NOTICE: This post references card features that have changed, expired, or are not currently available

An industry insider leaked a bit of interesting information to me the other day. Apparently BankAmericard is planning to release a premium card to compete with the Chase Sapphire Reserve. Here are the bits that he revealed:

An industry insider leaked a bit of interesting information to me the other day. Apparently BankAmericard is planning to release a premium card to compete with the Chase Sapphire Reserve. Here are the bits that he revealed:

- $450 annual fee

- Travel fee reimbursement (he didn’t know how much)

- Redeem points for 1.5 cents each towards travel

- No transfer partners

- To be released September or October 2017

My first thought was that this was simply another me-too card like the US Bank Altitude Reserve or the UBS Visa Infinite Card. And it probably is. But then a couple of exciting possibilities occurred to me…

Bank of America Preferred Rewards

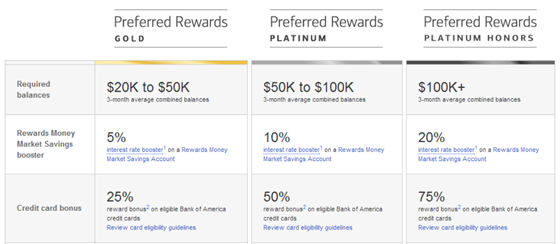

Bank of America’s Preferred Rewards program offers extra benefits to those with substantial savings and investments with Bank of America, Merrill Edge, and Merrill Lynch.

Those who can cobble together $100,000 or more of investments get a number of benefits including a 75% rewards bonus on eligible Bank of America credit cards.

One of the credit cards that is eligible for this bonus is the BankAmericard Travel Rewards card. The bonus turns this ho-hum 1.5% towards travel rewards card into a 2.625% everywhere beast of a card.

You know where I’m going with this, right? I see two exciting possibilities with the new card if it qualifies for the 75% bonus…

3X becomes 5.25X, and 4.5% towards travel becomes 7.875%

I don’t have any information about how many points per dollar this new card may offer, but I do know that all of the cool kids are offering 3X for travel plus another bonus category or two. That makes me think that we’ll see something similar with BankAmericard. Perhaps they’ll match Chase and offer 3X for travel and dining, and 1X everywhere else. Or maybe they’ll try to out-cool Chase (like US Bank tried to do with 3X mobile pay) with a 3X category intended to appeal only to millennials.

If they offer 3X categories and if Preferred Rewards apply to this card, then those with Preferred Rewards Platinum Honors status will earn at the following rates:

- 3X categories: 3X x 1.75 = 5.25 points per dollar

- Everywhere else: 1X x 1.75 = 1.75 points per dollar

And, since we were told that points can be used for 1.5 cents per point value towards travel, this means that the effective rebate for spend would be as follows:

- 3X w/ Platinum Honors = 5.25 points per dollar x 1.5 cents per point = 7.875% towards travel

- 1X w/ Platinum Honors = 1.75 points per dollar x 1.5 cents per point = 2.625% towards travel

This would make the new card as good as the Travel Rewards card with Platinum Honors for everyday spend, and much better than almost any other card for it’s 3X categories.

1.5X everywhere becomes 3.9375% everywhere

Another intriguing possibility is if BankAmericard allows cardholders to move points from the Travel Rewards card to the new premium card, or to pool the points together. Since the former card earns 1.5 points per dollar for all spend, the combination would be like using the Freedom Unlimited with the Sapphire Reserve. Use the fee-free card to earn 1.5 points per dollar, move those points to the premium card, and spend those points for 1.5 cents per point value towards travel. The combination gives a very good base earning rate of 2.25% for non-bonus spend.

That’s all very good, but remember that the Preferred Rewards program does apply to the no fee Travel Rewards card. So, those with Platinum Honors status actually earn 2.625 points per dollar for all spend. If those customers were able to then move those points to the new premium card and spend points at 1.5 cents per point value, we would have an awesome result: 3.9375 cents per point value towards travel for all spend.

