NOTICE: This post references card features that have changed, expired, or are not currently available

Note: As of 10/13/15 the Target REDcard (REDbird) can only be loaded with cash in-store at Target. Gift cards and/or debit cards no longer work to load REDcard. For more info, see: Here is the REDbird memo, “Cash is the only tender guests can use”

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

Bluebird, REDbird (the Target Prepaid REDcard), and Serve are prepaid reloadable cards from American Express. The cards are marketed as no-fee checking account alternatives, but they also can be used to increase credit card spend (to earn rewards). The key is to find ways to use rewards credit cards to buy Visa/MasterCard debit gift cards, at a low price, that can be used in-store to reload these prepaid cards. Bluebird and Serve can be reloaded at Walmart. REDbird can be reloaded at Target. All three have a hard limit of $5,000 in “cash” (really cash or in-store debit or reload card) reloads per calendar month. Serve, additionally, can be reloaded with Amex credit cards online up to $1,000 per month. Once money is loaded to these cards, it can be withdrawn for free in a number of ways: in-network ATMs, link bank account and withdraw online, and pay bills for free with their online bill pay service (Bluebird also offers paper checks).

For complete background details, please see:

- The complete guide to Bluebird, REDcard, and Serve

- How to determine which gift cards work to load Bluebird/Serve at Walmart

- Best options for buying Visa and MasterCard gift cards

- Best options for Serve online loads

Only one per person, but…

Each person is only allowed to have one Bluebird, REDbird, or Serve account. You can’t even have one Bluebird and one REDbird, for example. You have to choose just one. And, if you’re satisfied with $5,000 worth of increased credit card spend per month, one card is plenty.

If you want more than one card, the key is to convince family or friends to sign up for cards and to let you manage them. Your friend must be 18 or older and must have a valid US social security number. Your friend won’t incur any costs, nor will there be any impact on their credit report. Still, I recommend being generous with anyone willing to setup an account for you. My advice is to offer them free hotel nights using your points, free flights, or whatever you think is appropriate.

Friend Signup Details:

- Serve and Bluebird can be ordered online for free. REDbird requires first getting a temp card in-store before registering online.

- Amex uses public records to ensure that the person applying is who they say they are. You are best off having your friend setup the account with their own address & phone number if they do not live with you.

- Amex often requests uploading proof of identity. You or your friend may have to upload photos of their drivers license and social security card, for example.

- Each account needs to be linked to a unique email address. I recommend setting one up for your friend and giving them access to it during the signup process. You may need access to emails from the account later on so its best not to have your friend use their own email address.

- Each account needs a password. Your friend shouldn’t use a password that they use for other things since they’ll have to share it with you.

- Each account needs a four digit PIN. Your friend shouldn’t use a PIN that they use for other things since they’ll have to share it with you.

- Each account needs a security question and answer. I’d recommend telling your friend ahead of time what to choose.

Why managing multiple cards can be a challenge.

Over time, I’ve increased my family and friend collection of “bird” cards and I now manage 7 altogether. At the time of this writing, all 7 are REDbird cards, but I may convert one or two to Serve when I get a chance. There are a number of reasons why managing multiple cards can be challenging:

- Loads and load limits: Each card is limited to $2,500 per day and $5,000 per month of in-store loads. How can you keep track of which cards have already been loaded and to what extent? It can be a huge pain to log into each account regularly to check on it.

- Name checking cashiers: When loading friends’ cards in-store at the register, you may encounter a cashier who wants to compare the name on the card to your drivers license. How do you deal with those situations?

- Logging into accounts: People have encountered problems with logging in and out of different accounts from the same computer and browser. At one point in time, for example, Bluebird bill payments were getting sent to the wrong billers! How can you make sure that things like that don’t happen to you?

- Withdrawing money: When linking a bank account to your Bluebird, REDbird, or Serve account, you will likely be asked to upload proof that the bank account is yours (i.e. the account holder’s). As a result, you probably don’t want to link bank accounts for a card in your friend’s name. If you can’t withdraw to a bank account, then what’s the best way to get your money back?

I have no doubt that there are many good solutions to the above challenges, but I’ll present here the solutions I’ve found to work…

Keep track of loads and load limits

I have a wallet that I use just for this purpose. It has three separate slots. At the beginning of each month, I put all 7 of my cards in the front slot. When I load a card in-store, I make sure to load one card with the full $2,500 allowed per day. I then put the card back into my wallet, but into the middle slot. This way, I know that cards in the middle slot have been loaded half way to the full $5,000 allowed per month. When I later reload a card from the middle slot, I then move it to the last slot. This tells me that the card is done for the month.

