NOTICE: This post references card features that have changed, expired, or are not currently available

Towards my ridiculous quest to visit Richard Branson’s Necker Island, I signed up for four Virgin Atlantic credit cards. A week on Necker Island costs 1.2 million Virgin Atlantic miles. My strategy to get there is simply to sign up for lots of cards. After meeting the $12K spend requirement, per card, I’m now almost a third of the way to my goal.

When looking at the miles that posted to my Virgin Atlantic account, I found something interesting…

First a little background info

The Virgin Atlantic Word Elite credit card is a reasonably profitable card for a frequent flyer. It earns 1.5 miles per dollar for all spend (and 3 miles per dollar on Virgin Atlantic purchases), plus you get bonus miles at the end of the year for high spend. $15K spend results in 7,500 bonus miles; $25K spend results in another 7,500 bonus miles for a total of 15,000 bonus miles. If you were to spend exactly $25,000 in one membership year, you would earn 37,500 base miles plus 15,000 bonus miles for a total of 52,500 miles. That’s an average of just over 2 miles per dollar. Even though Virgin Atlantic miles aren’t nearly as valuable as many other mileage currencies, a 2X average is pretty good.

Another perk of the card is that you earn one tier point for every $2,500 of spend. You can earn up to two tier points per month and a maximum of 24 tier points per year. Tier points are used to determine your elite status, as follows:

- Earn 15 Tier points in a rolling 12-13 months and you will reach Silver.

- Earn 40 Tier points in a rolling 12-13 months and you will reach Gold.

Status benefits can be found here:

Status through credit card spend

Since the credit card offers one tier point for every $2,500 of spend, you would think that you could earn Gold status by spending $100,000 with your Virgin Atlantic credit card. But you can’t. Thanks to the 2 tier points per month limit, the best you can do is qualify for Silver status. Right?

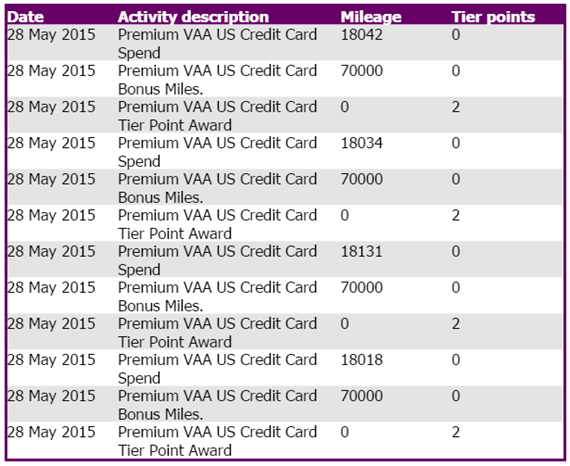

Not so fast… Take a look at the recent activity on my Virgin Atlantic account:

You can see above that I earned the maximum of 2 tier points from each credit card. My account now shows a total of 8 tier points that were earned in one month.

In my case, I met all four $12K spend requirements in one billing cycle, but if I was interested in elite status I could have done the following:

- Billing cycle 1: Spend $5,000 per card; earn 8 tier points

- Billing cycle 2: Spend $5,000 per card; earn 8 tier points

- Billing cycle 3: Spend $2,500 per card; earn 4 tier points

At the end of 3 billing cycles I would have spent $12,500 per card and I would have earned 20 tier points and met the minimum spend requirements. If I then signed up for 4 more cards and did it all again I would earn enough for Gold status!

Is it worth it?

To me, this is merely an interesting find rather than a practical one. Most of Virgin Atlantic’s elite status benefits are only useful for those who fly Virgin Atlantic often. I have yet to fly them once. Those who fly Delta without status might find some of the perks interesting though. Gold status gives you a sort of Delta elite status “light”:

- 100% bonus on base miles flown (if you credit paid flights to Virgin Atlantic rather than to Delta)

- Priority baggage, Check in, Boarding and Security with Delta Air Lines

- Extra Baggage (extra piece of baggage is available in Economy Class only) and access to preferred seating

- Upgrades to First Class when travelling on Delta’s US domestic network (not including certain routes between New York and LA, San Francisco, or Seattle)

- Gold members will be able to access to any of Delta Sky Clubs® (must have a transatlantic sector to/from the UK within the itinerary, when travelling in Economy Class).

