NOTICE: This post references card features that have changed, expired, or are not currently available

When the Discover It Miles card was first introduced, I was excited about the potential (see: Discover introduces a new card and a potentially VERY lucrative 1st year offer). Instead of a standard signup offer, Discover has promised to double all miles earned on the card in the first year. The card is essentially a 1.5% cash back card, but for the first year it really earns 3% cash back. That’s an excellent rate of return, but that wasn’t what I was most excited about.

The really exciting potential, I thought, was with the Discover Deals shopping portal. I wrote:

I haven’t received confirmation from Discover about this yet, but I believe that means that points earned through Discover Deals will also be doubled! Discover Deals is already my go to portal / savings engine for a vast number of opportunities. Can you imagine how lucrative it could become if all points earned were doubled at the end of the year?

The Discover Deals website offers most cardholders a combination of discounts and extra cash back at merchants if you first click through from the site. My hope was that we would be able to take advantage of extra miles deals with the Discover It Miles card and then have those miles doubled at the end of year 1.

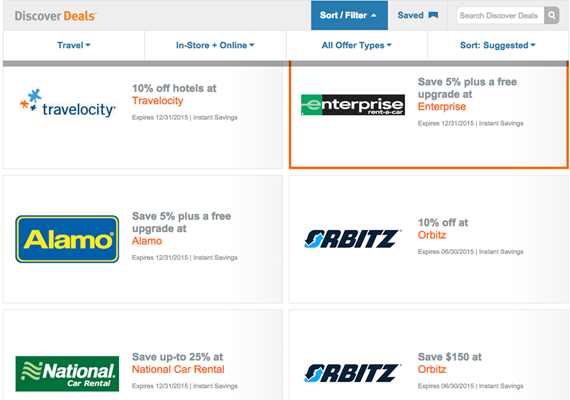

Unfortunately, it looks like Discover It Miles cardholders are not offered the chance to earn extra miles through Discover Deals. Via Twitter, Perryplatypus told me that he was unable to find any deals for extra miles when logging in with his Discover It Miles account, but when he logged in with a regular Discover It account, the usual cash back deals were available. With the Discover It Miles account he found only discounts:

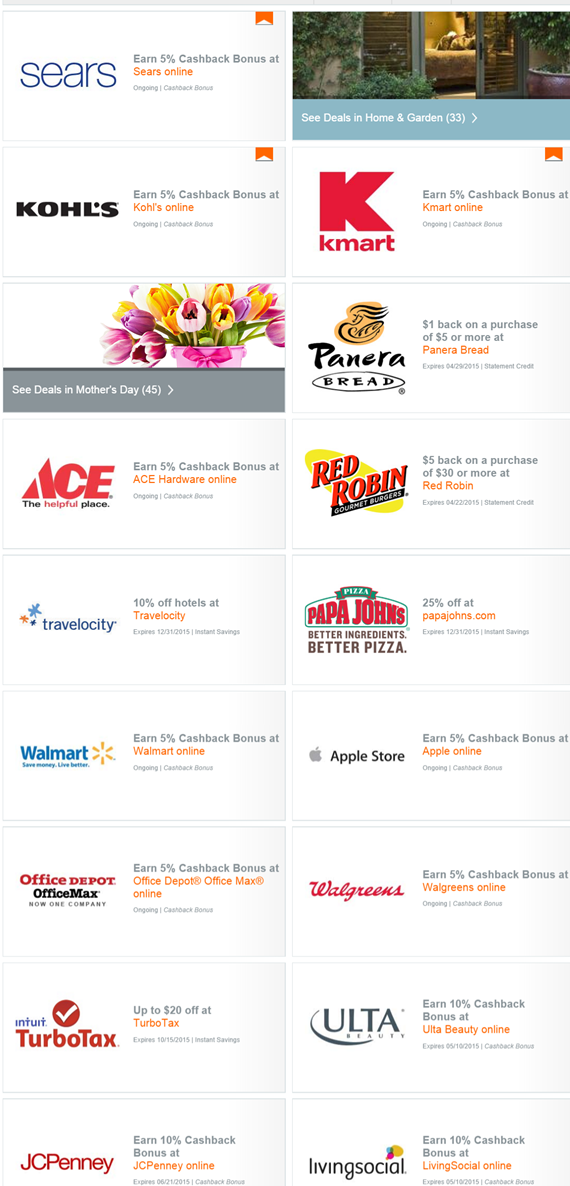

Contrast this to what you might see as a regular Discover It (not Discover It Miles) cardholder. Note that there is a combination of discounts and cash back bonuses (such as an extra 5% cashback bonus at Sears):

But 3% cashback is good, right?

Yes, 3% is good… if you spend a lot of money on the card. Suppose you spend $50,000 on this card in one year instead of spending the same on a 2% cash back card. You would earn a total of $1500 worth of “miles” (which can be exchanged for cash back). With a 2% cash back card, though, you would have earned $1000. So, the Discover It Miles card, for the first year, is $500 better. It’s like a $500 signup bonus for those who spend $50,000. If you were to spend only $10,000, though, you’ll earn only $100 more than with a 2% cash back card, so the “signup bonus” would be minimal.

