NOTICE: This post references card features that have changed, expired, or are not currently available

Last month I asked “Should I bet on Choice?” Thanks to my Chase Amtrak card (which is now a Freedom card), I had a short term opportunity to convert up to 25,000 Amtrak points to Choice at a 1 to 3 ratio. In the aforementioned post, I said that I wasn’t going to do the transfer. In the end, though, I changed my mind (and several reader comments helped convince me to do so). Ultimately my decision boiled down to the fact that I blog about points & miles and so it makes sense for me to get to know all of the major point programs, including Choice.

I converted 25,000 Amtrak points into 75,000 Choice points in late September. I haven’t yet used any of those points but I’ve already come very close… a few times. For example, at one point my wife and I considered going to see the Michigan Wolverines play in the Battle 4 Atlantis preseason basketball tournament in Nassau Bahamas. I looked at the adjacent Comfort Suites hotel (see Mommy Points’ review here) and found rooms for 25,000 points per night (vs. about $300 per night). Ultimately we decided not to go, but we could have productively used all 75,000 points for 3 nights. While there are known to be much better uses of Choice points, I would consider 3 nights for 25,000 Amtrak points an excellent deal.

Given my recent almost-success in using Choice Privileges points, I started thinking about manufacturing points with the new Bank of America Amtrak credit cards. With the Amtrak World MasterCard, $20,000 of annual spend gives the cardholder the ability to transfer up to 25,000 points to Choice at a 1 to 3 ratio. 25,000 points would transfer into 75,000 Choice points.

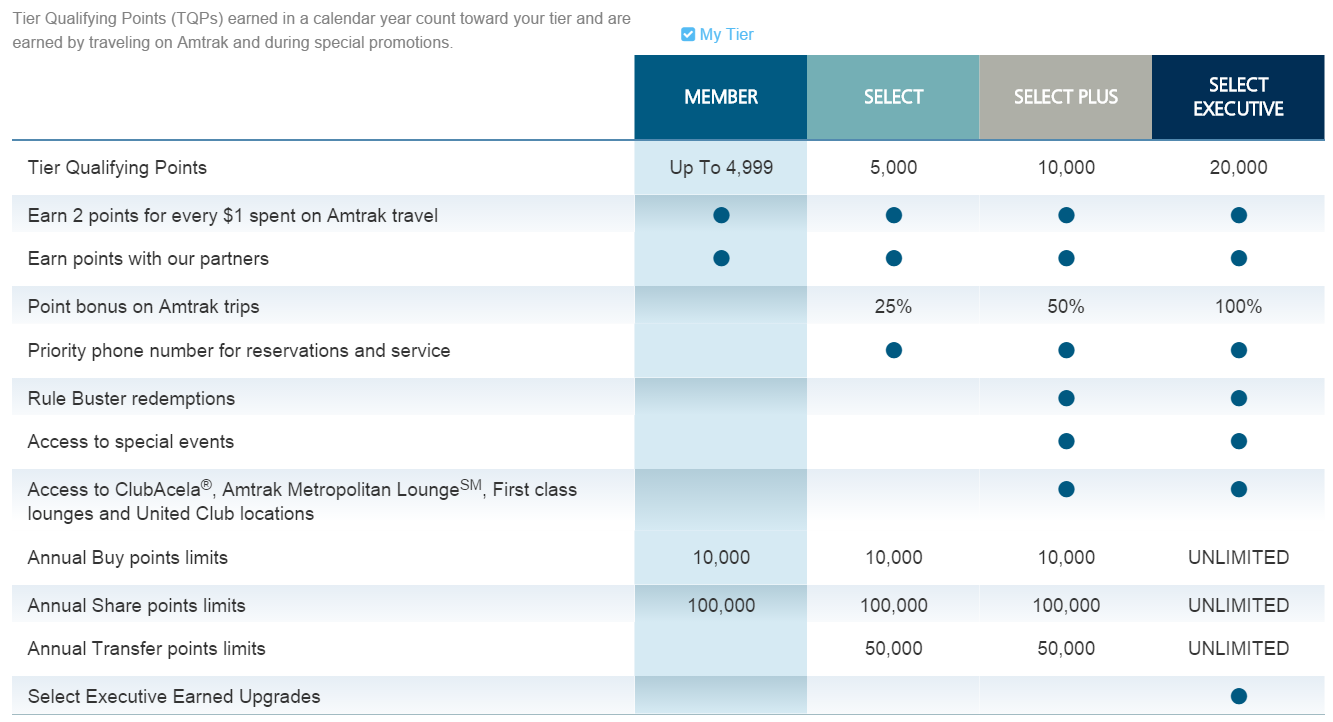

The same $20,000 of spend on the Amtrak World MasterCard would result in 4,000 Tier Qualifying Points (TQPs) towards elite status. With another 1,000 TQPs, one could obtain Amtrak Select elite status which grants the ability to transfer up to 50,000 points per year. While each Amtrak card is capped at 4,000 TQPs that can be earned, it is theoretically possible to get two Amtrak cards and earn up to 8,000 TQPs (note, though, that this has yet to be proven). If that works, one could even go all the way to top tier Select Executive status by obtaining five Amtrak cards and spending $20,000 on each one. Select Executive status grants the ability to transfer an unlimited number of points to Choice (or to Hilton at a less exciting 1 to 2 ratio).

