NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

I expect that many readers are interested in the Amex SPG lmited time 35K offers for both personal and business cards. I know that I am. Unfortunately, the offer terms state “Welcome bonus offer not available to applicants who have or have had this product.” Amex apparently keeps track of whether or not you’ve had the card in the past 7 years. If you have had the card, you’re not eligible for the new bonus, even if you never got a signup bonus for the card before. Of course if you’ve had only the personal SPG card before, you can still get the business SPG card, and vice versa.

I was pretty sure that I had both the personal and business card within the past 7 years, but my credit card tracking spreadsheet only showed the personal card. Was it possible that I never had the business card? That would be great! But I also knew that I wasn’t always good about keeping my credit card application spreadsheet up to date. It was likely that I had the card before but forgot to record it.

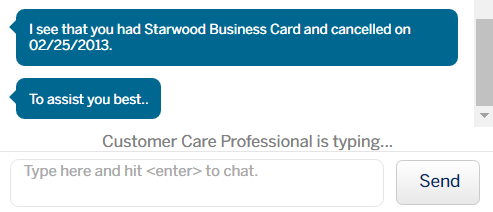

To find out for sure, I logged into my Amex account and initiated a chat…

I asked if I had ever had the SPG business card before…

Rats! I have had the card before and so I’m not eligible for the bonus for the same business. But, I’ve had luck in the past with other Amex cards when I’ve signed up under a second business, so I’ll try that.

UPDATE: If you’re also interested in applying under a second business (with a different EIN), I highly recommend waiting to see the results of my experiment. I’m going to rush things forward to try to get results way ahead of this offer’s 4/5 expiration date.

UPDATE 2: My experiment did NOT work. I applied for the SPG business card under a second business with a different EIN (business tax ID), and I spent $5,000 on the card. When my statement closed, I had earned just the 5,000 points from spend, but did not earn signup bonus points. The business card currently offers 25,000 points after $5K spend, then 10K additional points with $2K additional spend, so I would have earned 25,000 points if this experiment had been successful.

No more than 5 credit cards

Another rule to watch out for is that Amex will allow each person to have no more than 5 credit cards. This count includes both personal and business credit cards. It’s OK to have more charge cards, but only up to 5 credit cards.

Amex credit cards (which count towards your 5 card max) include:

- SPG cards

- Delta cards

- Hilton cards

- All “Blue” cards (Blue Cash, Blue Sky, Blue for Business, etc.)

- EveryDay cards

- Plenti card

- The Mercedes-Benz credit card (but not the Mercedes-Benz Platinum charge card)

- SimplyCash

- Lowes Business

And, again, charge cards do not count towards your total. So, if you have any of these, they do not count towards your 5 credit card limit:

- Platinum cards, including the Business Platinum card

- Premier Rewards Gold

- Business Gold Rewards

- Business Green Rewards

- Green card

- Gold card

- The Plum Card

Employee cards and authorized user cards also do not count towards your total.

I currently have 4 Amex credit cards: 3 Delta cards (but I plan to cancel one of them), and the Old Blue Cash card.

My next steps:

- I’ll cancel the Delta card that I no longer want (because why not)

- I’ll sign up for the SPG business card under a second business (I legitimately have several separate businesses)

- I’ll meet minimum spend without buying gift cards. See: How to avoid Amex Clawbacks.

- I’ll wait and hope that the 2nd business approach works*

* UPDATE: If you’re also interested in applying under a second business (with a different EIN), I highly recommend waiting to see the results of my experiment. I’m going to rush things forward to try to get results way ahead of this offer’s 4/5 expiration date.

Data Point: Warning! You can’t rely solely on what AmEx Chat tells you.

Even if customer service tells you you’ve never had this card before, you need to verify with the “New Accounts Team” at 800-952-7560 to see if you’re eligible for the bonus. I just found out I am being denied the bonus for previously having this card even though Chat told me I hadn’t.

