NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

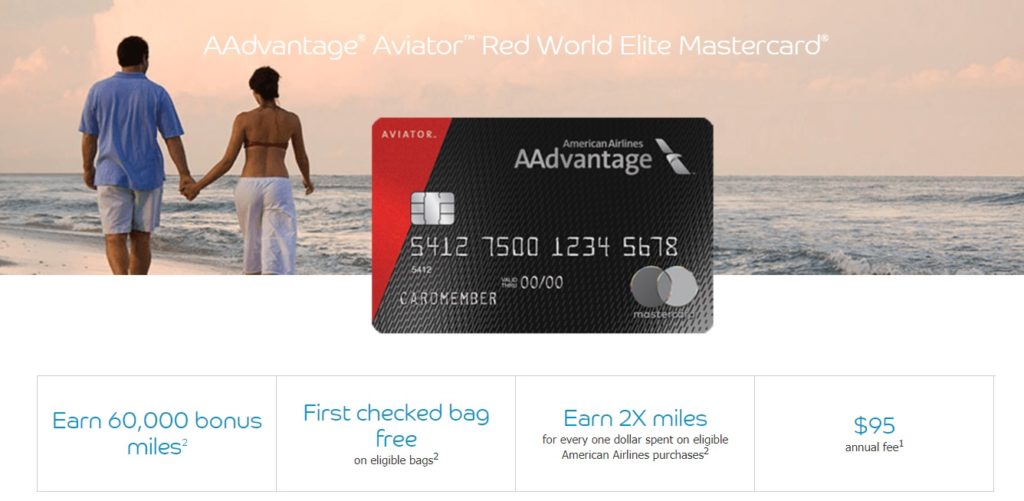

Barclaycard has yet again increased generous sign up bonus on the American Airlines Aviator Red World Elite Mastercard: you can now earn 60,000 American Airlines miles on first purchase and payment of the annual fee.

The Offer

- 60,000 American Airlines miles on first purchase and payment of the annual fee

- US Credit Card Guide reports that you may be able to receive an additional 500 Miles by using promo code 752657 application.

- Direct link added to our Best Credit Card Offers page

Card Details

- $95 Annual fee charged on 1st statement

- Earn 2X on American Airlines

- Earn 1X everywhere else

- First checked bag free

- Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation

- 10% rebate on AA awards (up to 10K per year)

- Reduced mileage awards

- 25% off in-flight purchases

- From the terms: This one-time AAdvantage® bonus mileage offer is valid for first-time cardmembers with new accounts only. Existing cardmembers, existing accounts, and previous cardmember with accounts closed in the past 24 months may not be eligible for this offer. This is a limited-time offer and may be canceled at any time without notice. Please allow 4-6 weeks for AAdvantage® bonus miles to be deposited into your AAdvantage® account after the qualifying transaction has posted and your annual fee has been paid.

Quick Thoughts

Sixty thousand miles for a single purchase is an outstanding offer. With increased American Airlines award availability popping up now and then in business class as of late, this offer would give you enough for a one-way business class ticket to either Europe or South America (even round trip to South America 1) or to Asia 1 (Japan / Korea). Alternatively, you could fly a route like Cairo to Tokyo on Etihad in first class for 50K American Airlines miles or fly one-way in business class to Japan on Japan Airlines (availability varies on this). That kind of bonus with no minimum spend is terrific. American certainly hasn’t been known for generous award availability over the past few years, but over the past month we’ve seen some spurts of availability. Considering the bonus doesn’t even require meeting a minimum spend but rather just a single purchase, this is the definition of low-hanging fruit. You probably won’t find domestic saver availability, but if you’re interested in international travel this is worth a look.

Cairo to Abu Dhabi to Tokyo was a lot of flying in Etihad first class – and it’s just 50K AA miles.

H/T: US Credit Card Guide

[…] Nice: 60K American AAdvantage miles after a single purchase + fee […]

Can I apply the 2nd Barclay AA card? My 1st Barclay card is 3 years old now

I just got flat-out rejected, because I have an open Aviator Red, which was covnerted from an old Barclays USAir card.

I opened the Barclays USAir card in Nov 2013, then at the time of the merger it was converted to an Aviator Red which I currently have open. Based on the statements here, I just applied for the new 60k Aviator offer, and was instantly rejected. I called the reconsideration line, and an agent quickly explained to me that it was because I currently have an open Aviator card. Reconsideration was not possible, according to her, and she clearly stated that it didn’t matter whether my existing Aviator card had been converted from another card or not.

So based on all that, it’s quite clear that you shouldn’t keep your Aviator open if you want to apply for a new one. I’m wondering if I can close mine, and then open a new one in a couple of months. I’m not sure, due to the 24 month period mentioned in the T&C. I suspect Barclays is getting better at enforcing these rules.

Strange. I have the Aviator Red, was the USAir card, just like you. But they did not hesitate to give me the new one AND the 60K bonus. Maybe it was random; maybe they’ve had enough applications; who knows?

USAir cards were churnable back then. Would it be possible that you were rejected due to having a few too many? I had 4 cards before and am keeping one of them open at this time. Just applied and got rejected. Online status said ‘Currently we are unable to offer you a credit card…’ I wonder if I have any chance when calling the recon line???

