NOTICE: This post references card features that have changed, expired, or are not currently available

By Julian, author of Devil’s Advocate…

Banks have a lot of rules… and they love changing them. I don’t know if this is because banks aren’t very good at writing rules in the first place, or if it’s simply because bank attorneys need to create enough work for themselves to pay the mortgage on their second home in the Hamptons (not to mention the upkeep on the ski condo in Aspen). But for whatever reason, banks are endlessly sending out changes to their terms and conditions.

In fact, if you’ve got even just a couple of credit cards, you’ve probably received enough notices informing you of “Important Changes To Your Account Terms” to build an Eighth Wonder of the World.

With so much paperwork filling up your mailbox, it’s almost impossible to keep up with the fine print. Most folks just chuck everything into the garbage or ignore it entirely. This is doubly true for notices attached to your monthly statements – if you track your credit card activity using your bank’s online portal, you might not even look at the actual statement when it arrives in the mail or by e-mail.

Most of the time you’re not missing anything. But once in a while a vital piece of info gets disseminated this way, and because you didn’t see it, you’re surprised when the change goes into effect. (I am sure I do not need to add that bank surprises almost never save the consumer money.)

This is why it’s not at all shocking that a change announced by American Express on their card statements from two months ago has barely been mentioned anywhere. But if you have an Amex charge card, you’d better know about this change. If you don’t, it’s almost guaranteed to cost you money.

Charge cards versus credit cards.

While many people use the terms “charge card” and “credit card” interchangeably, they are two very different things. A credit card has a preset revolving credit limit that allows you to pay only a portion of your bill each month. A charge card generally doesn’t have that option.

Very few banks issue charge cards anymore, but the one major exception is Amex. If you have any flavor of Amex Platinum or Amex Gold – or even an Amex Green – it’s a charge card. Other Amex cards, such as the Everyday cards or the Delta ones, are regular credit cards. But Amex cards with color or rare gemstone names are charge cards.

Now, you may have one of these cards and not even noticed it was a charge card. If you pay your bill in full every month anyway (which you absolutely should), there isn’t really much of a difference.

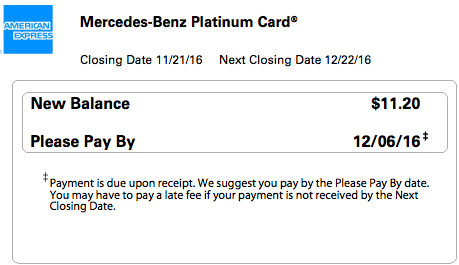

But Amex has long had a slightly different due date system for their charge cards. Take a look at a portion of the most recent statement for my own Amex Mercedes Benz Platinum card…

Like all Amex charge cards, this card technically doesn’t have a due date, but rather a “Please Pay By” date. This is more than just politeness. If you look closely at that box, you’ll see that Amex further states they only “suggest you pay by the Please Pay By date” and that payment is technically due upon receipt.

However, they also note that as long as payment is received by the next closing date, you will be safe from late fees. This means you’ve got a pretty large amount of leeway. Personally, I’ve paid this card as late as the day before the next closing date and not had any problems.

This also means Amex is leaving a lot of late fees on the table.

If you recall what I said earlier about changes to account terms and conditions almost never saving the customer money, I am sure you can guess what change Amex is making…

Pull out your October statement.

If you’ve got an Amex charge card, go find your statement with a closing date of anytime in October, then thumb through it past the payment coupon and the actual charges and the fine print about how Amex is allowed to take every bit of info they know about you and sell it to the highest bidder with no regret or repercussions whatsoever.

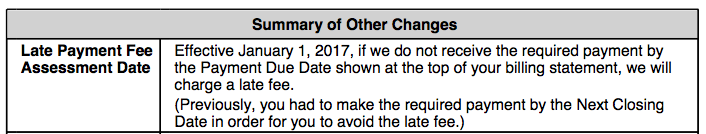

Eventually on page 53 of 76 or so, you’ll find a section entitled “Notice of Important Changes To Account Terms” and that’s where you’ll finally find the bad news…

Yep, Amex is no longer allowing payments to post by the Closing Date. You now have to make your payment by the due date or you’ll be charged a late fee of up to $38.

