NOTICE: This post references card features that have changed, expired, or are not currently available

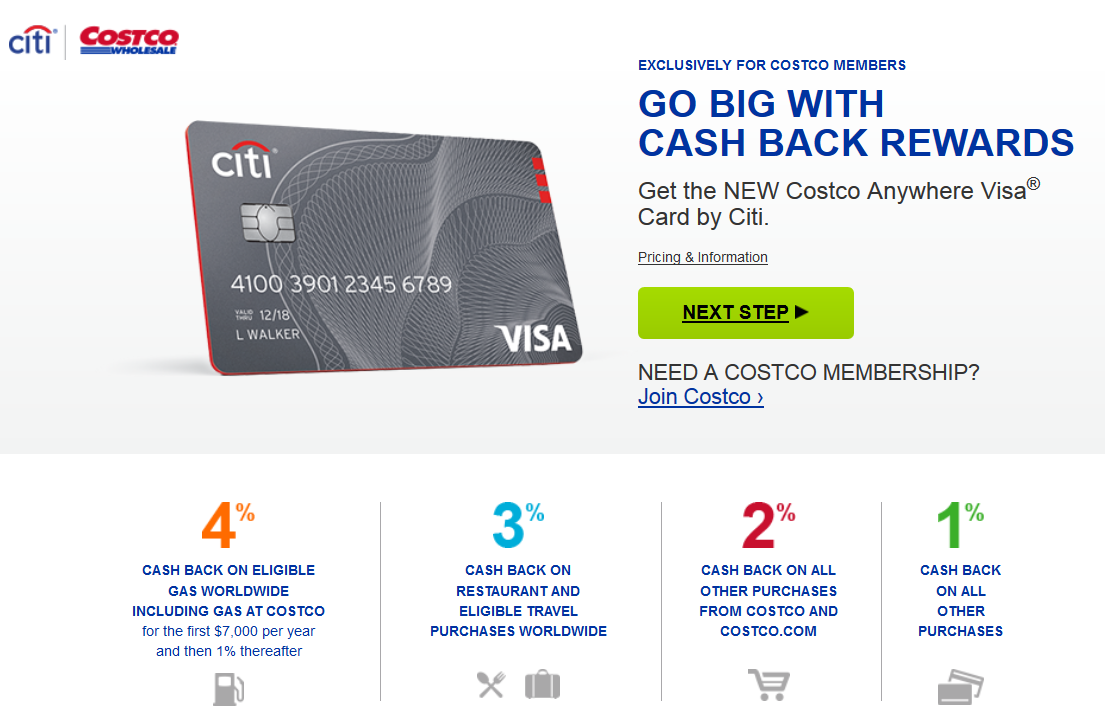

Costco recently switched their co-branded card from Amex to Citibank. Now, in store, they accept only Visa credit cards (or Visa/MC debit cards). And, they now offer a co-branded Visa credit card instead of the old Amex Costco card.

On the surface, the new Costco Anywhere Visa card looks pretty awesome with 4% cash back for gas, 3% cash back for travel and dining, and 2% cash back for Costco purchases. And, the card has no annual fee.

The Costco Anywhere Visa is available both as a personal credit card and as a business credit card.

When I plug in the above cash back categories to my Credit Card Analysis Spreadsheet, I find that the card averages an excellent 2.28% cash back given the spend assumptions in the spreadsheet (15% travel, 20% dining, 15% gas, 25% grocery: 12.5% Costco + 12.5% other grocery).

Even better, one can get a no-fee 2% cash back card (such as the Citi Double Cash or Fidelity Visa) and use that card anywhere that the Costco card earns less than 2%. In that case, the combination averages (with my spending assumptions) 2.65% cash back!

