NOTICE: This post references card features that have changed, expired, or are not currently available

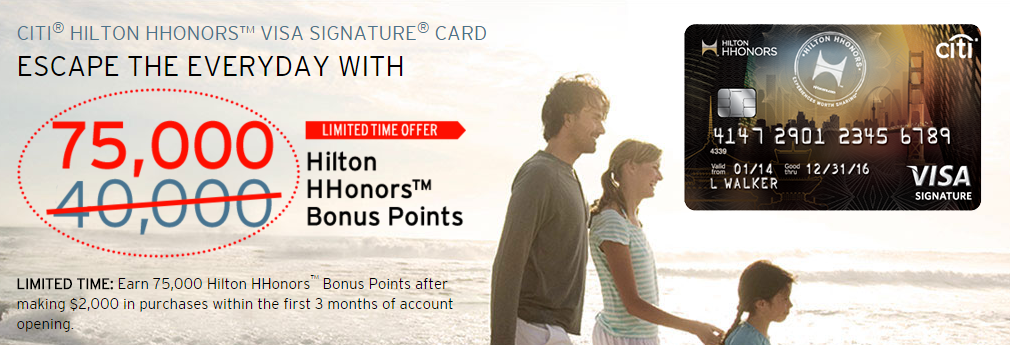

Perhaps in response to last week’s 70K Hilton Amex offer, Citi has upped the bonus on their no annual fee Visa Signature to 75K.

The Offer

Earn 75,000 Hilton HHonors™ Bonus Points after making $2,000 in purchases within the first 3 months of account opening.

Card Benefits

- HHonors Silver status.

- Fast track to HHonors Gold status after four stays within your first 90 days of account opening or when you make $20,000 or more in purchases each calendar year.

- 6X HHONORS BONUS POINTS for every $1 spent on hotel stays within the Hilton Portfolio.

- 3X HHONORS BONUS POINTS for every $1 spent at supermarkets, drugstores and gas stations.

- 2X HHONORS BONUS POINTS for every $1 spent on all other purchases.

You can find the application link on our Best Signup Offers page.

Never miss a Quick Deal, Subscribe here.

[…] Citi HHonors Visa Signature 75K Bonus Offer […]

[…] Citi HHonors Visa Signature 75K Bonus Offer […]

[…] Citi HHonors Visa Signature 75K Bonus Offer […]

[…] Citi HHonors Visa Signature 75K Bonus Offer […]

This card is used frequently in our household due to the 3x points on drugstore purchases (I buy some gift cards at drugstores, & of course our prescriptions, & other items–aiming for those purchases that provide other rewards like CVS Extrabucks). I have not found another card that offers this. We used to have a AmEx Hilton card that did, but they changed the terms so we switched to Visa.

Can you get the Amex and Citi cards and get both levels of points?

Yes it is possible to get both cards and have the bonuses go into the same account.

And to get even more Hilton points, get a Hawaiian Airlines card and a Virgin Atlantic card and transfer in the points. Hilton by far is the easiest program to collect points.

Do the Hilton points expire?

Yes, 12 months if there is no activity on the account .Very easy to avoid though… just buy like a $1 Amazon gift card and when the points post to your Hilton account, it will reset the clock.

thanks for the alert — fascinating that there’s so many ways to earn Hilton Honors points. (and I’m really paying attention at last, after getting the Diamond status match in December through early 2017 — and fooey on Hyatt for missing the boat)

Yes, this card gives 5k more points that the amex offering, but amex has rather better category bonuses. (which would really matter if I could re-gain confidence in ms again, right now, I’m with those essentially paralyzed with confusion & doubt)

The offer went from 70k/$1000 spend to 75k/$2000 spend?

Yup, and by comparison, the amex competitor “only” went from $750 to $1k.

self correction (wish we could edit our posts): the spend requirement doubled to 2k, but you’re off on the bonus (the citi version went up from 40k to 75k…..)

No coming into today the best offer available was 60K after $1K in spend. The public offer is only 40K.