This change is effective January 1, 2017, so if you’ve got a January payment already set up, you’d better check that it’s happening before the due date, not the closing date.

Some of you might be asking “okay, but if Amex wants us to pay by the due date, who cares?” And on general principle, I agree. You should never be spending money that you don’t already have, so it shouldn’t make a difference what date the bank wants you to send the money to pay the bill.

But there’s two problems with the way Amex is handling this.

Why the big secret?

First, they haven’t exactly been shouting about this change from the rooftops. Burying it deep inside a monthly statement might be cost effective for them, but it’s not particularly helpful to their customers. I also haven’t seen any e-mails or an announcement from Amex of any sort about this change.

To be fair, I did notice a small banner on the Amex website when I signed into my account a week or so ago. But when I went back to take a screenshot for this post, I couldn’t find it anywhere. So they’re certainly not making that banner prominent or particularly easy to stumble upon, which means a lot of customers are going to get a rather unpleasant surprise when their January payment is suddenly late.

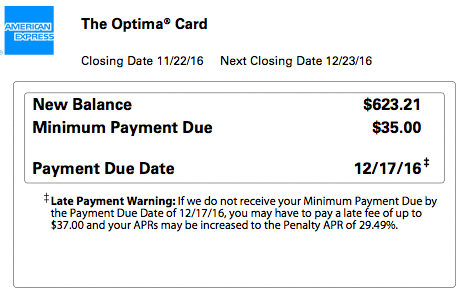

The other issue with this change is the way Amex sets their due dates. On a normal Amex credit card, the due date tends to run about a week or so before the next closing date. That’s similar to the credit card payment timeline at most banks.

But on Amex charge cards, the gap between the time you receive your statement and the “Please Pay By” date is extremely short. As you can see in the earlier screenshot from my Mercedes Benz Platinum, the “Please Pay By” date is just 15 days after the statement closes.

If you’re a customer who gets their statement by mail and are subject to the whims of the United States Postal Service, you might have no more than a week to pay your bill once you get it. Better not be out-of-town when that statement arrives.

It’s possible Amex will reset their charge card due dates once this change is implemented in order to give customers a little more time to receive their statements and pay their bill. But they haven’t said anything about doing that, which brings us back to the lack of information I previously mentioned.

In the end, this isn’t an awful change, but the rollout and implementation of it are far from ideal. Hopefully Amex will make more of an effort to get the word out in the next few weeks before the change takes effect. In the meantime, if you have family and friends with Amex charge cards, do them a favor and make sure they get the news.

Other Recent Posts From The “Bet You Didn’t Know” Series:

• The Secret Shortcut to LaGuardia’s Amex Centurion Lounge

• Cracking the Bulk Fare Code! How to Tell When a Flight is a Bulk Fare

• Two Quirks in the Hyatt Changeover That Might Be Mattress Run Worthy

Find all the “Bet You Didn’t Know” posts here.

I am very disappointed in AMEX. I have had a green card for more than 20 years and was always a huge promoter of American Express because they did NOT charge a late fee. Now, they are just like any of the banks – I will not be promoting them any more and will not use my card as much – maybe they are being penny wise but pound foolish.

I loved the flexibility of the due date prior to the change. I wasn’t aware that they had changed this and I was still paying before closing. When I was 2 days later than their new due date suddenly my card was turned off. This is how I discovered the change. This month I’m 3 days late so I guess they will charge me. I loved this card prior to the change.

Essentially these fees are structure that even if only 10% make the payment error and half of the get the charge reversed, there is still 5% of fees collected. And lets face it, thats the name of the game. More fees…more fees.