I plan to sign up for more Virgin Atlantic cards soon. Maybe I’ll go for status just for fun. I wish they would offer Gold members a discount on award redemptions. A 10% discount, for example, off the 1.2 million Necker Island award would be worth striving for. What do you think Richard? Time for a new Gold perk?

[…] Expert tip: it is very likely that there is a sneaky way to earn elite status through credit card spend alone. See this post for ideas. […]

[…] http://frequentmiler.boardingarea.co…necker-island/ […]

Citi is apparently offering a 25% transfer bonus to Virgin Atlantic thru 8/25/15:

http://www.milevalue.com/25-transfer-bonus-from-citi-thankyou-points-to-virgin-atlantic/

Wouldn’t this make your quest a lot easier…?

Thanks! Quick Deal coming soon

[…] FrequentMiler made an interesting find this week, a way you can manufacture spend your way to gold status on Virgin America. […]

Hey Greg, put this on the list for when you get there:

https://www.youtube.com/watch?t=64&v=Ih9yF0UY9vs

[…] An interesting find on my way to Necker Island by Frequent Miler. For me, file this under interesting but useless (I don’t chase status). […]

I normally don’t bother to comment but some of the negativity I’ve seen here lately is too much. This is the best blog bar none. It’s fun, informative, and not at all pushy. No one thinks the Necker Island is a reasonable goal, but it makes for great blog material!

Whenever I do apply for a credit card I SEARCH out YOUR links, even if some other blogger is spamming it 100x a day.

Can someone explain how this only costs 1.2 million Virgin Atlantic miles? I was thinking about doing this, but the website https://www.virginamerica.com/cms/elevate-frequent-flyer/partners/hotel-partners/virgin-limited-edition/Necker-Island

says it is 1.75 million miles. Is there some other discount? If someone can explain why their website says 1.75 million and this post says 1.2 million, that would be helpful. Thanks

The link you found was for booking with Virgin America miles. I’m planning to use Virgin Atlantic miles. The Virgin Atlantic price can be found here: http://www.virgin-atlantic.com/us/en/flying-club/flying-club-partners/virgin-group/necker-island.html

Thanks!

Arithmetic check: you’d actually have to spend $5,000 per card per month and $100,000 total to earn gold status. Obviously the more cards you have the faster it could be accomplished. To earn gold status in 3 months you’d need 7 cards, which is a happy medium because you could meet the $15k spend threshold simultaneously.

Thanks Kevin! That was a big error on my part. I’ve updated the post with (hopefully) correct numbers now. I kept the 4 card example for now, though.

Your example is way more realistic, but the reason I think of this card as having a $15k threshold is that the 7500 anniversary bonus supposedly posts after you meet the spend and not just on the anniversary date.

Ooh, I didn’t know that! If I could find proof of that I’d consider adding $3K spend to each of my current cards before cancelling.

Haven’t tested it myself because I’ve been busy meeting the spend of my additional cards I acquired through the Spanish line (RIP), but I read it on FT a few months ago. I’ll try to track it down.

Rats!

Why did you add RIP to the Spanish line? No longer works?

The card terms aren’t promising: Earned Anniversary Flying Club miles will be posted to your Flying Club account each year within four to six weeks of the anniversary of your card’s open date.

Yes, I guess I’m wrong about this. There’s a recent FT datapoint that indicates the bonus posted on the statement closing before the anniversary date.

BTW, As a gold member, you are allowed free date changes on awards. As I’m based out of SFO, I like virgin program for VX and HA redemptions.. this is the most useful feature for me.

You’re right. Free award changes are a huge perk.

FM, nice find.. I may fly VS because their timings from SFO are so good.. departing 09:25 PM.. that’s really awesome.

I love your blog and apply through your links.. I’m sure you have learned to ignore people like Askia. You should know that for every Askia there are 100s of fans who are silent admirers.

Thanks

Will you take me to Necker Island with you? I will carry your bags.

Sure, but unless you have 1.2 million miles, I don’t think they’ll let you stay 😉

Now that Redbird is done with free credit card loading i really want to know how much you are paying in fees by partaking in this experiment?