A better option

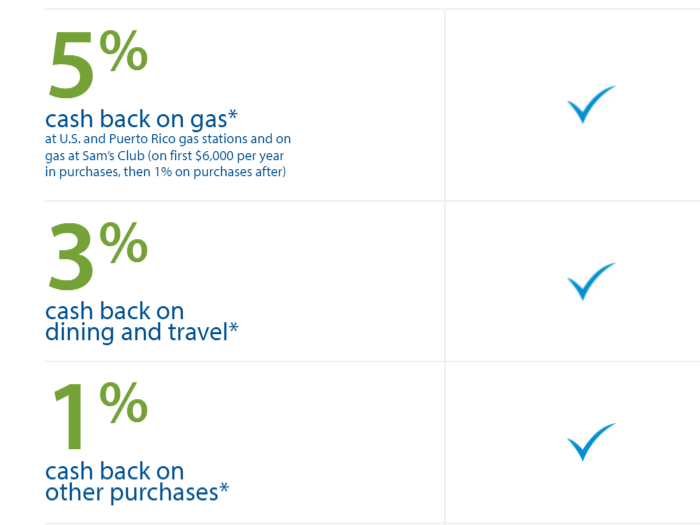

Given its high bonus categories and no-annual fee, I would declare the Costco Anywhere card to be the best cash back card, except for one thing… There’s a better option that has been around for a while: the Sam’s Club MasterCard.

As you can see above, the Sam’s Club MasterCard offers similar bonus categories to the Costco card, but with a higher cash back rate for gas (5% vs. Costco 4%), and without a bonus for spend at Sam’s Club itself (that’s weird).

A sharp reader may notice that the Sam’s Club card has a lower cap on its gas category: $6,000 per year vs. the Costco card’s $7,000 per year. That’s true, but the Sam’s Club card still comes out ahead for gas. Suppose you spend exactly $7,000 per year on gas. The Sam’s Club card would result in $310 cash back whereas the Costco card would result in just $280 cash back.

And, the strange lack of a bonus category for Sam’s Club purchases hardly matters at all. If you pair the Sam’s Club card with a 2% cash back card, you can still get 2% cash back at Sam’s Club and at Costco too (if you go with the Fidelity Rewards Visa 2% card). Overall, if paired with a 2% cash back card, my Credit Card Analysis Spreadsheet shows that the combination can average a whopping 2.8% cash back.

Best cash back combos and once per year redemptions

Last year I published “Best credit card combos: Cash Back”. In that post, I examined a number of different combinations of cash back cards to see which combinations were best. If you’re interested in cash back, I recommend checking out that post. If you’re more interested in points & miles, please see:

- Best credit card combos: Ultimate Rewards (earn up to 2.16 points per dollar)

- Best credit card combos: Membership Rewards (earn up to 2.56 points per dollar)

- Best credit card combos: ThankYou Rewards (earn up to 2.23 points per dollar)

- Best credit card combos: Mixed rewards (earn up to 3.23 points per dollar)

In the Cash Back Combos post, I complained about the way in which the Sam’s Club card delivered its rewards. I wrote:

This one has a fantastic combination of category bonuses, but cash back can only be retrieved once per year. It is paid in the form of a check made out to Sam’s Club. In order to cash the check, you have 180 days to get yourself physically to a Sam’s Club store. Yeesh.

Well, it turns out that the Costco Anywhere card works the same way. Here’s the text from the Costco Anywhere Visa landing page:

Cash back will be provided as an annual reward coupon in February billing statements, redeemable for cash or merchandise at US Costco Warehouses.

For some, that may be a big problem. Others may not mind the once per year in-store redemption option at all.

Wrap Up

The new Costco Anywhere Visa card is a very good cash back card. However, the Sam’s Club MasterCard paired with a no-fee 2% cash back card is a bit better – even for those who shop regularly at Costco (if so, you would want to get the Fidelity Visa 2% card now that Costco accepts Visa). Of course, you would still need to go to Sam’s Club to redeem your cash back. So, if that’s not an option for you, the Costco card is well worth a look.

For the record, at least at the time of this writing, I have no affiliate links for either card.

[…] has a great credit card line up for Costco. In fact, Frequent Miler did the analysis after asking whether The Costco Anywhere Visa was the best cashback card, bar […]

[…] and notes from around the interweb: Frequent Miler argues that the Costco Anywhere Visa® Card by Citi is the best new cash back […]

Ft Knox Credit Union VISA Will automatically cash credit your monthly statement 5%. Membership was either free or some small small fee. Seems like a no brainer to me. I am a costco member but plan to use the FKCU VISA instead. Also, Exec members do not earn the 2% back on gasoline purchases – so there is not any double dipping.