The question of how a person with limited expenses could spend $20,000 on one or more Amtrak cards is best left to other posts and pages (see, for example, “How to increase credit card spend”). The question of whether it’s a good investment is the point of the rest of this post…

Rebate per dollar Amtrak (up to 3.05 cents)

Amtrak’s credit cards promise to offer good value when points are redeemed for Amtrak travel. With their new revenue based program beginning in January 2016 (see this post for details), Amtrak points will be worth 2.6 cents each on Acela routes and 2.9 cents each elsewhere. With either Amtrak credit card, points become more valuable because cardholders get an automatic 5% rebate on awards. Let’s look at an example:

Suppose, with next year’s new program, you want to redeem points for a sleeper car that would otherwise sell for $1,000. Amtrak’s point estimator tells us that the trip will cost you 34,500 points. With the 5% point rebate, you’ll get back 1725 points, so your final cost will be 32,775 points. That comes to a per point value of $1000 / 32,775 = 3.05 cents per point.

If you ride Amtrak often, then the credit card’s 1 point per dollar base earning rate is pretty good. And, the World MasterCard’s 2X earnings for travel and 3X for Amtrak spend are excellent.

If you don’t ride Amtrak often, though, the points may go unused and would therefore be of no value. Your best alternative then would be transfer to hotel points…

Rebate per dollar Choice (up to 2.4 cents)

Choice does not have a revenue based reward scheme like Amtrak’s 2016 program. Instead, the value you get when redeeming points fluctuates tremendously from property to property and from one circumstance to another. If we were to assume that we would average about 1 cent per point value, then we could say that Choice transfers give us roughly the same value as using Amtrak points directly: Each Amtrak point is worth about 3 cents towards Amtrak rides; or, each Amtrak point can be converted to three Choice points and used for 3 cents worth of Choice hotel stays.

Does it get better than that? Loyalty Traveler has been able to cherry pick Choice awards for much better than 1 cent per point value each. For example, he writes about using 20,000 points per night for a $450 per night hotel in Oslo (see “How I stole 2 nights at The Thief Oslo with points”). That’s arguably 2.25 cents per point value. Suddenly the idea of manufacturing Amtrak points is looking good. 3 points per dollar X 2.25 cents = 6.75…

But, wait…

Loyalty Traveler also taught us that its possible to buy Choice points for .75 cents each (3/4 of a penny each). The trick is to book and then cancel Points Plus Cash stays. You do need at least 8,000 Choice points to begin with, but you could always start by buying those points for 1.1 cents each and then going from there. Let’s say, for example, that you want to accumulate approximately 60,000 points. You can buy the first 8,000 points from Choice directly for 1.1 cents each. Then, you can book and cancel Points Plus Cash stays until you’ve bought the rest of the needed points for .75 cents each. Your total cost would be:

- 8000 points at 1.1 cents each = $88

- 52,000 points at .75 cents each = $390

- Total cost: $478

- Total cost per point = $478 / 60,000 = .8 cents per point

If we agree, based on the math shown above, that Choice points can be easily bought at .8 cents each, then we have a much better way to evaluate the wisdom of manufacturing Amtrak points:

- $20,000 of 1X Amtrak credit card spend = 20,000 Amtrak points

- 20,000 Amtrak points transferred to Choice = 60,000 Choice Privileges points

- At .8 cents per point value, 60,000 points = $480

- Effective rebate % = $480 / $20,000 = 2.4%

Compare that to spending $20,000 on a card with 2% cash back rewards, or the equivalent (e.g. Fidelity Investment Rewards Amex, Citi Double Cash, Barclaycard Arrival Plus, Capital One Venture Rewards):

- $20,0000 spend = $400 (or $400 worth of points)

- Use $400 to buy Choice points at .8 cents each = 50,000 points

Conclusion

Manufacturing spend on Amtrak cards offers approximately 2.4% returns in the form of Choice Privileges points (when compared to buying points). That’s a bit better than a 2% cash back card, but it severely limits your rewards options. I’d far prefer to earn 2% back in a currency that can be used for anything (or for any travel, in the case of Arrival Plus and Venture Rewards). More importantly, there are several cards that offer even better value. For example:

- Discover It Miles offers an effective rate of 3% cash back for the first year (1.5% is doubled after a year).