A few DPs: AMEX Plat and PRG personal: I’ve had these set up for a couple of years with autopay 25 days after statement date which is (was) approx. 10 days after the “Please Pay By” date shown on the statements. Everything has paid like clockwork for past two years, including past the October terms change referenced in this article, but frankly I wasn’t paying attention to exactly when the autopay was kicking in and whether or not there had been any accumulated late fees. I went in today (2/10) and looked at the latest statements; in both cases, Jan 2017 says “Payment Due Date” on both and the autopay dates have been automatically changed to match the due dates. Whew!

My AMEX Bus Plat still uses “Please Pay By” terms and the autopay is set for 25 days after statement, so this hasn’t hit the business charge cards yet (at least for me).

It seems business cards still have old terms. Correct?

Oh wow, thanks for the run down. I came upon this as I was wondering why the due date on my Amex Green card was suddenly moved to be 10 days later than it had been previously. What I didn’t realize was that the “please pay by” date WASN’T a hard due date all this time. So the net effect it’s had on me is to make it seem like I have more time to pay, lol. I knew this couldn’t have been a GOOD change overall.

I have an Gold Personal and Platinum Business. I just noticed it on the Gold Personal and it has been changed to a Payment Due date. The Platinum business is still listed as a Please Pay By date. I wonder if the change is only to personal cards.

[…] 1st, 2017 American Express are making changes to the way late fees are handled on charge cards (via Frequent Miler). Previously you had until the next statement closing date to pay your bill to avoid any late fees […]

FYI. The “Please pay by:” date is NOT a “Payment due date:” per Amex rep.

The notice ONLY refers to “Pay over time” accounts. You may want to verify and get this in writing.

I don’t believe the agent is correct. The change in terms doesn’t say anything about it only referring to Pay Over Time accounts. I understand what you mean about the two different types of due dates, but I don’t personally have the Pay Over Time feature on any Amex account yet I received this notice on my statement. If the agent is correct, then Amex has done an even worse job than I thought rolling out and explaining this change, but I think the agent is misinformed. I’ll see if I can get some clarification.

I wish they would not write such small letters you barely can read , and such long lengthy , so people just don’t read it . Too sneaky

My Business Rewards Gold T&Cs still has the language guaranteeing a minimum due date of 25 days after statement close (for pay over time eligible charges), even though previous “suggested” intervals were sometimes as short as 15 days. I’d find it hard to believe that AmEx would establish 2 different due dates.

True, although it would seem they must have previously had two separate dates since the suggested date was always around 15 days but you’d get 25 days for Pay Over Time. It’s logical they would make it all one date with this change, and based on the above comments it seems they will. But it hasn’t happened yet for everyone.

A situation in which I’ve taken advantage of the, now old, charge card payment system…

My Platinum card statement closed on 6/15 and the AF posted on that statement. The Please Pay By date was ~7/8 and the next statement close date was 7/15. I had a 3 day trip planned for 7/10-7/13 in which I wanted to have access to the Miami Centurion lounge. I was able to hold off canceling my card until after the trip because the payment technically wasn’t due until 7/14 (1 day before the next close date). I could have paid the AF, then cancelled after my trip, then asked for an AF refund, but that was a big enough inconvenience that I probably would have just skipped the Lounge. So, thanks Amex! I was able to squeeze a little more value out of my Platinum in year 1 b/c of the, now old, payment system.

Thanks for letting us know about this!

My PRG due date used to be 15 days after, but now I have 22 days to pay.

Seems Amex must be sliding these due dates later, though not yet for everyone. Good to know, though.

For my PRG the due date was readjusted two statements ago. There is now MORE time between the closing date and the due date. I noticed the change at the time but not the change to the t&c. Amex may be making the adjustment you suggest already. But also as you say, their transparency could be better

Interesting. Amex has not yet adjusted my own Platinum due date, as can be seen in the screenshot above. But it will be helpful if that’s the plan, though I agree that better communication from them on this sure would be useful.