Over the coarse of the first couple of weeks each month, I make sure to load each card halfway ($2,500) before “finishing off” any of the cards for the month. This is important only because I sometimes get near to the end of a month and realize that I have a lot of loads yet to accomplish. I don’t usually like to do more than one or two $2,500 reloads per day, but if necessary I could do all 7 in one day. If I had, instead, completed the loads for four of my cards and had three cards remaining with $5,000 yet to reload, then it would necessarily take me two calendar days to max out the reloads (since each reload is limited to $2,500 per day).

A generalized approach would be to use a wallet with just two slots. Put all of your cards in slot 1 at the beginning of the month. As you load each card with whatever amount you’re comfortable with (e.g. $500, $1,000, etc.), move it to the next slot. Once all cards have been moved to slot 2, move them all back to slot 1 and start again. As long as you can remember the monthly total load amount represented by slot 2, you’ll know where you are in the process.

Dealing with name checking cashiers

In my experience, it has been extremely rare to encounter a cashier who compares the name on my “bird” card to the name on my drivers license, but it has happened. My approach to this is to always reload my own card last each month. This way, if I encounter a name checking cashier, I can at least reload my own card (since I know I haven’t maxed it out yet). Then, I try to avoid that cashier in the future. In some cases it may even be necessary to avoid that particular store in the future if they’ve established a store-wide rule about this.

Logging into accounts

As I mentioned above, its possible to encounter serious technical issues if you log in and out of different accounts using the same computer and browser. There are a few good solutions to this:

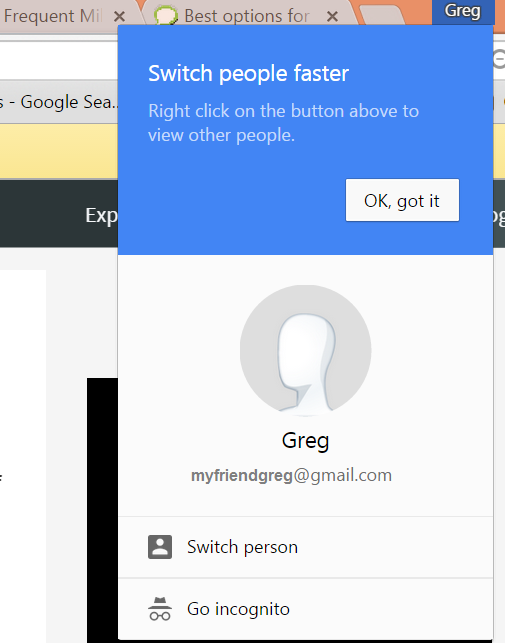

- Use a different browser for each person’s card. For example, I use Chrome for one account, Firefox for another, IE for a third, and Opera for a fourth.

- Use your browser’s private mode (incognito mode in Chrome). Launch a new private browser window each time you log into a different account. You may have to close and reopen all browser windows each time you change accounts.

- Turn off cookies or clear them each time.

- Use Chrome’s “Switch Person” capability. I haven’t tried this myself yet, but I’m pretty sure it would work and would be the easiest and fastest option. So, yes, it is high on my to-do list to do this going forward. You will need a unique Gmail account for each person to do this, but it doesn’t necessarily have to be the same email address that was used to register their bird account (but it would be simpler if it was).

Withdrawing money

Without linking a bank account, there are three options for withdrawing money from your friend’s account (it’s really your money, so its OK to do so):

- Pay your own bills. For example, I regularly pay my own credit card bills from the accounts I manage.

- Send yourself money. Bluebird, REDbird, and Serve have the ability to Send Money to other people who have similar cards. You can send up to $2,500 per month. So, for example, you could log into your friend’s account and Send Money to yourself (make sure to send to the email address linked to your bird card). Once the money is in your own account, you can withdraw to a linked bank account (Settings… Withdraw Funds).

- Withdraw cash. With REDbird cards, withdraw cash for free from any Allpoint ATM. With Bluebird or Serve, withdraw cash for free from any MoneyPass ATM. To me, this is a time consuming and unpleasant way to unload $5,000 per month so I don’t use this option.

Reader suggestions?

How about you? Do you have any tips to share for making it easier to setup and manage multiple Bluebird, REDbird, and/or Serve accounts?

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

I tried to load my Target card at two So Cal locations and failed. I was told they are working on their systems and you are unable to load with a debit card. Anyone else have this issue?

