K more per card for that small of an extra bonus. So, I would earn:

- 7.5K bonus

- 4.5K mile earnings from additional $3K spend (above the $12K spent anyway)

- Total: 12,000 miles

Overall total: 105,000 miles per card x 4 = 420,000 miles

Why 4 cards in one day?

First, I was hoping for automatic approval. Even without that, though, doing multiple applications in one day makes sense. Often, when a person applies for multiple credit cards from the same bank on the same day, credit bureaus will combine the credit inquiries into one. So, by applying for multiple BOA cards in one day, the negative effect of four hard inquires on my credit should be minimalized.

Please note that this trick won’t work with most other banks. Most banks would prevent you from getting more than one of the same card at the same time.

Why not more than 4?

Remember that $12K spend requirement per card? Yeah, that’s why.

Plus, even though I’ll likely end up with only one hard credit inquiry from the four applications, I will have four new accounts on my credit report. This can negatively affect my credit score going forward. I didn’t want to push it with more.

Should you do it too?

Probably not. Keep in mind that Virgin Atlantic miles are not particularly valuable compared to most other airline miles. For example, most would agree that the BOA Alaska 25K offer is a much better deal than this one. And, as I expounded at length in my prior post about Necker Island, there are far better things you can do with your points and miles.

Hat Tip: Rapid Travel Chai

My friend Stefan, author of Rapid Travel Chai, seems to be all-knowing when it comes to the ins and outs of applying for rewards credit cards. He speaks often about topics like these at Frequent Traveler University events and Chicago Seminars. To figure out how best to take advantage of this Virgin Atlantic offer, I consulted with him directly and he was a huge help!

[…] mainly me who participates in this activity. I don’t churn as aggressively as others, nor do I plan my churning as well as I’d like (yet). I’ve gotten better over the […]

[…] after I successfully signed up for 4 Virgin Atlantic cards in one day, I started hearing that BOA had changed their approval process. I experienced the new process […]

[…] 420,000 miles closer to Necker Island […]

[…] if you can get a couple Virgin Atlantic bonuses (at once), you can easily rack up enough points for 4 nights at top […]

[…] to get 1.2 million Virgin Atlantic miles for a trip to Richard Branson’s private Necker Island, I previously signed up for four Virgin Atlantic credit cards at once. Thanks mostly to REDbird, I quickly met the spend requirements and earned about 90,000 miles per […]

[…] reading closely some tutorials about applying for, and getting approved, for multiple Bank of America cards in one […]

[…] been posting success stories of applying for the same card in the same day (e.g Frequent Miler on Virgin Atlantic & Million Mile Secrets with AS). There are some reports of shut downs for this behavior, I […]

Another crazy thing you did was report this

[…] my ridiculous quest to visit Richard Branson’s Necker Island, I signed up for four Virgin Atlantic credit cards. A week on Necker Island costs 1.2 million Virgin Atlantic miles. My strategy to get there is […]

[…] Miler got 4 Virgin Atlantic cards at once. (as part of his insane plan to try and get 1.2 million Virgin Atlantic miles to spend a week on […]

FYI – Applied for 3 Alaska Airlines card today with $100,25k points offer. Instant approval on first, approval on second after calling the phone number. Got denied for third one as per the new BoFA policy of 2 credit card applications in 90 days.

Sounds like you talked with the wrong agent

Hi Greg,

Did you literally use four different browsers (IE, Chrome, Firefox, etc. on multiple computers) or did you have multiple tabs in incognito mode under one browser?

TIA…Cheers!

I did literally use four different browsers: IE, Chrome, Firefox, and Opera. That said, there’s no reason to other than the spectacle of it. There’s no reason to even use multiple tabs. It would end up the same to do one application at a time in one browser tab

[…] of card membership. Some spend requirements are much higher. For example, I recently signed up for multiple Virgin Atlantic cards each of which required $12,000 of spend in 6 months to get the full bonus. And, I also signed […]

How many days did you wait before calling and getting the approval?

I tried calling the a few hours after submitting the application and the next day but 3 reps I spoke to are all saying that they can’t make changes to the application and I have to wait.

I called minutes after applying. Make sure to use this number: 866-811-4108

[…] soon as you get a card, get another. They do not care. FrequentMiler got 4 Virgin Atlantic cards in one day, had to call for about […]