[…] to the point – FrequentMiler analyzes the new Costco Visa – it looks enticing! That said, his conclusion is the same one I had come to some time ago, […]

Do you really have a choice? Isn’t it true that you have to have the membership in order to cash out the annual reward check? Between Sam’s and Costco, you only choose one of the two at a time to join, since you don’t want to pay two membership fees at the same time.

These two cards are not like any other regular cash back cards. Though they are free, they are bound to a membership that you have to pay for. As a result, it does not seem to be flexible enough for one to switch back and forth.

Fair point

The Pentagon Federal Credit Union Platinum Cash Rewards Plus card gets 5% cash back on gas, with no limits on the amount you can earn, and no annual fee. Furthermore, the cashback is automatically disbursed as a statement credit every month, so no need to wait or visit a warehouse.

You can join the credit union, among other ways, if you’ve ever volunteered for an eligible organization (e.g., donated blood through the Red Cross).

Sam’s Club potential max gas benefit: $6,000 x 0.05 = $300/year (not $310 as stated in post).

Another big advantage of the Sam’s Club MasterCard over the Costco Anywhere Visa is zero foreign transaction fees! Citi charges 3% FTF on their Visa (except at Costco worldwide). That plus the expanded travel categories covered by the Sam’s Club MasterCard (adds timeshares, bus lines, rail, tour operators, and travel sites, which Costco/Citi doesn’t cover), makes the Sam’s card much better for travelers. The Costco card has more gas limitations also no convenience stores–both exclude other warehouse clubs and some groceries. Sam’s does fall down on purchases in the store, only paying 1%, but any MasterCard is accepted (just like any Visa is now accepted at Costco), so you can use your Citi Double Cash for 2% (if you pay off in full). To me, the Sam’s Club MasterCard is worth having for the $45 “annual fee,” without regard to shopping there. Spend $1,500 on travel and you break even. Spend $1,833.33 on travel (but less categories and must be purchased within the US) to break even with the Costco Anywhere card on travel. Between shopping at the two, it will depend on what your shopping list, and what the stores near you carry. For me, Costco is generally better for shopping, and definitely better for pharmacy (for the uninsured), so I will have both cards, and pay both membership fees, but the Sam’s Club MasterCard is the winner, IMO. Interestingly the WalMart MasterCard pays 3% on WalMart.com purchases, beating both the Sam’s Club MasterCard and the Costco Anywhere Visa for online purchases. Frankly, if buying from the WalMart pharmacy, perhaps the thing to do is take out a WalMart MasterCard and buy online, if possible. (The are a few items (most OTC) in the WalMart ReliOn branded line which are cheaper there than in comparable brands or even generic at Costco, but for most prescription items, Costco pharmacy beats WalMart, hands down, especially for the Costco Member Prescription Program for the uninsured.)

> Sam’s Club potential max gas benefit: $6,000 x 0.05 = $300/year (not $310 as stated in post).

As stated in the post, the assumption was spending $7K, so your $300 + the extra $10 from $1000 at 1%

For costco visa, this is what I am seeing: ” 3% cash back on restaurant (including cafes, bars, lounges and fast food restaurants) and eligible travel purchases worldwide, including airfare, hotels, car rentals, travel agencies, cruise lines and Costco Travel.”

Don’t know if it helps with the pharmacy comparison, Federal law requires pharmacies to be open to non members at either club.

Additionally, Sams offers every payment option you could want right now, versus limited options at Costco.

Keep in mind you can buy costco gift cards online with any payment method. I’ve gone this approach several times over the years when meeting minimum spend on various cards. They’re accepted at the pharmacy too.

Yes Costco Anywhere Visa is the best.

I was stop by sams club the other days

OMG! I asked myself Are they really willing to compare with Costco?

Not Because i’m a Costco Member that sam’s club allover service .

They can’t compare with Costco ??

Comparing credit cards is completely different from comparing stores

Normally I’d agree with you but given the fact that they require paid-for memberships and are exact substitutes for each other you can’t (shouldn’t) compare the credit cards without factoring in the overall quality/experience of Sams vs Costco.