Han, usually–but not always–when Target cashiers say such things nowadays that’s because they don’t know how to work the new registers. Take a look at my guide and see if you can gently nudge them through the steps: https://goo.gl/gjNp7Y

If they don’t let you swipe, that’ another story.

Can I load my greenserve card with a reloadit pak online via the reloadit site, then log on to my serve account to pay bills?

I think so

This chrome plugin is awesome

MultiLogin https://chrome.google.com/webstore/detail/multilogin/nccllfnllopfpcbjdgjdlfmomnfgnnbk

[…] and sticking to a routine. Details of the routine can be found in yet another post: Managing multiples: Bluebird, REDbird, Serve. In that post, I mentioned that a good way to manage multiple accounts online is to use […]

This has worked well until recently when I have had a couple VGC’s declined for an invalid pin…I reset one online and it still did not work the second time. Have you considered outlining a workaround for this issue? I still have the purchase and activation recipes to file a claim if need be. I am looking to reduce the “hassle factor” going forward.

Thank you!

John

I don’t know a good way around that issue. I’ve never had that problem with Vanilla gift cards or gift cards from Simon Mall, but it has happened to me with US Bank gift cards from the grocery store. In those cases, I used up the cards like regular credit cards since resetting the PIN didn’t fix them.

Greg,

You say you pay your credit card bills from the other accounts you manage. When you fill out the “Pay Bill” option do you put anything on the memo line to indicate it was meant for your account even though its being paid by a different person’s BB account? Have you even encountered a problem from the CC company paying your CC from a different person’s BB account?

No, I don’t fill out the memo. I’ve never had any problems.

For the time being I only want to manage 2 RB’s, mine and husbands. He has a temporary RB, I still have a BB.

1. Can I use my BB to load his RB so I can close my BB?

2. Does RB have a feature to set up auto bill pay or do you have to remember to make the payment every month? (sorry, I looked at RB intro and couldn’t find the answer).

3. I’m making a list of bills that are currently on autopay with other cards but don’t earn more that 1X pts/miles. Those are ones I want to autopay with RB accounts. But maybe there is a cc which earns pts/miles for these. Please tell me if there are good cc’s for these or if I should just stick with RB. They are:

AAA auto and home insurance, Freepress, Consumers Energy, Detroit Edison, water, house alarm

1) No, Redbird can’t be loaded with Amex, which Bluebird/Redbird is. Only with pin-based gift cards (besides debit and cash).

2) Redbird doesn’t have auto bill pay. I use Google calendar to remind me of such things.

Pin based cards are not working from what I understand today.

1. You can Send Money from your BB to your husband’s BB, up to $2,500.

2. No

3. Best bet is to use a card that offers great rewards for all spend since those examples do not fit within bonus categories. A good example is the Discover It Miles card which earns 3% for the first year. Or, the Fidelity American Express that earns 2% everywhere

I live in Florida where RedBird is not available. I’ll be in PA next week, can I pick up a card there and reload it in Florida?

Thanks!

Yes

mint works pretty well for serve, but unfortunately Redbird is still in beta.

I’m a total noob, but I’m really excited to learn more about MS. Does anyone have a detailed primer of sorts on MS and its various forms/approaches? I tried drawing my own flow chart just to get my head around it (get card with promo, buy this, load that, pay card off, etc), which helped, but I still feel a bit lost and confused on the real nuts and bolts of how to do it best. How to use Serve, for instance, really confounds me, particularly in light of the limitations it seems to now have. I use online portals a lot for purchases all over, so that I’m familiar with, but in this context I feel less confident, too. Love this site!

This might be a good place to start: https://frequentmiler.com/visa-gift-card-pins-and-example-uses/

Great post……….Macerich mall offices now sell gc for $1k for $3.95………can’t use a AMEX GC to buy…..have to use a Biz card but an SPG earning 1.25 miles drops cost per mile to .316 cents per mile…….I’ll do that all day long………even if it takes a little while for those sweet ladies to process my 15k………cuts down Target cashier time too………

They allowed you to purchase $15K of gc at one time?

Yes…..I put 8k, 6k, and 1k on three different biz cards……….Everybody is happy………..

First month 5k….next month 10k……then 15k……….

No AMEX GC, but can you use AMEX biz cards to buy?

yes

I know Simon offered $1k giftcards with a business account after verifying your business with them. I had no cue about Macerich’s business offerings. Are you saying as long as you have a business credit card you can purchase 1k? No business verification necessary.