3.9% to 7.9%

In the unlikely event that both of the above scenarios come true, a person with both cards and with Platinum Honors status could use the premium card just for spend within its 3X categories and use the no-fee Travel Rewards card for spend everywhere else. That cardholder would earn a rebate on spend of 7.9% for category spend and 3.9% everywhere else. That would be insane.

I don’t think this combination is likely, but its fun to imagine the possibilities.

Other guesses

More likely than any of the above, we can guess that the new premium card will be a Visa Infinite card and will offer some form of lounge access, global entry or TSA-Pre reimbursements, rental car benefits, etc. But, what will the new card be called? Here are a few guesses (mostly based on the idea that this card is a premium version of the no-fee Travel Rewards card):

- BankAmericard Travel Rewards Reserve

- BankAmericard Travel Rewards Infinite

- BankAmericard Travel Rewards Platinum

- BankAmericard Infinite Travel Rewards

What do you think this new card will be called? Comment below.

[…] June I published some inside info that was leaked to me about an upcoming new card from BankAmericard. I had been told that the new card would have the following […]

[…] Frequent Miler is reporting that Bank of America plans to enter the premium credit card market with a new card in September or October of 2017 to compete directly with the Chase Sapphire Reserve. This isn’t the first new card to enter the space with U.S. Bank launching the Altitude Reserve and UBS launching the Visa Infinite (American Express also made significant changes to their Platinum card in response). […]

sub

It is likely they will exclude the card from the preferred rewards program, much like they do the Merrill+ card.

“Redeem points for 1.5 cents each towards travel” isn’t the best description. Points are worth 1 cent each on travel, but you earn 1.5 points on each dollar of spend. The other available redemptions are worse than 1 cent per point.

I’d be surprised if they exclude it from the Preferred Rewards program since they’ll want to target the same customers as those with Preferred Rewards status. I think more likely they won’t have 3X categories

Based on last year survey, they had 2x on dining and travel which makes it 3.5 for preferred clients. All other charges were 1.5.

is there a premium card /bank which offers hefty bonus points for new account. my friend just had an inheritance.

[…] Bank of America (BankAmericard) is entering the picture. The Frequent Miler wrote about rumors of this new card that’s supposed to come with the […]

[…] FrequentMiler is reporting on a potential Bank Of America premium credit card. I would recommend reading their article (by clicking on their name), but essentially: […]

[…] – are we getting a Bank of America Chase Sapphire clone soon? […]

Doctor already discussed a rumor bofa premium card last Dec. The existing bofa travel card gets 1.5 points for every charge which can be used towards travel charges. I’d imagine there might be dining and travel bonuses since the fee is 450 and other perks. Otherwise, I’ll stick with my free travel card that earns 2.625. Here’s the link for doctor old discussion http://www.doctorofcredit.com/bank-america-survey-regarding-two-new-cards-bank-americard-premium-rewards-store-card/

[…] Frequent Miler, we might see a valuable new credit card from Bank of America in the near […]

It would be awesome if they had transfer partners. They already have Alaska, Asiana, Virgin and Amtrak.

I use B OF A Travel Rewards at 2.625 percent cash back for everyday spend, because of my combined assets there. It is the best card that I know about. I can’t imagine them giving much more cash back than that. I guess we can hope, and maybe there is some formula for them where including the fee, and maybe with even higher balances there, it makes sense for B of A.

But to hope for signicantly more than that may be unrealistic. I hope for it of course, but not counting on a 3.5pc or more cash back card.

(If they do come out with a better card, I hope it’s metal like chase sapphire reserve!)

Great news, more cards is always better for us.

Will BoA up their insuranceprotections and offer price protection, extended warranty, and return protection? Without these it doesn’t really encourage everyday use.

Actually back in Dec a rumor was discussed on doc site. They were saying 95 fee now it’s 450. They probably added more benefits to it. Here’s the old discussion on Doc site.

http://www.doctorofcredit.com/bank-america-survey-regarding-two-new-cards-bank-americard-premium-rewards-store-card/

Thanks!