- Bank of America’s Travel Rewards card offers up to 2.63% back in points that can be used for any travel expense. However, to get that top rate return you would need to hold accounts with Bank of America and Merrill Edge with a combined value for $100,000 or more. More details can be found here.

- A number of cards offer 5X rewards within various categories (grocery stores, office supply stores, etc.). If your manufactured spend activities take place within those categories, you’ll do much better than the Amtrak to Choice 2.4% value. See: Best category bonuses.

Each of the above examples offer far better rewards for your spend even if you use those rewards to buy Choice points.

Long story short: Manufacturing Choice Privileges points through spend on Amtrak credit cards is not a great idea.

[…] outside of the scope of this post. You can figure out the details yourself by starting here: Manufacturing Choice. Is it worth it? Hint: it’s probably not worth […]

[…] Choice Privileges is the loyalty program for Choice Hotels which includes mostly low-end brands such as Comfort Inn, Quality Inn, Econo Lodge, etc. I can’t remember the last time I’ve stayed at a Choice property, but I am interested in their loyalty program. In addition to the normal ways of earning points (such as staying at hotels, for example), points can be purchased cheaply through the “points plus cash trick,” or you can transfer points from Amtrak at a favorable 1 to 3 ratio if you have Amtrak elite status or you spend heavily on the new Amtrak World Mastercard. […]

[…] Week From Frequent Miler Manufacturing Choice. Is it worth it? – Does it make sense to manufacture Choice Hotels points with the Amtrak credit […]

Choice is a terrible choice. The program lost it’s best redemptions IMO when the all inclusive Barcelo’ hotels terminated their partnership with them. Most domestic hotels are the bottom of the barrel choices. Their points expire after 2 years even if you earn more. Even with status afforded by their CC you still have a short redemption window of 60 days, or 30 days if no status. So those great European redemptions would have to be last minute…..only thing they are good for is topping off points in SW for companion pass, unless you like hotel 6 style properties.

I have a good stash of UR and no Amtrak card from Chase.

My SW CP is set to expire this year. Is there any value in setting myself up for the SW UR next year?

This is what I am thinking:

Transfer some UR to Amtrak now (before Dec 31)

Apply for a BOA Amtrak card and spend the 20K

Transfer the Amtrak points (transferred from UR + 40K) to Choice(@ 3X) and then to SW for CP

Is this a reasonable approach or is there too much opportunity cost involved?

Great idea. The transfer ratio from Choice to SWA is 6000 to 1800, I believe. So, the transfer ratio from Amtrak to SWA is 2000 to 1800. You lose 10% of your points vs transferring directly from Chase to Southwest, but you gain the fact that the transferred points count towards your companion pass.

Overall, I think its worthwhile if you’d make good use of the companion pass, but keep in mind that $20K spend will only get you the ability to transfer 25,000 points to 75,000 Choice points. Choice points transfer 6000 at a time, so you could convert 72,000 of those points into 21,600 Southwest points. Not nearly enough for a Companion Pass. Do you have other ways to get the rest?

Thanks. Let me ask again – The 20K spend triggers the ability to transfer @ 3X to choice but limited to transferring only 25K from Amtrak. Is that correct?

I did not know this and if this is the case, I will refrain from this idea. 🙂

Thanks very much for revisiting this subject, and you’ve given us much to think about. (and test) Perhaps we could get you and Drew Macomber again on a video or chat somewhere to discuss (even debate) the merits of this the amtrak transfer to choice. (especially as he, via TIF, has been the one repeatedly drawing our attention to some creative interpretations, including on Oct. 4th)

To your argument here, it hadn’t even occurred to me that I would ever intend to spend on a BA/Amtrak card for the 1/3 Choice points/stays — not per se. That is, it seems you set up a straw man, and then mightily knock it down.

What your stats don’t address is the merits of the present still intriguing opportunity (until early December) to transfer Chase Ultimate Rewards points to Amtrak… that is, now, (before that option goes away) with the future plan to have the option to transfer them again to Choice…. (over 3 years with status, AND as Drew and others have noted, we could transfer now up to 110k in CUR points to Amtrak, then add the 20k points earned from the new Amtrak card spend, plus the 20k bonus, altogether netting 150,000 Amtrak points => which could transfer (over 3 years) to 450,000 Choice points…. No wonder you didn’t figure in the cost of those points, as there’s so many different calculation “ifs” that could go into figuring out just how much each point cost you in the first place)

I personally am thinking to transfer “just” 60k CUR points to Amtrak now…. that is, if I can be sure of the plan to earn Amtrak status next year with the new card.