Update. Contacted Barclay. No deal. I was given the same reason just like what phone-home received (see above.)

[…] If you’ve recently applied for 50k offer on Aviator card, reach out via secure message and request a match. Usually, Barclays will do it as long as you’ve applied within the last 30 days. (hat tip Frequent Miler) […]

[…] Barclaycard is out with a new AA 60,000 mile offer after first purchase, Citibank’s previous 60K offers have gone away. Fortunately we found 50K working links to […]

Looking for some feedback, T&Cs page says “previous cardmember with accounts closed in the past 24 months may not be eligible for this offer” – I downgraded the Aviator Red to the no-fee Aviator a couple months ago. I’m curious if there are any data points out there that would allow me to skate by and get this 60k bonus since I didn’t technically close my account, rather, I downgraded it.

Thanks much! I asked and received the extra 10K since I JUST got my card and wasn’t even billed yet for the annual fee. Just have to pay the fee and then use the card once. Hoo-ah!

JRG, Did you call or message? I just applied last week and like to get them to match as well. Thanks!

Kay

I sent a secure message; they answered in about 5 hours. Great service.

[…] Hat tip Frequent Miler […]

Meh. If only DisAAdvantage Rupiah could be used for anything akin to a decent redemption, then maybe I’d add some more to my existing stockpile of 1.5 million unusable DisAAdvantage Rupiah. But since AA works harder than any other airline to intentionally screw their members, it’s just not worth the hard pull to me if the points were completely free or even if it was a money maker – the points are worthless. More of worthless is still worthless.

YMMV.

YMMV indeed. I’ve found AA miles to provide good redemption values for shoulder season travel from my home airport, RDU, to Hawaii and Japan. Looking forward to acquiring more. Unfortunately, I have a “new” Aviator Red card–an applied for one rather than an upgrade from U.S. Airways. So I’m unlikely to qualify for the 60K offer until:

1. I cancel

2. Waiting to apply for… not sure how many months these days.

… and hoping the 60K offer is still out there.

@Nick Reyes, any thoughts on canceling now and how months I ought to wait until reapplying? Barclays sure isn’t BofA (e.g. easy cancel, wait a month, and re-apply for AS cards).

Barclay closed my account a few years ago because of ms. Am I banned for life?

I don’t know for sure, but I’ve heard of people getting back in. If it’s been a couple of years, it’s probably worth a try.

Have they said how long this offer will be out? I am waiting on the new BOA card to come out in September(?) and I don’t want to apply for anything until I apply for that card since BOA is being very stingy lately

I didn’t see an expiration date. The standard offer was 40K, then it increased

to 50k a while ago, and now it’s 60k. I’m not sure what that means for the longevity of it, but I would assume it’ll be around for at least a couple of weeks. Of course, we don’t yet have an exact date for the BOA card either. Hard to say.

I guess risking 10k in AA miles is worth waiting for a $500 sign up 😉

Can those who got the card when it was US Air and still hold it get this offer, or are we excluded as “existing cardmembers?”

Yes, you should still be able to get it based on all of the data points I’ve seen so far.

Where can you put the promo code? I can’t find a place to put it in the application. Thx!

I’m actually not sure. I saw that US Credit Card Guide included it and that someone in the comments there mentioned another promo code that works for 500 bonus miles. However, I don’t see where you can enter it, either.

Hi! I just cancelled my Citi AA card after I couldn’t get them to wave the annual fee. :(. I assume since this is not a Barclay card, I can get this offer. Can you confirm? Also, I have 3 Barclay cards, 2 opened in the last year (4/16, 9/16, and 4/17). I’ll be canceling the Hawaiian card in 9/17 when the AF hits. Any thoughts on my chance of approval? Should I cancel Hawaiian card first to increase odds? Thanks!

The Citi AA card and Barclay AA card are totally separate — you can definitely get this offer. In fact, my wife recently opened both a Citibusiness AA card (65K targeted offer) and this Aviator Red card (50K offer at the time) around the same time to rack up some AA miles.

As for your chances of approval, that’s harder for me to say. Barclaycard has historically been pretty good on reconsideration if you’re not initially approved, but if you’re planning to cancel the Hawaiian card within a couple of weeks anyway, why wait to cancel it? I assume you’re not buying a ticket to Hawaii in September and counting on it for a free bag, right? I don’t see it hurting your chances at approval if you cancel that, and by contrast it may help.

My wife has AAdvantage silver Aviator no fee card that was downgraded from the red card. Anyone know if she can apply for and get this bonus on the red card or should she cancel the silver first and apply for red card? Any input?

You mean the no-fee Aviator card I assume. The Aviator Silver is an upgrade from the Red (the Aviator Silver has a $195 annual fee).

But the answer to your question is that she can most likely apply for the Red card. Back when this was a US Airways card, people used to be able to successfully apply for the card again and get the bonus again within a few months of getting the first card. For example, I opened two in the space of 6 months and got the bonus on both (and I still have both open because they keep waving the fee and they offered a good spending bonus on one of them so far this year). I haven’t seen many data points on opening multiple Reds since the online application only came up this past winter. But assuming her Aviator was an old US Airways card that got converted and downgraded, I would imagine she doesn’t need to cancel first.