If I don’t use costco visa card, do I still get 2% rewards for being costco executive member?

Yes they’re separate. Every year you’ll receive two different checks, one for cc cb and one for executive 2% cb.

Thanks, in that case,won’t downgrade.

Even if you do downrange, ask them for a refund (difference between $55 and $110). You’re never on the hook for fees if you’re not satisfied .

Is there any sort of sign up bonus for the Costco card?

Unfortunately no

Btw

The Cash Rewards BofA card gives 2% cash back at grocery stores and wholesale stores (incl Costco), 3.5% cashback if you have Platinum Honors rewards with BofA

$2500 quarterly limit wake up

That’s why smart people have 2 or more BOA cash back cards, Ace.

BOA gas rate is 3% (5.25% with Plat Honors) and is NOT constrained by which gas station you use.

Sam’s Club card constrains you to Sam’s Club gas stations, Costco to Costco Gas. This is a HUGE limiter to me. Not sure why this point wasn’t pointed out with big blinking lights in the post above.

It’s not, though. They’re on gas, including Sam’s Club or Costco. So anywhere.

I stand corrected, Read. I read their terms a little too quickly. I remain a “BOA Fanboy” on the cash back terms themselves when modified by the Platinum Honors bonus, however. 🙂

I have the BankAmericard Cash Rewards CC, but unfortunately, it doesn’t cover gas purchases at Costco. This is taken from the small print on the BoA card description:

“Purchases made at merchants whose primary line of business is not the sale of automotive gasoline or fuel, like superstores, supermarkets and truck stops will not earn bonus cash rewards.”

I get my gas mainly at Costco, so I’m still trying to figure out if the PenFed or Fort Knox cards will get 5% there or if they exclude Costco too. Otherwise I’ll be getting the Citi Costco card.

Sure thing, douche.

I have the BankAmericard Cash Rewards CC, but unfortunately, it doesn’t cover gas purchases at Costco. This is taken from the small print on the BoA card description:

“Purchases made at merchants whose primary line of business is not the sale of automotive gasoline or fuel, like superstores, supermarkets and truck stops will not earn bonus cash rewards.”

I get my gas mainly at Costco, so I’m still trying to figure out if the PenFed or Fort Knox cards will get 5% there or if they exclud Costco too. Otherwise I’ll be getting the Citi Costco card.

Try using the Sam’s Club Mastercard for gas at Costco. Good luck!

@ SDO

You can redeem the check for cash at the Costco service counter.

Yes I know that the annual Costco memberahip fee is considered a sunk cost. But can the Costco Visa card truly be considered as a no annual fee card? My gut tells me there’s some sort of cost, opportunity or otherwise, that’s associated with being tethered to Costco at the end of the reward year to spend those rewards at Costco.

Two things (as I conducted my own analysis):

– there is an annual fee–your Costco membership fee. You can get into Costco with a friend or family’s member.

– the freedom is much better until December 31, 2016, earning 5% back at Costco, Sam’s and BJs. Plus, I could never get on board with the earning structure of Costco. Cold hard cash always wins.

Yeah, I would eliminate at least the 12.5% Cistco spend in your calculations, at least for 2016.

Your comment is pretty confusing. You’re advocating the freedom and 5% yet end with the antiquated “cash wins” belief.

Also, are you referring to the earnings structure of member benefits, i.e. 1% vs 2%? Their system makes sense to me, as well as 90%+ yearly conversion rate.

Also, yes you can get into Costco via piggybacking through being the second member on the account or through having them buy you cash cards. Using cash cards means no warranty protection. You’re also losing out on possibly making money from this, since anything above $55/$110 earned in cb is profit. If you’re not spending enough to justify the member fee then just go to member services and request a refund between your member fee and rewards issued. Most of the time they’ll let you keep your membership, rinse and repeat. Thus, you’re not really paying anything here so no, I don’t look at this card as having an annual fee.

Obviously if you’re not going to earn $110/member year then I wouldn’t advise getting this card. As always, that part is YMMV. Its somewhat similar to the AT&T 3% access card which offers 10k points with yearly $10k+ spending. If you’re spending over $10k then you’re really not paying an annual fee. Bottom line is the AF is washed away with enough usage.