The wild card though, as you know, is figuring out just how (in one calendar year) to earn the Amtrak “status” needed to make the transfer possible from Amtrak to Choice. You write:

“While each Amtrak card is capped at 4,000 TQPs that can be earned, it is theoretically possible to get two Amtrak cards and earn up to 8,000 TQPs (note, though, that this has yet to be proven).”

Key here being to get past the 5,000 TQP threshold. Alas, AGR points from “rail running” for this fall (as you described earlier this year) while feasible for me, won’t count for next year (and “rail running” disappears next year). So I’d either have to plan to spend $500 outright on Amtrak next year to get the 5th 1k TQP’s or get a second card — and “hope” that 5k spending on it would provide the needed 1k TQP that would count on the first AGR account…. a huge unknown.

Precisely the question I put to Drew — to which he hasn’t yet revisted… Would Chase/Amtrak permit two cards (whether by the same person or say, a married couple) to contribute to the same Amtrak account?

Great questions. We won’t know whether the 2 card trick works until someone tries it and reports back. A while ago I reported that the trick does work with BOA and Virgin Atlantic, but that doesn’t prove that it would work with BOA and Amtrak.

Here’s an idea: Get two Amtrak cards now and quickly spend $5K on each one.

If you see that you earn tier points from both cards then complete a total of $25K spend across the two cards (e.g. $20K on one and $5K on another) before your December statement closes.

If you do not get tier points from both cards, then Rail Run this year for 1000 status points and complete $15K more spend on the card that did earn tier points.

With either approach above, you should get bumped up to Select status for the rest of this year and all of next year. I don’t know whether Amtrak status extends partly into the year following as well? Many airline programs, for example, extend status through Feb of the year after. If so, you should have 3 calendar years with which to transfer up to 50K points to 150K Choice points: end of this year, anytime next year, and beginning of 2017.

If you don’t have the option of spending $20K quickly on one card, how about Rail Running in early January 2016 (before the 24th when the new program kicks in) to get 1,000 points, then use an Amtrak card to get the other 4,000 points.

Without the minimum points per trip like original AGR, rail running becomes a lot harder since you have to spend $500 on Amtrak spend.

Right. That’s why I suggested Rail Running before Jan 24 when the new rules kick in.

Didn’t catch that. Ten one ways (or five multi city segments), for about $80 and a day worth of time (along the Surfliner corridor), seems doable.

Marvelous response and great ideas. Your attention to detail amazes yet again, and very grateful especially for your last observation and suggestion: In my recollection of all the various descriptions of the new AGR program going into effect “in January,” I had not previously seen that there indeed is a specific date for the new program to go into effect — namely, January 24th! So yes, if the old plan & rules remain in effect until the 23rd, and if my plan remains to go for status in the upcoming calendar year, you’ve opened up a Jan. window for me to do some serious rail travel (ok, running — including on that Philly-Paoli line you , or maybe Fredericksburg to ALX to WAS or maybe BWI. or maybe even the business express fares between DC & Philly) And I actually could do business while “running.” 🙂

Yet before I set the plan, would hope to confirm further your observations about the “3 year” window. In Drew’s Oct. 4th post, he seemed esp. confident that if one would earn AGR status this year (2015), the membership counts also for next year, and into Feb of the “3rd” year… (2017) If status earned in 2016, then counts into Feb. of 2018.

Still want to see this somewhere in black ‘n white myself. Have enormous respect for both of you…. yet have learned that always best to check details and keep testing. (and sometimes give back with a nugget or two of further inspired discovery)

With Drew being at last “out of Africa,” maybe he too will revisit the subject.

(wish either one of you had an affiliate link for the BA/Amtrak card — least we could do…. will remember)

This is a great analysis, but it ignores the short-term opportunity to manufacture Chase UR points and transfer them to Amtrak and then convert them to Choice. If someone can take advantage of the current Staples offer and cheaply MS with an Ink card at 5X, then the math changes. I’m going to dump about 50k UR points into Amtrak and ultimately turn them into 150k of Choice points. That will mean that I will have a lot of Amtrak points that sit in my account for a year, since the 20k Amtrak bonus + 20k spend will generate 40k in addition to the 50k I’m transferring in, but I don’t mind the wait. I think that 150k Choice for two years in a row is probably better than getting them all at once anyway, since Choice points have a hard expiration date on Dec 31 two years after earning them.

Yep, great point! By using your Ink card to get 5X UR points and transferring to Amtrak then to Choice, you’re essentially earning 15X Choice points per dollar.