Basically a “live run” on how your spending/manufacturing $50k+per month and if your buying gift cards how much are you spending.

My only thing, and I could be wrong, is that you have a nice “go to” method that your using and not sharing due to it getting shut down. Can you break down with transparency how you will hit the spends and your associated costs?

Thanks!!

That’s a good idea. I’ll see if I can dig up the details to put that together.

Does not take much money to do 50k – it might take a bit of time though. I could spend 50k and even come out ahead by a few hundred, but it would be quite a painful exercise.

@FM – Please don’t kill the little that is remaining with overexposure. Trust you to judge the fine balance.

Abby – You mentioned a few times that Chase has shut down yours – and others accounts for doing the same thing. But, he’s not applying for 4 cards at once with Chase – he’s applying with Bank of America. People have been churning Bank of America cards every few months for years. I doubt that he received any preferential treatment because he is a blogger, any one can do this.

frankly, all this ‘quest’ shows me is that blogger affiliate partners are allowed to do things that we can’t.

you have no fear of shutdown. the things you do with chase would have you banned for life if you weren’t an affiliate (i was banned for life by chase for doing a fraction of what you do- along with many many others). with a wink and a nod, you ‘push the envelope’ to spur others to sign up with your links. you’ll counter that you do get shut down- yeah, by prepaid companies, NEVER by your affiliate partners.

you churn cards and MS with impunity. i have no problem (many do, i don’t) that you make your income thru affiliate links. i do have a problem that the things you do, with the full knowledge of your affiliate partners, will get your readers shut down. given that a chase shutdown is for life and that there is NO WAY you would pass an Amex FR unscathed given the level of your MS, the double standard is, well, tantamount to entrapment.

I’m sorry that you got the wrong idea here.

1. I signed up for Bank of America cards, not Chase cards

2. I do not have affiliate links for cards discussed here

3. When banks decide who to shut down they don’t check with their affiliate marketing department to see if its OK. The department that handles shut downs wouldn’t have any idea who I am.

4. I write frequently about the risks involved in activities like these.

i know what cards you applied for. you have the affiliate link on your CC page.

i brought up chase as a first hand example. i SERIOUSLY doubt there isn’t a quid pro quo- whether you’re directly aware of it or not. the banks read their affiliates’ blogs- there are many examples of them forcing changes of either content or profanity, for example. you KNOW this, so don’t be coy. ergo, they KNOW who you are, they KNOW what you’re doing. when non-affiliate cardholders do stuff that puts them on their radar, they get shut down. you, and other affiliates, ARE on their radar but nobody gets shut down. coincidence? not. even when doing 1mm mile march madness, aggressive churning/MS AND… writing about it with them editing your content. but *somehow* you are still standing. hmmm…

your risk disclosure is cya- but you are smart enough to know that people read your over the top exploits and rationalize that if you’re still alive, they will be ok since they are doing a fraction of what you do.

i’m convinced that, if i were a top chase affiliate, i’d still have my accounts open. chase pays you to tell people about things that chase will then take adverse action against them for emulating. from a legal standpoint, this is VERY questionable behaviour by chase/others.

my comment wasn’t anti-you. it was anti-bank. if they’re going to compensate you for driving CC sign ups with your content, it’s unethical and, arguably, illegal to take punitive action against those who follow your sponsored ‘advise’ (and, yes.. i’ve read your advertiser’s disclosure. it’s BS. they do provide input and they do have rules you must follow- yes?!? YES). one’s credit is not just about a business relationship with the bank. the bank’s adverse actions impact one’s credit worthiness- creates red flags ‘closed by issuer’, reduces average age of accounts and, puts a chexsystems mark when the bank closes your account vs voluntary closure.

you seem a smart guy, Greg. nothing i have said here isn’t something you don’t already know.

Don’t be so bitter b/c you crossed the line and pissed off Chase. I’ve opened 7 new Chase cards (with no pre-existing relationship) in the last year with considerable MS and have never had a problem.

Have you read the recent postings on Flyertalk? People are being denied by chase for opening 5 new accounts with any bank in last 2 years. Nothing they can do about it even calling reconsideration line.