Nevermind, possible false alarm. Spoke with the New Accounts Team and another Customer Service rep, who both verified I never had the SPG Biz card before. Still, a bit concerned as to why the first chat rep was so adamant about me being denied the bonus.

ehhh… I was reassured the bonus would post after a few billing cycles, but I followed up with AmEX Chat again today. Now they tell me the system says the account was ineligible for the bonus because of having a previous account of the same product type, even though Customer Service told me the account was eligible. Rep opened up internal investigation with the “Specialist Team” to look at chat & call records. Moral of the story so far: AmEx customer service reps may not always have accurate information at their fingertips.

Ugh. Thanks for keeping us up to date.

Welp, it’s official. They denied the bonus after investigation. I

Boo Amex. So it didn’t help that you spoke with “…the New Accounts Team and another Customer Service rep, who both verified I never had the SPG Biz card before.” ?

That’s not fair. Did you ask for courtesy points? Supervisors have some latitude with that, I think

Further experiment results:

I spend the additional $3K needed for the extra 10K bonus just in case that would work. It didn’t work. I earned only the expected 3K points

I applied for 2 business cards becuase I have 2 businesses. This was before I saw your experiment. When I called in to ask what my promotions were for each one, they told me I had the 35,000 promotion for each one of them. Do you think this is false? I called separately. I have not met the qualifying spend so I don’t know if it’s valid

If you applied for both at around the same time, I think you have a real chance of getting both bonuses. The restriction is against already having had the card at the time you apply. In your case, it sounds like you didn’t already have the card for either application.

This would be very interesting if it works for you. Please report back to let us know whether or not you get both bonuses!

Results are in: No dice. I did NOT earn a signup bonus for my second SPG Biz card in which I signed up under a second business.

It’s not looking good. When I logged into my Amex account this morning, it showed that I had earned just 5,000 starpoints. But when I log into the associated SPG account, I don’t see any points so I guess it is still in-process. Once the 5K points show up in my SPG account I’ll declare the experiment complete

Hi Greg, any further update on this?

I’m still waiting. My statement closed today, but I haven’t yet earned any points. Even if the signup bonus doesn’t work, I should earn 1 point per dollar for spend. So, I’m hoping/expecting to have results by tomorrow or the next day. Once the 5K spend points post, I’ll either declare victory (if I also get the signup bonus 25K) or defeat.

Update: Finally received card and spend $5K right away. $5K spend should result in 25K bonus. If so, I’ll then spend the additional $3K to get the extra 10K bonus.

Next steps:

1) Wait until $5K charge moves from pending to actual

2) If necessary, call Amex to move up the billing close date to try to force quicker results

Update: I still have not received the card! This has been a very long “2 business days”. Before going on vacation last week I did an online chat to try to get the card expedited but that was useless. Just now I called and the rep said she would overnight it to me. She had no idea why it was held up so long.

Sub

Subscribe

Looking forward to hearing your updates!

I’m still waiting for my new card to appear so that I can knock out the spend. In the meantime I’ll pass along a note from a friend who had tried duplicating my Delta Plat business card experiment. He reports that he did NOT earn the bonus even though he used a new EIN.

While I understand the experiment and discussion is related to the SPG business card, my experience from last month using a new EIN (on a second legitimate business) for an AmEx Platinum account did not yield me a second bonus. I filed a complaint but customer service manager was unmoved. Just adding a data point.

Thanks JC

Greg & others,

What about other banks (Chase, Citi, etc), do you have any data points as far as applying for business credit cards with business1 + SSN as well as business2 + EIN? Are the banks treating them as separate business entities period, or is the business under SSN seen differently? What about bonuses for checking accounts?

Thanks.

[…] American Express only count cards within a specific time frame. We believe that time frame is seven years, the issue with that of course is that some people don’t keep very good records (shame on you – use this to make it easier). A solution I’ve seen mentioned recently is that you can ask American Express via chat what cards you have/haven’t had before (Frequent Miler goes into some more detail about this here, rather than asking about one card I’…). […]