Showed. Then tax ID IRS letter. Easy process

Macerich has always sold the $1K cards to “corporate” clients. Be careful with the $1K cards. I eventually got shut down at Macerich for doing them. Corp order dept. apparently monitors them. The $500s seem to be under the radar.

How many 1k cards were you buying? Do they continue to sell you 500 cards?

Actually, I wasn’t buying many $1K cards before they shut me down. My mall needed “approval from corporate” a day or so before I picked up my cards. I bought $10,000 at a time, and liquidated them ASAP. Only did it a few times a month for a few months before they told me they were instructed not to sell to my EIN anymore, as I was “not using them as indicated”.

The mall is actually not as convenient to me as Simon, so without the $1K cards, I don’t go there. I’ve also cut down on Simon, and don’t do business orders there anymore and stick to the $2500/day limit, under the radar…

FYI…An extremely heavy-MSer “titan” told me NOT to do the Macreich $1Ks, and says he doesn’t do them because of rampant shut downs. As usual, YMMV.

I was planning on buying 9k a month TOTAL…….and the mall lady said that corporate had to approve prior to the actual sale…….

Chrome’s switch person feature is a God-send for managing multiple accounts.

It looks like you buy $35,000 worth of GC each month, right? So over a year that is 420K points, but it costs about 1% due to the GC fee, right? So you are paying $4,200 for 420,000 points + alot of time and energy. Is it worth it or am I missing something?

For paying minimum spend for a new card it seems good, but I don’t see the benefit on this scale.

420k x 5x ink points is 2100000 miles

except I thought he said they were bought at Kroger and CVS or something. Plus, INK limits you to 50K

Ink limits you to $50K in spend at 5x categories (250,000 points annually), not 50K in points.

1. I usually start with buying Amex gift cards through a portal so I net about 1% in profits not counting credit card rewards (~2% cash back minus ~1% in fees for buying Visa gcs).

2. I hardly ever earn just 1 mile per dollar. Often I am meeting minimum spend for a big credit card bonus. Or, I’m working towards a big spend bonus. Or, I have a great retention offer that gives me extra points. Or…

If we conservatively say that I average just 1.5 miles per dollar + 1% cash back, then $420K would mean:

* $4,200 cash back

* 630K miles

In reality I’m sure I do far better than that, but I haven’t tracked it precisely.

Yes, its worth the effort to me, but if it doesn’t work for you don’t do it. There are easier ways to earn miles!

Are you using your AGC at CVS to buy VGCs? I’ve just been buying sunnies at Walmarts but I probably get denied about 20% of the time. It’s slowed down my MS quite a bit. I’m probably just averaging 6-8k a month now unlike back when you could use AGC directly on Redbirds and I was doing 20k a month with a lot less effort.

Yes, I buy Visa gift cards at CVS with Amex gcs

Forgive me, but I’m having trouble with the math you used for your workflow.

So you buy amex gc with your CC of choice = 1% fee + 2% cashback + CC points (you conservatively estimated at 1.5 miles per dollar)

you then use amex gc to buy visa/mastercard gc @CVS = 1% fee

So doesn’t the two 1% fees cancel the 2% cashback?

So your net on $420k would be:

630k miles with $0 cashback

Please let me know if I’m getting this wrong.

There is no 1% fee for buying Amex gift cards. There is a very small fee and when it is possible to buy gift cards and get 2.25% cash back through a portal, I net about 2%, after fees.

I cancelled my RB via the online method. Then I went to apply for a BB and it says that I am still a RB member. I did this a couple of weeks ago and I am still greeting the error.

Do you have any recommendations on how to get around this?

TIA

I’ve heard that a lot lately. No, I don’t know the secret to this. Have you tried calling?

Not yet. I will call and report back after I do so.

Well that was easy enough. I called and they made sure that I used the exact information that was under my RB account. Capitalization and using a different email was what was wrong.

Customer Service was excellent. They were nice and wanting to help you fix the issue.

The odd thing is that when I went from BB to RB, I changed my phone number and email?

Thanks again!

I almost forgot. My phone number was saved as home. They had me change it to mobile but use the same number.

Just a comment on Chrome’s multiple user management. You can add an unlimited number of users, and none of them have to be linked to an actual Google account.

You go into your preferences, and under People, just hit Add Person, type in the name, and you’re done. The first screen that pops up within that new profile will ask to you log in with your Google account, but you can just click the “No thanks” link below and to the left of the login box.

Awesome! Thanks so much. That will make things so much easier!