What is the risk of a shutdown? Since miles aren’t doubled until the end of year 1, people worry that Discover will shut down those who spend too aggressively with this card. If that happens, cardholders might get the 1.5% cash back they had earned so far, but they almost certainly won’t get double.

So, those who spend too little won’t gain much from the card, and those who spend too much (i.e. those who manufacture tens of thousands of dollars in spend per month) risk getting shutdown and losing out on the rewards doubling. Personally, I wouldn’t risk more than $50,000 of spend in the first year with this card. And, after the first year, there is little reason to use the card since you can do better with other cards.

Recommendation

If you’re a heavy spender who can easily spend up to $40,000 or $50,000 in a year, and you value cash back this seems like a worthwhile offer. Those who spend much less, or prefer “real” miles (miles that can be redeemed for award flights rather than as cash equivalents), would do better elsewhere.

[…] shopping: As I’ve written about before, even though both cards have access to “Discover Deals”, most online shopping offers are […]

[…] Discover It Miles not as lucrative as I had hoped (The Frequent Miler). I don’t bother with pure cashback MS, I don’t have the scale to justify compared to credit card sign-up bonuses and annual big spend bonuses. […]

[…] Discover It Miles not as lucrative as I had hoped – This card is missing one feature which really hinders its value proposition. […]

I’m real pissed at discover for doing this to me. It’s also a 0% intro apr card so they usually give poor limits.

Since I’m pissed, I’m going to abuse teh rewards program and do a bunch of MS on this card. Buying amex GC sounds good.

[…] Will Discover really double all points earned including those earned through Discover Deals? Note: Please see an update here: Discover It Miles not as lucrative as I had hoped. […]

This is the kind of post that puts you in the HOF because you dare to put yourself on the line for the most inane and dubious offers just to be the point man for us and say “no, that’s a shitty offer”……………..On the other hand, today, I tasked my lovely wife to do her Smart and Final daily run from the groundwork you laid long before………..you have made our lives better Frequent Miler and we love you for doing that!

I got the It Miles card and just started Redbird loads. I’m still uncertain about waiting an entire year for essentially what is the “signup bonus”. I have the Arrival, may just stick with that. Not sure.

My guess is that you’re safe if you stick to around $4K or less per month ($5K is probably safe too). That way you’ll still earn a lot more for the year than with the Arrival

I use my Miles card to buy AGC through cashback portals and use the AGC to load Redcard. Get more value that way than direct loading, and no complaints from Discover so far.

Does anyone know if you can convert a regular Discover IT card to Discover IT Miles, and if so, get the 3% for the first year?

Yes. When I applied for the Disc-Miles card, an agent actually called me to ask if I wanted a card conversion or a 2nd card (with credit line reallocation).

The Discover deals page could be accessed at the bottom of the homepage under rewards

https://www.discovercard.com/cardmembersvcs/deals/app/home?

Yes but the deals page lists only discounts not extra miles offers

The only cash back offers I see is for cruise-lines under the Discover miles

Can you detail the cruise line offer here?

I happen to try a couple of those discount offers for rental cars. None of the discount codes worked. I got the message every time that the offer was not available at your rental location. So I wouldn’t even count on those deals either.

Also, are gift cards available for using rewards?

I don’t think they offer discounted gift cards the way Discover It does, but I hope someone with a Discover It Miles card can verify?

Re giftcards: I just have the miles card and the only options are cashback to bank or statement credit for travel. I’ve heard some say that you can transfer to your Discover IT account (in which case you could get discounted gift cards that way)

I was thinking this would be a good option for loading Redbird, but maybe not.

I think it is a good option for that since with Redbird you can easily do enough spend to make it worthwhile

Not sure why people think we will get shut down. I suppose anything is possible but we don’t have any data points to support that. In two months I’ve done 20k, 10k each month, and will be stepping things up a bit to cycle credit faster and anticipate 15k per month for the rest of the year. I make sure that I’m turning a profit on the 1.5% and use the rewards each month to cover the cost of MS.

True, we don’t have any data points regarding this with Discover, but there is a long history of banks shutting down accounts when they offer short term higher payout rates and cardholders ‘abuse’ the privilege by spending massive amounts on the card.

I only have the regular Discover It card, and I got a very strange call a few months ago asking me about various large purchases at grocery and drug stores. I had a targeted spending bonus in the middle of 2014 that required large monthly spending for six months. The purchases were about 6 months old, so I told the rep that I couldn’t remember exact purchases (which was true). My card is still open, but it was definitely bizarre. Still not sure what the concern was.

I am in the midst of one of those offers on my old regular discover. Spend $3000 per month for six months (through July) and earn $500 cash back.